A Guide on How to Prepare for Tax Season

Tax season doesn’t have to be a mad dash of late nights and lost receipts. For B2B service businesses, getting ready for tax time really boils down to three things: getting your documents in order, giving your books a solid year-end review, and a bit of smart planning.

Nailing this process means you can swap that last-minute stress for proactive control, making filing a whole lot smoother.

Why Bother With a Tax Prep Strategy?

For any service business, tax time is more than just a chore—it’s a chance to get a crystal-clear look at your financial health. Generic advice won’t cut it. You’re dealing with the nitty-gritty of client invoices, contractor payments, payroll, and software subscriptions. This guide will help you build a system to keep all those moving parts in line.

The stakes are higher than just avoiding a few penalties. Think about the time and energy you sink into disorganized tax prep. That’s valuable time you could be using to grow your business and serve your clients.

The Real Cost of Getting Taxes Done

The sheer scale of tax compliance really puts the value of a good plan into perspective. In the U.S., it’s estimated that taxpayers will spend about 7.1 billion hours on filing requirements for the 2024 tax year. That’s a staggering amount of time, translating to an economic hit of around $316 billion in lost productivity.

For the average person filing a Form 1040, that’s about 13 hours and $290 just to get it done. You can read more about these tax compliance costs to see the full picture.

As a business owner, that lost time is doubly painful. It’s time you’re not spending on sales, client work, or strategy. A streamlined tax process literally gives that time back to you.

A Quick-Start Framework for Success

To get ahead of the game, you need a simple framework that hits the most important areas first. This approach breaks the process down, making it much more manageable from the start.

Here’s a quick checklist to get you rolling. Think of these as the foundational pillars of a stress-free tax season.

Quick-Start Tax Preparation Checklist

| Preparation Area | Key Action | Why It Matters |

|---|---|---|

| Document Gathering | Create a central digital folder for all income and expense records. | Prevents that frantic, last-minute search for receipts and ensures you don’t miss a single valuable deduction. |

| Financial Review | Reconcile all bank and credit card accounts for the entire year. | Guarantees your financial statements are accurate and ready for your tax preparer to dive right in. |

| Strategic Planning | Review your Profit & Loss for tax-saving moves, like retirement contributions or equipment purchases. | Turns tax season from a reactive chore into a proactive financial planning tool that can save you money. |

By breaking it down into these three key areas, you can tackle your tax prep with confidence instead of dread. Now, let’s dig into the specifics of each step.

Gathering Your Essential Tax Documents

The secret to a stress-free tax season isn’t some magic formula; it starts long before you even think about calling your accountant. It all comes down to having every single necessary document organized and ready to go. For a service business, this means having the right records to prove your income and justify every deduction you want to claim.

If you skip this prep work, you’re not just creating a headache for yourself. You’re also looking at higher professional fees and opening the door to costly mistakes. Trust me, an organized digital file is the single best thing you can do to ensure your tax return is accurate and optimized.

Your Income Verification Checklist

First things first, you need to be able to prove every dollar your business brought in. This goes beyond just looking at your bank deposits. The real goal is to create a crystal-clear, auditable trail that connects those deposits back to the actual services you provided.

Here’s the essential list of what you need to pull together:

- Gross Receipts: This is the complete collection of all your client invoices, payment confirmations from systems like Stripe or PayPal, and any records of cash payments you received.

- Forms 1099-NEC & 1099-K: If you were a subcontractor for other businesses, you should get a 1099-NEC from any client who paid you more than $600. Likewise, payment processors will send you a 1099-K if you hit certain transaction volumes.

- Bank and Merchant Account Statements: These are your ultimate source of truth. Use them to cross-reference your invoiced income and make absolutely certain nothing slipped through the cracks.

A quick but important tip: Don’t just rely on the 1099s that land in your inbox. You are responsible for reporting all income, whether a 1099 was issued or not. Meticulous records are your best defense.

