Understanding Net Cash Flows for Your Service Business

Let’s get straight to it: net cash flows are the bottom line of your business’s cash game over a certain period, whether that’s a month or a quarter. It’s the final tally of all the actual cash that came into your bank account minus all the cash that went out.

If the number is positive, you brought in more cash than you spent. If it’s negative, you spent more than you earned. Simple as that.

What Are Net Cash Flows Really

Think of net cash flows like your personal checking account. You start the month with some money, your paychecks land (cash in), and you pay for rent, groceries, and Netflix (cash out). What’s left at the end is your personal net cash flow.

It’s the same idea for your business, just with a bit more structure. This isn’t about profit—it’s about liquidity. It’s the real cash you have on hand to pay your team, keep the lights on, and fund your growth. A service business can look profitable on paper but go under if clients are slow to pay their invoices, causing a cash crunch. This is exactly why tracking net cash flow is non-negotiable.

The Three Engines Driving Your Cash

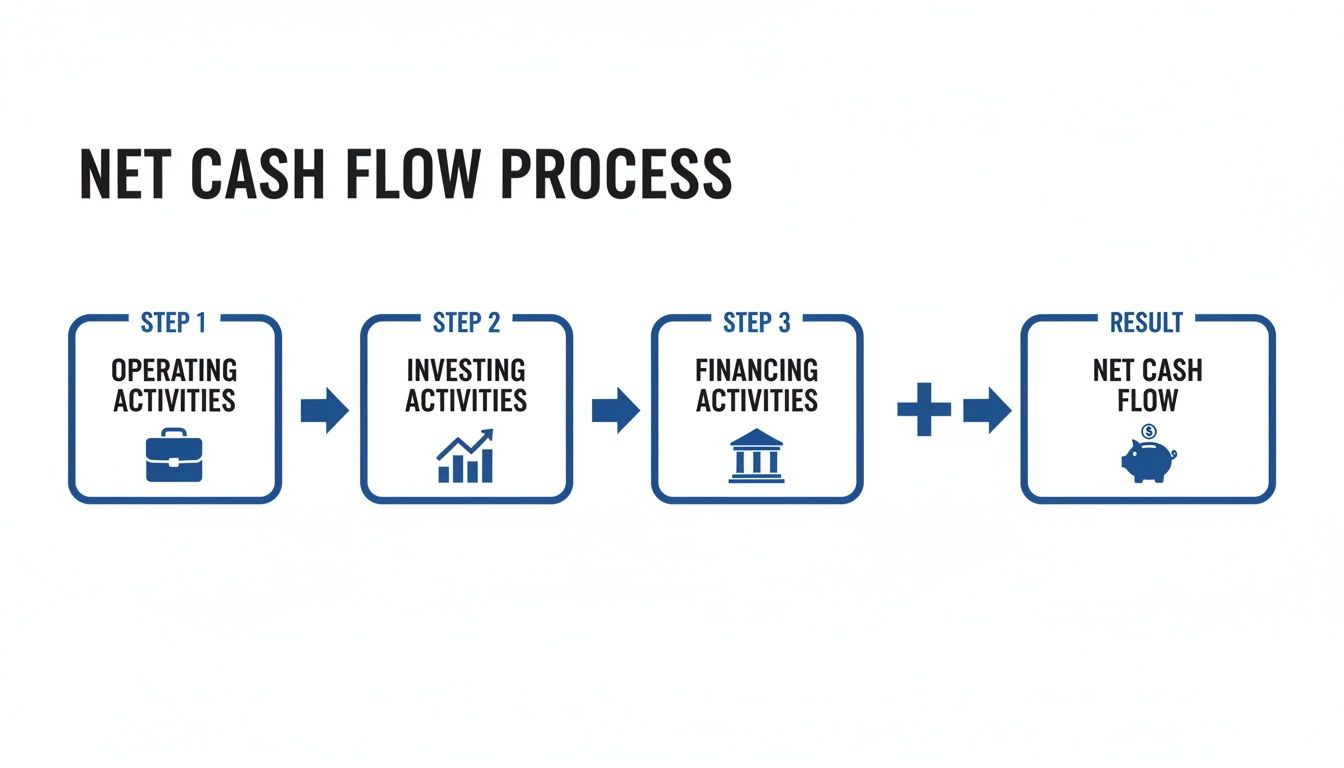

To really get a handle on your net cash flow, you need to understand the three distinct activities that drive it. Each one tells a different part of your financial story.

