How to Prepare Financial Statements: A Practical Guide for Service Businesses

Turning raw transaction data into a clear financial picture is a straightforward process. First, you close your books for the period. Then, you make key adjustments for things like accruals and depreciation. Finally, you generate the core reports. This process takes all the daily numbers from tools like QuickBooks and turns them into a high-level view of your business’s financial health.

Your Blueprint for Financial Clarity

Financial statements are not just a year-end hassle you endure for tax season. For a growing service business, they are your strategic blueprint. They tell a clear story about where you’ve been, where you are now, and where you’re headed.

Think of them as a dynamic tool, not just a static document. They give you the confidence to make big decisions—whether that’s hiring a new team member, investing in software, or mapping out your next quarter.

This is where meticulous preparation pays off. It’s the difference between reactive bookkeeping (just logging what happened) and proactive financial management. When you get this right, all that raw data from platforms like QuickBooks and Gusto becomes an actionable story. That clarity is gold, whether you’re in an internal budget meeting or talking with potential investors.

The Three Pillars of Financial Reporting

At the heart of it all are three core financial statements. Each one gives you a unique window into your business’s performance and stability.

Here’s a quick breakdown of what each statement tells you and the fundamental business question it answers.

The Three Core Financial Statements Explained

| Statement | What It Shows | Key Question It Answers |

|---|---|---|

| Income Statement (P&L) | Your profitability over a specific period (like a month or quarter) by subtracting expenses from revenues. | Are we making money? |

| Balance Sheet | A snapshot of your financial position at a single point in time, detailing assets, liabilities, and equity. | What is the company’s net worth? |

| Statement of Cash Flows | The movement of cash from operating, investing, and financing activities. | Where did our cash come from, and where did it go? |

Getting comfortable with these three reports is crucial. They work together to paint a complete picture that one statement alone can’t provide.

A business can be profitable on its income statement but still run out of cash. Understanding all three statements together is non-negotiable for sustainable growth and avoiding common financial pitfalls.

To ensure every report is built on a reliable foundation, you need a consistent process. Establishing clear Standard Operating Procedures (SOPs) is the best way to get there.

The global accounting services industry, which handles this vital work, ballooned to an estimated $643.8 billion in revenue, showing just how much businesses value accurate financial data. For service firms, precise statements aren’t just good practice—they’re a competitive necessity. You can dive deeper into these market trends and insights at IBISWorld.

Mastering the Month-End Close Process

Getting your financial statements right starts with a solid month-end close. This isn’t just about ticking boxes; it’s the bedrock that ensures every number feeding into your reports is accurate and reliable. If you skip corners here, your financials are built on shaky ground, plain and simple.

Think of it like a chef prepping their station before a dinner rush. They aren’t just winging it. They’re organizing ingredients and sharpening knives so everything is ready to go. The month-end close is your financial prep work.

Your Actionable Month-End Checklist

A systematic approach is the best way to avoid mistakes. While every service business has its own quirks, a core checklist helps build the muscle memory for a clean close every single time. It’s about creating a repeatable workflow you can count on.

Here’s a practical rundown for a growing service business, especially if you’re using a tool like QuickBooks Online:

- Categorize All Transactions: Dive into your bank and credit card feeds. Every single transaction needs a home, assigned to the correct income or expense account. No exceptions.

- Review Outstanding Invoices (Accounts Receivable): Who still owes you money? Check your A/R aging report and follow up on anything overdue. This is key for making sure your revenue is recognized properly.

- Log All Bills (Accounts Payable): Get every bill you’ve received but haven’t paid yet into the system. This is crucial for capturing all your expenses for the month.

- Reconcile Bank Accounts: This is non-negotiable. You have to match every transaction in QuickBooks to your official bank statement. It’s how you catch duplicates, missed entries, or even potential fraud.

- Reconcile Credit Card Accounts: Do the exact same thing for all your business credit cards. It’s amazing how many small, recurring software fees can slip through the cracks if you don’t.

- Process Payroll Journal Entries: If you use a system like Gusto, make sure your payroll runs are recorded correctly, splitting out wages, taxes, and benefits into the right accounts in your general ledger.

For a more detailed look at structuring this process, you can explore some month-end close best practices and see how to implement them. A documented workflow is what separates the pros from the amateurs.

The whole point of the month-end close is to get to a clean trial balance. If your debits and credits don’t match after you’ve gone through these steps, stop. Find the error now before it contaminates your financial reports.

A Real-World Reconciliation Scenario

Let’s make this real. Imagine a digital marketing agency is closing out its books for the month. The owner logs into QuickBooks and sees a long list of transactions in the bank feed.

