Outsourced Accounting Services for Small Business: Streamline Finances, Cut Costs

When you hear "outsourced accounting," what comes to mind? For a lot of small business owners, it's about handing off the financial grunt work. Things like daily bookkeeping, payroll, and invoicing. And they're not wrong, but that’s only half the story.

True outsourced accounting is a partnership. It’s about bringing in an external firm to manage your entire financial operation—from the basics all the way up to high-level strategy. This isn't just about freeing up your time (though that's a huge perk). It's a strategic move to build a professional-grade, scalable financial back office without the staggering cost of hiring an in-house team.

Why Growing Businesses Outsource Their Accounting

Most founders start out doing their own books. It seems manageable at first. But as the business grows, so does the complexity. Suddenly, what used to be a quick weekend task turns into a time-sucking monster. This is that critical fork in the road where outsourcing stops being a "nice to have" and becomes essential for survival and growth.

The biggest driver? The slow realization that your time is better spent elsewhere. Every hour you wrestle with a spreadsheet, chase a late payment, or try to figure out payroll is an hour you’re not spending on sales, product development, or talking to customers. That opportunity cost is real, and it can quietly stifle the very activities that bring in revenue.

It's About More Than Just Saving Time

Reclaiming your schedule is a game-changer, but the real win is gaining clarity and control over your finances. Let's be honest, messy books lead to bad decisions. When you can't fully trust your numbers, you're flying blind. You can't project cash flow with confidence, understand your true profitability, or get through tax season without a major headache.

A good outsourced partner flips the script, turning your accounting from a reactive chore into a proactive tool. They deliver:

- Accurate and Timely Reporting: Clean, reliable financial statements that arrive on a predictable schedule. No more guessing.

- Deep Expertise: You get access to a full team of experienced bookkeepers and CPAs who have seen it all in your industry.

- Modern Technology: They'll get you set up and running seamlessly on platforms like QuickBooks and Gusto, building an efficient back office.

This isn't just a niche trend anymore; it's becoming standard practice. A striking 37% of small businesses now outsource their accounting, putting it right up there with IT services. Many are making the switch to tap into efficiencies from modern practices like automation in accounting. The shift makes sense—it’s about getting superior expertise for less than the cost of a full-time hire.

A Strategic Move for Real Growth

Ultimately, opting for outsourced accounting is an investment in a stable foundation for growth. Instead of worrying about the high cost and risk of hiring a full-time controller, you get a dedicated partner who is genuinely invested in your company’s financial health.

By delegating financial tasks, business owners can focus on running their business. This reclaimed time might be used to expand into new markets, enrich current opportunities, or design new products, all ideally leading to greater profitability.

For many businesses, the journey starts when they decide to outsource bookkeeping for small business. This move alone lifts a huge daily weight. From there, a true partner helps you connect the dots, using that clean data to guide your biggest decisions and navigate the future with confidence.

The True Cost of In-House vs Outsourced Accounting

Choosing between an in-house accounting team and an outsourced partner isn't just about comparing a monthly fee to an annual salary. To get a real sense of the financial impact, you have to look at the fully loaded cost of a hire versus the comprehensive, flexible nature of outsourced accounting.

An in-house bookkeeper costs far more than just their base pay. When you factor in benefits, payroll taxes, vacation time, and the tools they need to do their job, the real number can be 30-40% higher.

This means a bookkeeper with a $60,000 salary could actually cost your business closer to $84,000 a year. And that’s before you even get to the hidden, less obvious expenses.

In-House vs Outsourced Accounting A Realistic Breakdown

A direct comparison makes the financial logic much clearer. Let's break down where the money really goes.

| Factor | In-House Team | Outsourced Provider |

|---|---|---|

| Salary & Benefits | High, fixed cost (e.g., $84,000+ per year) | Predictable, scalable monthly fee |

| Software Costs | Business bears the full expense | Included in the service fee |

| Training & Development | Ongoing expense and time commitment | Provider's responsibility |

| Expertise Level | Limited to one individual's skills | Access to a full team of experts |

| Turnover Risk | High impact; knowledge loss | Low impact; continuity is built-in |

| Scalability | Difficult; requires a new hire | Easy; adjust service level as needed |

Ultimately, the decision comes down to the value you receive. With an in-house employee, you pay for their time, no matter the workload. With outsourced accounting, you pay for the specific outcomes you need, gaining a scalable financial engine designed to support your growth.