- Operating Activities: This is the cash generated from your day-to-day business. Think client payments for services minus cash paid for everyday expenses like payroll, software subscriptions, and office rent.

- Investing Activities: This bucket tracks cash related to long-term assets. For a service business, that usually means buying new laptops for the team (a cash out) or selling an old company vehicle (a cash in).

- Financing Activities: This is all about cash transactions with owners and lenders. Taking out a business loan or putting your own money into the company are cash-in activities. Taking an owner’s draw is a cash-out.

Let’s break these down so you can see how they fit together.

The Three Pillars of Net Cash Flows at a Glance

| Cash Flow Activity | What It Includes (Examples for Service Businesses) | What It Tells You |

|---|---|---|

| Operating | Client payments, vendor payments, payroll, rent, utilities | How well your core business generates cash. Is it self-sustaining? |

| Investing | Buying/selling equipment (computers, furniture), purchasing property | How you’re allocating capital for long-term growth. |

| Financing | Taking out or repaying loans, owner contributions, owner draws | How you’re funding the business—through debt, equity, or distributions. |

Seeing these three pillars separately gives you a much clearer picture than just looking at the final number.

A common mistake is confusing net cash flows with net income (or profit). Net income is an accounting figure that includes non-cash items like depreciation. Net cash flow is the raw, unfiltered truth of what actually happened in your bank account.

The Statement of Cash Flows pulls these three categories together to give you that final net cash flow number. A positive flow is generally a great sign of health and efficiency. A consistently negative flow, on the other hand, is an early warning to start digging deeper.

If you’re using accrual accounting, understanding how to adjust for it is key. You can learn more about making an accrual to cash adjustment in our detailed guide. Mastering this is your first step toward making smarter, more confident decisions for your business.

The Three Core Components of Your Cash Flow

To really get a handle on your net cash flows, you have to know where your money is coming from and where it’s going. The Statement of Cash Flows isn’t just one big number; it organizes everything into three distinct categories. Think of them as the three engines powering your business.

Each engine has a different job, and together, they tell the full story of your company’s financial health. It’s like having three separate buckets, each collecting and pouring out cash for a specific purpose. Looking at each bucket individually gives you so much more insight than just staring at the final balance in your bank account.

Let’s break them down.

Cash From Operating Activities: The Engine Room

This is the heart and soul of your business. Cash from Operating Activities (CFO) tracks the money moving in and out from your main business operations—the actual services you get paid for every day. A strong, positive CFO is a clear sign that your core business model is working.

For any service business, this includes:

- Cash Inflows: This is pretty straightforward—it’s the payments you receive from clients for your hard work. This is the lifeblood of your operation.

- Cash Outflows: These are the everyday costs of keeping the lights on. Think payroll for your team, office rent, software subscriptions, marketing campaigns, and what you owe your vendors.

Your operating cash flow is arguably the most important financial metric you can track. It answers one simple question: “Is my core business actually making money?”

When your CFO is consistently positive, it means your company can generate enough cash to keep things running and hopefully grow, all without needing to borrow money or find investors. A healthy business always makes more from its operations than it spends. That extra cash can be used to pay down debt, invest in new opportunities, or be paid out to the owners.

For a deeper look into this, check out our guide on how to find operating cash flow.

Cash From Investing Activities: Building for the Future

The second engine, Cash from Investing Activities (CFI), is all about the cash you use to buy or sell long-term assets. These aren’t your day-to-day expenses; these are strategic investments meant to expand your business’s capabilities.

Common investing activities look like this:

- Buying assets (cash outflow): Purchasing new computers for your growing team, upgrading office furniture, or even acquiring another small business.

- Selling assets (cash inflow): Getting rid of an old company vehicle or selling equipment you no longer need.

Don’t be alarmed by a negative number here. A negative CFI is often a fantastic sign, especially for a company that’s growing. It shows you’re putting your profits back into the business to fuel future success. For example, spending $10,000 on new laptops is a negative cash flow from investing, but it’s a smart move to make your team more productive.

Cash From Financing Activities: Funding and Ownership

Last but not least, Cash from Financing Activities (CFF) covers the money moving between your company and its owners or lenders. This part of the statement shows how your business is being funded—whether through taking on debt or getting cash from owners—and how you’re returning that money.

This bucket tracks cash movements such as:

- Taking out a loan (cash inflow): The funds you receive from a bank.

- Receiving an owner investment (cash inflow): When you or another owner puts personal money into the business.

- Making loan payments (cash outflow): Paying back the principal on a business loan (the interest part shows up in operations).

- Paying dividends or owner draws (cash outflow): Distributing profits to shareholders or yourself.