Assembling Your Expense Documentation

This is where the magic happens for service businesses. Every legitimate business expense lowers your taxable income, but you absolutely need the receipts and records to back it up. That shoebox overflowing with crumpled papers? It’s not going to work.

To make things easy, your expense documentation should be categorized logically. Think about the different types of costs you have and group them together.

Key Expense Categories to Organize

- Contractor Payments: Collect all invoices and proof of payment for any freelancers or agencies you worked with. Crucially, make sure you have a completed Form W-9 for every single U.S.-based contractor you paid $600 or more.

- Software and Subscriptions: This is a huge category for most service businesses today. Compile a master list of all recurring software costs—think project management tools, your CRM, marketing software, cloud storage, and your QuickBooks subscription.

- Home Office Expenses: If you have a dedicated office space in your home, you can deduct a portion of your home’s expenses. You’ll need to gather records for your rent or mortgage interest, utilities, property taxes, and home insurance for the year.

- Professional Development: This bucket includes all the costs for courses, workshops, industry conferences, and any professional memberships that help you do your job better.

- Marketing and Advertising: Round up the receipts for your digital ad spend (Google, LinkedIn, etc.), website hosting fees, any graphic design work, and other promotional costs.

For a more exhaustive look at what you should be tracking, our guide on how to keep track of business expenses provides some deeper strategies.

Setting Up a Simple Digital Filing System

A logical digital folder system is your absolute best friend during tax prep. It saves you from that frantic, last-minute hunt for a specific receipt and makes the handoff to your accountant completely seamless.

A great starting point is to create a main folder for the tax year, something like “2024 Tax Documents“. Inside that folder, you can create subfolders for each major category.

Example Folder Structure:

└── 📂 2024 Tax Documents

├── 📂 01_Income

│ ├── 📄 Client_Invoices

│ └── 📄 1099s_Received

├── 📂 02_Expenses

│ ├── 📄 Contractor_Payments

│ ├── 📄 Software_Subscriptions

│ └── 📄 Marketing_Costs

└── 📂 03_Financial_Statements

├── 📄 Bank_Statements

└── 📄 Credit_Card_Statements

This simple setup forces a good habit: categorizing documents as you receive them, not all at once when you’re under pressure. It’s a small change that pays off big time in efficiency and accuracy. When your accountant asks for your software receipts, you can find and send that folder in seconds.

Finalizing Your Year-End Bookkeeping

Once you have all your documents in one place, it’s time to make sure your books are clean, accurate, and complete. I like to think of bookkeeping records as the source code for a tax return. If there are bugs in that code, the final output will be flawed, potentially costing you money or attracting unwanted attention from the IRS.

Finalizing your year-end books isn’t just about checking off a task. It’s about building a solid, defensible financial story for the entire year. This process is what turns all that raw data—invoices, receipts, and bank statements—into clear financial reports your tax preparer can actually use.

The Power of Reconciliation

The cornerstone of clean books is, without a doubt, reconciliation. This is the methodical process of matching every single transaction in your accounting software (like QuickBooks) with what actually happened in your bank and credit card accounts. It’s your number one defense against errors, fraud, and missed deductions.

Skipping reconciliation is like trying to build a house without checking if the foundation is level. You’re just guessing your numbers are right, and small mistakes early on can cause huge structural problems down the road.

Reconciliation is what confirms that the numbers on your Profit & Loss and Balance Sheet are tied to real-world cash movements. This isn’t just a best practice—it’s a non-negotiable step for financial accuracy.

This process forces you to confront and fix the little issues that can completely distort your tax picture. For a detailed walkthrough, you can check out our guide on how to reconcile bank accounts.

Hunting Down Common Discrepancies

As you go through your reconciliations, you’re going to find discrepancies. It’s perfectly normal, but you have to investigate and resolve every single one. Ignoring them is how small bookkeeping issues snowball into massive tax season headaches.

Keep an eye out for these usual suspects:

- Duplicate Entries: This happens a lot when a payment is recorded manually and then imported again through a bank feed. Deleting the duplicate keeps you from overstating your income or expenses.

