Double entry bookkeeping in accounting: A Clear Beginner’s Guide

At its heart, double-entry bookkeeping is the simple idea that every single financial transaction has an equal and opposite effect in at least two different accounts. It’s the fundamental concept that keeps your financial records balanced, accurate, and honest.

Think of it like an old-fashioned balance scale. For every debit you place on one side, you must place an equal credit on the other. This ensures the scale—and your books—always remains perfectly level.

What Is Double Entry Bookkeeping and Why It Matters

Double-entry bookkeeping is the universal language of business finance. It’s a methodical system designed to paint a complete, verifiable picture of your financial health. Unlike the much simpler single-entry method that just tracks cash coming in and going out, this system tells the full story behind every dollar.

This isn’t some new-fangled idea; it has a rich history that goes way back. The earliest complete records we have of this system date to 1299–1300, preserved in the ledgers of Florentine merchants. It was later documented by Luca Pacioli in his 1494 book, ‘Summa de Arithmetica,’ and Gutenberg’s printing press helped spread this powerful accounting method across Europe. You can see how it evolved by exploring the history of double-entry bookkeeping on Wikipedia.

The Foundation of Modern Accounting

This core principle of balance is what makes double entry bookkeeping in accounting so reliable. Because every transaction gets two entries, it creates a self-checking mechanism that dramatically reduces errors. If your books don’t balance, that’s an immediate red flag that something is off.

This system is the engine running under the hood of all modern accounting software, including tools like QuickBooks. When you categorize a transaction in the software, it’s automatically handling the corresponding debits and credits in the background for you. Understanding what’s happening is crucial for any business owner because it:

- Ensures Accuracy: Creates a reliable financial record you can trust.

- Provides a Complete Picture: Shows you not just what you spent, but where the money came from and where it went.

- Enables Financial Reporting: Is the only way to generate accurate financial statements like the Balance Sheet and Income Statement.

- Improves Decision-Making: Delivers the solid data you need to make smart decisions about cash flow, profitability, and growth.

A Practical Analogy

Think of your business finances like a photograph. Single-entry bookkeeping is like a blurry, black-and-white snapshot—it gives you a vague idea of what’s going on but lacks any real detail. Double-entry bookkeeping, on the other hand, is a high-resolution, full-color panorama.

It captures every detail from multiple angles, showing you exactly how different parts of your financial landscape connect. You can see your assets, liabilities, and equity with total clarity, empowering you to navigate your business with confidence.

Ultimately, getting a handle on double-entry bookkeeping is the first real step toward achieving financial control. It elevates bookkeeping from a simple data-entry chore into a strategic tool that helps prevent costly mistakes and fuels sustainable growth. Without it, your financial data is incomplete, unreliable, and frankly, not very useful.

The Accounting Equation: Your Financial Bedrock

At the heart of double-entry bookkeeping lies one simple, unbreakable rule: the accounting equation. Think of it as the bedrock your entire financial house is built on. It’s the formula that brings clarity to your finances and ensures your books always, always balance.

The equation itself is refreshingly simple:

Assets = Liabilities + Equity

Let’s break that down. What your business owns (its Assets) has to equal what it owes to others (its Liabilities) plus what the owners have put into it (its Equity). It’s a perfect, real-time snapshot of your company’s financial position.

Breaking Down the Components

To really see this in action, let’s look at what each part means for a typical service business.

-

Assets: These are the resources your company owns that hold future value. The most obvious asset is cash in the bank, but it also includes things like company computers, office furniture, and—a big one for service businesses—unpaid client invoices, which we call Accounts Receivable.

-

Liabilities: These are your company’s debts or financial obligations to other parties. Common liabilities include a small business loan, the outstanding balance on your company credit card, or bills from your suppliers that you haven’t paid yet (Accounts Payable).

-

Equity: This is what’s left for the owners. It’s the value remaining after you subtract liabilities from assets, representing the owners’ stake in the company. Equity includes the initial cash an owner invests and any profits the business has earned and kept over time. For a deeper dive, check out our guide on the basic accounting equation.

Keeping the Scale Balanced with Every Transaction

The real magic of the system is how it keeps this equation perfectly balanced with every single transaction. For every action, there’s an equal and opposite reaction somewhere in the formula.