First up, revenue. They code a $5,000 retainer and a $7,500 project payment to “Service Income.” Next, expenses. A $150 charge for their project management tool goes to “Software Subscriptions,” and a $500 payment goes to a specific “Client Ad Spend” expense account.

Now for the hard part: reconciliation. They pull up the official bank statement, which shows a closing balance of $42,125.50. But in QuickBooks, the balance is $42,025.50. That’s a $100 difference. They start going line by line, checking off every matching transaction.

And there it is. A $15 bank service fee was never entered. On top of that, a client’s $85 check was deposited but never recorded as a payment against their invoice. After adding the bank fee expense and applying the customer payment, the numbers match perfectly. That simple reconciliation just prevented their net income from being wrong.

From Reconciliation to Reporting

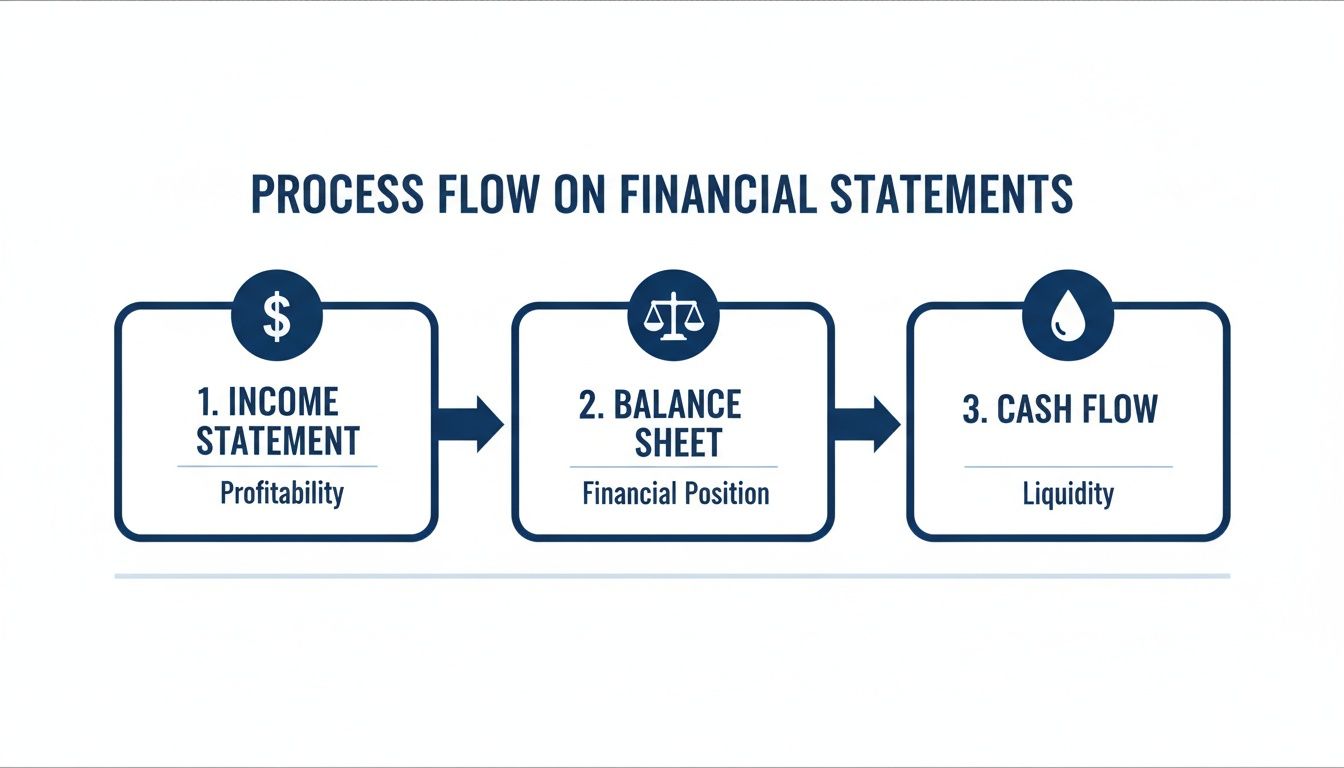

Once every account is reconciled and every transaction is categorized, you finally have a clean, adjusted trial balance. This is the official starting point for creating your financial reports. The infographic below illustrates how this crucial groundwork flows directly into your core statements.