- Uncategorized Transactions: Most accounting software has a “catch-all” account like “Ask My Accountant” or “Uncategorized Expense.” Leaving transactions here is a huge red flag that you have expenses you can’t deduct or income you haven’t properly recorded.

- Transposed Numbers: A simple typo, like entering $158 instead of $185, can throw off an entire reconciliation. These tiny errors have to be found and fixed to make the books balance.

- Personal vs. Business Expenses: It’s so easy to accidentally use the business card for a personal purchase. These need to be re-categorized as an “owner’s draw” or “shareholder distribution,” not a business expense.

Getting these issues sorted out means your accountant can get straight to work on tax strategy instead of spending billable hours just cleaning up your records. This accuracy is critical. For the 2025 filing season, the IRS processed 145.9 million individual returns and issued $274.98 billion in refunds. Tax pros filed 74.9 million of those returns, and clean books are what help them navigate that high-volume system efficiently. You can find more IRS filing season statistics that show just how much precision matters.

Conducting a Final Financial Statement Review

With your accounts reconciled, the final step is a good, hard look at your two most important financial reports: the Profit & Loss (P&L) statement and the Balance Sheet. This is your last chance to spot anything that looks off and make sure the story your numbers are telling makes sense.

Reviewing Your Profit and Loss Statement

Your P&L (also called an Income Statement) is a summary of your revenue and expenses for the year. As you review it, ask yourself a few questions:

- Does my revenue look right? Compare the total income on the P&L to what you know you billed clients. Does it match your expectations for the year?

- Are there any weird expense spikes? Look at your expenses month by month. If your software costs suddenly tripled in July, is there a good reason, or did something get miscategorized?

- Are any big expense categories missing? If you know you spent a lot on marketing but that category seems low, it’s a sign that those expenses might have been dumped somewhere else by mistake.

Scrutinizing Your Balance Sheet

The Balance Sheet gives you a snapshot of your company’s financial health by detailing your assets, liabilities, and equity. Pay close attention here:

- Accounts Receivable (A/R): This is the money clients still owe you. Do you see old, unpaid invoices from months ago? It might be time to write those off as bad debt.

- Accounts Payable (A/P): This is what you owe to vendors. Make sure this balance actually reflects your outstanding bills.

- Undeposited Funds: This is a classic problem account in QuickBooks. A large balance here usually means you’ve recorded customer payments but haven’t properly matched them to a bank deposit.

Think of this final review as your quality control check. It ensures the financial package you hand over to your tax preparer is a true reflection of your business’s performance, setting the stage for a much smoother tax filing.

Managing Payroll and Contractor Filings

Paying your team is one of your biggest responsibilities as a business owner. Come tax season, that responsibility gets even more serious. Whether you have full-time employees or a crew of freelance pros, getting your year-end filings right isn’t just good practice—it’s the law. This whole process boils down to accuracy and hitting your deadlines, making sure both your people and the IRS get the right information when they need it.

For any B2B service business, this is a big deal. The money you pay out to people is often your largest single expense. Nailing the associated tax forms, like W-2s for your staff and 1099s for contractors, is a cornerstone of a solid, compliant tax return.

W-2s for Employees: The Unmissable Deadline

If you have employees on your payroll, you’re on the hook for giving each of them a Form W-2, Wage and Tax Statement. This little document is a big deal; it spells out their total wages for the year and exactly how much tax you withheld on their behalf.

The deadline here is non-negotiable: you have to get those W-2s into your employees’ hands by January 31. Missing this date isn’t just a headache for your team, who need it for their own taxes, but it can also trigger penalties from the IRS. This is where modern payroll platforms are worth their weight in gold, automating the whole creation and distribution process and saving you from a mountain of manual work.

