Accounts payable vs accounts receivable: A quick guide to improving cash flow

At its core, the difference between accounts payable and accounts receivable is pretty simple. Accounts payable (AP) is the money your business owes to suppliers and vendors, which makes it a liability on your books. On the flip side, accounts receivable (AR) is the money customers owe you for services you’ve delivered, making it an asset.

Getting a firm grip on this distinction isn’t just accounting jargon—it’s the foundation of managing your business’s financial health.

The Foundation of Your Financial Statements

Think of accounts payable and accounts receivable as two sides of the same coin. They are the opposing forces that directly shape your cash flow, your balance sheet, and your company’s overall financial stability. In fact, nearly every transaction done on credit creates both: one company’s payable is always another’s receivable.

Managing both well is about more than just good bookkeeping; it’s about having strategic control over your finances. Letting your AP slide can damage relationships with vendors and rack up late fees. At the same time, inefficient AR processes can starve your business of the cash it needs to operate and grow.

Key Differences Between AP and AR at a Glance

To make it crystal clear, here’s a quick table breaking down the fundamental differences between these two critical accounts. It offers a simple snapshot of their opposite roles in your financial world.

| Characteristic | Accounts Payable (AP) | Accounts Receivable (AR) |

|---|---|---|

| Balance Sheet Classification | Current Liability (Money Owed) | Current Asset (Money Expected) |

| Direction of Cash Flow | Outflow (Paying Bills) | Inflow (Collecting Payments) |

| Core Business Function | Paying for goods/services received | Collecting on goods/services delivered |

| Primary Documents | Supplier Invoices, Purchase Orders | Customer Invoices, Sales Orders |

| Primary Management Goal | Control spending and manage payment timing | Accelerate cash collections and reduce bad debt |

Ultimately, you can think of AP as your short-term debt and AR as your short-term income waiting to land in your bank account. The real skill is in balancing these two to maintain healthy working capital, ensuring your service business has the funds to cover its bills and invest in its future.

For a deeper dive into the mechanics of managing money moving in and out of your business, this comprehensive guide to payments and receivables management is a great resource. It helps clarify how these critical functions work together to keep your business on solid ground.

