How to Calculate Capital Spending for Smart Business Growth

When you’re trying to get a handle on your company’s finances, you’ll often hear about CapEx. This number comes from a simple calculation: adding the change in your net fixed assets to the depreciation expense for the period. But what this really shows is how much your company is investing in long-term assets like machinery, buildings, and technology—the real fuel for future growth.

What Capital Spending Really Means for Your Business

Before you can nail down how to calculate capital spending, it’s important to get what this number truly represents. At its core, capital spending, or CapEx, is a direct investment in your company’s future. These aren’t just any purchases; they are significant acquisitions of physical assets that will keep providing value long after the current year is over.

Think of it like this: the money you spend on monthly rent or employee salaries keeps the lights on today. That’s an operating expense (OpEx). But the money you invest in a new delivery truck, a high-capacity server, or a major office renovation is a capital expenditure. These aren’t just costs; they are strategic decisions meant to build your company’s value and operational muscle for the long haul.

Distinguishing CapEx from Daily Costs

One of the most common hangups for business owners is figuring out where to draw the line between a capital expenditure and a routine operational cost. The key difference always comes down to the purchase’s purpose and its lifespan. OpEx covers the day-to-day grind, while CapEx is all about funding long-term growth and efficiency.

Here’s a practical way to think about it:

- Purpose: OpEx is for maintaining the business as it is right now (think utility bills, office supplies). CapEx is for improving or expanding the business (like buying a new building or upgrading all the company computers).

- Lifespan: An operating expense is usually used up within the year. A capital asset has a “useful life” that goes well beyond 12 months, providing benefits for years to come.

- Accounting Treatment: OpEx gets fully deducted from your revenue in the year you spend it. CapEx is different; it’s capitalized. This means the asset goes on the balance sheet, and its cost is spread out over its useful life through depreciation.

To make this crystal clear, let’s look at them side-by-side.

Capital Spending (CapEx) vs. Operating Spending (OpEx)

| Attribute | Capital Spending (CapEx) | Operating Spending (OpEx) |

|---|---|---|

| Purpose | To acquire or upgrade long-term assets for future benefit. | To support day-to-day business operations. |

| Time Horizon | Benefits extend beyond one year. | Benefits are consumed within one year. |

| Financial Statement Impact | Appears as an asset on the balance sheet and is depreciated over time on the income statement. | Appears as a full expense on the income statement in the period it occurs. |

| Examples | Buying a new building, purchasing heavy machinery, upgrading a server network, acquiring a vehicle fleet. | Employee salaries, rent, utilities, office supplies, marketing costs, repairs and maintenance. |

Understanding this distinction is fundamental to good bookkeeping and sound financial strategy.

Smart CapEx is not just about spending money; it’s about strategically allocating resources to build a stronger, more competitive business. It is a direct indicator of leadership’s confidence in the company’s future prospects and growth strategy.

Why This Calculation Matters

Getting a grip on your CapEx is so much more than an accounting chore. This number is a vital sign of your company’s health and where it’s headed. A healthy amount of capital spending shows that a business is reinvesting in itself to stay competitive, boost productivity, and drive real, sustainable growth.

For example, a manufacturing company that invests in new, automated machinery (a CapEx purchase) can crank out more products and lower its labor costs over time. A software firm that buys a powerful new server suite can improve its product’s performance and handle more customers. These decisions are foundational to scaling a business.

A popular formula for this calculation is: CapEx = Ending Net Fixed Assets + Depreciation Expense – Beginning Net Fixed Assets. This is a reliable way to track the reinvestment into a company’s core physical assets. For a deeper dive, you can see more details on how financial experts use this calculation for business analysis.

The Two Main Ways to Calculate Capital Spending

Alright, now that you have a firm grasp on what capital spending is and why it’s such a critical number to watch, it’s time to get into the nuts and bolts. How do you actually calculate it?

There are two primary, reliable methods for figuring out your CapEx, and each uses a different financial statement as its source of truth. Both will get you to a final number, but they offer slightly different perspectives on your company’s investment activities.

Let’s walk through both approaches. Understanding each one will give you the flexibility to analyze your business’s financial health with much greater accuracy and confidence.