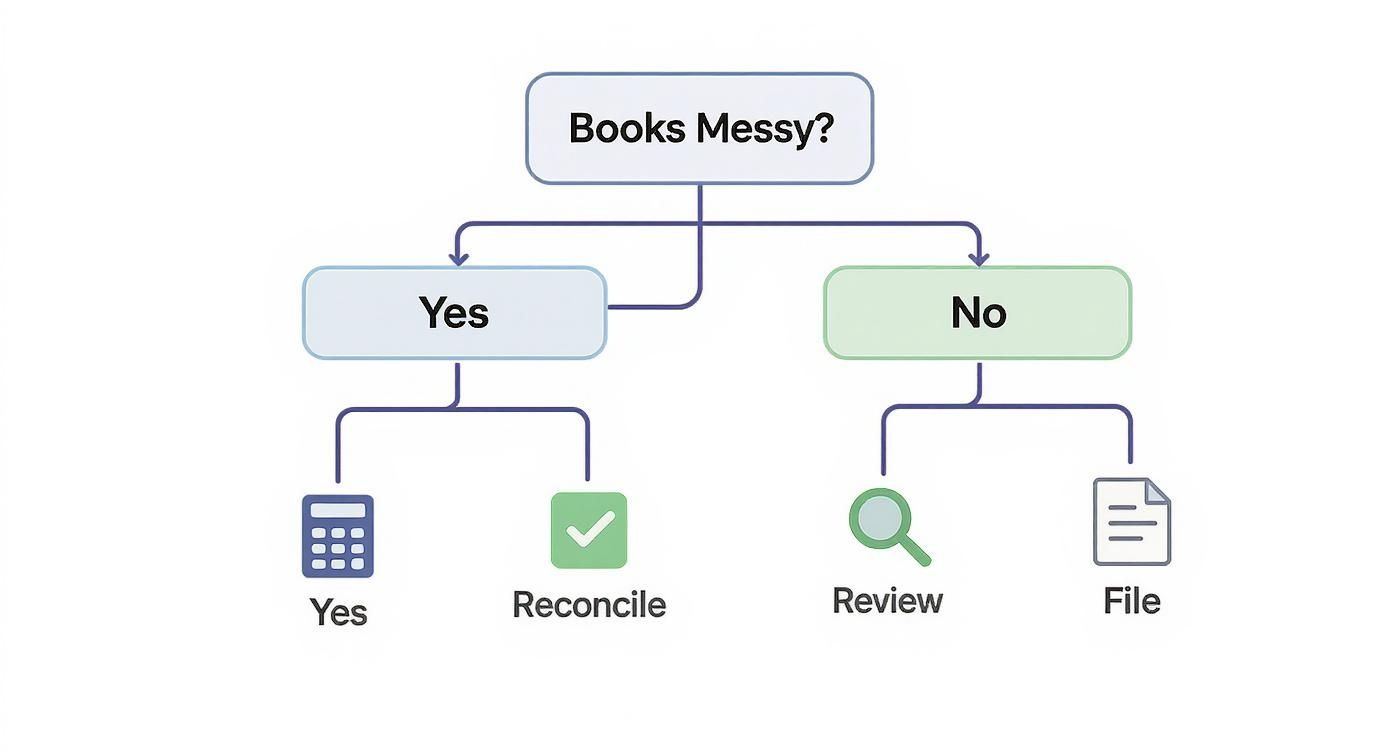

This flowchart shows how organized books—a must-have for accurate payroll—are the foundation for a painless filing season.

As you can see, starting with clean, reconciled books is really the only way to ensure a smooth journey to filing your taxes.

1099s for Contractors: Your Due Diligence

The rules for independent contractors are a bit different, but the IRS is just as strict. If you paid any U.S.-based contractor $600 or more for their services during the calendar year, you are required to send them a Form 1099-NEC (Nonemployee Compensation).

And just like with W-2s, the deadline to get this form to your contractors is January 31. The secret to avoiding a last-minute scramble is to get a completed Form W-9 from every single contractor before you cut their first check. That form gives you their correct name, address, and Taxpayer Identification Number (TIN), which you absolutely need for an accurate 1099 filing.