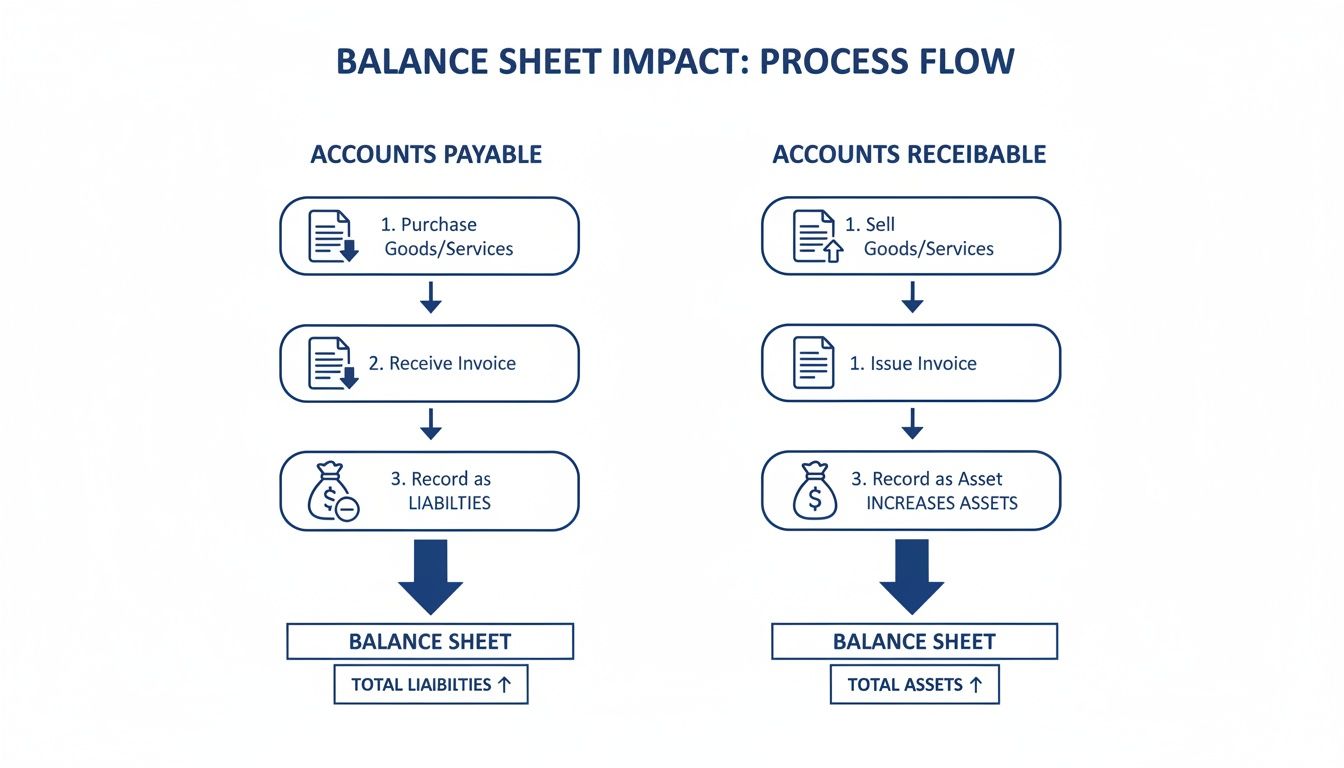

How AP and AR Impact Your Balance Sheet

It’s one thing to know the difference between accounts payable and accounts receivable, but it’s another to see how they actually work on your financial statements. In double-entry bookkeeping, every single transaction hits at least two accounts. This is what keeps your books balanced and makes your balance sheet a true snapshot of your company’s financial health.

When your service business takes on a new expense on credit—like a monthly software subscription—it creates accounts payable (AP). This isn’t just a bill to be paid later; it’s formally recorded as a current liability on your balance sheet. This entry shows you have a short-term obligation, money you owe and have to pay, usually within a year.

On the flip side, when you finish a project and invoice your client, you create accounts receivable (AR). This gets recorded as a current asset on your balance sheet. It represents money you’ve earned but haven’t collected yet—a future cash inflow that you have a legal claim to.

Tracing a Transaction on the Balance Sheet

Let’s walk through two common scenarios for a consulting firm to see this in action. These examples show just how directly AP and AR influence your financial position.

Scenario 1: Creating Accounts Payable

Your firm signs up for new project management software. The bill is $500 and it’s due in 30 days.

- Initial Journal Entry:

- Debit: Software Expense for $500 (this increases your expenses)

- Credit: Accounts Payable for $500 (this increases your liabilities)

That one action immediately increases your total liabilities on the balance sheet.

Scenario 2: Creating Accounts Receivable

You send a client an invoice for $5,000 for consulting services you’ve completed. The payment is due in 30 days.

- Initial Journal Entry:

- Debit: Accounts Receivable for $5,000 (this increases your assets)

- Credit: Service Revenue for $5,000 (this increases your revenue)

Now, your total assets on the balance sheet have gone up, reflecting the money you’re owed.

These entries are much more than just bookkeeping. They directly affect key financial health metrics that lenders and investors watch closely, like your current ratio (current assets / current liabilities) and working capital (current assets – current liabilities).

The Impact on Financial Health Metrics

Let’s look at the numbers. Say that before these transactions, your firm had $20,000 in current assets and $8,000 in current liabilities.

- Before: Your working capital was $12,000 ($20,000 – $8,000).

After you record the $500 AP liability and the $5,000 AR asset:

- New Current Assets: $20,000 + $5,000 = $25,000

- New Current Liabilities: $8,000 + $500 = $8,500

- After: Working capital is now $16,500 ($25,000 – $8,500).

Even before any cash has changed hands, your books show a stronger financial position. This is because your expected income (AR) grew more than your immediate obligations (AP). It’s a perfect example of how managing your AP and AR meticulously gives you a real-time, accurate picture of your business’s liquidity and operational health.

Comparing Daily AP and AR Management Workflows

When you look at a balance sheet, accounts payable and accounts receivable are just single lines. But behind those numbers are two very different, often opposing, daily workflows. The real difference between them comes down to their goals. AP management is all about control, accuracy, and being smart about when your cash goes out. AR management, on the other hand, is built for speed and efficiency to get cash in the door faster.

For any service business, getting these separate workflows right is absolutely critical. If one process breaks down, it puts immediate stress on the other. This can mess with everything from your vendor relationships to your ability to make payroll.

This process flow diagram shows you exactly how Accounts Payable hits your balance sheet as a liability, while Accounts Receivable is recorded as an asset. It really highlights their opposite but deeply connected roles.

As you can see, AP activities increase what you owe (liabilities) and eventually reduce your cash. AR activities do the opposite—they increase what you own (assets) and, once collected, boost your cash reserves.

The Accounts Payable Workflow: Control and Cost Management

The daily AP workflow is fundamentally about managing what you owe and protecting the company’s cash. Think of it as a defensive process. It’s designed to make sure every single dollar you spend is legitimate, properly approved, and paid at a time that works best for your cash position.