This section gives you a clear picture of your company’s capital structure. A big cash inflow might mean you just took on debt to fund an expansion, while a steady outflow could show that you’re responsibly paying down your loans.

Calculating Net Cash Flows Step by Step

Now that we know about the three engines driving your business’s cash, let’s put it all together. Figuring out your net cash flow isn’t nearly as scary as it sounds. At its core, it’s really just a simple addition problem that tells the full story of your company’s cash movement over a period.

The main formula is refreshingly simple:

Net Cash Flow = Cash from Operating Activities + Cash from Investing Activities + Cash from Financing Activities

This one number quickly shows whether your total cash went up or down. To make this tangible, let’s walk through an example using a fictional service business I’ll call “Pixel Perfect Marketing,” a small digital marketing agency. We’ll build out its Statement of Cash Flows piece by piece.

Finding Your Numbers in QuickBooks

Most modern accounting software can generate a Statement of Cash Flows for you, but there’s real power in knowing where the numbers actually come from. Tools like QuickBooks Online pull data straight from your Profit & Loss Statement and your Balance Sheet to build this report.

Here’s a look at the tool many service businesses use to keep their financials straight.

Using software like this makes the process much faster, but the logic is exactly the same whether you’re clicking a button on a report or plugging numbers into a spreadsheet yourself.

To get your net cash flow, you’ll need to grab the totals from each of the three main sections. Think of it like assembling a puzzle; each piece gives you a different angle on your business’s financial health.

Let’s imagine that for the month of March, Pixel Perfect Marketing’s activities gave them the following totals.

Step 1: Assemble Your Cash Flow Components

First up, we need to figure out the net cash provided (or used) by each of the three core activities. This just means adding up all the cash that came in and went out within each category.

For our example, Pixel Perfect Marketing’s March financials look like this:

- Cash from Operating Activities: After collecting payments from clients and paying for salaries, rent, and software subscriptions, they had a net positive cash flow of $15,000. This is a great sign—it shows their day-to-day operations are bringing in cash.

- Cash from Investing Activities: The agency decided to invest in the future by buying new, high-powered laptops for their design team, spending $8,000. This is a cash outflow, so it’s a negative number: -$8,000.

- Cash from Financing Activities: The owner, Jane, took an owner’s draw of $5,000 for personal use. This is another cash outflow, making the total -$5,000.

With these three numbers, we have everything we need to calculate the final net cash flow for the month. If you want to go deeper into the specifics, our guide on cash flow calculation breaks down the process even further.

Step 2: Calculate the Final Net Cash Flow

Now for the easy part. We just plug our numbers into the main formula. This step pulls everything together—operations, investments, and financing—to give us the big picture.

The Calculation:

- Start with Operating Cash Flow: $15,000

- Add Investing Cash Flow: + (-$8,000)

- Add Financing Cash Flow: + (-$5,000)

Putting it all together:$15,000 - $8,000 - $5,000 = $2,000

So, Pixel Perfect Marketing’s net cash flow for March was $2,000. What this means is that after all the dust settled—running the agency, buying equipment, and paying the owner—the company’s total cash balance increased by $2,000.

Step 3: Reconcile with Your Bank Balance

The last step is a sanity check to make sure your math is right. The change in your cash on the Statement of Cash Flows should perfectly match the actual change in your bank account. It’s the moment of truth.

Let’s say Pixel Perfect’s starting cash balance on March 1st was $25,000.

- Beginning Cash Balance: $25,000

- Add Net Cash Flow for March: +$2,000

- Ending Cash Balance on March 31st: $27,000

If you pull up the company’s bank statements and see a balance of $27,000 at the end of the month, you know your calculation is spot-on. This final check confirms that your financial reports are grounded in reality, giving you the confidence to use these numbers to make smart business decisions. This whole process takes the mystery out of the report and turns it into a genuinely useful tool.

What Your Cash Flow Numbers Are Telling You

Once you have your final net cash flows number, the real work starts. That number itself is just data. The story it tells about your business is where the real value is. Learning to interpret these figures is like learning the language of your company’s financial health.

A single number doesn’t reveal much on its own. The context comes from comparing the three core pieces: operating, investing, and financing cash flows. The relationship between these categories paints a surprisingly vivid picture of where your company is today and where it’s headed.

Reading the Story in the Numbers

Different combinations of positive and negative cash flows from these three areas signal very different things about your business. Not all negative numbers are bad news, and positive numbers don’t always mean it’s time to celebrate. You have to dig into the “why” behind the figures.

