How to Setup QuickBooks Online for Service Businesses

Getting your financial house in order starts with a solid foundation, and for a service business, that foundation is almost always QuickBooks Online. The setup process goes way beyond just creating an account and picking a plan. It's about tailoring the system to your business, so it works for you, not against you.

The real magic happens after you get through the initial wizard. You'll need to customize your Chart of Accounts, connect your bank feeds to automate data entry, and design invoice templates that reflect your brand and encourage prompt payment.

Setting Up Your Financial Foundation in QuickBooks Online

Before we jump into the nitty-gritty, let's be clear: setting up QuickBooks Online correctly is a game-changer for any service business. This isn't just a box-ticking accounting chore. It's about building a system that gives you a crystal-clear, real-time view of your cash flow. It helps you send professional invoices that actually get paid faster and tracks the key performance indicators (KPIs) you need to grow.

A proper setup elevates QBO from a simple record-keeping tool into the financial command center for your entire operation. This guide will take you far beyond the basic setup wizard to build a financial system that can scale right alongside your business.

Avoiding Common Setup Pitfalls

So many business owners, in a rush to get started, fly through the initial setup only to create massive problems for themselves down the road. A sloppy setup inevitably leads to messy reports, unreliable data, and a huge headache come tax season.

For instance, if you just stick with the default Chart of Accounts, you might end up lumping all your revenue into one generic "Sales" bucket. That makes it impossible to see which of your services are actually profitable and which ones are just spinning your wheels.