Let’s say you buy a new $2,000 laptop (an Asset) with cash (also an Asset). Your Equipment account goes up, and your Cash account goes down by the exact same amount. The equation remains perfectly balanced.

What if you buy that same laptop on credit? Your Assets (Equipment) still go up by $2,000, but this time your Liabilities (Accounts Payable) also increase by $2,000. Again, the equation stays in perfect harmony.

To see how this works across different scenarios, here’s a quick look at how common transactions affect the equation.

How Common Business Transactions Affect the Accounting Equation

This table shows how the accounting equation stays balanced through several typical business activities.

| Transaction | Assets | Liabilities | Equity |

|---|---|---|---|

| Owner invests $10,000 cash | +$10,000 (Cash) | No Change | +$10,000 (Owner’s Capital) |

| Purchase $2,000 equipment with cash | -$2,000 (Cash) +$2,000 (Equipment) |

No Change | No Change |

| Take out a $5,000 bank loan | +$5,000 (Cash) | +$5,000 (Loan Payable) | No Change |

| Provide services for $3,000 on credit | +$3,000 (Accounts Receivable) | No Change | +$3,000 (Retained Earnings) |

| Pay a $500 utility bill with cash | -$500 (Cash) | No Change | -$500 (Retained Earnings) |

No matter what happens, the scale always returns to balance. This core principle is what gives you confidence in your financial data.

This isn’t some new fad; its roots run deep. The powerful Medici Bank of 15th-century Florence managed its massive empire using this very system. The method was officially documented in Luca Pacioli’s famous 1494 text, and today, 99% of businesses rely on it. It’s the foundation for modern accounting standards like GAAP and IFRS, which govern over $100 trillion in global transactions annually.

That historical precision is what Steingard Financial brings to your business. Understanding this equation turns bookkeeping from a chore into a logical story, ensuring every number is accurate and tells the truth about your financial health.

Understanding the Rules of Debits and Credits

Diving into double entry bookkeeping in accounting can feel a bit like learning a new language. The terms “debit” and “credit” are usually the first big stumbling block. Many people instinctively try to label them as “good” or “bad,” but in the world of accounting, they simply don’t have that meaning.

A much easier way to think about them is as simple directions. Imagine any account in your books as a “T” shape—what accountants call a T-account.

- Debit (Dr): This just means the left side of the T-account.

- Credit (Cr): This just means the right side of the T-account.

That’s really all there is to it. A debit is an entry on the left; a credit is an entry on the right. Whether that entry increases or decreases an account’s balance depends entirely on the type of account it is. This is where the core rules of double-entry come into play, making sure the fundamental accounting equation always remains in balance.

The Five Main Account Types and Their Rules

Every single transaction your business conducts affects at least two of the five main account types. To keep the accounting equation (Assets = Liabilities + Equity) perfectly balanced, each account type follows a specific rule for how debits and credits impact it. Getting these rules down is the key to mastering the system.

Let’s walk through them based on where they sit in the equation.

Key Takeaway: The rules for debits and credits are essentially mirror images. Accounts on the left side of the equation (Assets) go up with debits. Accounts on the right side (Liabilities & Equity) go up with credits.

Here are the rules you absolutely need to know:

- Assets: This is your cash, equipment, inventory, and what customers owe you (accounts receivable). Since assets are on the left side of the equation, they increase with a debit and decrease with a credit.

- Expenses: These are your costs of doing business, like rent, payroll, and marketing. Expenses ultimately reduce your company’s equity, so they follow the same rule as assets: they increase with a debit. When you pay a utility bill, you debit the Utilities Expense account.

- Liabilities: This is money you owe to others, like bank loans or vendor bills (accounts payable). Liabilities are on the right side of the equation, so they work the opposite way: they increase with a credit and decrease with a debit.

- Equity: This represents the owner’s stake in the business. Just like liabilities, equity sits on the right side of the equation, so it increases with a credit.

- Revenue: This is the income your business earns from selling goods or services. Revenue boosts your overall equity, so it follows the same rule: it increases with a credit.

For a more detailed breakdown, feel free to check out our guide on understanding debit and credit in accounting.