Using the Balance Sheet and Income Statement

The first method is a formula-driven approach that pulls data from two of your core financial statements: the balance sheet and the income statement. This is often called the indirect method because it calculates CapEx by looking at the change in your asset values over a specific period.

The formula itself is pretty straightforward:

CapEx = Ending Net Fixed Assets + Depreciation – Beginning Net Fixed Assets

Let’s break down what each of those pieces means in plain English:

- Net Fixed Assets (PP&E): This is the book value of your company’s long-term assets, like Property, Plant, and Equipment. You’ll find this line item right on your balance sheet. The “Net” part just means it’s the original cost of the assets minus all the depreciation that has built up over time.

- Depreciation: This is a non-cash expense found on your income statement. It represents how much of an asset’s value has been “used up” during the period. We add it back in the formula because it reduces the book value of your assets on paper, but no actual cash left your bank account because of it.

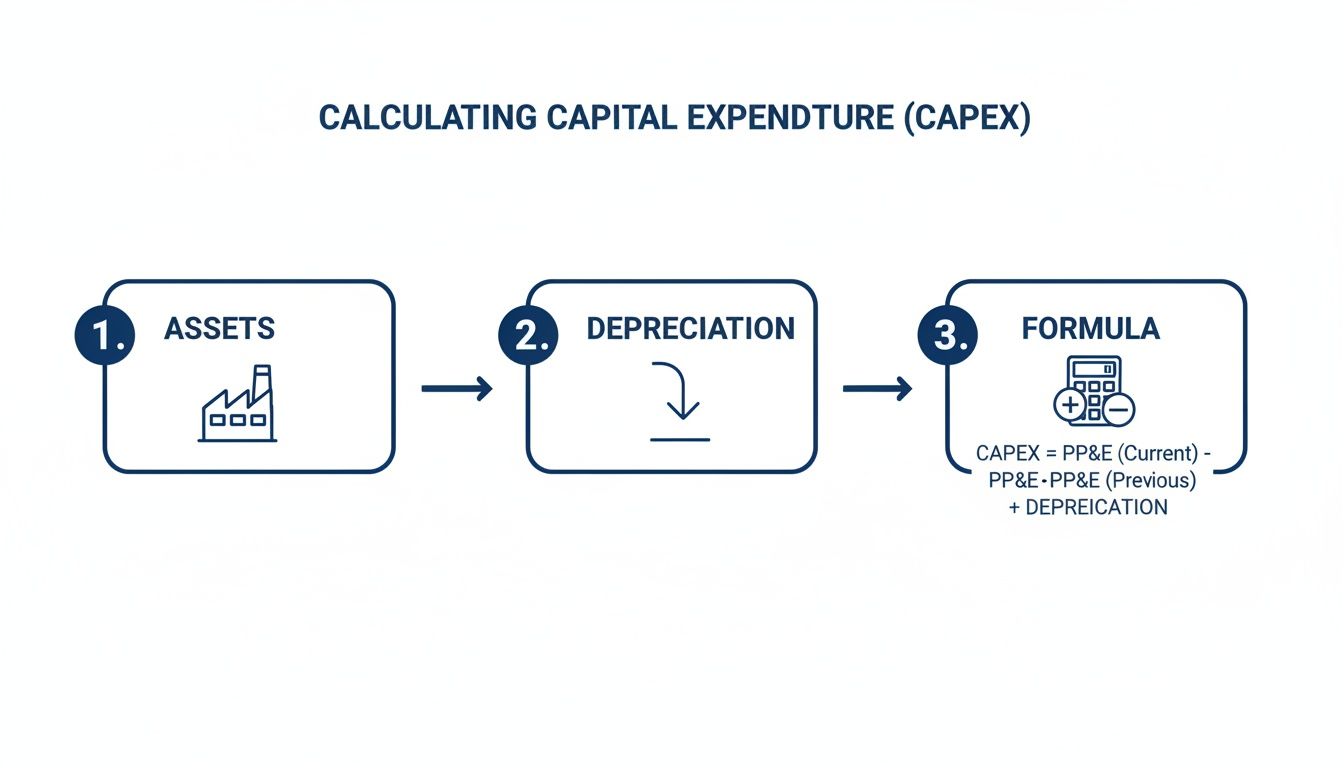

This process is visually represented in the diagram below, breaking down the flow from identifying the assets to the final calculation.