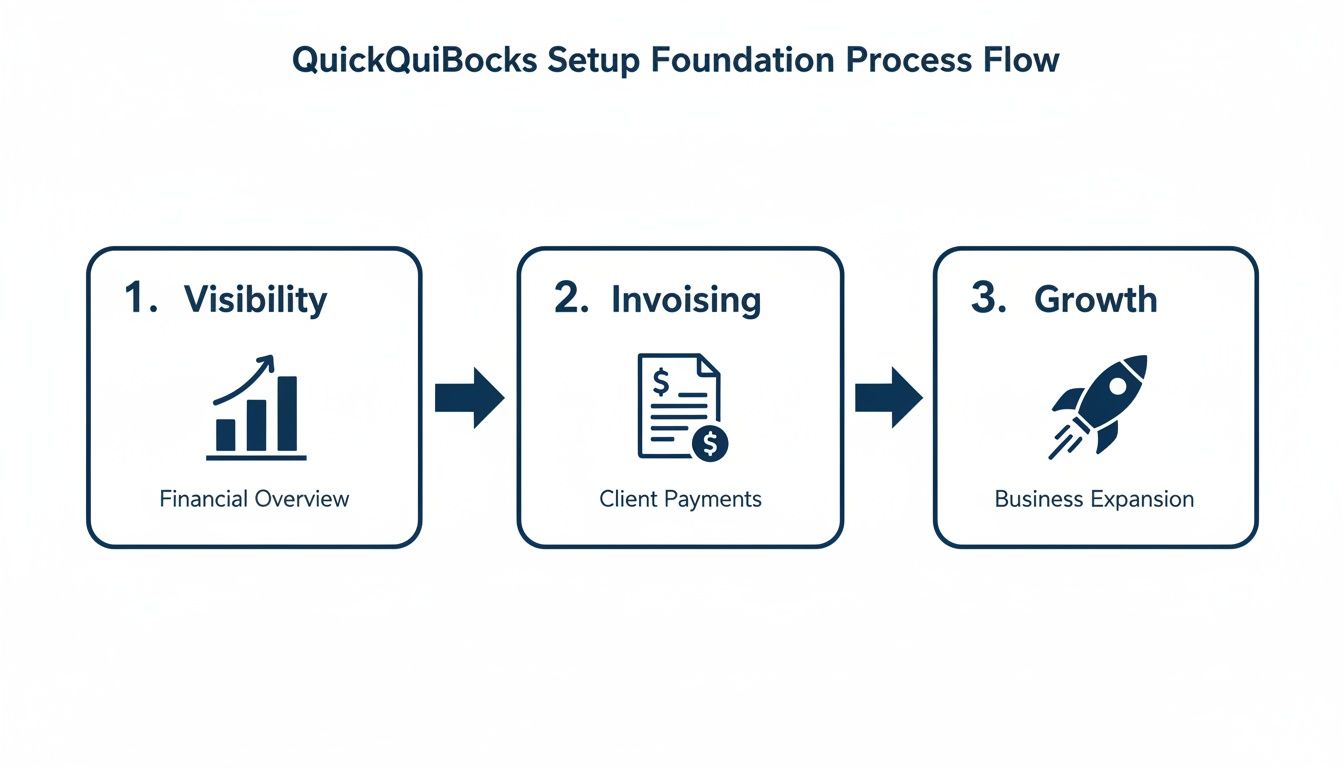

This flow chart really brings home the core benefits of putting in the effort upfront: gaining visibility, streamlining your invoicing, and paving the way for growth.

You can see how each step logically builds on the last, creating a powerful system where clear financial data directly fuels smart business decisions.

Choosing The Right Plan For Your Business

QuickBooks offers a few different subscription levels, and picking the right one from the start can save you both money and hassle. It’s tempting to go for the cheapest option, but you need to think about what your business needs right now and where you'll be in a year. Upgrading is easy, but starting with a plan that’s too limited can hold you back.

Here’s a quick breakdown to help you decide which QBO plan makes the most sense for your service-based business.

Which QuickBooks Online Plan Fits Your Service Business

| Plan | Best For | Key Service Features | Estimated Monthly Cost |

|---|---|---|---|

| Simple Start | Freelancers and solopreneurs with basic needs. | Send estimates & invoices, track income & expenses, capture receipts. | $30 |

| Essentials | Growing small businesses that need to manage bills and track time. | All Simple Start features, plus manage & pay bills, track time for invoicing, add up to 3 users. | $60 |

| Plus | Businesses needing to track project profitability and manage inventory. | All Essentials features, plus project profitability tracking, inventory management, add up to 5 users. | $90 |

| Advanced | Established businesses needing deeper analytics and automation. | All Plus features, plus batch invoicing, advanced reporting, dedicated support, add up to 25 users. | $200 |

Ultimately, the Plus plan is often the sweet spot for most service businesses, offering the project profitability tools that are so crucial for understanding your margins. But if you're just starting out, Essentials provides a great balance of features without being overwhelming.

The Power Of A Purpose-Built System

When you take the time to set up QuickBooks Online correctly for your specific business, you unlock its most powerful capabilities. Don't just take my word for it—Intuit’s own data shows that 74% of customers using features like Intuit Assist feel they have a better handle on their business's financial health. That clarity comes directly from a well-configured system.

A system built with purpose delivers huge benefits:

- Clear Financial Reporting: You can generate an accurate Profit & Loss or Balance Sheet with one click, giving you numbers you can actually trust.

- Improved Cash Flow Management: Easily see who owes you money and what bills are coming due, so you can keep your cash moving in the right direction.

- Simplified Tax Preparation: When everything is categorized correctly all year long, tax time is no longer a frantic scramble. It becomes a simple process of review and filing.

By treating your QBO setup as a strategic project rather than an administrative chore, you lay the groundwork for sustainable growth and confident decision-making. You're not just doing bookkeeping; you're building business intelligence.

As you get started, it's helpful to understand the landscape of AI bookkeeping automation features and how they stack up against other platforms. And if you're new to the world of finance, brushing up on the fundamentals with our guide on https://steingardfinancial.com/bookkeeping-basics-for-small-business/ will make this entire process much smoother.

Configuring Your Company and Core Settings

This is where you build the foundation of your entire financial command center. The initial setup isn't just about plugging in your company name; it’s about making critical choices that will shape how QuickBooks Online (QBO) functions for your service business day in and day out. Getting these details right from the start saves you from countless hours of frustrating cleanup work down the road.