A solid AP workflow has a few key stages:

- Vendor Onboarding: This means properly vetting and setting up new suppliers in your system before you ever receive a bill.

- Invoice Processing: When an invoice comes in, it needs to be entered accurately. This often involves a three-way match, where you compare the invoice to the purchase order and the proof of service.

- Approval Routing: The invoice is then sent to the right manager or department head to get the green light.

- Payment Scheduling: This is where you strategically time the payment to fit your cash flow needs. You might pay early to snag a discount or use the full payment terms your vendor agreed to.

The focus here is all on verification and control. Rushing this can lead to expensive mistakes like paying the same bill twice, overpaying, or even falling victim to invoice fraud. A tight workflow is your first line of defense. For a deeper dive, check out this comprehensive guide to Accounts Payable workflow for more insights on optimizing each step.

The Accounts Receivable Workflow: Speed and Cash Acceleration

In complete contrast, the accounts receivable workflow is an offensive strategy. Its entire purpose is to turn the services you’ve already delivered into cash in the bank as fast as you can. Every day an invoice goes unpaid, your business is essentially giving your client an interest-free loan.

The AR process usually involves these steps:

- Client Onboarding & Credit Policy: You start by setting clear payment terms and credit limits right from the beginning.

- Invoicing: As soon as the work is done, you need to generate and send an accurate invoice—no delays.

- Collections (Dunning): This is the systematic process of following up on unpaid invoices with reminders and calls.

- Cash Application: Once payment arrives, you have to correctly apply it to the right open invoice in your system.

A bottleneck in your AR process will inevitably strain your AP process. Slow collections mean less cash available to pay your own bills. This creates a predictable and stressful cash crunch that can stop growth in its tracks and ruin good vendor relationships.

This dynamic really shows how critical the link is between the two functions. You can’t effectively manage what you owe if you can’t collect what you’re owed.

Improving both processes is a must. For example, you can learn more about what an accounts payable workflow is and see how automation can slash manual data entry and approval times. On the AR side, setting up automated payment reminders or offering easy online payment options can drastically shorten how long it takes to get paid. At the end of the day, mastering both workflows is the foundation of a financially healthy service business.

The Critical Link Between AP, AR, and Cash Flow

Your balance sheet gives you a snapshot of your company’s assets and liabilities at a single moment in time. But your cash flow? That’s the dynamic, moving lifeblood that keeps your business running day after day. The constant push and pull between your accounts payable (AP) and accounts receivable (AR) is the very heart of that flow. It’s not just about what you owe versus what you’re owed; it’s about the crucial timing gap between the two.

For any service business, success often boils down to managing and closing this gap. Simply put, you have to collect cash from your clients (AR) before you need to pay your vendors and operating expenses (AP). When that timing is off, even a profitable business on paper can find itself without enough cash to cover its bills.

The Cash Conversion Cycle in Action

Let’s walk through a real-world scenario. Imagine your marketing agency finishes a $10,000 project for a new client and sends an invoice with 30-day payment terms. That $10,000 is immediately recorded as an asset in your accounts receivable. At the same time, you have a $4,000 bill due in 15 days for a key piece of software you used on that project.

If the client pays on day 29, everything works out. But what if they’re late and don’t pay until day 45? Your $4,000 AP obligation doesn’t wait. You’re now forced to dip into your cash reserves to pay that vendor, creating a temporary shortage. This is the classic cash flow crunch, and it can quickly hurt your ability to make other timely payments, potentially damaging your business credit.

The ultimate goal for sustainable growth is to shorten your cash conversion cycle. This means systematically collecting receivables faster than you pay your payables, creating a positive cash flow that fuels your business instead of straining it.

Key Metrics to Monitor Your Cash Flow Health

To move from guesswork to strategic management, you need to track a couple of essential Key Performance Indicators (KPIs). These metrics measure just how efficient your AP and AR processes really are.

- Days Sales Outstanding (DSO): This AR metric tells you the average number of days it takes to get paid after you’ve completed work and sent an invoice. A lower DSO is always better—it means you’re turning your services into actual cash more quickly.

- Days Payable Outstanding (DPO): On the flip side, this AP metric shows the average number of days it takes you to pay your own bills. A higher DPO can be a strategic advantage, as you hold onto your cash longer, but letting it stretch too far can damage your relationships with vendors.

Getting a handle on these numbers is the first step. You can learn more about how they fit into the bigger financial picture by understanding your complete cash flow calculation.