This visual guide shows that calculating CapEx is really about reconciling the change in your long-term assets with the non-cash expense of depreciation to isolate your actual cash investment.

A Practical Example

Let’s make this real. Imagine you run a small catering company. Pulling up your financials for the last year, you find these numbers:

- Beginning Net Fixed Assets (Jan 1): $120,000 (this includes your vans, ovens, kitchen equipment)

- Ending Net Fixed Assets (Dec 31): $150,000

- Depreciation Expense for the year: $15,000

Now, just plug these into our formula:

CapEx = $150,000 (Ending) + $15,000 (Depreciation) – $120,000 (Beginning) = $45,000

That $45,000 is your answer. It tells you that your catering company spent exactly that much cash during the year on new long-term assets—maybe you bought a new delivery van or a commercial-grade refrigerator.

This method is especially useful for companies that use accrual-basis accounting, where revenues and expenses are recorded when they’re earned, not necessarily when cash changes hands. To clarify this concept, you can learn more about the difference between cash basis and accrual basis accounting to see how it impacts your financial reporting.

Using the Cash Flow Statement

The second, and often more direct, way to pin down your capital spending is by looking at your Statement of Cash Flows. This financial statement is a powerful summary of all the cash that came into and went out of your business over a period.

The Statement of Cash Flows doesn’t just show you if you made a profit; it shows you where your cash actually went. For calculating CapEx, it’s the most direct source you can possibly use.

To find what you need, look for the section titled “Cash Flow from Investing Activities.”

Within this section, you’ll find line items that directly call out the purchase or sale of long-term assets. Keep an eye out for descriptions like:

- “Purchase of property, plant, and equipment”

- “Acquisition of fixed assets”

- “Capital expenditures”

This figure represents the actual cash that left your bank account to buy those assets. If you also sold some old equipment, you’ll see a line item like “Proceeds from the sale of equipment.” To get your total CapEx, you would primarily use the purchase figure. This method is often much cleaner because it isn’t an indirect calculation; it’s a direct report of cash spent.

Which Method Should You Use?

Honestly, for most businesses, looking at the cash flow statement is the most transparent and straightforward way to determine capital spending. It shows the exact cash impact of your investment decisions, which is what most owners and investors really care about.

However, the balance sheet method is an excellent cross-reference. If you calculate CapEx both ways and the numbers don’t match up, it could signal a bookkeeping error or a more complex transaction, like an asset you acquired through debt instead of cash. Using both methods provides a valuable check-and-balance for your financial records.

Practical Ways to Track Your CapEx Accurately

Knowing the formula for how to calculate capital spending is just the first step. The real challenge? Feeding that formula with clean, accurate data. A calculation is only as good as the numbers you put into it, which is where we move from theory to practice. It’s time to build a solid system for tracking your capital expenditures from day one.

The foundation of all this lies right inside your accounting software. Whether you’re on QuickBooks, Xero, or another platform, the principles are the same, and it all starts with a well-organized Chart of Accounts.

Setting Up Your Chart of Accounts

Your Chart of Accounts is the backbone of your financial records. To track CapEx properly, you have to create a clear dividing line between your capital assets and your everyday expenses. Getting this right from the start prevents a lot of headaches and costly reclassifications down the road.

Instead of lumping everything into a generic “Equipment” account, get specific with your fixed asset accounts. This extra detail makes tracking depreciation and managing your assets so much easier.

I recommend setting up accounts like:

- Computer Equipment: For all laptops, desktops, and servers.

- Office Furniture & Fixtures: This covers desks, chairs, and shelving.

- Machinery & Heavy Equipment: Perfect for specialized production machinery.

- Vehicles: For any company cars, trucks, or vans.