Uncovering the Hidden In-House Expenses

Beyond the obvious costs, an in-house hire brings a handful of financial drains that many business owners don't see coming. These variables can seriously inflate the true cost of managing your books internally.

Here are a few of the expenses people tend to forget:

- Recruitment and Training: Finding, interviewing, and onboarding a new employee takes a lot of time and money. Then you have to keep them up-to-date on changing software and tax laws.

- Software and Equipment: You’re on the hook for buying and maintaining accounting software licenses, like QuickBooks Online, plus the computer and office gear they need.

- Employee Turnover: If your bookkeeper leaves, you’re not just repeating the expensive hiring process. You’re also facing the risk of critical knowledge walking right out the door, potentially leaving your finances in a mess.

- Limited Expertise: A single employee, no matter how good they are, only knows so much. You’ll probably still have to pay extra for a CPA during tax season or for specialized advice on a tricky issue.

The opportunity cost of managing every financial task can be immeasurable. Outsourcing accounting allows business owners to focus on critical business decision-making and growth.

This highlights the core problem: hiring one person often creates a single point of failure and a bottleneck for specialized financial guidance. This is where an outsourced model offers a completely different kind of value.

The Financial Advantage of an Outsourced Partner

When you work with an outsourced accounting firm, you're not just hiring one person—you're getting access to an entire team's collective expertise for one predictable monthly fee. This model gets rid of all those hidden costs that come with a full-time employee.

An outsourced provider handles all the recruiting, training, and retaining of top talent. They also cover the costs of advanced accounting technology, which means you get the best tools without paying for them directly. It's also worth looking into how various professionals, including accountants, leverage AI front desk solutions to save money to see how modern tools can create even more efficiency.

Good firms also bring process improvements that an in-house employee might miss. For example, they can introduce systems to simplify bill payments and improve cash flow. You can learn more by checking out our guide that answers the question, "what is AP automation?".

Services That Define a Great Accounting Partner

When you start looking at outsourced accounting services, a lot of the proposals can blur together. Every firm talks about "bookkeeping" and "financial reporting," but those terms barely scratch the surface of what a truly valuable partnership looks like.

The real difference isn't just in what they do, but how they do it and what it means for your business. It’s about shifting from just looking at last month's numbers to actually using that information to make smarter decisions for the future. Let’s pull back the curtain on what a top-tier firm should really be delivering.

Foundational Services: The Bedrock of Financial Health

Before you can get into any kind of high-level strategy, the basics have to be rock-solid. This is non-negotiable. These core services are the engine of your financial operations, ensuring every number is clean, correct, and ready for analysis. If your foundational bookkeeping is sloppy, any reports or forecasts built on top of it are worthless.

Here's what that bedrock should include:

- Meticulous Transaction Categorization: This is way more than just dumping expenses into buckets. A great partner digs in to understand your business model and builds a Chart of Accounts that actually tells a story. A marketing agency's P&L, for example, needs to track completely different things than a construction company's.

- Timely Reconciliations: Your bank and credit card accounts should be reconciled every single month, no exceptions. This is how you catch errors, spot potential fraud, and confirm that the cash balance in your books is real. It gives you a true picture of your cash position.

- Accounts Payable (AP) and Receivable (AR) Management: This is all about cash flow. A good partner doesn't just process bills; they help you optimize payment schedules, chase down overdue invoices from customers, and make sure your own vendors get paid on time. It's about keeping cash moving and maintaining good relationships.

Getting these fundamentals right means you can actually trust your numbers when you’re making a big move, like hiring a new team member or investing in new equipment.

Strategic Services That Drive Growth and Clarity

With a solid foundation in place, a great partner moves beyond simple bookkeeping and starts acting as a strategic advisor. This is where you see the real return on your investment—when raw data gets turned into insights that help you run a better business.

