How to Do Accounting for a Small Business A Practical Guide

Getting your accounting right from day one is probably the single most important thing you can do to build a sustainable service business. This isn't about generic advice; it's about creating a real-world system that works for you, using powerful tools like QuickBooks Online. A proper setup goes way beyond just picking software—it means designing a chart of accounts that tells the true financial story of your company.

Building Your Small Business Accounting Foundation

So many entrepreneurs dive headfirst into their passion, whether it's consulting, design, or another service, only to get completely bogged down by the financial side of things. If that sounds familiar, you're not alone.

Imagine juggling client calls and project deadlines, yet feeling a pit in your stomach when you think about the numbers. It's a common story. Recent surveys show that 60% of small business owners feel they aren't knowledgeable about accounting and finance. Data also shows that around 70% of small businesses don't have an accountant, and a full 21% admit they don’t really understand bookkeeping basics.

This shaky foundation is where small problems can quickly snowball into major roadblocks, hurting everything from your cash flow to your tax situation.

Choosing the Right Accounting Software

For most service-based businesses here in the U.S., the go-to choice is QuickBooks Online. It's not the market leader by accident. QBO integrates with nearly every other tool you'll use, from payment processors to payroll systems like Gusto. That connectivity is what makes a modern, automated accounting system possible, saving you hours of manual data entry and cutting down on human error.

When you're picking a QBO plan, think about these key things:

- Scalability: Can this software grow with you? A basic plan is fine for a solo operator, but an agency with a growing team will need more powerful features for tracking projects and managing staff.

- Integrations: Make sure it connects seamlessly with your bank accounts, credit cards, and payroll provider. This is an absolute must-have for an efficient setup.

- Reporting: The point isn't just to log transactions—it's to understand what they mean. Your software has to generate clear Profit & Loss (P&L) statements, Balance Sheets, and cash flow reports that you can actually use.

Here’s a quick look at the QuickBooks Online dashboard, which gives you that high-level overview of your financial vitals at a glance.

The dashboard pulls together critical info like your income, expenses, and profit, giving you a real-time snapshot of your business's financial health.

Designing a Meaningful Chart of Accounts

Once your software is ready, the next critical piece of the puzzle is your Chart of Accounts (COA). The best way to think about the COA is as the filing cabinet for your finances. It’s a complete list of all the categories—or "accounts"—you'll use to classify every dollar that moves through your business.

A generic, out-of-the-box COA from QuickBooks just isn't going to cut it.

Your Chart of Accounts should tell the financial story of your unique business. A well-designed COA makes your financial reports intuitive and lets you spot trends, measure profitability by service line, and make genuinely informed decisions.

For instance, a marketing agency might break down its main "Revenue" account into more specific sub-accounts like "SEO Services," "PPC Management," and "Content Creation." This gives you immediate insight into which services are actually making you the most money. Likewise, you can detail "Expenses" with accounts for "Software Subscriptions," "Contractor Payments," and "Advertising Spend."

As you start setting up your books, it's also a good time to get comfortable with basic terms like understanding gross vs. net income, which is foundational to all financial reporting. If you need a hand with this crucial setup step, check out our detailed guide on https://steingardfinancial.com/how-to-create-a-chart-of-accounts/. Taking the time to build a thoughtful COA is the true bedrock of useful financial reporting.

Mastering Your Daily and Weekly Accounting Routines

Okay, you’ve got your accounting system set up. Now the real work begins. Great financial management isn't about a frantic scramble at tax time; it’s about small, consistent habits that paint a clear, real-time picture of your business's health.

Think of it less as a chore and more as your company's pulse. A steady rhythm of daily and weekly financial tasks keeps everything else running smoothly. This is how you move from setup to execution and finally ditch that shoebox full of receipts for good.

The Power of Consistent Transaction Categorization

Every single dollar that moves in or out of your business needs a name and a place to go. This is the heart of bookkeeping, a task called transaction categorization. When a client payment lands in your bank account, your software needs to know that's "Service Revenue." When you pay for your Adobe subscription, it gets filed under "Software Expenses."

This might sound basic, but it's non-negotiable for getting accurate reports. Without it, your Profit & Loss statement is just a meaningless jumble of numbers. Good categorization is what turns that data into a story, telling you exactly where your money is coming from and where it's going.

Modern tools like QuickBooks do a lot of the heavy lifting. You can set up "bank rules" to automatically categorize recurring transactions. For instance, a rule can tell the software that every payment to "Gusto" should always be coded to "Payroll Expenses." Simple.