When you buy a new asset, you’ll record the purchase in one of these dedicated accounts, not an expense account. This immediately flags it as a long-term investment rather than a simple operational cost. Getting this categorization right is crucial, and our guide on how to keep track of business expenses has more tips that can help with the overall process.

Maintaining a Fixed Asset Register

While your accounting software handles the numbers, a fixed asset register (sometimes called a fixed asset schedule) manages the details. Think of it as a master inventory list for every significant asset your company owns. This document becomes your single source of truth for managing assets throughout their entire lifecycle.

A good register should track several key pieces of information for each asset:

- Asset Description: A clear description (e.g., “Dell XPS 15 Laptop, Serial #ABC123”).

- Purchase Date: The day the asset was officially acquired.

- Purchase Cost: The full, landed cost, including shipping, installation, and taxes.

- Useful Life: The estimated number of years the asset will be in service, according to accounting standards.

- Depreciation Method: Whether you’re using straight-line, declining balance, etc.

- Salvage Value: The estimated value of the asset at the end of its useful life.

- Location: Where the asset is physically located.

This register isn’t just for the bookkeeper; it’s incredibly valuable for insurance claims, physical audits, and strategic planning.

A well-maintained fixed asset register is your best defense against inaccurate financial statements and a lifesaver during tax season or an audit. It moves you from guessing to knowing exactly what your assets are worth.

Using QuickBooks for Asset Management

Modern accounting software like QuickBooks Online makes this whole process much simpler. You can manage your fixed assets directly on the platform, creating a seamless link between your register and your bookkeeping.

The Fixed Asset Manager in QuickBooks lets you add new assets, track their cost, and even automate your depreciation journal entries. This integration ensures that the data in your register always lines up perfectly with the figures on your balance sheet.

Here’s a look at what a fixed asset list might look like inside QuickBooks Online.

This screenshot gives you a clean, at-a-glance view of your company’s investments, showing each asset, its purchase details, and its accumulated depreciation.

By putting these tools and systems in place, every capital purchase gets categorized correctly from the moment it happens. This systematic approach ensures that when it’s time to calculate your capital spending, you’re working with data that is complete, accurate, and easy to verify, making your entire financial analysis that much more powerful.

Connecting CapEx to Your Overall Financial Strategy

Figuring out your capital spending is much more than just an accounting chore. It’s a strategic move that plugs directly into the financial heart of your business. That final CapEx number tells a story about your company’s ambitions, its confidence in the future, and its ability to generate profits for the long haul.

Looking at CapEx in a vacuum completely misses the point. To really get a feel for its impact, you have to connect it to other key financial metrics, especially free cash flow (FCF). Free cash flow is the cash your company generates after covering all the expenses to maintain or expand its asset base. It’s the lifeblood of a healthy business.

CapEx and Its Link to Free Cash Flow

Investors and analysts are obsessed with free cash flow for a good reason: it’s the cash left over to repay debt, pay dividends, and chase new opportunities after you’ve reinvested in the business. The formula itself shines a spotlight on CapEx’s role:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

This simple equation shows a direct trade-off. All things being equal, the more you spend on CapEx, the less free cash flow you’ll have in the short term. This isn’t automatically a bad thing—as long as the investment is solid. A big CapEx outlay today on new machinery that boosts efficiency should lead to much higher operating cash flow down the road.

This is the classic balancing act of strategic financial planning. You’re giving up some cash today for the promise of more cash tomorrow. Understanding this dynamic is absolutely critical for making smart investment decisions. It’s also key for communicating your strategy to lenders or investors who want to see that your spending is purposeful, not just frivolous. A solid cash flow projection is one of the most powerful tools you can have for planning these major investments.

Aligning Spending with Long-Term Business Goals

Your capital spending budget should be a direct reflection of your company’s long-term strategic plan. Think of it as the financial muscle behind your vision. Whether your goal is to break into a new market, overhaul your tech, or make your supply chain more resilient, your CapEx plan is what brings it to life.

Just think about these common strategic goals and how CapEx fits right in:

- Market Expansion: Planning to open a new office or retail store? The costs for the building, renovations, and equipment are all major capital expenditures that have to be budgeted for.

