Payroll Services for Small Business: A Practical Guide to Payroll Efficiency

When you’re running a small business, payroll can feel like one of those necessary evils. It’s the complex, time-sucking task that pulls you away from what you actually love doing. In simple terms, a payroll service is a third-party company that takes this entire burden off your shoulders. They handle everything from calculating employee paychecks and tax withholdings to filing payroll taxes and ensuring you’re compliant with the law.

Think of it as moving from clunky spreadsheets and manual calculations to an automated, expert-led system. It’s about making sure your team gets paid accurately and on time, every single time, without you having to become a tax law expert overnight.

Why Payroll Is a Lifeline for Small Businesses

It’s Friday afternoon. Instead of sketching out your next big growth strategy, you’re hunched over a laptop, trying to make sense of timesheets, overtime rules, and confusing tax codes. Sound familiar? Many entrepreneurs see payroll as just another administrative chore, but that perspective misses the point entirely. Good payroll management isn’t a cost center; it’s a strategic pillar for your business.

Let’s use an analogy. A skilled pilot focuses on flying the plane—navigating, communicating, and ensuring a safe journey. They don’t manually calculate fuel burn rates or manage air traffic patterns mid-flight; they trust the control tower for that. A payroll service for small businesses is your financial control tower. It expertly handles the intricate routes of tax laws, deductions, and deadlines.

This frees you up to stop wrestling with spreadsheets and focus on steering your business where it needs to go.

From Tedious Chore to Strategic Asset

The real cost of handling payroll yourself isn’t just the price of software or the hours you put in—it’s the lost opportunity. Every hour spent deciphering payroll is an hour you didn’t spend on sales calls, improving your product, or talking to customers.

This time drain adds up fast. Roughly one-third of small businesses report spending over six hours a month just on payroll tasks. It’s no surprise that 31% of owners want to hand these duties off to reclaim their time for activities that actually generate revenue. You can dig into more payroll statistics and trends to see just how common this challenge is.

By outsourcing payroll, you’re not just buying a service; you’re buying back your most valuable asset: time. It’s a direct investment in your company’s potential for growth and stability.

This table offers a clear, high-level comparison, helping you quickly see the practical differences between handling payroll in-house and partnering with a service.

Manual Payroll vs A Payroll Service At a Glance

| Aspect | Manual In-House Payroll | Using a Payroll Service |

|---|---|---|

| Time Investment | High; hours spent on calculations, filings, and corrections. | Low; setup is initial, then minimal time per pay run. |

| Accuracy | Prone to human error, which can lead to payment issues. | High; automated calculations drastically reduce errors. |

| Compliance Risk | High; you are solely responsible for all tax law changes. | Low; the service tracks and implements tax updates for you. |

| Cost | Seems low, but hidden costs include time, software, and penalties. | Predictable subscription fees, clear value for the cost. |

| Scalability | Difficult; adding employees increases complexity exponentially. | Easy; scales with your business as you hire more people. |

| Employee Experience | Basic; manual pay stubs, limited self-service options. | Professional; online portals, direct deposit, clear pay stubs. |

As you can see, the shift is about more than just convenience—it’s a strategic upgrade for your entire operation.

Key Advantages of a Modern Payroll Approach

Moving from DIY payroll to a dedicated service provider fundamentally changes how your business runs. It’s about more than just cutting checks. It’s about building a scalable, compliant, and efficient engine in your back office.

The core benefits really boil down to a few key things:

- Reduced Compliance Risk: Payroll services are obsessed with the ever-changing federal, state, and local tax rules, which helps protect you from expensive mistakes and penalties.

- Enhanced Accuracy: Automation is your best friend here. It minimizes the kind of human errors that lead to incorrect paychecks and unhappy employees.

- Improved Peace of Mind: There’s a huge weight lifted when you know an expert team is handling this critical function. It lets you focus on your core business with real confidence.

- Foundation for Growth: A professional payroll system grows with you. It’s just as easy to pay 30 employees as it is to pay three.

Ultimately, using a payroll service reframes a dreaded task into a powerful tool that supports your business’s health and sets you up for long-term success.

What a Payroll Service Actually Does for You

If you think a payroll service just cuts checks and handles direct deposits, you’re only seeing the tip of the iceberg. That’s like saying a chef just heats up food. The real work of payroll services for small business happens beneath the surface, managing the complex and high-stakes tasks that keep your business running smoothly.

