Bookkeeping for small business: Master Your Finances with Easy Steps

For most small business owners, bookkeeping isn't exactly the most exciting part of the job. It often feels like a chore you have to get through, especially when tax season looms. But thinking of it that way misses the point entirely. Good bookkeeping is much more than just tracking numbers; it's the very pulse of your business, telling you exactly how healthy it is in real-time.

Think of it like the dashboard in your car. It gives you all the critical signals—your speed, your fuel level, any warning lights—so you can make smart decisions on the road. Clean books do the same for your company, letting you know when to hit the gas on growth or when it might be time to ease up and check under the hood.

Why Bookkeeping Is Your Business’s Most Important Tool

Let’s be honest, the word "bookkeeping" can cause a bit of anxiety. It can feel like a complex, tedious task that’s best left to accountants. But this view overlooks its real job: to translate every sale, every expense, and every paycheck into a clear story about how your business is actually doing.

Without that story, you’re basically flying blind. You might feel busy and see money coming into the bank, but you won't have a clue about your actual profit margins, where your cash is really going, or if you can truly afford to hire that new team member you desperately need.

A chef wouldn't dream of running a restaurant without knowing their food costs, inventory levels, or which dishes make them the most money. In the same way, you can't effectively run your company without a firm grip on your numbers.

Turning Data Into Decisions

When done right, bookkeeping turns all that raw financial data into information you can actually use. It gives you the clarity to answer the big questions that keep every owner up at night:

- Are we really making money? Revenue is one thing, but profit is what keeps the doors open.

- Where is all our cash going? Finding those surprise cost-sinks or unnecessary expenses can instantly improve your bottom line.

- Can we afford to grow? Whether you're looking for a loan, talking to investors, or just planning your next move, solid books are non-negotiable.

- Are we ready for tax season? Organized records not only make filing taxes less painful but also help you find every possible deduction, saving you from overpaying or facing penalties.

The High Cost of Financial Illiteracy

This isn't just theory—there are real-world consequences to ignoring your books. Many entrepreneurs are passionate experts in their field but don't start out with a strong financial background. This creates a massive risk.

Recent data from an Intuit QuickBooks financial literacy report is pretty revealing. Nearly half (42%) of small business owners admit they started with limited financial knowledge, and a shocking 60% don't feel confident about their accounting skills. This uncertainty isn't just stressful; it's expensive. The average small business loses over $3,000 a year just from simple bookkeeping mistakes.

The key is to shift your mindset. Stop seeing bookkeeping as just another administrative cost and start treating it as a strategic investment. It’s the tool that protects what you’ve built, shows you where the opportunities are, and gives you the peace of mind that comes from truly knowing where your business stands.

The Four Core Bookkeeping Tasks You Must Master

Thinking about bookkeeping can feel like staring at a mountain of numbers. But it’s not one giant, intimidating task. It's really just four distinct jobs that, when done right, give you a crystal-clear picture of your financial health.

For any small business owner, getting these four activities into a regular rhythm is the secret to turning confusing data into smart, confident decisions. Let's break down exactly what they are.

1. Transaction Categorization

Every dollar that comes in or goes out has a story. Transaction categorization is simply the process of giving each of those dollars a specific job title so you can understand what it's doing. Think of it like sorting your mail. Instead of letting everything pile up in one messy stack, you sort it into piles—bills here, client checks there, junk mail in the trash.

When you pay for your scheduling software, that’s not just "$50 spent." It’s a "Software & Tools" expense. When a customer pays an invoice, that isn't just "$2,000 in the bank." It's "Service Revenue." Getting this right ensures your reports actually mean something, showing you exactly where your money comes from and where it's going.

2. Bank Reconciliation

Ever look at your bank account and think, "That number doesn't feel right"? That flicker of doubt is precisely what bank reconciliation is designed to eliminate. This is the simple but essential process of matching every transaction in your accounting software with the corresponding one on your bank and credit card statements.

It’s basically a monthly quality control check for your money. This process confirms that what you think happened financially is what actually happened. It’s amazing what this simple check-up uncovers:

- Duplicate entries that accidentally inflate your expenses.

- Missed transactions, like an automatic payment you forgot about.

- Bank errors or hidden fees that need to be challenged.