Mismatched names and TINs are one of the most common triggers for an IRS notice. Getting that W-9 upfront is one of the simplest habits you can build to dodge compliance headaches later on.

Correctly Classifying Workers

One of the biggest financial risks for any business owner is misclassifying an employee as an independent contractor. The IRS looks at this distinction very closely, and getting it wrong can lead to some painful consequences, including back taxes, hefty fines, and interest payments.

It really all boils down to control. Think of it this way:

- Employees: You control what work gets done and how it gets done. You’re typically providing the tools, setting the work hours, and managing the entire process.

- Contractors: You only control the final result of the work. They control the means and methods of getting there, usually with their own tools and on their own schedule.

If you’re even slightly unsure about how to classify someone, it’s always safer to talk to a financial professional. The short-term savings you might see from classifying someone as a contractor just aren’t worth the long-term risk of an IRS audit. A deep dive into your payroll services can bring clarity and help you make the right call.

A Note on Owner Compensation

Don’t forget about yourself! How you pay yourself as the business owner has major tax implications, especially if your business is set up as an S-Corporation. The IRS requires S-Corp owners to pay themselves a “reasonable salary” as an employee, which gets reported on a W-2.

This salary is subject to payroll taxes (think Social Security and Medicare). Any profits left over after that can be taken as a distribution, which isn’t subject to those same payroll taxes. Forgetting to run a reasonable salary through your payroll is a huge red flag for the IRS, but it’s a common mix-up that proper tax prep can easily straighten out.

Knowing When to Partner with a Financial Expert

Trying to tackle tax prep on your own can feel empowering at first, but it’s a classic case of diminishing returns. So many business owners hit a wall where the hours they spend wrestling with spreadsheets and tax forms cost them more in lost opportunities than they’d ever save in professional fees.

Recognizing that moment—the one where you need to bring in an expert—is a pivotal step in your business’s growth. This isn’t about admitting failure; it’s a smart, strategic business decision. The DIY approach works great, right up until it doesn’t. When your finances get more complex than your expertise, you’re not just risking a messy tax return. You’re risking expensive compliance mistakes that can come back to haunt you.

Key Triggers That Signal It’s Time for Help

Certain milestones are pretty clear indicators that you’ve outgrown the DIY method. Think of them less as growing pains and more as signals of increasing financial complexity. If any of these sound familiar, it’s probably a good time to think about getting professional support.

- You Just Hired Your First Employee: The second someone goes on your payroll, you’ve stepped into a whole new world of compliance. Withholding taxes, state filings, and W-2s are not forgiving of errors.

- Your Business is Growing Rapidly: A sudden revenue surge is an amazing problem to have, but it brings new tax planning challenges—and opportunities—that you might not even know exist.

- You’re Facing Complex Transactions: Did you sell a major business asset? Acquire another company? Or start dealing with messy multi-state sales tax? These situations have very specific tax implications that really need an expert eye.

- You Feel Overwhelmed: This is the big one. If you’re constantly behind on your books and the thought of digging into your numbers fills you with dread, that’s your sign. Your time is far better spent on your clients and your strategy.

The real return on investment from a financial partner isn’t just about having clean books. It’s about reclaiming your time, preventing expensive IRS issues, and gaining strategic insights that go far beyond basic tax compliance.

Exploring Your Options for Financial Support

Partnering with a financial expert doesn’t mean you have to hand over the keys to everything all at once. The support you get can be shaped to your specific situation, offering a flexible path to getting your finances squared away. You might just need a one-time project to get ready for taxes, which could later evolve into a more consistent partnership as you grow.

- One-Time Bookkeeping Cleanup: This is perfect if your books are a mess and you just need to get tax-ready, fast. An expert can come in, reconcile your accounts, and hand over a clean financial package to your tax preparer.

- Ongoing Monthly Services: This option provides continuous support, including monthly reconciliations and financial reporting. It keeps you on track all year long, which pretty much makes tax season a non-event.