Quick Reference Normal Balances

The “normal balance” of an account is just the side—debit or credit—that records an increase. For instance, Cash is an asset, and assets increase with a debit, so the Cash account has a normal debit balance.

This little table is a fantastic cheat sheet to help these rules stick.

Normal Balances and Debit/Credit Rules by Account Type

| Account Type | Increases With a… | Decreases With a… | Normal Balance |

|---|---|---|---|

| Asset | Debit | Credit | Debit |

| Expense | Debit | Credit | Debit |

| Liability | Credit | Debit | Credit |

| Equity | Credit | Debit | Credit |

| Revenue | Credit | Debit | Credit |

When you apply these simple rules, every journal entry you make will keep your books in perfect harmony. It takes what feels like an intimidating subject and turns it into a logical, practical tool for keeping your financial data reliable.

Applying Bookkeeping Principles in the Real World

Theory is great, but the real test is seeing how double entry bookkeeping in accounting works with actual business transactions. Let’s step away from the abstract rules for a moment. We’ll follow a brand new consulting business, “Innovate Solutions,” as it navigates its first month.

This practical walkthrough will make everything click. We’ll start from day one, recording each key financial event and creating the journal entries. You’ll see exactly how every move keeps the accounting equation perfectly balanced.

Transaction 1: The Initial Investment

The owner, Alex, kicks things off by investing $20,000 of personal savings into a new business bank account. This single action increases the company’s cash and, at the same time, creates the owner’s stake in the business.

Two accounts are involved here: Cash (an Asset) and Owner’s Capital (an Equity account).

- The Cash account goes up, and since assets increase with a debit, we debit it for $20,000.

- The Owner’s Capital account also goes up, and equity increases with a credit, so we credit it for $20,000.

The Journal Entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Day 1 | Cash | $20,000 | |

| Owner’s Capital | $20,000 | ||

| To record owner’s initial investment |

Just like that, our debits equal our credits. The equation is in balance.

Transaction 2: Buying Essential Equipment

Next up, Innovate Solutions needs a workhorse laptop and buys one for $2,500 using the business debit card. This is what we call an asset exchange—the business simply swapped one asset (Cash) for another (Equipment).

- The Equipment account (an Asset) increases, so we debit it for $2,500.

- The Cash account (also an Asset) decreases, so we credit it for $2,500.

The Journal Entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Day 3 | Equipment | $2,500 | |

| Cash | $2,500 | ||

| To record purchase of a laptop |

Here’s how this looks inside our T-accounts, which help visualize the flow of money.

Cash (Asset)

| Debit | Credit |

|---|---|

| (1) $20,000 | (2) $2,500 |

| Balance $17,500 |

Equipment (Asset)

| Debit | Credit |

|---|---|

| (2) $2,500 | |

| Balance $2,500 |

Notice the total value of assets didn’t change at all; it just moved from one pocket to another.

Transaction 3: Invoicing the First Client

Things are moving! Innovate Solutions finishes a project and sends its first client an invoice for $5,000. The cash isn’t in the bank yet, but the work is done and the revenue has been earned. This creates an asset called Accounts Receivable.

This is the heart of accrual accounting, a method that double-entry bookkeeping makes possible. You recognize revenue when you earn it, not just when you get paid. This gives you a much truer picture of your company’s performance.

- Accounts Receivable (an Asset) goes up, so we debit it for $5,000.

- Service Revenue (a Revenue account, which boosts Equity) also goes up, so we credit it for $5,000.

The Journal Entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Day 15 | Accounts Receivable | $5,000 | |

| Service Revenue | $5,000 | ||

| To record revenue from Client A |

This transaction increases both the asset side (what you have) and the equity side (what you’ve earned) of the equation, keeping everything perfectly in sync.

Transaction 4: Receiving Client Payment

Ten days later, the client pays the $5,000 invoice in full. This is another simple asset swap. The promise of payment (Accounts Receivable) has now turned into cold, hard cash.

- The Cash account (an Asset) increases, so we debit it for $5,000.

- The Accounts Receivable account (an Asset) decreases, so we credit it for $5,000.

The Journal Entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Day 25 | Cash | $5,000 | |

| Accounts Receivable | $5,000 | ||

| To record payment received from Client A |

Let’s update our T-accounts to see the impact.