Underneath the simple act of paying your team is a massive foundation of calculations, tax filings, and compliance management. A good payroll service doesn’t just move money around; it navigates the dense fog of financial regulations for you, ensuring every pay period is handled correctly and on time.

Core Functions Beyond the Paycheck

At its heart, a payroll provider is your specialist for everything related to employee compensation. They manage a precise, legally-required process that’s far more involved than basic math. This is where their expertise really shines.

Their main duties include:

- Calculating Gross Wages: This means accurately processing hourly timesheets, overtime, salaries, commissions, and bonuses.

- Managing Deductions: They handle all the withholdings for things like health insurance premiums, 401(k) contributions, and any wage garnishments.

- Withholding Taxes: This is a big one. They calculate and set aside the correct amounts for federal, state, and local income taxes, plus Social Security and Medicare (FICA).

- Filing and Paying Taxes: The service then sends these withheld taxes to the right government agencies on your behalf, hitting every strict deadline to keep you out of trouble.

This process turns what could be a risky administrative headache into a predictable, automated part of your business.

A modern payroll dashboard, like the one from Gusto, brings all these complex tasks into a single, clear interface.

As you can see, things like running payroll, tracking time off, and pulling reports are all centralized, giving you a command center for your team’s compensation.

Understanding Different Service Models

Not all payroll services are built the same, and the market is growing fast to meet the demand. The global payroll services market is expected to hit $51.4 billion by 2030, largely driven by small and medium businesses. You can read more about the growth in payroll services to see just how essential these tools have become.

Knowing the main service models will help you pick the right one for your business.

Key Takeaway: Choosing a payroll service isn’t just about software; it’s about deciding how much responsibility you’re ready to hand off. Your choice directly affects how much time you spend on payroll and your level of compliance risk.

Let’s look at the most common options available.

- DIY Payroll Software: This is the most hands-on option. Software like QuickBooks Payroll will do the wage and tax calculations for you, but you’re usually responsible for filing the forms and paying the taxes yourself. It’s better than a spreadsheet, but it still requires a lot of your time and attention.

- Full-Service Payroll Provider: This is the most popular choice for a reason. Providers like Gusto or ADP not only calculate everything but also automatically file and pay all your payroll taxes. They typically offer an accuracy guarantee, taking on the liability if they make a mistake.

- Professional Employer Organization (PEO): A PEO takes it a step further by becoming a “co-employer” of your staff. This model bundles payroll, benefits, workers’ comp, and HR support into one package. It often gives small businesses access to better, enterprise-level benefits at a lower cost.

Ultimately, a payroll service acts as a specialized extension of your own team. It provides the expertise and automation you need to manage one of the most critical functions of your business without a single hiccup.

The Real-World Benefits of Outsourcing Payroll

Choosing to use payroll services for small business goes far beyond just getting a few hours back each week. It’s really a strategic decision that delivers tangible, bottom-line advantages. When you look at it this way, payroll shifts from an administrative headache to a powerful operational asset.

The most immediate gain is obvious: time. But it’s not just about freeing up your calendar. It’s about what you do with that reclaimed time. Instead of wrestling with tax forms and calculations, you can reinvest those critical hours into activities that actually grow your business—like refining your product, chasing new sales leads, or strengthening customer relationships.

Your Insurance Policy Against Costly Penalties

Compliance is where outsourcing payroll truly pays for itself. Trying to navigate the tangled web of federal, state, and local tax laws is a high-stakes game. A single mistake—an incorrect withholding, a missed deadline—can trigger significant IRS penalties that can easily cripple a small business. In fact, nearly half of small businesses face fines for payroll errors.

Think of the monthly service fee as an insurance policy. For a predictable cost, you transfer the risk of non-compliance to a team of experts whose entire job is to stay on top of ever-changing regulations. This protects your cash flow and provides invaluable peace of mind. To dive deeper, check out our detailed article on the benefits of outsourcing payroll.

By partnering with a payroll service, you’re not just delegating a task; you’re mitigating one of the most significant financial risks a small business faces. It’s a proactive defense against costly government penalties.