- Technology Upgrades: To keep up, you might need to invest in a new server infrastructure or a custom software platform. This CapEx is essential for improving your service and being able to scale.

- Supply Chain Overhaul: Investing in a new warehouse, a fleet of delivery trucks, or automated sorting equipment is a capital-intensive strategy meant to slash long-term operating costs and boost reliability.

A capital budget that isn’t tied to clear strategic objectives is just spending. A budget that is directly linked to your business goals is a true investment plan.

Considering Broader Economic Trends

Your CapEx decisions don’t happen in a bubble; they’re shaped by the wider economic environment. Paying attention to global trends can show you where the smart money is flowing and highlight competitive pressures you need to address.

For instance, recent data shows that even with a hot M&A market, these deals account for only about 7% of cash expenditures by major public companies—the lowest share in a decade. This signals a strategic shift. Companies are increasingly funneling capital into technology, automation, and building stronger supply chains. As you can see from these global capital allocation trends on PR Newswire, you have to factor in these dynamic market conditions when deciding where to put your money.

By connecting your capital spending calculations to your broader financial strategy—from cash flow management to long-term goals and market trends—you transform a simple accounting metric into a powerful tool for building a more resilient and profitable business.

Common Mistakes to Avoid When Calculating CapEx

Even with the right formulas, figuring out how to calculate capital spending comes with a few common pitfalls. It’s easy to make small mistakes that can throw off your financial statements, leading to bad strategic calls and even compliance headaches. Getting CapEx right is all about sweating the small stuff.

One of the biggest and most frequent slip-ups is misclassifying expenses. It can be tempting to log a big purchase as a regular operating expense (OpEx) to snag an immediate tax deduction. That’s a critical error.

Let’s say you buy a $25,000 commercial printing press. Expensing it all at once might lower your tax bill this year, but it gives a completely warped view of your company’s financial health. You’ve just understated your assets on the balance sheet and overstated your expenses on the income statement, making the business look less profitable and weaker than it really is.

Forgetting Associated Costs

Another classic trap is only looking at the sticker price of a new asset. That’s just the starting point. The real capital cost includes every single dollar you spent to get that asset up and running.

You need to think beyond the purchase price and remember to capitalize these costs:

- Shipping and freight charges to get the equipment to your door.

- Installation and setup fees, including any specialized technicians needed.

- Sales tax you paid on the purchase.

- Training costs required for your team to use the new asset safely and correctly.

Forgetting these “soft costs” means you’re undervaluing the asset from day one. That throws your depreciation schedule out of whack for years to come. For instance, a $50,000 machine could easily cost $57,000 once you add $4,000 for installation, $2,500 in taxes, and $500 for shipping. The full $57,000 is the number you need to capitalize.

A core principle of accurate CapEx calculation is capturing the asset’s full, landed cost. Any expense that is directly attributable to bringing the asset into service must be included in its initial value.

Inconsistent Depreciation Methods

Depreciation is a huge part of the CapEx picture, but if your methods are all over the place, it’s impossible to make meaningful year-over-year comparisons. While it’s fine for different types of assets to have different depreciation schedules, you absolutely need to be consistent within similar asset classes.

If you use the straight-line method for one delivery truck, you should stick with that for the next one you buy. Bouncing between methods without a solid business reason muddies the water, hiding how fast your assets are actually losing value. It’s also a red flag that could attract unwanted attention during an audit. Consistency is everything for reliable financial analysis.

To help you stay on track, I’ve put together a quick-reference table to spot and fix these common mistakes before they become bigger problems.

Troubleshooting Common CapEx Calculation Errors

It’s one thing to know the theory, but it’s another to catch errors in the wild. This table is designed to be your go-to guide for identifying and correcting the most frequent trip-ups I see when business owners calculate CapEx.