Cash (Asset)

| Debit | Credit |

|---|---|

| (1) $20,000 | (2) $2,500 |

| (4) $5,000 | |

| Balance $22,500 |

Accounts Receivable (Asset)

| Debit | Credit |

|---|---|

| (3) $5,000 | (4) $5,000 |

| Balance $0 |

The Accounts Receivable balance is now zero, which tells us at a glance that the invoice has been paid.

Transaction 5: Paying a Business Expense

Finally, Innovate Solutions gets a bill for its professional liability insurance and pays the $300 premium. This transaction reduces cash and creates a business expense.

- Insurance Expense (an Expense account, which reduces Equity) goes up, so we debit it for $300.

- Cash (an Asset) goes down, so we credit it for $300.

The Journal Entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Day 28 | Insurance Expense | $300 | |

| Cash | $300 | ||

| To record payment for insurance premium |

Each one of these examples shows the logical, self-correcting nature of the system. By always recording equal debits and credits, a business builds an accurate and verifiable financial history—the absolute foundation for generating reports you can actually trust.

From Daily Transactions to Powerful Financial Reports

Every time you log a transaction—whether it’s a small supply purchase or a major client payment—you’re laying another brick in your company’s financial foundation. A single entry might not seem like much, but the real power of double entry bookkeeping in accounting is how it weaves all these individual pieces together into a clear, coherent story. This process really comes to life at the end of each month when it’s time to generate insightful financial reports.

This is where all that careful work of tracking debits and credits pays off. The goal isn’t just to have a long list of transactions; it’s to transform that raw data into a clear snapshot of your business’s health—intelligence you can actually use to make smart decisions.