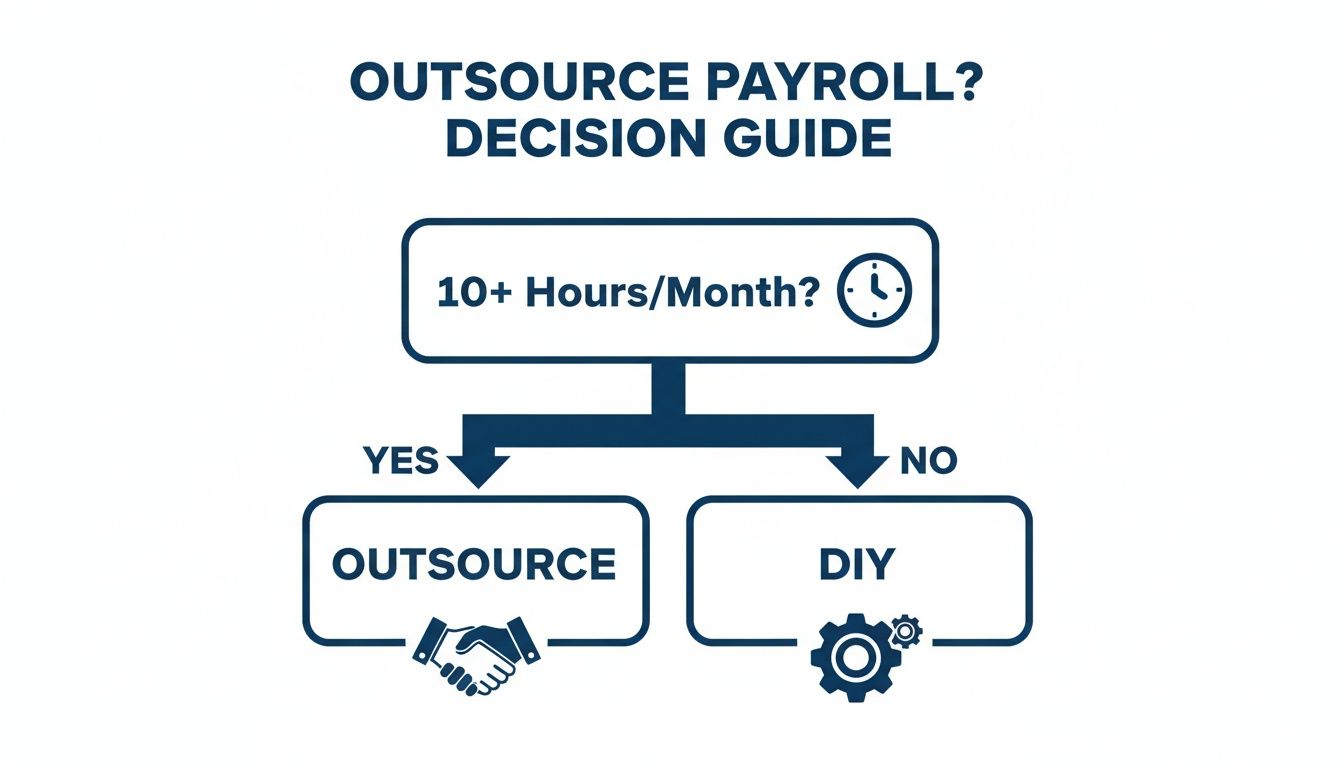

This decision tree helps visualize if outsourcing makes sense based on how much time you’re currently spending.

The key takeaway is that once payroll consumes more than a couple of hours per week, the opportunity cost of doing it yourself becomes too high to ignore.

Fort Knox Security for Your Sensitive Data

Payroll data is some of the most sensitive information your business handles. We’re talking Social Security numbers, bank account details, and home addresses. For a small business, trying to replicate the cybersecurity infrastructure of a top-tier provider is just not realistic or cost-effective.

Professional payroll companies invest heavily in security measures like:

- Data Encryption: Protecting data both when it’s being sent and when it’s stored.

- Secure Servers: Housed in facilities with advanced physical and digital security.

- Redundant Backups: Ensuring your information is never lost due to a system failure.

This Fort Knox-level security shields you and your employees from data breaches and identity theft—a level of protection most in-house systems simply can’t match.