- Outsourced Payroll and HR: If managing payroll, benefits, and the compliance that comes with it is eating up your time, outsourcing this function can be a total game-changer.

The modern tax environment just keeps adding layers of complexity. For the 2025 tax season, professionals are navigating new federal legislation, figuring out how different states are conforming to those changes, and dealing with the readiness of the IRS itself. Staying ahead of these moving parts requires proactive communication and the right technology, which really underscores why expert guidance has become so valuable. You can get a deeper sense of the challenges tax professionals face to understand the current landscape.

To make your first meeting with a potential financial partner truly productive, do a little prep. Arrive with your main pain points identified, have access to your current accounting software, and be ready to talk about your business goals. This preparation ensures you find a partner who doesn’t just clean up past problems but helps you build a more profitable future.

Common Questions About Tax Preparation

Even with a solid game plan, you’re bound to have questions as tax season approaches. Let’s tackle some of the most common ones we hear from service business owners, giving you practical answers to keep you moving forward.

What Should I Do If My Bookkeeping Is a Mess?

It happens to the best of us. The year gets busy, and before you know it, your books are months behind. The first thing to remember is not to panic. Trying to cram a year’s worth of bookkeeping into a few frantic weeks is a recipe for error.

This is the perfect time to bring in a professional for a one-time cleanup project. An experienced bookkeeper can sort through months of transactions, correctly categorize expenses you might have missed, and get all your accounts reconciled. This doesn’t just get you ready for your tax preparer; it gives you a clean slate for the new year.

The point isn’t just to get through this year’s taxes—it’s to break the cycle. A cleanup project is great for shining a light on what’s not working in your current process, so you can build a better, more sustainable system going forward.

How Do Estimated Tax Payments Actually Work?

As a business owner, you don’t have taxes automatically withheld from a paycheck. That means you’re responsible for paying your own income and self-employment taxes during the year through estimated tax payments. These are typically due quarterly on April 15, June 15, September 15, and January 15 of the next year.

The amount you pay is based on your expected annual income. If you don’t pay enough, the IRS can hit you with a penalty. A good general rule is to set aside 25-30% of your net earnings for taxes, but this number can vary quite a bit. A financial pro can help you figure out a more accurate number for your specific situation, which helps you avoid underpayment penalties without tying up too much of your cash.

Are There Any Commonly Missed Deductions?

Absolutely. Service business owners frequently miss out on valuable deductions simply because they aren’t tracking them properly. We all know about software and contractor costs, but here are a few other key areas that often get overlooked.

- Home Office Deduction: Many business owners are hesitant to claim this, thinking it’s an audit red flag. But as long as you have a space in your home used exclusively and regularly for your business, you’re entitled to claim it.

- Bank Fees: All those little fees—monthly service charges, wire fees, and other account costs—are fully deductible. They might seem small one by one, but they really add up over a year.

- Professional Development: This is more than just big conferences. The cost of online courses, memberships in industry groups, business books, and even paid newsletters are all deductible expenses.

- Payment Processing Fees: That small percentage that Stripe, PayPal, or Square takes from every single transaction? That’s a business expense. Make sure you’re deducting it.

Is Filing a Tax Extension a Bad Idea?

Not at all. In fact, filing an extension can be a very smart, strategic move. It is not a sign that you’ve done something wrong. It grants you an automatic six-month extension to file your return, pushing the deadline from April 15 to October 15. This can be a huge help if you’re still waiting on documents or just need more time to get everything right.

But there’s one very important catch: an extension to file is not an extension to pay. You still need to estimate what you owe and pay that amount by the original April 15 deadline. If you don’t, you’ll face penalties and interest. An extension simply gives you the time to file an accurate return, which is always better than rushing to meet a deadline with incomplete information.

Navigating these questions is much easier when you have an expert in your corner. The team at Steingard Financial specializes in bookkeeping and payroll for service businesses, helping you turn tax season stress into year-round financial clarity. Discover how we can prepare your business for a seamless tax season.