First up are the basics: your legal company name, address, and Employer Identification Number (EIN). While this part feels straightforward, these details are essential for generating accurate tax forms and professional invoices. Think of it as establishing your business's official identity within the system.

Nailing the Company Details

One of the most common mistakes I see people make is glossing over the business type selection. Are you an S-Corp, a Sole Proprietor, or an LLC? Choosing the correct entity here tells QBO which tax forms you'll need and helps align your Chart of Accounts with standard reporting practices for your specific structure. This decision has a direct impact on your year-end financial prep, so take a moment to double-check it.

Equally important is picking the right industry. QBO uses this information to suggest a starting Chart of Accounts and even offer performance benchmarks. For a B2B service company, selecting "Consulting" or "Marketing Services" gives you a much more relevant starting point than a generic tag like "Professional Services."

Pro Tip: Don't skip the small stuff. Take a minute to upload your company logo right away. This ensures every single invoice and sales receipt you send out is branded, reinforcing your professional image with every client interaction.

Customizing Account and Settings

With your basic info locked in, it's time to dig a little deeper. QBO's setup wizard will walk you through the big stuff, but the real magic happens in the 'Account and Settings' menu. Once you've confirmed your subscription, plan to spend about 20 minutes here fine-tuning the sales, expenses, and advanced tabs. This is how you make the platform truly work for you. If you need a more visual guide, there are plenty of comprehensive video tutorials on how to set up QuickBooks Online that can walk you through this section.

This screen is where you'll find all the key levers to pull to customize QBO for your business.

Working through these tabs lets you dial in everything from how your invoices look to how you track project costs, setting the stage for smooth financial management.

Inside the Sales tab, you can set your default invoice terms. By setting this globally to "Net 30," for instance, you won’t have to manually adjust it on every invoice, which helps standardize your cash flow. You can also switch on payment reminders to automatically nudge clients about upcoming or overdue payments—a simple bit of automation that can seriously shrink your accounts receivable.

Here are a few sales settings I always tell clients to configure immediately:

- Customize Look and Feel: Match your invoice template to your company’s branding. A polished, professional look matters.

- Preferred Invoice Terms: Set your standard terms (e.g., Net 15, Net 30) to create consistency for your clients and your cash flow projections.

- Enable Online Payments: This one is non-negotiable. Connect QuickBooks Payments or another processor so clients can pay you directly from the invoice with a credit card or ACH transfer. It dramatically speeds up how quickly you get paid.

Over in the Expenses tab, you'll configure how you track your spending. For service businesses, enabling features like billable expense tracking is a game-changer. It allows you to pass costs like specialized software or travel directly on to clients, ensuring you never absorb a reimbursable expense and accidentally kill your project profitability. Taking the time to get these settings right builds a solid, scalable foundation for your company's financial operations from day one.

Building Your Financial Blueprint with the Chart of Accounts

Think of your Chart of Accounts (CoA) as the internal skeleton of your business's finances. It's the complete list of every single account you use to categorize transactions. When you first fire up QuickBooks Online, it hands you a generic CoA. This is like getting a one-size-fits-all t-shirt—sure, it covers the basics, but it doesn’t really fit your business.

A generic CoA just won't cut it for a service business that needs sharp insights. You'll be stuck with vague reports that don't tell you where your money is really coming from or where it's all going. To make smart moves, you need a financial blueprint that actually mirrors how your company operates.

Understanding the Core Account Types

Before you start tinkering, it's crucial to get a handle on the main building blocks of any CoA. Every single transaction you record will fall into one of these five buckets. Grasping these is the key to a solid setup.

- Assets: This is everything your company owns. We're talking about cash in the bank, accounts receivable (the money clients owe you), and equipment like laptops.

- Liabilities: This is what your company owes to others. This includes credit card balances, business loans, and accounts payable (money you owe vendors for their services).

- Equity: This represents the net worth of your business. It’s what’s left over when you subtract liabilities from assets, including things like owner contributions and retained earnings.

- Income (or Revenue): This is the money you earn from providing your services. It's the lifeblood of your company.

- Expenses: This is the money you spend to keep the lights on, from software subscriptions to paying contractors.