Interpreting Your DSO and DPO

Once you calculate these KPIs, you get a much clearer view of your operational health.

Let’s say your DSO is 45 days and your DPO is 30 days. This signals a negative cash gap. On average, you’re paying your bills a full 15 days before you collect the revenue needed to cover them, forcing you to rely on existing capital to fund day-to-day operations.

Now, flip those numbers. A DSO of 25 days and a DPO of 40 days is an ideal situation. You’re collecting cash well before your own bills are due, creating a healthy cash buffer that can be used for growth, investment, or weathering unexpected expenses.

It’s also important to remember that external factors can throw a wrench in your receivables. In the United States, small businesses see major regional differences in collection times. While the national average time to get paid is 29.8 days, businesses in the Midwest get their cash fastest at 25.8 days. Meanwhile, companies in the West wait the longest, at 32.6 days. These numbers show exactly why proactive AR management is so critical for staying liquid when your own AP obligations come due. Mastering the delicate balance between accounts payable vs accounts receivable is what separates financially fragile businesses from resilient ones.

Mitigating Risk with AP and AR Internal Controls

Without strong internal controls, both your accounts payable and accounts receivable can quickly become major sources of financial risk. These processes aren’t just administrative tasks; they’re critical checkpoints that protect your company’s assets and profitability. Weak controls can lead to everything from fraudulent payments to uncollected revenue, quietly draining your resources.

Establishing robust internal controls is really about creating a structured, predictable system that protects against both human error and intentional misuse. It’s how you ensure every dollar leaving your business is legitimate and every dollar owed to you is diligently pursued.

Fortifying Your Accounts Payable Process

The biggest risks in AP management are unauthorized payments, duplicate invoices, and outright fraud. A well-designed system of controls can effectively shut down these threats, protecting your cash outflow.

Implementing these safeguards builds a resilient AP function:

- Segregation of Duties: This is a simple but powerful one. Make sure the person who approves invoices is not the same person who processes the payments. This basic separation makes it much harder for fraudulent transactions to slip through.

- Three-Way Matching: Before any payment goes out the door, the supplier’s invoice must be matched against the initial purchase order and the proof of service delivery. This validation step confirms you are only paying for what you actually ordered and received.

- Clear Approval Hierarchy: Establish specific spending limits for different managers. This prevents unauthorized large purchases and makes sure significant expenses get the appropriate level of scrutiny.

Securing Your Accounts Receivable and Revenue

On the AR side, the risks are just as severe—late payments, mounting bad debt, and poor cash flow. The longer an invoice goes unpaid, the less likely it is you’ll ever see that money.

Aging accounts receivable beyond 90 days poses a serious risk to profitability, with collection rates plummeting to as low as 50%. Historical benchmarks show that when the value of invoices aged over 90 days surpasses 22% of total receivables, write-off rates can surge by three to four times. This happens as older invoices run into disputes or customer insolvency, turning potential revenue into permanent losses. You can find more detailed stats on the financial impact of aging receivables.

Effective internal controls are not administrative burdens; they are essential safeguards that protect profit, ensure data integrity, and build a resilient financial foundation for your service business.

To protect your incoming cash flow, proactive controls are completely non-negotiable.

- Systematic Invoicing: Send accurate, professional invoices the moment services are completed. Any delay in invoicing directly causes a delay in payment.

- Regular Credit Reviews: You should periodically review the creditworthiness of your clients, especially those with large or growing balances. Don’t be afraid to adjust credit terms for higher-risk customers to minimize potential losses.

- Proactive AR Aging Analysis: Don’t wait for invoices to become ancient. Regularly review your AR aging report to spot and follow up on overdue accounts before they snowball into a serious problem.

By implementing these distinct controls for accounts payable vs accounts receivable, you create a financial framework that doesn’t just manage day-to-day transactions but actively protects your business from common and costly risks.

How Technology and Experts Transform AP and AR

Getting a handle on the differences between accounts payable and accounts receivable is a great start. But the real game-changer is putting systems in place that make managing both sides of the coin efficient and dead-on accurate. For most service businesses, this means moving beyond manual spreadsheets and into strategic financial management, powered by modern software and an expert financial partner.

For many, the journey starts with powerful, user-friendly accounting platforms. A tool like QuickBooks Online is designed to bring total clarity to your finances, automating the core tasks and slashing the risk of human error that can really mess with your cash flow.

The Role of Automation and Software

Think of technology as the engine that drives your AP and AR workflows. When you automate the repetitive stuff, you get back precious time and gain a real-time, crystal-clear view of where your money is. This is where platforms like QuickBooks Online and Gusto really prove their worth.