- Fraudulent charges that could have easily slipped by.

Reconciliation ensures your books are a perfect mirror of reality. If you want to get into the nitty-gritty, we've put together a guide on how to reconcile bank accounts.

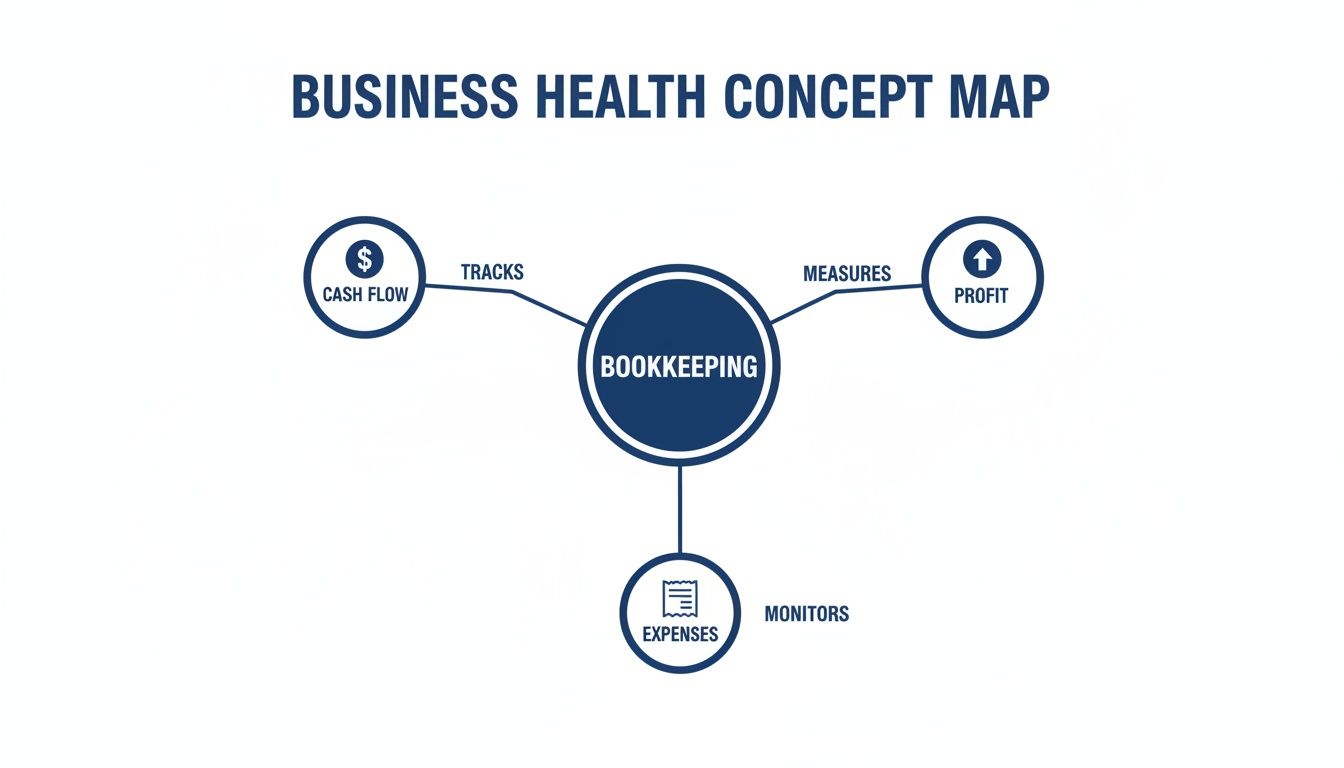

This diagram shows how these core tasks are directly tied to the health of your business—they are the controls you use to manage cash flow, measure profit, and monitor expenses.

As you can see, bookkeeping isn't just about entering data; it's the central nervous system for the financial side of your company.