The point isn't to create a hundred different accounts. The real goal is to create meaningful accounts that give you actionable data. A well-designed CoA should tell the story of your business's financial health at a glance.

Customizing Income Accounts for Clarity

For any service business, lumping all your revenue into a single "Sales" account is a massive mistake. How can you possibly know if your retainer clients are more profitable than your one-off projects? You can't. That’s why getting specific with your income accounts is so critical.

Instead of one generic bucket, create several detailed accounts. This small change will immediately make your Profit & Loss statement show you exactly which revenue streams are fueling your growth.

A B2B consulting firm, for example, might structure their income like this:

- 4000 Revenue (This is a parent account)

- 4010 Consulting Services: For hourly or project-based work.

- 4020 Retainer Income: For those recurring monthly fees from ongoing clients.

- 4030 Project Management Fees: Revenue tied specifically to project oversight.

- 4040 Reimbursed Expenses Income: To track client-reimbursed costs separately from your main revenue.

This level of detail instantly transforms your reports from a confusing mess into a powerful tool for making decisions.

Tracking Expenses with Precision

Just like you need detail on the income side, you need precision with your expenses. The default expense accounts in QBO are often way too broad. "Office Expenses" could mean anything from printer paper to your monthly Zoom subscription. To really understand where your money is going, you have to break it down.

Think about the most significant or frequent costs in your service business. Do you hire a lot of freelancers? Is your software bill creeping up every month? Create specific expense accounts for these major costs.

Here’s a practical example of how a service business could structure key expense categories:

- Advertising & Marketing:

- Digital Advertising (for your Google or LinkedIn ads)

- Marketing Software (for your CRM, email tools, etc.)

- Contractor & Professional Fees:

- Subcontractor Payments

- Legal Fees

- Accounting & Bookkeeping Fees

- Software & Subscriptions:

- Project Management Tools (like Asana or Monday.com)

- Cloud Storage & Hosting

- Design Software (like Adobe Creative Cloud)

By setting up this structure from day one, you can easily run a report to see if your software spend is getting out of hand or to analyze your reliance on subcontractors. This isn't just about tidy bookkeeping; it's about gaining the operational intelligence you need to run your business more profitably. Your Chart of Accounts is the foundation for it all.

Automating Data Entry with Bank and Credit Card Feeds

Manually punching in every single transaction is a surefire way to fall behind on your bookkeeping—fast. This is where one of the most powerful features in QuickBooks Online comes into play: bank and credit card feeds. By securely connecting your financial accounts, you create a direct pipeline for your transaction data, which gets rid of the vast majority of manual data entry.

Think of it this way: without bank feeds, you're a librarian trying to catalog every book by hand. With bank feeds, the books arrive with their catalog cards already filled out. All you have to do is put them on the right shelf. This simple connection transforms your bookkeeping from a tedious chore into a simple process of review and confirmation.

This bit of automation is the key to keeping accurate, up-to-date books with minimal effort, giving you a real-time view of your company's financial standing.

Securely Connecting Your Financial Accounts

First things first, you need to link your business bank accounts, credit cards, and even your PayPal account directly to QuickBooks. QBO uses secure, bank-level encryption for this, so your financial data stays protected. Just navigate to the Banking tab, select Link account, and search for your financial institution.

Once you plug in your login credentials, QuickBooks will automatically import the last 90 days of transactions. From that point on, it will pull in new transactions every night, creating a steady stream of data that flows right into your bookkeeping workflow.

Mastering the Bank Feed Workflow

With transactions flowing in, your job is to tell them where to go. Each line item that appears in your feed needs to be assigned to the correct account in your Chart of Accounts. For instance, a payment to Google would likely get categorized under your "Digital Advertising" expense account.

This is also where you'll match transactions. When a client pays an invoice online, you'll see two entries: the deposit in your bank feed and the payment record already in QBO. The system is pretty smart and will often suggest a match; your job is to simply confirm it. This matching process is crucial for keeping your accounts receivable accurate and avoiding the nightmare of double-counting income.