As you can see, each statement builds on the last. You start with profitability (Income Statement), then look at your financial position (Balance Sheet), and finish with cash movement (Cash Flow). It’s a logical sequence that turns raw, reconciled data into the complete story of your business’s performance. By nailing the month-end process, you’re setting yourself up for every smart decision that comes next.

Making Key Adjustments for True Profitability

So, you’ve reconciled your bank accounts and categorized every transaction. Your books are clean, but are they accurate? Not quite yet. To get a real sense of your profitability for a specific period, we need to make a few adjusting entries.

This is the step where we move from just tracking cash to proper accrual accounting. It’s the gold standard for a reason. The goal here is simple: match revenues to the period you earned them and expenses to the period you incurred them, no matter when the cash actually moved.

These adjustments are non-negotiable if you want financial statements that tell the true story of your service business. They ensure a huge annual expense doesn’t make one month look like a complete disaster while the other eleven seem artificially profitable.

Recording Accrued Expenses

Accrued expenses are simply costs your business has used up but hasn’t paid for yet. Forgetting to record these is probably the most common way to accidentally overstate your profit for the month. It’s a classic timing issue that can throw your entire analysis off track.

Let’s say you hired a freelance designer who did $2,500 worth of work for you in March. They wrapped things up on March 30th but didn’t get their invoice over to you until April 5th. You plan to pay it on April 15th.

Even though you aren’t cutting a check until April, the work was done in March. To get an accurate picture, you need to make an adjusting entry to recognize that $2,500 cost in March. This is how you get a true reading of March’s profitability.

Accounting for Accrued Revenue

On the other side of the coin, you have accrued revenue. This is income you’ve earned by delivering a service but haven’t had the chance to bill for or collect yet. This happens all the time in service businesses, especially those with long projects or milestone-based billing.

Imagine your consulting firm hits a major project milestone at the end of May, earning you $10,000. Your contract, however, says you’ll send the invoice on June 10th. Without an adjusting entry, your May income statement would be missing that $10,000, making the month look less successful than it actually was.

By recording it as accrued revenue, you correctly show that the money was earned in May, keeping your reporting timely and accurate. You can dig into more scenarios like this by exploring these detailed examples of adjusting entries.

Handling Depreciation of Assets

When you buy a big-ticket item—a new server, a company car, or high-end office equipment—you don’t just write off the whole cost in one go. Instead, you spread that cost over the asset’s “useful life” through a process called depreciation.

Suppose your company buys a new video production setup for $12,000. You figure it will be useful for about five years (60 months). Using the common straight-line depreciation method, the math is simple:

$12,000 (Asset Cost) / 60 months (Useful Life) = $200 per month

Every month, you’ll record a $200 depreciation expense. This small, consistent adjustment properly matches a piece of the asset’s cost to each period it helps you generate revenue. It prevents a massive one-time expense from completely skewing your numbers.

Managing Prepaid Expenses

Prepaid expenses are the opposite of accrued expenses. You’ve paid for something in advance, before you’ve fully used the service or received the goods. For service firms, common examples are annual software subscriptions or business insurance premiums.

Let’s say on January 1st you pay $3,600 for your annual business liability insurance policy. It wouldn’t be accurate to log a $3,600 expense in January, because that policy covers you for the whole year.

Instead, you recognize a slice of that expense each month.

- Total Cost: $3,600

- Coverage Period: 12 months

- Monthly Expense: $300

Each month, a simple adjusting entry moves $300 from your prepaid insurance (an asset) to your insurance expense account. This smooths out the cost over the year, giving you a much more stable and realistic look at your monthly operating expenses.

Generating Your Final Financial Reports

You’ve done the hard work of reconciling accounts and making all the necessary adjustments. Now comes the rewarding part: creating the reports that tell your business’s story. This is where all that meticulous prep culminates, turning a clean trial balance into the three core financial statements.

This isn’t just about clicking a button in your accounting software. It’s about truly understanding what each statement reveals about your company’s performance and stability.

The good news? If you’ve done everything correctly up to this point, generating the reports is actually the easiest part. Modern tools like QuickBooks do the heavy lifting, pulling the right numbers from your adjusted trial balance and plugging them into the correct format.

The Income Statement: Your Profitability Scorecard

First up is the Income Statement, which you’ll often hear called the Profit and Loss (P&L) statement. This report is your direct measure of profitability over a set period—be it a month, a quarter, or the full year. It answers the most fundamental question in business: Did we make money?

In QuickBooks Online, you can pull this report by navigating to Reports > Standard > Profit and Loss. Just set your desired date range, and the software will lay out your revenues and expenses, ending with your net income.