Access to a Team of On-Call Experts

Finally, outsourcing gives you immediate access to a deep bench of specialists. Imagine having a team of payroll and tax experts on call without adding a single person to your headcount. This resource is invaluable when you face tricky situations like processing multi-state payroll, handling wage garnishments, or just trying to understand new tax legislation. For a small company, this level of expertise would otherwise be completely out of reach financially.

How to Choose the Right Payroll Service

Picking the right payroll service for your small business can feel like a huge task. With so many options out there, each one promising to make your life easier, how do you find a partner you can trust for the long haul?

The secret isn’t finding the flashiest software. It’s about choosing a service that fits your company’s unique DNA.

Think of it like buying a vehicle. A solo entrepreneur might just need a nimble scooter (like a basic payroll software), but a growing business with employees in multiple states needs a heavy-duty truck (a full-service provider). The first and most critical step is getting a clear picture of what you actually need.

This simple, structured approach turns an overwhelming decision into a series of easy-to-answer questions, guiding you to a solution that will support your business as it grows.

Audit Your Business Needs First

Before you even glance at a provider’s website, you need to take a snapshot of your payroll requirements—both for today and for the near future. This internal audit will become your scorecard for judging potential partners.

Start by asking yourself these fundamental questions:

- Who are you paying? Are they all W-2 employees, or do you also work with 1099 independent contractors? A service that handles both seamlessly can save you a lot of headaches.

- How big is your team? A company with three employees has completely different needs than one with thirty. Don’t forget to factor in your growth plans for the next year or two.

- What software do you already use? Your payroll system has to play nicely with your existing accounting software, like QuickBooks or Xero. Good integration avoids tedious manual data entry and keeps your financial records accurate.

Answering these questions first keeps you from getting distracted by fancy features you’ll never use and helps you focus on what really matters.

Key Criteria for Evaluating Providers

Once you’ve mapped out your needs, you can start weighing your options against a consistent set of criteria. It’s time to look past the marketing hype and dig into the nitty-gritty details of what they offer.

This is a big responsibility. Small businesses in the United States manage an annual payroll of $3.47 trillion. With that much on the line, finding a reliable provider is non-negotiable.

Focus your evaluation on these core areas:

- Transparent Pricing: Look for a clear fee structure. Is it a flat monthly fee plus a cost per employee? Ask about hidden charges for year-end tax forms (W-2s/1099s), off-cycle payroll runs, or initial setup fees.

- Essential Features: At the very least, any service you consider should offer automated tax calculation, filing, and payments. Other must-haves include direct deposit, an employee self-service portal, and detailed payroll reports.

- Scalability: The right provider will grow with you. Make sure the service can handle multi-state payroll, benefits administration, and HR support if you think you’ll need those functions down the road.

A great payroll service acts as a true partner. They should offer an “error-free guarantee,” taking financial responsibility for any tax filing mistakes they make. This one feature provides an incredible layer of protection and peace of mind.

Questions to Ask Potential Payroll Partners

With your needs and evaluation criteria in hand, it’s time to vet your shortlist. Don’t be shy about asking direct, specific questions during a demo or sales call. How they answer will tell you a lot about their service and expertise. To dig deeper into this process, check out our complete guide on how to outsource payroll for your small business.

Here is a checklist of powerful questions to get you started:

- Can you show me a live demo of how your system syncs with my accounting software?

- What is your process for handling payroll corrections or amendments after a run?

- What level of customer support is included in the standard plan—phone, email, or chat?

- How do you handle more complex items like wage garnishments or other deductions?

- What exactly does your error-free guarantee cover?

Choosing a payroll service is a foundational business decision. By taking a thoughtful, structured approach, you can find a partner that not only saves you time but also provides a stable, compliant foundation for your company’s growth.

Making a Smooth Transition to Your New Payroll System

Switching to a new payroll provider doesn’t have to be a headache. With a little planning, the whole process can be surprisingly smooth, keeping errors at bay and your team happy. Think of it like moving to a new house—the key is to have all your boxes packed and labeled before the moving truck shows up.

In this case, your “boxes” are all your crucial business and employee details. Taking a step-by-step approach to gathering and setting up this information will make the entire switch straightforward and successful.

Gathering Your Essential Payroll Data

Before you can even think about running payroll, you need to collect all the necessary information. This is the foundation of the whole setup. Get this part right, and everything else falls into place. Your new provider will give you a list, but having these documents ready will make things move much faster.