The goal here is to touch each transaction just once. By setting up smart rules and checking your bank feed every week, you build an efficient system that slashes manual data entry and cuts down on human error.

Managing Cash Flow with AP and AR Workflows

For any service business, cash flow is king. You can be profitable on paper but still find yourself unable to make payroll if you aren't managing your cash well. This is where Accounts Payable (AP) and Accounts Receivable (AR) come into play.

Accounts Receivable (AR): This is all the money your clients owe you. A solid AR process means sending invoices out the door quickly, with clear payment terms (like "Net 30"), and having a system to follow up when payments are late. A quick weekly peek at your "Aged Receivables" report in QuickBooks will show you exactly who’s behind so you know who to nudge.

Accounts Payable (AP): This is the money you owe your vendors. An organized AP system lets you track bills, schedule payments to avoid late fees, and keep your suppliers happy.

Keeping a tight grip on both AP and AR is how you avoid nasty cash flow surprises.

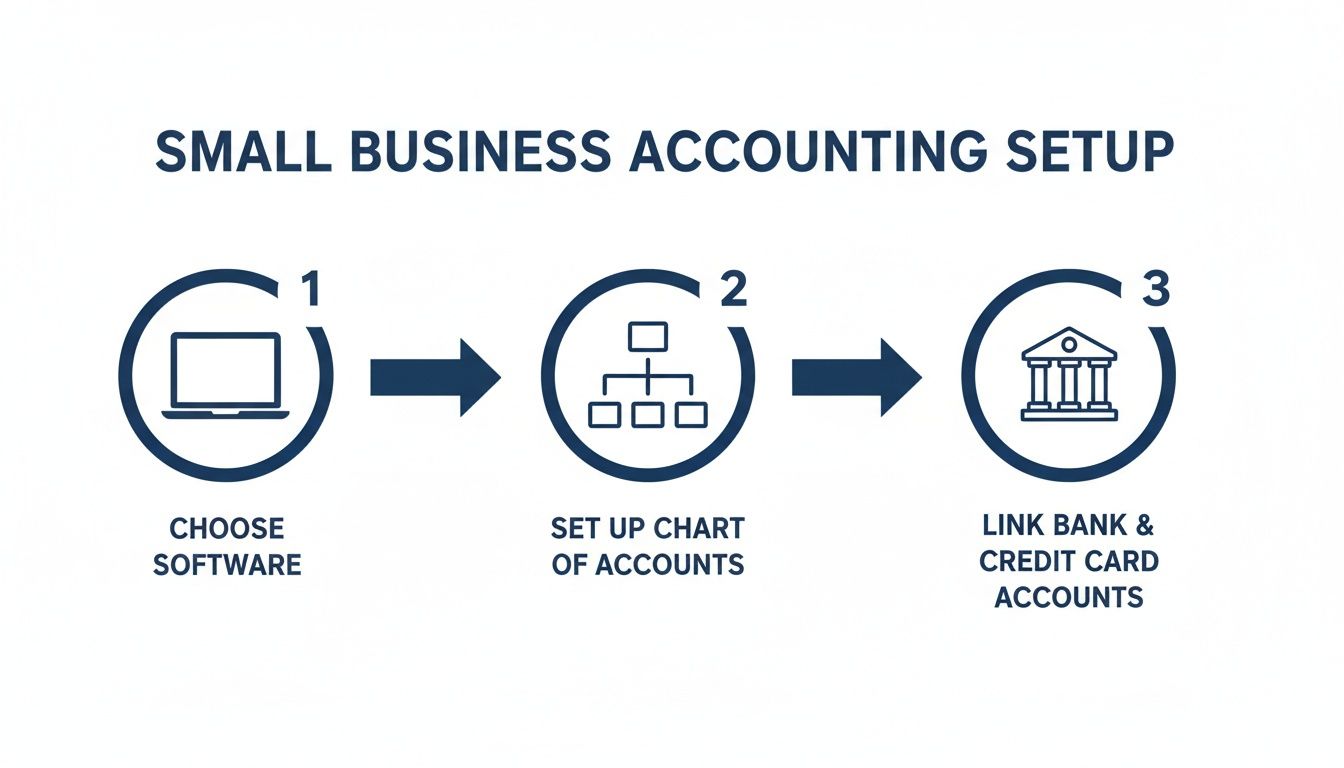

As you can see, linking your accounts is the last setup piece before these daily and weekly habits can truly take hold.