Key Takeaway: The goal isn't just to categorize transactions but to match them to existing entries like invoices, bills, and expense receipts whenever possible. A clean bank feed is a well-matched bank feed.

Unlocking True Automation with Bank Rules

This is where you can save hours of work every single month. Bank Rules are instructions you create to tell QuickBooks how to automatically categorize recurring transactions. If you have a transaction that happens the same way every time, you absolutely should have a rule for it.

Think about common expenses like your monthly rent, software subscriptions, or even regular coffee shop meetings with clients. Instead of manually categorizing these each time they pop up, you can build a rule to handle it for you.

For example, you can create a rule that says:

- If: The transaction description from the bank contains "Adobe Creative Cloud."

- And: The amount is between $50 and $60.

- Then: Automatically categorize it to the 6550 Software & Subscriptions: Design Software expense account.

Once you set this rule, every future Adobe charge gets categorized correctly without you lifting a finger. Building out rules for your top 10-15 recurring expenses can automate a huge chunk of your bookkeeping. You'll find a detailed guide on https://steingardfinancial.com/how-to-reconcile-bank-accounts/ that can help you understand the end goal of this process. Getting your bank feeds and rules right makes reconciliation a breeze.

Streamlining Your Cash Flow With Invoicing and Payroll

For any service business, cash flow isn't just a number on a report; it's the lifeblood of the entire operation. This is where your careful QuickBooks Online setup starts to really pay off. Now we get to focus on the two most important workflows for managing that flow: getting paid for your work (Accounts Receivable) and paying your team (Payroll).

When you get these two areas right, you build a powerful system for managing your revenue and what is likely your largest expense—your people. It’s the difference between guessing your cash position and knowing it with absolute certainty.

Mastering Invoicing for Faster Payments

Let's be honest: slow-paying clients can crush a service business. Your invoicing process shouldn't just be about recording a transaction; it should be a tool that actively encourages clients to pay you on time. QuickBooks Online has some great built-in features designed to shorten that cash cycle.

The very first thing you should do is enable QuickBooks Payments. This feature lets clients pay you directly from the invoice link using a credit card or ACH bank transfer. Removing friction is the name of the game here. The easier you make it for clients to pay, the faster that money hits your account.

From there, automation becomes your best friend. If you have clients on a monthly retainer, set up recurring invoices. This feature automatically generates and sends their invoice on a schedule you define, which means you never have to worry about forgetting to bill for your ongoing work.

Another powerful tool is automatic payment reminders. You can set up QuickBooks to send polite follow-up emails for invoices that are getting close to their due date or are already overdue. This takes the awkward task of chasing payments off your plate and keeps your cash flow moving.

Key Takeaway: A modern invoicing strategy isn't passive. It's an active, automated system that combines branded templates, multiple payment options, recurring billing, and automated reminders to get you paid faster.

Integrating Payroll for Seamless Expense Tracking

Payroll is often the single biggest expense for a service business. Managing it accurately isn't just about paying your team on time; it's about making sure your labor costs are correctly reflected in your financial reports. A disconnected payroll system creates hours of manual work and opens the door to costly errors.

This is exactly why integrating a dedicated payroll platform like Gusto is a common best practice when you set up QuickBooks Online. The direct integration creates a smooth flow of data between the two systems. It eliminates manual journal entries and gives you a crystal-clear picture of your labor expenses. For broader insights into optimizing financial transactions, you can also explore resources from payments experts who specialize in this area.

When you run payroll in Gusto, the integration automatically handles several key tasks in the background:

- It creates a detailed journal entry in QuickBooks for every single payroll run.

- It syncs gross wages, employer taxes, and benefit contributions to the correct expense accounts in your Chart of Accounts.

- It records all your payroll tax payments and liabilities accurately.

This automation ensures your Profit & Loss statement always reflects your true labor costs. That's essential for calculating project profitability and making smart staffing decisions. You can dive deeper into the specifics by checking out our guide on how to properly configure QuickBooks Payroll and its integrations.