But don’t just skip to the bottom line. This report is a goldmine of insights. Use it to analyze key trends:

- Revenue Streams: Are certain services bringing in more cash than others? Is your client revenue actually growing month over month?

- Cost of Goods Sold (COGS): For a service business, this is your direct labor and other costs tied to client delivery. Are these costs scaling in a healthy way as your revenue grows?

- Operating Expenses: Have any expense categories, like marketing spend or software subscriptions, jumped unexpectedly? This can be a red flag for wasteful spending.

A well-organized P&L gives you a crystal-clear view of where your money is coming from and where it’s going, allowing you to make much smarter decisions.

The Balance Sheet: A Snapshot of Your Financial Health

Next, you’ll run the Balance Sheet. Unlike the P&L, which looks at a period of time, the Balance Sheet is a snapshot of your company’s financial position on a single day. The whole report is built on one simple, powerful equation: Assets = Liabilities + Equity.

This report tells you what your company owns (assets), what it owes (liabilities), and what’s left for the owners (equity). To generate it in QuickBooks, just head to Reports > Standard > Balance Sheet.

When you’re reviewing it, keep an eye on these key areas:

- Liquidity: How much cash do you have on hand? Is your accounts receivable balance creeping up, signaling that clients are taking longer to pay you?

- Solvency: Compare your total assets to your total liabilities. A healthy ratio here means you have the ability to cover your long-term debts.

- Equity: Is your retained earnings (your accumulated profits) growing over time? This is a great sign that the business is building real value.

To get a better sense of how all these pieces connect, you can learn more about the complete trial balance format that forms the foundation for all these reports.

The Statement of Cash Flows: Demystifying Your Cash Movement

Finally, we have the Statement of Cash Flows. This one often causes the most confusion, but it’s arguably the most critical report for the day-to-day survival of your business. It bridges the gap between the profit you see on your P&L and the actual cash sitting in your bank account.

The statement neatly breaks down all your cash movement into three activities:

- Operating Activities: Cash from your core business operations. For a service firm, this is cash from clients minus cash paid for salaries, rent, and vendor bills.

- Investing Activities: Cash used to buy or sell long-term assets, like purchasing new computers or selling an old company vehicle.

- Financing Activities: Cash from investors, banks, or owners. Think of things like receiving a bank loan, an owner putting more capital in, or taking an owner’s draw.

A business can be profitable on its income statement but still face a cash crunch. The Statement of Cash Flows reveals the reality of your liquidity, highlighting whether you’re generating enough cash from operations to sustain and grow the business.

Analyzing Your Statements and Avoiding Common Pitfalls

Getting your financial reports generated is a huge step, but the work isn’t quite done yet. An accurate statement is only useful if you can actually understand it, explain it, and use it to steer the ship. The last piece of the puzzle is performing a critical review to catch anything that looks off and to add some much-needed context.

This is where you turn the raw numbers into a story. Think of it this way: you’ve gathered your ingredients (transactions), followed the recipe (reconciliation and adjustments), and baked the cake (generated the reports). Now, it’s time to taste it before you serve it to your team or investors.

Performing Your Final Review

Before you even think about sharing these statements, take a moment to do a high-level review. You’re not looking for tiny typos here; you’re hunting for red flags that could point to a bigger problem.

A great way to do this is with a simple variance analysis. Just compare this month’s numbers to last month’s, and then compare them to the same month from last year. You’re looking for any big, unexplained swings.

- Sudden Revenue Spikes or Dips: Did a major client finally pay an overdue invoice, or did that new service line take off way faster than you thought? Knowing the “why” behind the number is everything.

- Unusually High Expenses: Did your software bill jump 30% because of a price hike you forgot about, or did someone accidentally pay a vendor twice? It’s time to dig in and find out.

- Anomalies in Gross Margin: If your cost of services suddenly shot up compared to your revenue, it could be a sign that you’re underpricing projects or running into some serious efficiency issues.

This review is your last line of defense. It’s much, much better for you to catch a mistake now than for a lender to question it when you’re applying for a loan.

Adding Context with Management Notes

Clean numbers are fantastic, but they don’t always tell the whole story on their own. This is where adding a brief executive summary or a few management notes can be a game-changer. A short narrative provides context and keeps people from jumping to the wrong conclusions.

For example, if you made a large, one-time purchase for new equipment, your cash flow from investing activities is going to look terrible. A simple note explaining this prevents stakeholders from thinking the business is suddenly hemorrhaging cash. It shows you’re in control and thinking ahead.