To help you connect the dots, here’s a quick breakdown of these core tasks and why each one is so crucial for your business's stability and growth.

| Core Task | What It Is | Why It Matters |

|---|---|---|

| Transaction Categorization | Sorting every income and expense transaction into the correct account (e.g., "Software," "Rent," "Sales Revenue"). | Provides an accurate picture of where money is coming from and going to, which is essential for budgeting and tax preparation. |

| Bank Reconciliation | Matching your internal financial records against your monthly bank and credit card statements. | Catches errors, detects fraud, and confirms the accuracy of your cash balance, giving you confidence in your financial data. |

| Accounts Payable/Receivable | Tracking money you owe to suppliers (AP) and money customers owe to you (AR). | Directly manages your cash flow. Good AR gets you paid faster, while good AP maintains strong vendor relationships and avoids late fees. |

| Payroll & Reporting | Calculating employee wages, withholding taxes, managing benefits, and filing necessary government reports. | Ensures your team is paid correctly and on time, maintains legal compliance, and provides a true understanding of your labor costs. |

Mastering these four areas moves you from simply recording history to actively shaping your company’s financial future.

3. Accounts Payable and Receivable Management

Cash flow is the lifeblood of a small business. Managing it well boils down to two sides of the same coin: Accounts Receivable (AR) and Accounts Payable (AP).

Accounts Receivable (AR) is all the money your customers owe you. It’s the stack of unpaid invoices for work you’ve already completed. A good AR process means invoicing quickly, keeping track of due dates, and consistently following up so cash flows into your business predictably.

Accounts Payable (AP) is all the money you owe to others. These are the bills from your vendors, suppliers, and contractors. Proper AP management means knowing what's due and when, so you can pay on time, maintain good business relationships, and avoid costly late fees.

When you manage AR and AP well, you create a healthy rhythm for your cash flow, allowing you to see financial bumps in the road long before you hit them.

4. Payroll and Reporting

If you have a team, payroll is easily one of your biggest expenses—and one of the most critical bookkeeping functions to get right. It’s so much more than just writing checks. It involves calculating wages, withholding the right amount of taxes, tracking benefits, and staying compliant with a web of federal and state rules.

Accurate payroll bookkeeping keeps your team happy and paid on time, which is huge for morale. It also protects your business from expensive fines and legal headaches by making sure you remit the correct payroll taxes to the government. When payroll is handled correctly and integrated into your books, you get a true picture of your labor costs and how they impact your bottom line.

Choosing Your Path: DIY Bookkeeping vs. Hiring a Pro

Every small business owner eventually hits a fork in the road with their finances. Do you keep wrestling with the books yourself, or is it time to hand the reins to a professional? This isn’t just about saving a few hours—it's a strategic choice that directly impacts your company’s financial accuracy, its potential for growth, and frankly, your own peace of mind.

There’s no single right answer here. But understanding the real-world trade-offs of each path is the first step to making a decision you can feel good about. Let's break down the realities of both DIY bookkeeping and professional outsourcing.

The Do-It-Yourself Approach

Handling your own bookkeeping can feel empowering, especially when you're just starting out. Modern accounting software like QuickBooks Online has made this more accessible than ever, giving you direct, hands-on control over every dollar.

The biggest draw is obvious: cost savings. By not paying a monthly fee, you keep that cash in the business for other things. You also develop an intimate understanding of your cash flow because you see every single transaction as it happens.

But that control comes at a price. The most significant cost is your own time—hours spent categorizing transactions and reconciling accounts are hours you’re not spending on sales calls or serving your clients. There's also a much higher risk of error. A simple miscategorization or a missed bank reconciliation can snowball, leading to messy financial reports and a chaotic tax season.

When to Consider Outsourcing to a Professional

The other path is to hire a professional bookkeeping firm. This moves the task off your plate and into the hands of an expert whose entire job is to ensure accuracy and compliance.

Imagine this scenario: your business is booming, but your books are a complete mess. Transactions are uncategorized, bank reconciliations are piling up, and you haven’t seen a clean month-end report in ages. This nightmare is a reality for the 60% of small business owners who feel they aren't knowledgeable enough about accounting. Data shows that 21% admit they simply don't know enough about bookkeeping, and a staggering 70% don't even have an accountant. It’s no wonder that 30% of small businesses already choose to outsource their bookkeeping.

The tipping point often arrives when the value of your time spent on bookkeeping exceeds the cost of hiring an expert. If an hour of your work generates $200 in revenue, but you spend five hours a month on bookkeeping, you're looking at a $1,000 opportunity cost.