You’ll need information broken down into two main categories:

- Company Information: This is the high-level stuff, like your Federal Employer Identification Number (EIN), any state and local tax ID numbers, and the business bank account you’ll use to fund payroll.

- Employee Information: For every single person on your team, you’ll need their completed Form W-4 (for federal taxes), any state-specific withholding forms, direct deposit bank details, and their pay information—rate, salary, and any recurring deductions for things like health insurance.

Getting this data organized upfront is a game-changer. If you want a deeper dive into what this entails, you can check out our guide on how to set up payroll for your small business.

Integrating Your Payroll and Accounting Software

One of the biggest wins you get with modern payroll services for small business is how they talk to your accounting software. This connection automates your bookkeeping, which means no more tedious double-data entry. It keeps your financial records perfectly in sync and always up to date.

Let’s look at a classic example: connecting Gusto to QuickBooks.

When you run payroll in Gusto, the integration automatically pushes a journal entry right into QuickBooks. It intelligently sorts out wages, taxes, and deductions, mapping them to the correct accounts. Your books stay balanced without you lifting a finger.

This kind of automation means your financial reports are always built on real-time data, giving you a crystal-clear picture of your labor costs whenever you need it.

Your First Payroll Run Checklist

Okay, the moment of truth: running your first payroll on the new system. To make sure it goes off without a hitch, a simple checklist is your best friend. This is your final quality check before hitting that “approve” button.

We’ve put together a straightforward checklist to help you make sure the transition is error-free. Following these steps will give you the confidence that everything is set up correctly from day one.

Your Payroll Implementation Checklist

Follow these steps to ensure a seamless and error-free transition when setting up your new payroll service.

| Step | Key Action | Pro Tip |

|---|---|---|

| 1. Gather All Company Docs | Collect your Federal EIN, state/local tax IDs, and bank account info. | Create a secure digital folder to store all these documents for easy access. |

| 2. Collect Employee Data | Get a completed W-4, state forms, and direct deposit info for every employee. | Have employees fill out their information directly in the new system’s portal to reduce entry errors. |

| 3. Configure Pay Schedules | Set up your pay periods (weekly, bi-weekly) and establish the official pay date. | Make sure your first pay date in the new system doesn’t overlap or leave a gap from your old system. |

| 4. Set Up Deductions & Benefits | Enter all pre-tax and post-tax deductions, like health insurance or 401(k) contributions. | Double-check the deduction amounts per pay period, not just the monthly total. |

| 5. Integrate Accounting Software | Connect your payroll platform to your accounting software (like QuickBooks or Xero). | Before running payroll, sync the chart of accounts to ensure wages and taxes post to the right places. |

| 6. Run a Payroll Preview | Always run a pre-calculation report before finalizing. | This is your chance to catch a simple typo that could cause a big headache later. Review every line. |

| 7. Verify the First Payroll Run | After running payroll, confirm the total withdrawal from your bank matches the payroll total. | Download the detailed payroll report and save it for your records. |

For your very first payroll run, consider running your old system in parallel. It might feel like double the work, but comparing the numbers side-by-side gives you 100% confidence that your new setup is perfect before you cut the cord for good.

See How Small Businesses Win with Payroll Services

Talking about features is one thing, but seeing the real-world impact is another. Moving from concepts to concrete results shows just how powerful dedicated payroll services for small business can be. Let’s look at a couple of brief before-and-after stories that highlight how the right system solves specific, costly problems.

The Creative Agency Overwhelmed by Compliance

First up, a growing creative agency with 12 employees. The founder was constantly wrestling with payroll. They had a mix of full-time staff and freelance contractors spread across three different states, which turned every single pay run into a compliance nightmare.

The founder was sinking nearly 10 hours a month into manually calculating state tax withholdings, processing 1099 payments, and just trying to keep up with changing regulations. This administrative headache was becoming a real barrier to growth, making them hesitant to hire talent from new states.

Switching to a full-service payroll platform automated the entire process.

- Multi-State Taxes Handled: The system automatically calculated and filed the correct taxes for each state. No more guesswork or risk.

- Contractor Payments Simplified: Paying 1099 contractors became just as simple as paying W-2 employees, all inside the same platform.