Adding a quick, one-paragraph summary at the top of your financial package is incredibly powerful. It directs the reader’s focus right to the key takeaways—like strong revenue growth, a major new client win, or a successful cost-cutting effort—before they even get into the weeds.

Common Pitfalls for Service Businesses

If you run a service-based business, you’ve got your own unique set of accounting challenges. Just being aware of these common slip-ups can save you from massive headaches later on.

- Messy Chart of Accounts: A disorganized or ridiculously complex chart of accounts makes any real analysis impossible. If you have twenty different vague expense categories, you’ll never figure out where your money is actually going.

- Misclassifying Contractors vs. Employees: This is a huge compliance risk that comes with some very serious financial penalties. Make absolutely sure you’re classifying your team members correctly and handling their payments accordingly.

- Forgetting to Accrue Unpaid Invoices: As we touched on earlier, failing to record accrued expenses is the classic way to make your monthly profit look better than it is. It paints a misleading picture of your company’s actual financial health.

Having accurate financials is more critical than ever. We’re in an era where real-time visibility is what drives growth, and preparing statements properly ties directly into larger financial trends. With global financial assets surging in recent years, the need for precision is amplified. For startups, clean statements are what make it possible to scale. You can learn more about these global wealth trends and what they mean for businesses.

Frequently Asked Questions About Financial Statements

Even with a great process, it’s natural to have questions when you’re preparing financial statements. Accounting has its own language, and it can feel like a lot to take in. We’ve put together answers to some of the most common questions we hear from service business owners to help you feel more confident.

These aren’t just textbook definitions. They’re practical answers based on helping businesses just like yours get a better handle on their numbers.

How Often Should I Prepare Financial Statements?

For making decisions inside your business, preparing financial statements monthly is the way to go. This gives you a timely, accurate look at your performance. It helps you manage cash flow, adjust your strategy, and catch small issues before they snowball.

You have to prepare them at least once a year for taxes, of course. But if you’re looking to grow, get a loan, or bring on investors, you really need monthly—or at least quarterly—statements. It shows you have a solid grip on your finances.

Cash Basis Versus Accrual Basis Accounting

The biggest difference between cash and accrual accounting comes down to timing. This one concept has a huge impact on how your financial statements look and what they tell you about your profitability.

- Cash-Basis Accounting: You only record revenue when the money hits your bank account and expenses when you actually pay them. It’s simpler, but it can give you a skewed picture of how you actually performed in a given month.

- Accrual-Basis Accounting: This method records revenue when you earn it and expenses when you incur them, no matter when the cash actually changes hands.

For example, with the accrual method, you’d record the revenue for a $5,000 project you finished in March, even if the client doesn’t pay you until April. This gives a much more accurate view of your financial health, which is why most growing service businesses should be using the accrual method.

Should I Prepare Statements Myself or Hire a Pro?

You absolutely can prepare your own statements using software like QuickBooks, but the real question is whether that’s the best use of your time. The process requires a good grasp of accounting principles, and tiny mistakes can easily compound over time, leading to bad data and even worse business decisions.

A surprising number of CFOs lack confidence in their own financial data. Nearly half worry they’re making key decisions based on numbers that are incomplete or just plain wrong. Hiring a professional is an investment in clarity and peace of mind.

Bringing in an expert doesn’t just guarantee accuracy. It frees you up to focus on what you’re best at—running your business and taking care of your clients.

What Red Flags Should I Look For?

When you look at your financial statements, you should always have a critical eye out for things that just don’t seem right. These anomalies can point to deeper problems.

Here are a few common red flags to keep on your radar:

- Unexplained Swings: On your income statement, watch for any big, sudden changes in revenue or major expense categories that don’t make sense compared to previous months.

- Growing Receivables: Look at your balance sheet. Is your accounts receivable balance growing much faster than your revenue? That could mean you have a serious problem with collecting payments.

- Negative Cash: A negative cash balance is a dead giveaway that something is wrong in your bookkeeping. It’s impossible to have less than zero cash in the bank.

- Imbalance: The most basic red flag of all is a balance sheet that doesn’t balance. Your Assets must equal Liabilities + Equity. If they don’t, there’s a fundamental error that has to be fixed before you can trust any of the numbers.

Catching these issues early is one of the biggest benefits of sticking to a disciplined month-end close process.

Are you tired of second-guessing your numbers? The team at Steingard Financial provides meticulous bookkeeping and payroll services to give you the financial clarity you need to grow your service business with confidence. Let’s build a scalable back office that works for you. Learn more at https://www.steingardfinancial.com.