"Timely reporting leads to an ongoing understanding of the tax position of a company, which will help the business stay compliant and avoid potential penalties."

It's a critical shift. You start using your financial data to see what’s coming around the corner instead of just looking in the rearview mirror.

These strategic services are what make the difference:

- Custom Financial Reporting: You should expect more than a generic P&L and Balance Sheet. A valuable partner builds custom reports that track the Key Performance Indicators (KPIs) that matter most to your business, whether that's Customer Acquisition Cost (CAC) for a startup or Monthly Recurring Revenue (MRR) for a SaaS company.

- Cash Flow Forecasting: Knowing where your cash is today is one thing. Knowing where it will be in three or six months is a complete game-changer. Your provider should help you build realistic cash flow projections so you can see potential shortfalls long before they happen and plan for growth opportunities.

Advanced Support: Connecting Finances and People

The most forward-thinking accounting firms know that a company's financial health is directly linked to its people. They build services that connect the dots between your finances and your team, creating a truly unified back office.

This is a huge advantage for growing service businesses where payroll is often the biggest line item. A partner who gets this connection can add immense value.

For example, they might offer People Advisory services, using platforms like Gusto to handle everything from employee onboarding and benefits to helping you craft compensation plans that attract and keep top talent. This integrated approach ensures your staffing decisions are always financially sound.

Many business owners find payroll to be one of their most complicated and stressful tasks. If you're looking to get it off your plate, you can outsource payroll for small business to a provider who can manage everything from tax withholding to direct deposits. This is what a modern, strategic partnership looks like—one that understands how your money and your people work together.

How to Choose the Right Outsourced Accounting Firm

Picking the right partner for your outsourced accounting is easily one of the biggest financial decisions you'll make for your company. This isn't just about hiring someone to handle your bookkeeping; it’s about giving an outside team the keys to a core part of your business. The whole point is to find a firm that feels less like a vendor and more like an extension of your own team.

The right fit goes way beyond a fancy website or a rock-bottom price. You're looking for a partner with real expertise, a communication style that clicks with yours, and a genuine interest in seeing you succeed. Getting this wrong can mean months of headaches, confusing reports, and dead silence when you desperately need an answer.

Vetting Potential Partners with the Right Questions

Your first calls with potential firms are where you separate the real pros from the pretenders. This is your chance to get past the sales pitch and really understand how they operate. You need to come armed with specific, practical questions that show you how they actually work.

Don't just ask, "Do you have experience in my industry?" That’s a softball question. Instead, get specific. Ask them to walk you through a particular challenge they solved for a business just like yours. Their story will reveal far more about their problem-solving skills than a simple "yes" ever could.

Here are a few critical questions to keep in your back pocket:

- Book Cleanup Process: "What’s your exact process for cleaning up historical books from a previous accountant?" A solid firm will have a clear, step-by-step method they can explain.

- Technology Integration: "How do you work with the tools we already use, like QuickBooks Online and Gusto?" They should be absolute experts in your tech stack and be able to tell you how they’ll make it run better.

- Team Structure: "Who will be my day-to-day contact? How much access will I have to senior people, like a CPA?" You need to know exactly who you'll be talking to.

- Reporting Cadence: "What's in your standard monthly report package, and can we customize it to track our specific KPIs?" Generic reports won't cut it; they need to be built around your goals.

The best outsourced accounting firms act as an extension of your team, not just a vendor. Look for a firm that emphasizes proactive communication and provides insights before you even have to ask.

Looking Beyond the Technical Skills

Of course, technical skill is a must-have, but the cultural fit is just as crucial. You’re building a long-term relationship here. You need a partner who gets your vision and is truly committed to helping you get there. A firm that just wants to close your books and send an invoice will never deliver the strategic value you need to actually grow.

Think about this real-world scenario: a marketing agency was getting nowhere with their outsourced provider. Emails went unanswered for days, and their monthly reports were always late, making cash flow management a nightmare. They switched to a new firm that not only delivered reports on time but also set up a quick weekly call to go over key numbers. That simple, proactive step completely changed their financial visibility and ability to make smart decisions.