The Essential Habit of Bank Reconciliations

If you build only one financial habit, make it this one: bank reconciliation. This is where you match the transactions in your accounting software to your official bank and credit card statements, line by line. Think of it as the ultimate financial check-up for your business.

Why is this so critical? Reconciliation confirms that your books are a perfect mirror of what the bank says. It helps you:

- Catch Errors: Did you enter an invoice payment twice by accident? Did the bank make a mistake? Reconciliations bring these issues to the surface right away.

- Spot Fraud: An unfamiliar charge on your credit card statement will stick out like a sore thumb during reconciliation, letting you take action immediately.

- Gain True Cash Clarity: It confirms your actual cash balance, giving you 100% confidence in the numbers you're using to make business decisions.

Skipping reconciliations is one of the biggest mistakes we see small businesses make. It leads to messy, unreliable reports and a massive cleanup headache at the end of the year. Make this a non-negotiable part of your monthly routine. For a deeper look at the process, check out our guide on how to reconcile your bank accounts.

Here's a quick checklist to help you stay on track each week.

Essential Weekly Accounting Checklist

This simple checklist summarizes the key weekly tasks that will keep your small business accounting organized and provide the financial clarity you need to make smart decisions.

| Task | Why It Matters | Recommended Frequency |

|---|---|---|

| Categorize Transactions | Ensures your financial reports are accurate and show where money is coming and going. | 1-2 times per week |

| Review AR Aging Report | Lets you see who owes you money so you can follow up on overdue invoices promptly. | Weekly |

| Review AP Aging Report | Helps you manage your own bills and schedule payments to maintain good vendor relationships. | Weekly |

| Check Cash Balance | Gives you a real-time snapshot of your available funds for immediate decisions. | Daily or weekly |

Following these steps consistently transforms accounting from a daunting task into a powerful tool for growth.

Integrating Payroll and People Operations

For any service business, your people are everything. They’re your primary asset, your engine for growth, and almost always your single largest expense. This means treating payroll not just as another task to check off, but as a core piece of your financial strategy.

An integrated system, where your payroll platform talks directly to your accounting software, is the key. It eliminates hours of manual data entry, sure, but more importantly, it makes sure every single dollar spent on salaries, taxes, and benefits is categorized with perfect accuracy. This seamless flow of information from a tool like Gusto into QuickBooks is what turns raw data into real strategic insight.

Why Integration Is a Non-Negotiable

When your payroll and accounting systems are disconnected, you're essentially operating with a blindfold on. You might be processing payroll on time, but the financial story gets lost in translation. Critical details like employer payroll taxes, health insurance contributions, and 401(k) matches often don't get recorded properly in your financial statements.

This creates two massive problems:

- Inaccurate Financial Reports: Your Profit & Loss statement won't show your true labor costs, making it impossible to know how profitable you really are.

- Compliance Risks: Misclassifying payroll expenses can lead to serious headaches with the IRS and state agencies, and nobody wants to deal with penalties and back-interest.

A huge part of managing your team is knowing how to calculate employer payroll taxes to stay compliant. A properly integrated system automates most of this heavy lifting, mapping the correct tax amounts to the right expense accounts in your Chart of Accounts.

Connecting People Operations to Financial Health

Modern platforms like Gusto do so much more than just cut checks. They’ve become comprehensive people operations hubs, handling everything from employee onboarding and benefits administration to time tracking and HR compliance.

This centralized approach makes it crystal clear how people-related decisions directly impact your bottom line, and you can see it all right inside your accounting software.

When you link this hub to your books, you unlock a much deeper level of strategic thinking. The financial data gives you clear answers to crucial growth questions:

- Can we really afford to hire that new team member?

- What is the true, fully-loaded cost of an employee, benefits and all?

- How are our benefits costs trending over the last year?

This connection transforms your back office from a simple cost center into a strategic tool that aligns your team's growth directly with your company’s financial goals.

Navigating Month-End and Year-End Closing

Closing your books is where all the daily data entry pays off. This process is what turns a month's worth of raw transactions into real financial intelligence. Think of it less as a chore and more as a strategic checkpoint. It's how you confirm your numbers are solid, giving you a clear-eyed view to steer your business.