- Time Reclaimed: The founder got those 10 hours back every month. They immediately reinvested that time into winning new clients and developing their team.

Now, the agency confidently hires the best people from anywhere in the country, knowing their payroll compliance is completely managed.

The Restaurant Drowning in Manual Calculations

Next, imagine a popular local restaurant with a team of 30 employees. For the owner, the biggest headache was managing complex tip calculations and tracking the fluctuating hours for servers—all while staying compliant with wage and hour laws, a huge challenge in hospitality.

They were tracking time manually on paper sheets, which led to frequent errors. Calculating tip allocations took hours. This lack of transparency was starting to cause frustration among the staff, as pay stubs were often confusing and hard to get.

Implementing an integrated payroll service with time-tracking and tip-management features was a game-changer. The new system provided a clear, automated solution that transformed their operations.

The results were immediate. Tip calculations became automated and accurate, direct deposits were reliable, and employees could suddenly access their pay stubs and work schedules right from their phones. This new level of transparency and efficiency dramatically improved team morale. The owner could finally get back to focusing on the customer experience instead of being buried in payroll paperwork.

Common Questions About Payroll Services

Even after you see the benefits, deciding to bring on a payroll service for your small business can still feel like a big step. It’s only natural to have a few practical questions pop up. Getting straight answers is the last piece of the puzzle before you can feel truly confident in your decision. Let’s walk through some of the most common questions we hear from business owners.

How Much Do Payroll Services for a Small Business Cost?

There’s no single price tag, as it depends on your needs, but most providers use a similar pricing structure. Generally, you can expect a monthly base fee somewhere between $40 and $150. On top of that, you’ll see a per-employee fee, which usually runs from $6 to $12 per month.

Your basic plan will handle the essentials, like running payroll and filing taxes. If you opt for a higher-tier plan, you’ll often get valuable extras like HR support, benefits administration, or built-in time tracking. Always ask for a complete cost breakdown and keep an eye out for any one-time setup fees or extra charges for things like year-end W-2s.

Can I Switch Payroll Providers in the Middle of the Year?

Yes, you can absolutely switch providers mid-year. The key is timing it right to make the transition as smooth as possible. It’s much cleaner to make the move at the start of a new quarter—think January 1st, April 1st, July 1st, or October 1st. This timing makes tax reporting much simpler for everyone involved.

To get started, your new provider will need all your year-to-date payroll data from your old system. This history is crucial for making sure your employees’ W-2 forms are accurate at the end of the year. A good payroll company will have a team dedicated to walking you through this data transfer.

Key Insight: Don’t feel stuck with your current provider. A quality payroll service will handle the tricky parts of a mid-year switch, ensuring there are no disruptions for you or your team.

Is Payroll Software the Same as a Full-Service Provider?

This is a really important distinction, and it’s a common point of confusion. While they’re related, they serve different purposes.

- Payroll Software: Think of this as a DIY tool. The software does the heavy lifting on wage and tax calculations, but you’re still on the hook for filing the tax forms and sending the payments to the right government agencies yourself.

- Full-Service Provider: This is the “done for you” option. The provider manages the entire process from start to finish. They calculate, file, and pay every federal, state, and local payroll tax for you. Most also include an accuracy guarantee, which means they take on the financial risk if a penalty ever occurs.

The choice really boils down to how much of the process you want to manage yourself versus how much you’d rather hand off to an expert.

If I Use a Payroll Service, Do I Still Need an Accountant?

Yes, you absolutely still need an accountant. A payroll service and an accountant are two different specialists on your financial team, and their roles complement each other perfectly.

Your payroll service is the expert on everything related to paying your team—compensation, tax withholdings, and the specific compliance that comes with it. Your accountant, on the other hand, is focused on the big-picture financial health of your business. They handle strategic tax planning, prepare your main financial statements, manage your chart of accounts, and provide high-level business advice. Your payroll reports give your accountant the critical data they need to guide your overall financial strategy. They work in tandem to keep your business on solid ground.

Ready to stop worrying about payroll and get back to what you do best? The expert team at Steingard Financial provides meticulous payroll management and HR support tailored for service businesses. We partner with you to create a scalable back office, ensuring accurate data, fewer headaches, and a dependable partner invested in your growth. Learn how we can streamline your payroll today!