Industry Expertise and Proactive Communication

An accounting firm that truly understands your industry is a game-changer. They’ll already know the financial quirks, common pain points, and important benchmarks for your market. That expertise leads directly to more accurate financial statements and sharper advice. When you're talking to a firm, always ask for references from other clients in your space.

This demand for specialized, trustworthy partners is fueling major growth in the market. The global accounting outsourcing market is set to expand, with 68% of U.S. companies already outsourcing some services—the highest rate in the world. As this trend grows, finding a reliable, tech-savvy partner is key to staying accurate and compliant. You can find more insights about the global accounting outsourcing market on collarsearch.com.

Your chosen partner should also be a great communicator. This means they are:

- Responsive: They get back to you in a timely manner.

- Clear: They can break down complex financial topics into plain English.

- Proactive: They bring ideas and potential problems to you before they blow up.

In the end, choosing the right firm comes down to trust. Do you trust them with your sensitive financial data? Do you trust their expertise to help guide your decisions? And do you trust that they care about your success as much as you do?

Making a Smooth Transition to Your New Partner

You’ve done the hard work and picked a new accounting partner. That’s a big decision. Now comes the part that can feel just as daunting: making the switch without everything falling apart. A well-thought-out transition is the key to preventing lost data, operational headaches, and starting the new relationship on the right foot.

Think of the onboarding process as your roadmap. When you break it down into manageable chunks—what to do before they start, what to expect in the first month, and what success looks like after the first quarter—the whole thing feels much less overwhelming. This isn't just about handing over a few passwords; it's a methodical transfer of knowledge so your new team can truly understand your business.