A timely close is critical for making smart decisions on the fly, applying for a loan, or just making sure your tax prep is built on a foundation of rock-solid data. This is your chance to stop working in your business for a moment and start working on it—analyzing what happened and planning your next move with confidence.

The Essential Month-End Close Checklist

The month-end close shouldn't feel like a frantic scramble to the finish line. When you have a structured process, it becomes a predictable—and incredibly valuable—routine. The main goal here is to review, reconcile, and then report, making sure every number is correct and defensible.

It’s like a final quality control check before you lock in the month's financial story. Here’s a practical checklist to guide you:

- Finalize All Transactions: First things first, make sure every single invoice, bill, and expense from the month has been entered and categorized. This includes those last-minute credit card charges or payments that always seem to pop up.

- Reconcile All Accounts: This is the big one. You absolutely must reconcile every bank account, credit card, and loan account. This step confirms your books perfectly match the bank's records, which is the true cornerstone of accurate financials.

- Review Accounts Receivable: Pull up your aged receivables report. Who hasn't paid you yet? Now is the time to follow up on those overdue invoices and keep your cash flow healthy.

- Review Accounts Payable: On the flip side, check your aged payables report to see which bills are coming due. This helps you manage your cash outflows and prevents any missed payments.

- Record Accruals and Adjustments: This is a slightly more advanced step, but it's crucial for accuracy. You might need to record accrued expenses (services you've used but haven't been billed for yet) or recognize deferred revenue (money you've been paid for work you haven't finished).

Once you’ve ticked these boxes, you can finally run your key financial reports with confidence.

Generating Your Core Financial Reports

With the books officially closed, you can generate the two most important reports for any service business: the Profit & Loss (P&L) Statement and the Balance Sheet.

The P&L (sometimes called the Income Statement) tells you the story of your profitability over a specific period, like the month you just closed. It answers the simple but vital question: Did we make money? It does this by subtracting all your expenses from your total revenue to calculate your net income.

The Balance Sheet provides a snapshot of your company's financial health at a single point in time. It lays out what you own (Assets), what you owe (Liabilities), and your net worth (Equity).

Your P&L tells the story of your performance, while your Balance Sheet tells the story of your position. You need both to understand the full financial picture of your business.

Tracking Key Performance Indicators (KPIs)

Financial statements are great, but their true power is unlocked when you use them to calculate Key Performance Indicators (KPIs). These are specific metrics that give you quick, actionable insights into your business's performance. For a service business, a few KPIs are absolutely essential to watch.

Gross Profit Margin

This is the percentage of revenue you have left after subtracting the direct costs of providing your services (often called Cost of Goods Sold, or COGS). It’s your core profitability metric, telling you how efficiently you’re delivering your work. If you see this number start to dip, it might be a sign that your project costs are creeping up or that it's time to raise your prices.

Net Profit Margin

This is your bottom-line profitability. It’s the percentage of revenue left after all expenses—including overhead like rent, software, and salaries—have been paid. Essentially, it answers the question, "After everything is paid for, how much of each dollar in revenue do we actually get to keep?"

Customer Acquisition Cost (CAC)

This one is simple to calculate: just take the total cost of your sales and marketing efforts and divide it by the number of new customers you brought in during that period. Your CAC tells you exactly how much you're spending to win a new client, which is critical for knowing if your marketing strategies are actually providing a good return.

Tracking these KPIs every month transforms your accounting from a simple record-keeping task into a powerful decision-making tool. It gives you the data you need to make proactive adjustments instead of just reacting to problems after it’s too late.

Knowing When to Outsource Your Accounting

At some point on your entrepreneurial journey, the DIY approach to accounting stops being a cost-saver. Instead, it starts becoming a growth-limiter. Juggling client work, team management, and sales is already more than a full-time job. When you find yourself spending more time chasing down receipts than serving customers, it’s a clear signal you’ve hit a ceiling.

This transition isn't about giving up control; it’s about gaining strategic leverage. Handing over the books to a professional firm frees up your most valuable resource—your time—so you can focus on what you actually do best. It’s the classic shift from working in your business to working on your business.

Spotting the Triggers to Outsource

So, how do you know when you’ve reached that critical tipping point? The signs are usually pretty clear, showing up as bottlenecks and blind spots in your daily operations. It’s rarely one single dramatic event, but rather a collection of persistent challenges that start to slow you down.

Look out for these common triggers:

- You're Drowning in Bookkeeping: Are you consistently spending more than a few hours a week on financial admin? If bookkeeping is stealing your evenings and weekends, the cost of your lost time is probably far greater than the cost of outsourcing.