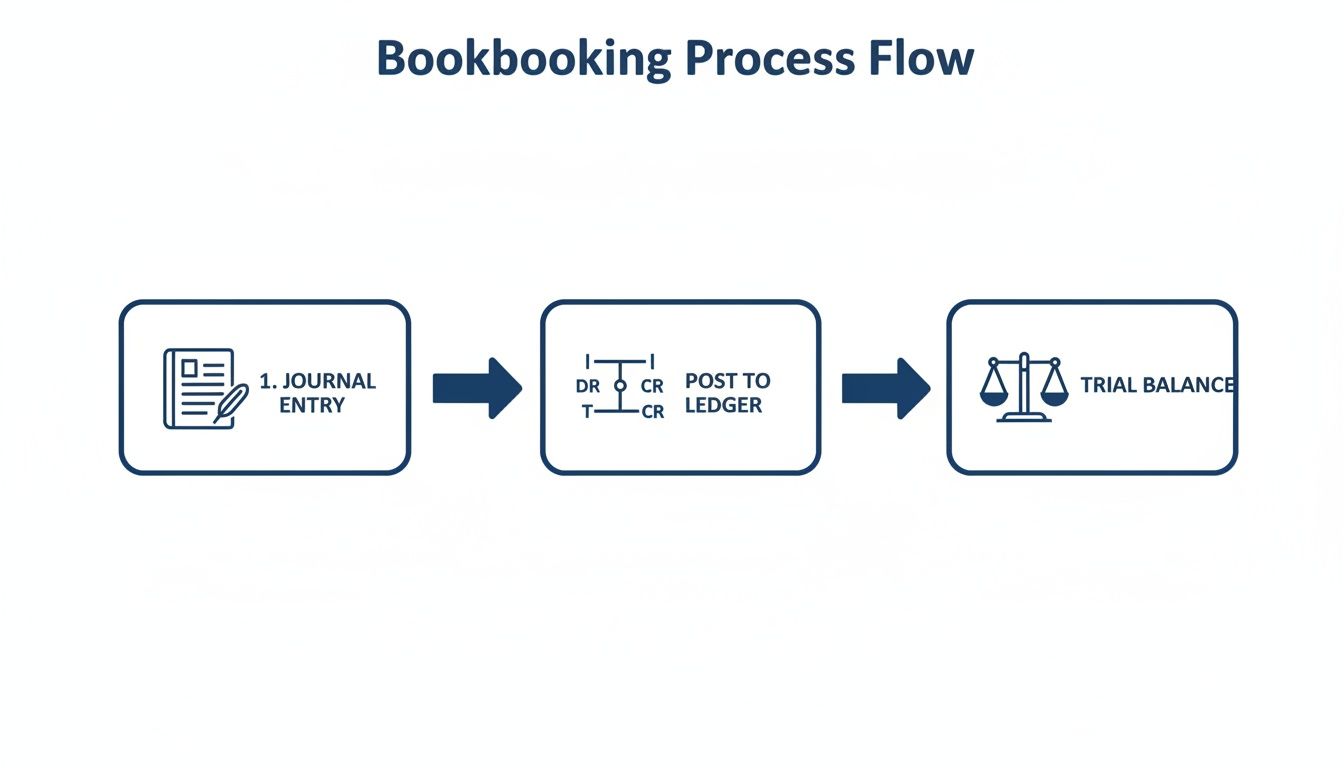

This flowchart shows how information moves through a basic bookkeeping system, from the initial transaction to the final reports.

As you can see, individual journal entries get sorted into ledgers. Those ledgers are then summarized in a trial balance, which acts as a final accuracy check before any reports are created.

The Critical Month-End Close Process

The month-end close is what connects your daily bookkeeping activities to your financial reports. Think of it as a methodical checklist you run through to make sure every transaction from the period is recorded correctly and that all your accounts are balanced and verified.

A huge part of this is bank reconciliation. This simply means comparing the cash transactions you’ve recorded in your books against your actual bank statements. Because double-entry gives you a complete, independent record, it’s much easier to spot discrepancies and figure out what’s going on with things like:

- Uncashed checks you’ve sent to vendors

- Bank service fees you might have missed

- Customer payments that haven’t cleared yet

- Potential red flags or fraudulent activity

After reconciling your accounts and making any needed adjustments, the next step is to prepare a trial balance. This is an internal report listing every account and its final debit or credit balance. If your total debits equal your total credits, your books are balanced, and you’re good to go. To get a better sense of this crucial document, you can check out the standard trial balance format.

With a balanced and reconciled trial balance in hand, you have everything you need to build your core financial statements. This is the moment when all that diligent bookkeeping pays off, allowing for creating a clear Profit and Loss statement and a Balance Sheet.

Generating Your Core Financial Statements

These reports are the ultimate result of using double-entry bookkeeping correctly. They translate all your transactional data into two essential documents:

- The Income Statement (or Profit & Loss): This report lines up your revenues against your expenses for a specific period, answering the most important question: “Are we profitable?”

- The Balance Sheet: This gives you a snapshot of your company’s financial standing at a single moment in time. It lays out what you own (Assets), what you owe (Liabilities), and your net worth (Equity), proving that your accounting equation is perfectly in balance.

These documents are far more than just a tax season requirement. They are your primary tools for analyzing cash flow, securing loans, talking to investors, and mapping out future growth. A professional service like Steingard Financial manages this entire process, ensuring you get accurate reports on time, every time, so you always know exactly where your business stands.

Implementing a Flawless Bookkeeping System

Knowing the theory behind double-entry bookkeeping is a great start, but actually putting it into practice without a hitch is a whole different ballgame. The good news? Modern accounting software has done a lot of the heavy lifting for us.

Tools like QuickBooks and Gusto are built on a double-entry foundation. When you enter a new invoice or categorize an expense, the software is working in the background, automatically making the correct debit and credit entries to keep the books balanced. This automation is fantastic for reducing the simple human errors that used to be common with manual ledgers, but it’s no silver bullet. The system is only as smart as the information you give it.

Building Your Blueprint: The Chart of Accounts

Before you log a single transaction, your first and most critical task is to set up a solid Chart of Accounts (COA). Think of the COA as the architectural blueprint for your company’s entire financial structure. It’s a master list of every single account your business uses, neatly organized into assets, liabilities, equity, revenue, and expenses.

A well-designed COA brings clarity and consistency to your finances. It gives every dollar a proper home, which makes your financial reports clean, logical, and easy to interpret. If you rush this step or get it wrong, you’ll quickly run into problems like:

- Miscategorized Transactions: Recording office supplies under “Marketing” doesn’t just look messy—it completely throws off your analysis of how profitable your marketing efforts really are.