Outsourcing brings some key advantages that go way beyond just saving time:

- Expert Accuracy: Professionals live and breathe this stuff. They understand the nuances of double-entry accounting and proper chart of accounts setup, dramatically reducing the risk of expensive mistakes.

- Strategic Insights: A great bookkeeper doesn’t just record the past; they help you understand it. They can point out spending trends, flag unusual activity, and deliver clean financial statements that let you make smarter, data-driven decisions.

- Scalability: As your business grows, your finances get more complex. An outsourced partner can easily scale with you, handling more transactions, new payroll complexities, and advanced reporting without you feeling any of the growing pains.

A Quick Self-Assessment

So, how do you know when it’s the right time to make the switch? Just ask yourself these three simple questions:

- Is bookkeeping keeping me from revenue-generating work? If you're constantly pushing client projects aside to catch up on your books, it's a clear sign your time is better spent elsewhere.

- Am I confident in the accuracy of my financial reports? If you have any doubt about whether your numbers are right, you can't rely on them for critical business decisions.

- Does the thought of tax season fill me with dread? A professional bookkeeper ensures your records are clean, organized, and audit-proof all year long, making tax filing a smooth, predictable process.

If you answered "yes" to any of these, it’s probably time to look into a professional partnership. To help you weigh your options, take a look at our guide on the benefits you can expect when you outsource bookkeeping for your small business. Making the right decision frees you up to focus on what you do best—running and growing your business.

Finding the Right Bookkeeping Partner for Your Business

Once you’ve decided that outsourcing your bookkeeping is the right move, the next big hurdle is finding the perfect partner. This isn’t just about hiring someone to punch in numbers; you’re bringing a key financial expert onto your team. Picking the wrong one can create more headaches than you started with, but the right partner quickly becomes an invaluable asset for growth.

Think of it like hiring a skilled mechanic for a high-performance car. You wouldn't just go with the cheapest option or the first name you find online. You’d want someone with specific expertise, a proven track record, and a communication style you can trust. The same level of care applies when you’re entrusting a firm with your company's financial health.

To cut through the noise, you need to ask more than just generic questions. It’s about digging into their skills, understanding their process, and making sure they’re truly aligned with your business goals.

Evaluate Their Tech Stack Fluency

In this day and age, bookkeeping for small business is driven by technology. A potential partner’s comfort level with your existing software isn’t just a nice-to-have—it’s a non-negotiable for a smooth and efficient relationship.

You don't want to be paying a firm to learn on your dime or, even worse, force you into a system that doesn't fit how you operate. An expert partner should be able to plug into your workflow seamlessly, not disrupt it.

When you’re interviewing firms, get direct with your questions about their technical chops:

- What accounting software are you certified in? Look for experts in platforms like QuickBooks Online, as this shows a real commitment to industry-standard tools.

- Have you worked with our specific payroll provider (like Gusto or QuickBooks Payroll)? Experience here is critical for dodging compliance issues and making sure your team gets paid correctly every time.

- How do you handle integrations with the other apps we use? A good firm can help connect your payment processors or expense management tools, creating a more automated and error-free system.

A partner who is already fluent in your tech stack can start optimizing your setup from day one.

Define the Full Scope of Services

Not all bookkeeping services are created equal. Some firms just offer basic data entry, while others provide a full suite of financial management services. It's absolutely crucial to understand exactly what’s included to ensure their offerings match what you need today and where you plan to be tomorrow.

Don't make any assumptions. Get a clear, itemized list of what they will actually handle. This is your chance to clarify expectations and avoid any surprise gaps in service later on.

The goal is to find a partner who can grow with you. A firm that only handles historical data entry might be fine for a brand-new startup, but a growing business needs a partner who can offer strategic insights, payroll management, and cleanup services.

Key service areas you need to talk about include:

- Cleanup and Catch-Up Work: If your books are behind or a bit of a mess, does the firm have a specific process (and cost) for getting everything in order?

- Payroll Management: Do they handle the whole payroll process, including tax filings and benefits, or do they just record the transactions after you’ve run it?

- Advisory and Reporting: Will they just send over standard reports, or will they actually meet with you to explain what the numbers mean and offer insights? We have a great resource that explains the various bookkeeping services for small businesses you should be looking for.