- Automated Invoicing and Reminders: QuickBooks can be set up to automatically create and fire off invoices the moment a job is done. Even better, it can send out polite payment reminders to clients who are dragging their feet, which directly helps shorten your Days Sales Outstanding (DSO).

- Streamlined Bill Pay: You can easily capture vendor bills, get them approved, and schedule payments right inside the software. This gives you precise control over when your cash goes out the door.

- Real-Time Reporting: Need to see who’s late on payments? Pull an AR aging report in seconds. Want to check your profitability for the month? A P&L statement is just a few clicks away. This kind of instant access empowers you to make smart decisions on the fly.

This move toward automation is more than just a convenience—it’s critical. It’s shocking how many businesses still rely on manual AP processing, which costs an average of $15 per invoice. On the AR side, inefficiencies mean only 36% of U.S. invoices are paid on time. And recent stats show that a staggering 68% of firms are still manually keying in invoice data.

The Strategic Value of Expert Financial Partners

While software gives you the tools, an expert financial partner like Steingard Financial provides the strategy and oversight. Our job goes way beyond just setting up the software; we architect and manage your entire financial back office to make sure it’s actually helping you hit your business goals.

Software can tell you what happened, but an expert can tell you why it happened and what you should do next. This insight is the difference between simply recording transactions and making strategic, data-driven decisions.

An experienced firm adds value in several critical areas:

- Optimized Workflow Design: We don’t use a one-size-fits-all approach. We design AP and AR workflows specifically for your service business, implementing the right internal controls from day one.

- Meticulous Reconciliation: We perform timely bank and credit card reconciliations to catch any discrepancies early. This ensures the data you see in your reports is always accurate and reliable.

- Insightful Reporting: We deliver financial statements that are clear and easy to understand. We also highlight the key performance indicators that actually matter, turning raw data into intelligence you can act on.

When you combine the efficiency of platforms like QuickBooks with professional oversight, you get a financial system that truly works for you. For more detail, check out our guide on automating the accounts payable process. Ultimately, this synergy between tech and expertise lets you focus on what you do best—growing your business, confident that your financial foundation is rock solid.

Frequently Asked Questions About AP and AR

When it comes to the day-to-day finances of a service business, a few questions about accounts payable and accounts receivable pop up time and time again. We hear them from clients all the time. Getting clear, practical answers is key to running your back office smoothly and making sound financial decisions.

Can a Profitable Business Still Suffer from Poor Cash Flow?

Yes, absolutely. It’s a surprisingly common trap for business owners to fall into, and it usually happens when accounts receivable collections are lagging.

You might be crushing your sales goals, sending out invoices, and seeing fantastic profits on your income statement. But profit on paper doesn’t pay the bills. If you aren’t collecting that cash in a timely manner, you won’t have the money in the bank to cover your own payables, payroll, or other essential expenses. This gap between reported profit and actual cash on hand can cause serious financial stress for even the most successful businesses.

What Is the Main Difference Between a Purchase Order and an Invoice?

Think of it this way: a purchase order (PO) is what you send a vendor to kick off a transaction. It’s a document created by you, the buyer, to officially authorize a purchase. It’s the very first step in your accounts payable process and confirms exactly what you’re ordering before anything happens.

An invoice, on the other hand, is a bill sent from the seller to the buyer after the service has been delivered. It formally requests payment for the work that’s been done and gets the accounts receivable clock ticking for the seller. In short, a PO is an order, and an invoice is a bill for that completed order.

The distinction is critical: a purchase order signals intent to pay, while an invoice creates a legal obligation to pay. Mistaking one for the other can lead to significant bookkeeping errors and payment delays.

How Do AP and AR Directly Affect Working Capital?

Working capital is one of the best quick-glance metrics for your company’s short-term financial health. The formula is simple: current assets minus current liabilities. Because accounts receivable (AR) is a current asset and accounts payable (AP) is a current liability, they have a direct and opposite impact on that number.

- Increasing your AR boosts your working capital, showing that you have more cash inflows on the way.

- Increasing your AP lowers your working capital, which means you have more payment obligations coming due soon.

The real goal is to manage both sides of the coin effectively. That means collecting your AR as quickly as you can to turn it into cash while strategically timing your AP payments to hold onto your cash as long as possible—without harming your vendor relationships. Nailing this balance is how you optimize your working capital.

Managing the delicate dance between what you owe and what you’re owed requires real expertise. The team at Steingard Financial provides meticulous AP/AR management, insightful reporting, and strategic financial oversight to give you peace of mind and a solid foundation for growth. Learn how we can optimize your financial back office today.