- Duplicate Accounts: Creating multiple expense accounts for the same vendor or software subscription makes it impossible to track your spending accurately.

- Inaccurate Financial Statements: When the underlying data is a jumble, the reports you generate are basically useless for making real business decisions.

Getting your COA right from the very beginning isn’t just a best practice; it’s non-negotiable for achieving true financial clarity.

The core purpose of any good bookkeeping system is to deliver unwavering financial accuracy. New technologies are always emerging to help improve financial accuracy in both reporting and day-to-day record-keeping.

Avoiding Common Implementation Pitfalls

Even with great software and a perfect COA, it’s still possible to make mistakes. Remember, automation is a powerful tool, but it can’t replace careful oversight. One of the most common errors we see is business owners failing to perform regular bank reconciliations. This is a crucial step where you verify that every transaction in your books perfectly matches what cleared your bank account. It’s how you catch small discrepancies before they snowball into huge problems.

Another frequent misstep is sloppy expense categorization. Just guessing where a transaction belongs can drastically overstate or understate your profits. This doesn’t just impact your ability to make smart decisions—it can also create a massive headache when it’s time to file your taxes.

The Value of an Expert Partner

This is exactly where having an expert bookkeeping partner makes all the difference. While you’re busy running and growing your business, a dedicated firm like Steingard Financial works to ensure your financial system is not only set up correctly but is also maintained with absolute precision. We’ll build a clean Chart of Accounts, handle the meticulous day-to-day transaction coding, and perform timely reconciliations every month.

With an expert on your side, you get all the benefits of a robust, double-entry system without needing to become an accountant yourself. We make sure your data is clean, your reports are accurate, and your financial system gives you the reliable insights you need to make confident decisions and drive sustainable growth.

Common Questions About Double Entry Bookkeeping

Even after you get the basics down, it’s completely normal to have a few questions about double entry bookkeeping in accounting. It’s a logical system, but some parts can take a minute to click. Let’s walk through some of the most common things people ask to make sure everything is crystal clear.

Getting these points sorted out really highlights just how valuable this accounting method is for running a modern business.

What Is the Difference Between Single Entry and Double Entry Bookkeeping?

Think of single-entry bookkeeping like your checkbook register at home. It’s a simple list that tracks cash coming in and cash going out. While it’s easy, it only tells one side of the story—the cash side—and gives you a very limited view of your company’s financial health.

Double-entry bookkeeping, on the other hand, records both sides of every single transaction. When a customer pays you, you don’t just see your cash go up; you also see that you’ve earned revenue. This two-sided approach is what keeps the accounting equation (Assets = Liabilities + Equity) in perfect balance, which is essential for creating an accurate Balance Sheet and other key financial reports.

Do I Need to Understand This If I Use QuickBooks?

Yes, but you don’t need to be a CPA. While fantastic software like QuickBooks handles all the debits and credits for you behind the scenes, having a basic grasp of the “why” is a game-changer.

Knowing what’s happening under the hood helps you categorize transactions correctly, catch mistakes when you’re doing bank reconciliations, and actually understand what your financial statements are telling you. It shifts you from being a passive software user to a confident business owner who can have a much more productive conversation with your bookkeeper.

Why Do Debits Sometimes Increase and Sometimes Decrease an Account?

This is easily the biggest source of confusion for anyone new to bookkeeping. The secret is that the effect of a debit or a credit depends entirely on the type of account and where it sits in the accounting equation.

Picture the equation as a balancing scale:

- Assets & Expenses: These accounts live on the left side of the equation. So, naturally, they go up with a debit (a left-side entry).

- Liabilities, Equity & Revenue: These accounts are on the right side of the equation. It follows, then, that they increase with a credit (a right-side entry).

So, if you debit a right-side account (like a Liability), it has to be a decrease to keep that scale balanced. The rules are set up this way on purpose to create a self-checking system that forces everything to be accurate.

Making sure you’re navigating the rules of double-entry bookkeeping correctly means your financial data will always be reliable. Steingard Financial is an expert at setting up and managing this system with precision, giving you the accurate, timely reports you need to make smart decisions and grow your business. Find out more about our expert bookkeeping services.