Analyze Their Communication and Reporting Rhythm

Clear, consistent communication is the bedrock of a successful partnership. You should never feel like your financial data has disappeared into a black box, only to reappear as a confusing report at the end of the month.

When looking for a bookkeeping partner, think about how they manage client communications; an efficient external accounting answering service can be a sign of professionalism, ensuring all your questions are handled promptly, especially during busy tax seasons. Establishing a reliable communication rhythm builds trust and gives you the confidence to make decisions based on timely information.

Before you sign any contract, get clear answers on these points:

- How often will I get reports? Will you receive weekly updates and monthly financial statements?

- Who is my dedicated point of contact? Knowing you have one specific person to reach out to is far better than a generic support email.

- What is your typical response time for questions? A responsive partner is essential when you have a pressing financial question.

A great bookkeeper doesn't just manage your numbers—they make sure you understand them, giving you the clarity you need to steer your business forward.

Turning Your Financial Reports Into Actionable Insights

Accurate bookkeeping is the essential first step, but its true power isn’t just in keeping tidy records. Clean books are pointless if they don't tell you a story. The real value comes from turning that raw financial data into clear, actionable insights that help you make smarter decisions about the future of your business.

Think of it like this: your day-to-day bookkeeping tasks create the raw ingredients—flour, sugar, eggs. Your financial reports are the recipe that brings them all together. The real prize, though, is the strategic insight you gain from that recipe, allowing you to see what’s working, what isn’t, and where to go next. A great bookkeeper doesn't just hand you reports; they help you read the recipe.

This shift toward advisory support is reshaping the industry. Bookkeeping is growing, with 73% of US accounting and bookkeeping practices reporting increased profits year-over-year. This is driven by tools like cloud accounting—now used by 58% of enterprises—which make real-time analysis and strategic guidance possible. You can discover more about these industry shifts and how they empower small businesses.

The Three Most Important Financial Reports

To get started, you really only need to focus on three core reports. Together, they form a complete picture of your company's performance and stability.

- The Profit & Loss (P&L) Statement: This is your performance report. It tells you whether you made or lost money over a specific period, like a month or a quarter.

- The Balance Sheet: This is a snapshot of your financial health at a single moment in time. It shows what you own (assets), what you owe (liabilities), and your net worth (equity).

- The Cash Flow Statement: This report tracks the actual movement of cash in and out of your business. It explains why your bank account balance might not match your profit.

Answering Critical Business Questions

Each report answers different but equally vital questions that every owner faces.

The Profit & Loss Statement answers:

- Are we actually profitable?

- Which of our services are generating the most revenue?

- Are our expenses under control, or are costs creeping up?

The Balance Sheet answers:

- Do we have enough assets to cover our debts?

- How much of the business do we truly own?

- Is our debt level sustainable for long-term growth?

Finally, the Cash Flow Statement answers:

- Where did our cash go last month?

- Do we have enough cash to cover payroll and upcoming bills?

- Are we collecting payments from clients fast enough?

Financial reports are like a health check-up for your business. The P&L checks your energy levels (profitability), the Balance Sheet measures your strength (net worth), and the Cash Flow Statement monitors your circulation (cash movement). Ignoring any of them means missing a vital sign.

From Reports to Key Performance Indicators

Beyond these core statements, a good bookkeeper helps you track Key Performance Indicators (KPIs). These are specific metrics that boil down complex data into simple, powerful numbers you can monitor over time. They act as your business's early warning signals and progress trackers.

For a small business, two of the most critical KPIs are pulled directly from your P&L:

- Gross Profit Margin: This tells you the percentage of revenue left after paying for the direct costs of delivering your service. A high margin means your core business is efficient and profitable.

- Net Profit Margin: This is the bottom line. It shows the percentage of revenue you actually keep as profit after all expenses—including overhead, salaries, and taxes—are paid.

Understanding these KPIs is what elevates bookkeeping for small business from a chore you have to do into a strategic tool you get to use. Instead of just seeing numbers on a page, you start seeing the levers you can pull to increase profitability, improve cash flow, and build a more resilient company.