Fine-Tuning Your Automation Settings

As your business grows, you'll want to dig into the advanced settings within QuickBooks Online to really customize your reporting and automation. In fact, Intuit reports that leveraging these kinds of features contributes to 74% of customers feeling more in control of their finances.

You can take this a step further by setting up bank rules to automatically categorize 70-80% of your common transactions and enabling time tracking for billable hours to ensure every minute of work is accounted for.

By combining an efficient invoicing workflow with a tightly integrated payroll system, you build a robust financial engine for your business. You'll not only get paid faster but also gain a precise, real-time understanding of your two most important financial levers: revenue and labor costs. This kind of clarity is the foundation for scaling your service business with confidence.

Common Questions About Setting Up QuickBooks Online

Even with the best plan, you're bound to have questions when you're setting up new software. When it comes to learning the ropes in QuickBooks Online, most service business owners tend to hit the same few snags.

Let's walk through some of the most frequent questions we hear. Getting these answers upfront will help you sidestep common issues that can complicate your books down the road.

Can I Migrate My Data From Another Accounting Software?

Yes, but you have to be very careful here. QuickBooks Online has some built-in tools for pulling data from QuickBooks Desktop. If you're coming from another platform like Xero or FreshBooks, the process is a bit more manual. You can usually export your core lists—customers, vendors, chart of accounts—as CSV files and then import those into QBO.

The real challenge is migrating your entire transaction history. It’s a complex project. Honestly, many business owners with messy historical books find it’s much cleaner to just pick a "start date" for their new QBO account. You simply enter the opening balances from your old system and move forward from there, leaving the old details behind.

If you're set on a complete, transaction-by-transaction migration, I strongly recommend working with a QBO-certified pro. They'll protect your data integrity and help you avoid costly mistakes that could take months to fix.

What Are the Most Common Mistakes to Avoid During Setup?

It's funny—the biggest pitfalls are usually the simplest things people overlook when they're rushing to get started. Avoiding these common mistakes will save you from major headaches later on.

Here are the top errors we see all the time:

- Using the Default Chart of Accounts: This is the big one. A generic Chart of Accounts gives you vague, useless financial reports that offer zero real insight into a service business's performance.

- Not Connecting Bank Feeds Right Away: If you put this off, you're signing yourself up for a mountain of manual data entry. Connecting your bank and credit card accounts on day one is the key to automation.

- Mixing Personal and Business Expenses: It’s tempting, but using a single bank account for everything makes reconciling your books a nightmare and creates a mess for tax time.

- Ignoring User Permissions: Giving every team member full admin access when they just need to create invoices is a major security risk.

How Do I Set Up Different Users and Permissions?

Getting your user access settings right is a huge part of keeping your financial data secure. You'll find everything you need under the Gear icon > Manage Users. From there, you can invite people to your account and give them specific roles.

QuickBooks has several pre-built roles, like company admin, standard user, or reports-only access. The trick is to follow the "principle of least privilege"—give each person the bare minimum access they need to do their job. For instance, a standard user can be restricted to only "Customers & Sales" or "Vendors & Purchases," which keeps them out of sensitive areas like payroll or banking.

You can also invite your accountant, which gives them the special access they need without using up one of your paid user slots.

What Is the Difference Between Online and Desktop?

The biggest difference really comes down to access and connectivity. QuickBooks Online (QBO) is cloud-based, so you can log in from any device with an internet connection. It’s a monthly subscription built for real-time collaboration with your team and seamless connections to thousands of other apps.

QuickBooks Desktop, on the other hand, is software you install on one computer. It's known for having some very deep, industry-specific features, especially for businesses with complex inventory or manufacturing needs.

But for a modern B2B service business that values remote access, team collaboration, and a wide world of app integrations, QuickBooks Online is almost always the better, more scalable choice. It’s simply built for how we work today.

A clean and accurate QuickBooks Online setup is the first step toward financial clarity. If you want to ensure your books are done right from the start, the team at Steingard Financial can build a scalable back office for your service business. Learn more about our expert bookkeeping and payroll services at https://www.steingardfinancial.com.