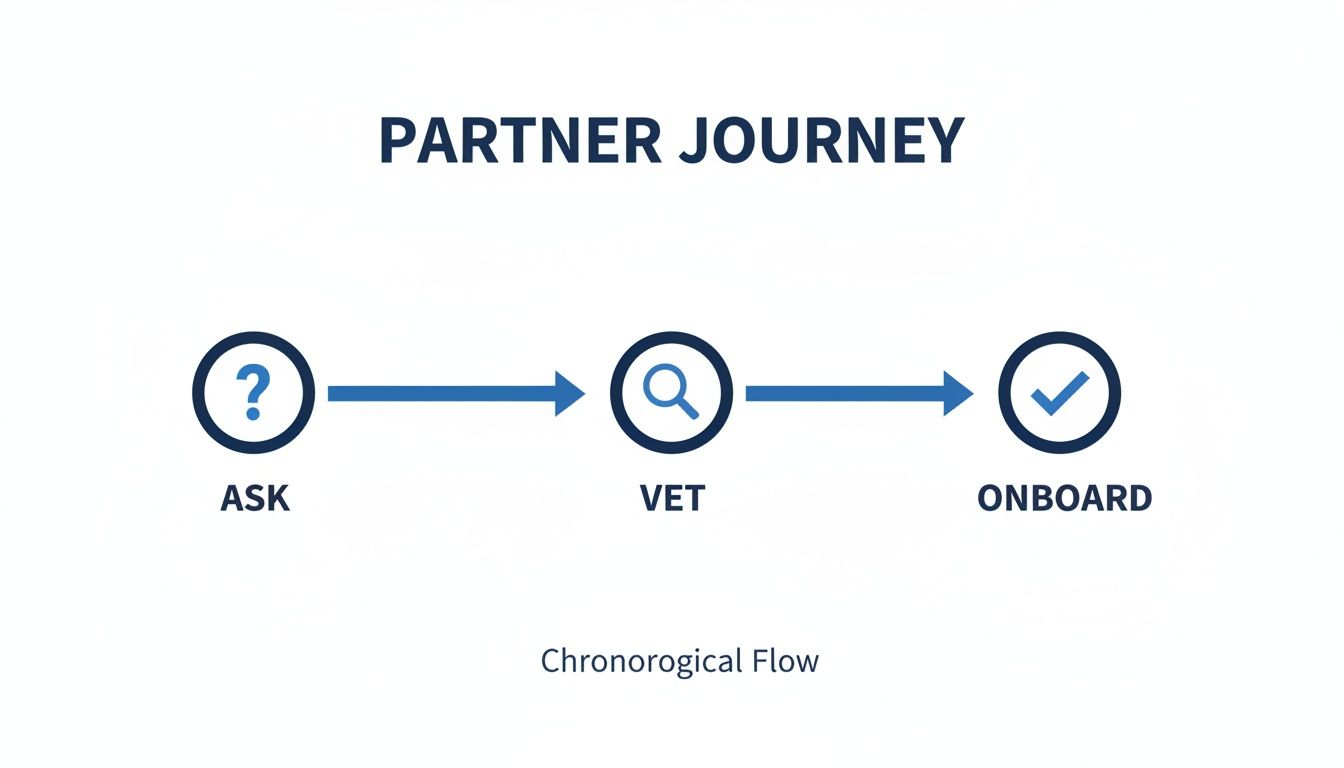

This simple journey map lays it out perfectly: you ask, you vet, and then you onboard.

Onboarding isn't an afterthought; it's the critical final phase that turns a good choice into a great partnership.

Your Pre-Launch Preparation Checklist

Before your new firm officially takes the reins, you need to get your financial house in order. Think of it like prepping your kitchen before a chef comes over to cook. Getting all the key documents and information ready upfront means your new team can dive right in instead of spending billable hours just chasing down paperwork.

This initial data dump gives them the historical context they need to understand your business's financial story from day one.

Here’s a great starting list of what to pull together:

- Prior Tax Returns: Have at least the last two years of your federal and state business tax returns ready.

- Historical Financials: This includes your full Profit & Loss, Balance Sheet, and Cash Flow statements for the previous fiscal year.

- Access Credentials: Get your logins ready for business bank accounts, credit cards, and your existing accounting software (like QuickBooks Online).

- Payroll History: Pull detailed payroll reports from your provider, such as Gusto. These should show employee wages, taxes, and deductions.

- Key Legal Documents: Don't forget copies of your articles of incorporation, operating agreement, or any significant loan paperwork.

Tuck everything into a secure shared folder. This makes the handoff both efficient and safe.

Navigating the First 30 Days

The first month is all about setting up systems, granting access, and finding a communication rhythm. Your new partner will be digging into your books, cleaning up any lingering issues from the past, and getting their own systems synched up with your operations.

This period is absolutely critical for building a solid foundation. You can’t over-communicate here. You want to make sure both sides are perfectly aligned on how things will work right from the get-go.

A successful transition lives and dies by open communication. Those first few weeks should be full of check-ins to talk about reports, address any compliance questions, and share insights about the business. It’s these touchpoints that build confidence and prove your new provider is delivering the value you signed up for.

During this initial sprint, you’ll work together on a few key tasks:

- Granting Secure Access: Your provider will need admin-level access. In QuickBooks Online, it's as simple as adding them as an "Accountant" user. For a payroll system like Gusto, you can add them as an external accountant with customized permissions.

- Defining the Reporting Cadence: Agree on a schedule for financial reports. You’ll probably want a monthly P&L and Balance Sheet at a minimum, but maybe you also need a weekly cash summary or a bi-weekly accounts receivable report. Get it on the calendar.

- Establishing a Communication Channel: Name a primary point of contact for your team and theirs. Set up a dedicated space for questions—whether that’s a shared Slack channel, a project management tool, or just a clear email thread.

Setting Benchmarks in the First 90 Days

Once the foundational work is done, the first quarter is all about optimization and seeing a real return on your investment. By now, your new partner should be fully integrated into your workflow. The day-to-day stuff should be running smoothly, and they should start bringing strategic ideas to the table.

This is where you’ll really start to feel the benefits of outsourced accounting services for small business. The focus shifts from cleanup to proactive financial guidance. Your provider should be spotting trends, suggesting ways to improve your processes, and helping you understand the story your numbers are telling.