- Your Financials Are a Mystery: You look at your P&L statement, but you don't really trust the numbers. If you can’t use your reports to make quick, confident decisions, your data isn’t doing its job.

- You're Facing Complex Issues: Maybe you just hired your first out-of-state employee, are dealing with sales tax in multiple jurisdictions, or need to properly track revenue for long-term projects. Financial complexity grows right alongside your business, and it can quickly outpace DIY knowledge.

- You Need Sophisticated Reports: Are you getting ready to apply for a business loan, bring on an investor, or create a detailed budget for the next fiscal year? Banks and investors demand clean, professionally prepared financial statements.

When these challenges start to feel familiar, it's a strong sign that you need a dedicated partner to manage your financial back office.

The Strategic Value of an Accounting Partner

Outsourcing your accounting is about much more than just offloading data entry. It’s about plugging into a team of experts—experienced bookkeepers and CPAs—who bring a level of precision and insight that’s nearly impossible to replicate in-house on a small business budget.

A great outsourced firm doesn’t just record history; they help you shape the future. They provide the clean data and strategic advice you need to scale your operations, manage cash flow, and maximize profitability.

This kind of partnership is particularly powerful today. The U.S. accounting services industry has grown into a $145.5 billion sector, with firms constantly evolving their offerings. In fact, 73% of accountants reported increased profits last year, largely by expanding into strategic advisory services—something 70% of firms now offer alongside traditional bookkeeping. You can check out more insights about the accounting industry and its growth on IBISWorld. This trend means you're not just hiring a bookkeeper; you're gaining a strategic advisor.

The benefits are immediate and tangible. You get access to meticulous transaction management, timely reconciliations, and a team that ensures your financial reports are always accurate and ready for review. For a deeper dive into what this partnership looks like, explore our guide on outsourced accounting for small businesses.

Ultimately, the decision to outsource is an investment in clarity, compliance, and growth. It allows you to build your business on a solid financial foundation, managed by professionals who are as invested in your success as you are.

Your Questions, Answered

Even with the best playbook, you're bound to have questions as you get your business's finances in order. Let's tackle a few of the most common ones we hear from entrepreneurs just like you.

What’s the Biggest Accounting Mistake You See Small Businesses Make?

Hands down, the single most damaging error is commingling personal and business finances. It happens all the time—using a personal credit card for a software subscription or depositing a client check into your personal checking account. It seems harmless, but it creates a massive headache later.

This tangles your books, makes tax time a nightmare, and can even put your personal assets at risk if your business ever faces legal action. The very first thing we do with any new client is ensure they have a dedicated business bank account and credit card. It’s a simple step that creates a clean line between you and the business, making everything else infinitely easier.

How Often Do I Really Need to Reconcile My Bank Accounts?

You need to reconcile every single business bank and credit card account at least once a month. Think of it as your monthly financial health check-up. This is where you match up every transaction in QuickBooks with what your bank statement says, ensuring nothing has been missed or miscategorized.

Reconciliation is your best defense against fraud, bank errors, and a skewed understanding of your cash flow. It's non-negotiable.

If you have a lot of transactions—like a busy consulting firm or an e-commerce shop—we strongly recommend reconciling weekly. Staying on top of it this often means you catch small issues before they snowball into a huge month-end cleanup project.

My Books Are a Complete Mess. Can a Professional Firm Still Help Me?

Absolutely. In fact, "my books are a mess" is probably the number one reason people call us. It’s far more common than you think, and it’s never too late to fix it. A good accounting firm has a specific, battle-tested process for untangling even the most chaotic financial records.

Our cleanup process usually involves a few key steps:

- A deep dive into your past transactions to figure out exactly what’s going on.

- Recategorizing everything to make sure expenses and income are in the right buckets.

- Reconciling all your accounts up to a clean, agreed-upon date.

- Rebuilding your chart of accounts so it actually makes sense for your business.

Yes, it's an upfront investment, but it gives you a solid, reliable foundation to build on. From that point forward, you can finally trust your numbers and make decisions with real confidence.

If you're ready to get your financial house in order for good, Steingard Financial is here to help. Our team of CPAs and seasoned bookkeepers specializes in cleaning up historical records and setting up systems that give you a clear, real-time view of your business's performance. Find out how we can become your trusted financial partner by visiting us at https://www.steingardfinancial.com.