| Common Mistake | Potential Impact | How to Fix It |

|---|---|---|

| Classifying CapEx as OpEx | Understates assets and net income, leading to inaccurate financial ratios. | Establish a clear capitalization policy (e.g., all assets over $2,500 with a useful life over one year are capitalized). |

| Omitting “soft costs” | The asset is undervalued on the balance sheet, and depreciation is calculated incorrectly. | Create a checklist for all major purchases to ensure shipping, installation, taxes, and other setup fees are included in the asset’s cost basis. |

| Inconsistent depreciation | Skews period-over-period financial comparisons and complicates asset management. | Document a standard depreciation policy for each class of assets and apply it consistently across your fixed asset register. |

| Ignoring asset disposals | Overstates the value of fixed assets on your books by keeping fully depreciated or sold assets listed. | Regularly audit your fixed asset register to remove disposed or obsolete assets and record any gain or loss on the sale. |

By being proactive and watching out for these common mistakes, you can ensure your capital spending numbers are solid. That accuracy is the foundation for making smart, strategic decisions that will fuel your company’s growth for years to come.

Common Questions About Capital Spending

As you get more comfortable with the formulas and strategies behind capital spending, a few questions tend to pop up again and again. Getting these cleared up is key to managing your company’s investments with real confidence.

Think of this as a quick-reference guide to tackle the most common points of confusion. We’ll fill in any remaining gaps, from distinguishing between different types of CapEx to understanding what it all means in the real world.

What Is the Difference Between Maintenance CapEx and Growth CapEx?

This is a fantastic question because the answer reveals a company’s true strategy.

Maintenance CapEx is the money you have to spend just to keep the lights on and maintain your current level of operations. Think of it as replacing a tired, old delivery van with a new one of the exact same model. You’re not expanding, just treading water.

Growth CapEx, on the other hand, is the exciting part. This is the investment you make to actually expand your business—buying a second delivery van to serve more customers or purchasing a larger oven to double your bakery’s output. Investors watch this split like a hawk because it shows if a company is just surviving or actively building a bigger future.

How Does Depreciation Affect the CapEx Calculation?

Depreciation is a crucial piece of the puzzle, especially when you’re calculating capital spending from the balance sheet. It’s a non-cash expense—an accounting concept that reduces the value of your assets on paper to reflect wear and tear, even though no actual money leaves your bank.

In the formula (Ending Assets + Depreciation – Beginning Assets), we add depreciation back for a very specific reason. Since depreciation artificially lowers the book value of your assets, adding it back cancels out that non-cash reduction. This move lets the formula zero in on the actual cash spent on new assets during the period, giving you a much cleaner picture of your investment activity.

Can Capital Spending Be a Negative Number?

Absolutely, and it isn’t automatically a bad sign. Capital spending turns negative when a company sells off more fixed assets than it buys in a given period. This usually points to a strategic pivot, not necessarily a business in decline.

For instance, a business might sell off an entire factory or a non-essential division for a big chunk of cash. If that cash infusion from the sale is larger than what was spent on new equipment elsewhere, your net CapEx will be negative. This happens all the time during corporate restructuring or when a company decides to ditch a particular business line to focus on what it does best.

A negative CapEx isn’t always a red flag. It often indicates a strategic divestiture, where a company is converting a physical asset back into cash to redeploy elsewhere, pay down debt, or return to shareholders.

Why Is CapEx So Important for Investors?

For investors, CapEx is one of the clearest windows into a company’s long-term vision and financial health. It shows exactly how much cash is being plowed back into the business to either defend its market position or fund future growth.

Here’s what the CapEx numbers signal to an investor:

- High and consistent CapEx usually means a company is in growth mode, aggressively adding capacity, or upgrading its tech to get ahead of the competition.

- Low or declining CapEx might suggest a mature business that doesn’t need much investment. But it can also be a warning that it’s not reinvesting enough to stay relevant.

- Strategic CapEx that lines up with industry trends (like investing in automation or AI) shows management is looking ahead and adapting smartly.

At the end of the day, capital spending is the financial proof behind the promises management makes to its shareholders. It’s where the money meets the mission.

At Steingard Financial, we transform complex bookkeeping into clear, actionable insights so you can focus on growth. Our expert team handles everything from meticulous transaction categorization to strategic payroll and HR support, giving you the financial confidence to make smarter decisions. Stop wrestling with spreadsheets and start building a more profitable business today. Learn more about how we can create a scalable back office for your company at https://www.steingardfinancial.com.