Your Onboarding Checklist for a Seamless Transition

Deciding to hire a professional bookkeeper is a fantastic step forward for your business. But to make sure the partnership gets off to a great start, a smooth and organized onboarding process is everything. This is more than just handing over a box of receipts; it's about building a solid foundation of trust and financial clarity from day one.

Think of it like setting up the GPS before a long road trip. A little prep work upfront guarantees you’ll get where you’re going without any wrong turns or headaches. A great bookkeeping firm will walk you through this, making the whole process feel less like a chore and more like a massive weight off your shoulders.

The Initial Discovery and Goal Alignment

It all starts with a discovery call. This isn't just a simple meet-and-greet; it's a strategic meeting where your new financial partner gets to know the unique rhythm of your business. They’ll want to understand your biggest pain points, your goals for the future, and what financial success really looks like to you.

This first conversation is so important for setting expectations. It makes sure everyone is on the same page about the scope of work, how you'll communicate, and which financial numbers matter most for your company's growth.

Gathering Your Financial Documents

Once you’re aligned on the goals, the next step is to gather all the necessary information. To build a truly accurate picture of your financial health, your bookkeeper will need secure, view-only access to a few key accounts and documents. This is always handled with the strictest confidentiality and security.

You can expect to provide access or documents for things like:

- Business Bank and Credit Card Accounts: This allows them to pull in historical transactions and set up automatic feeds for real-time data.

- Payroll System: If they're handling your payroll, they’ll need access to your provider, like Gusto or QuickBooks Payroll.

- Previous Financial Reports: This includes past tax returns, Profit & Loss statements, and balance sheets so they can understand your financial history.

- Loan and Lease Agreements: These are key documents that affect your liabilities and expenses and need to be recorded correctly.

System Setup and Chart of Accounts Optimization

With all your information in hand, your bookkeeping partner starts working on the technical setup. A huge piece of this puzzle is reviewing and optimizing your Chart of Accounts—the customized list of all the financial accounts in your books. They'll make sure it’s structured to give you truly meaningful insights specific to your business model.

A well-designed Chart of Accounts is the difference between a generic, confusing P&L and one that tells a clear story about your profitability. It’s the backbone of actionable financial reporting.

Finally, you’ll establish a consistent rhythm for communication. This means setting a schedule for when you’ll receive your monthly financial reports and planning for regular check-in calls. These meetings are where you'll discuss progress, ask questions, and start turning that financial data into confident business decisions.

Frequently Asked Questions About Small Business Bookkeeping

When you're running a small business, financial questions are bound to pop up. Let's tackle some of the most common ones we hear from entrepreneurs just like you.

Can I Do My Own Bookkeeping?

Absolutely. Especially in the early days when your business is simple and you have a low volume of transactions, handling it yourself is completely doable. Tools like QuickBooks Online are even designed for owners to get started on their own.

But the real question isn't can you, but should you? As your business grows, the complexity of your finances grows right along with it. The tipping point usually arrives when the time you pour into bookkeeping starts costing you more in lost sales opportunities than it would to just hire a pro. If you’re constantly behind or feel like you’re just guessing, that's a huge sign it’s time to outsource.

What Is a Chart of Accounts?

Think of a Chart of Accounts as the custom-built filing cabinet for your company's finances. It's simply a complete list of every category you use to sort your transactions, like "Software Subscriptions," "Client Revenue," or "Office Rent."

A well-organized Chart of Accounts is the bedrock of good financial reporting. It’s what makes your Profit & Loss statement clear and gives you real insight into exactly where your money is coming from and where it’s going. That kind of clarity is what fuels smart business decisions.

How Often Should I Reconcile My Accounts?

You need to reconcile every single one of your business bank and credit card accounts at least once a month. No exceptions. Reconciliation is simply the process of matching up your internal books with your bank statements to make sure everything lines up perfectly.

This monthly habit is non-negotiable for accurate bookkeeping for small business. It helps you catch bank errors, spot potential fraud right away, and gives you total confidence that your financial reports are reflecting reality. Plus, when tax season rolls around, having clean books makes everything easier, especially when you're looking for tax return strategies to streamline your filing.

Ready to gain complete confidence in your numbers and free up your time to focus on growth? Steingard Financial provides expert bookkeeping and payroll services tailored for service businesses just like yours. Get in touch today for a free consultation.