Here are a few milestones to hit in this period:

- KPI Identification and Tracking: Work with them to nail down the 3-5 Key Performance Indicators (KPIs) that actually drive your business forward. Maybe it's Gross Profit Margin, Customer Acquisition Cost (CAC), or Days Sales Outstanding (DSO). Once defined, they should build custom reports to track them.

- Process Optimization Review: Your provider should come back to you with their initial findings. For instance, they might suggest automating accounts payable to free up cash or refining expense categories to give you a clearer view for budgeting.

- First Full Month-End Close: This is a big one. The first complete financial close they perform is a major test. Sit down and review the reporting package together. Is it accurate? Is it easy to understand? Does it give you the insights you need to make smarter decisions?

A successful first 90 days cements the relationship. It’s the point where your outsourced firm stops being just a service provider and becomes a true financial partner invested in your growth.

Common Questions About Outsourcing Your Accounting

Deciding to bring in an outside partner to handle your finances is a big move. It’s completely normal to have questions and maybe even a few reservations. After all, this is about more than just numbers—it’s about trust, control, and putting the financial heart of your business in the right hands.

Let’s walk through some of the most common concerns we hear from business owners when they're thinking about outsourced accounting. The goal here is to give you clear, straight-up answers so you can move forward with confidence.

Will I Lose Control Over My Finances?

This is easily the biggest question we get, and it comes from a good place. As the owner, you absolutely need to have your finger on the pulse of your company’s financial health. The fear is that if you hand over the books, you'll suddenly be flying blind.

But a good outsourced partnership does the exact opposite—it gives you more control, not less.

Think about it. Right now, you might be buried in the weeds, chasing down receipts or trying to figure out how to code a transaction. A quality firm pulls you out of that daily grind. Instead, you get a high-level, real-time view of your finances through clean, accurate reports, available whenever you need them. You start making strategic decisions based on solid data, not just a gut feeling.

Is My Business Too Small to Outsource?

A lot of founders, especially in the early stages, think outsourced accounting is only for bigger companies. They tell themselves they’ll wait until they hit a certain revenue number or have a specific number of employees. This kind of thinking can actually hold you back.

The truth is, even the smallest businesses gain a huge advantage by getting their financial foundation right from the very beginning.

- It prevents expensive mistakes. Trust me, cleaning up a year's worth of messy books costs a lot more than just doing it right from month one.

- It builds good habits. A professional partner helps you create financial processes that can scale as you grow, so you're not constantly reinventing the wheel.

- It frees you up to focus on growth. In the early days, your time is your most valuable asset. Every hour you spend on bookkeeping is an hour you’re not spending on sales, product, or customer service.

The best firms offer flexible service models. You can easily start with the basics, like bookkeeping, and then add on services like payroll management or strategic forecasting as your business expands.

How Much Do Outsourced Accounting Services Cost?

Of course, cost is a major factor. But it’s important to look at it the right way. The price for outsourced accounting can be anywhere from a few hundred dollars a month for simple bookkeeping to several thousand for a full-service package that includes CFO-level advice.

The final cost really depends on a few things:

- Transaction Volume: How many transactions are you running through the business each month?

- Service Complexity: Do you just need the books done, or do you also need help with payroll, paying bills, invoicing customers, and tax planning?

- Initial Cleanup: Are your past records in good shape, or will the firm need to do a significant cleanup project to get you started on the right foot?

Instead of just asking, "What does it cost?" a better question to ask is, "What is the return on this investment?" When you add up the time you get back, the costly errors you avoid, and the strategic insights you gain, the value almost always outweighs the monthly fee.

Is My Financial Data Secure with an Outside Firm?

Handing over sensitive financial information requires a massive amount of trust. Data security is completely non-negotiable. Any reputable firm will be transparent about its security protocols and will have solid measures in place to protect your information.

Before you sign anything, ask potential partners directly about their security practices. They should be able to clearly explain how they use encrypted communication, secure document portals, access controls, and data backup procedures. Protecting client data is a cornerstone of their business, and they should have no problem proving it to you.

Ready to gain financial clarity and get back to focusing on what you do best? The team at Steingard Financial offers the expert bookkeeping, payroll, and advisory services your business needs to thrive. Learn how we can build a scalable financial back office for you.