Here are a few common scenarios you might see in a service business:

- Positive Operating, Negative Investing: This is often the sign of a healthy, growing business. It means your core services are bringing in more cash than they cost to deliver, and you’re smartly putting that money back into the business by buying assets like new tech or equipment to support more growth.

- Negative Operating, Positive Financing: This combination can be a major red flag. It suggests your day-to-day operations aren’t generating enough cash to pay the bills, so you’re leaning on loans or owner investments to stay afloat. While that might be expected for a brand-new startup, it’s not a sustainable path long-term.

- Positive Operating, Negative Financing: This usually points to a mature, stable company. You’re generating plenty of cash from your services and using it to pay down debt or distribute profits to the owners. It’s a great sign of financial strength and discipline.

This infographic breaks down how these three distinct activities flow together to give you that final net cash flow number.

As you can see, your final cash position is a direct result of these three separate, yet totally connected, parts of your business.

Going Deeper with Free Cash Flow

To get an even sharper view of how efficiently your business is running, many owners look at a metric called Free Cash Flow (FCF). It’s a simple calculation that takes your operating cash flow and subtracts any money you spent on capital expenditures (like buying new computers or vehicles).

Free Cash Flow = Cash from Operations – Capital Expenditures

FCF tells you how much cash your business actually has on hand after paying for the investments needed to keep things running or to expand. This is the “free” cash available to pay down debt, return to owners, or chase new opportunities. It’s a powerful indicator of your company’s ability to create real value. To help make sense of all this financial data, tools like Excel AI for financial analysis can be incredibly effective at uncovering deeper insights.

Broader Economic Trends and Your Business

Understanding your cash flow isn’t just an internal exercise; it also helps you see how your business fits into the bigger economic picture. For example, in 2025, long-term US funds saw $765 billion in net cash inflows—the second-highest amount in a decade. A huge chunk of that, a record $540 billion, went into taxable-bond funds, which shows strong investor confidence in certain areas.

When you can connect the dots between your own bookkeeping reports and these larger strategic insights, you stop being a reactive business owner and become a proactive one. Your cash flow statement isn’t just a history report; it’s a roadmap for your future.

Actionable Strategies to Improve Your Net Cash Flows

Knowing your numbers is the first step, but the real work is in making those numbers better. Healthy, positive net cash flows don’t just happen on their own; they’re the direct result of smart, deliberate strategies. For any service business, managing cash is a constant balancing act of getting money in the door faster while carefully controlling what goes out.

This doesn’t mean you need to overhaul your entire business. Instead, it’s about making small, consistent tweaks in each area of your cash flow. Let’s walk through some proven tactics you can put into practice today.

Boosting Your Operating Cash Flow

Think of your operating cash flow as the engine of your business. Keeping it running smoothly should be your top priority. The goal is straightforward: speed up your collections and be strategic about your payments.

A classic struggle for service businesses is the lag time between doing the work and actually getting paid. Shortening that gap is absolutely critical. You can start by trying one or more of these strategies to accelerate your accounts receivable.

- Require Deposits or Upfront Payments: For bigger projects, asking for a deposit—25-50% is a common range—gives you the cash to cover initial costs. It also shows the client is serious and committed.

- Offer Early Payment Discounts: A small incentive, like 2% off for paying an invoice in 10 days instead of 30, can work wonders. This simple offer can pull cash into your bank account weeks ahead of schedule.

- Invoice Immediately and Clearly: Don’t wait for the end of the month. Send your invoice the moment a project is done or a milestone is hit. Make sure your invoices are easy to read, itemized, and have crystal-clear payment instructions.

The other side of the equation is managing your accounts payable—the money you owe to your own suppliers and vendors. You want to hold onto your cash as long as you can, but it’s just as important to keep your vendors happy. It’s all about strategic timing, not avoiding payment.

Smart Moves for Investing and Financing Activities

While operating cash flow gets most of the daily attention, your investing and financing decisions can have a huge impact, too. These choices usually involve bigger dollar amounts and can affect your financial health for years to come.

One of the most frequent investing decisions for a service business is buying new equipment, whether it’s laptops or specialized software. This brings up the age-old debate of leasing versus buying.

Lease vs. Buy An Analysis

| Factor | Leasing Equipment | Buying Equipment |

|---|---|---|

| Upfront Cost | Low or no down payment, preserving immediate cash. | High initial cash outlay. |

| Long-Term Cost | Can be more expensive over the full term. | Cheaper in the long run; you build equity. |

| Flexibility | Easier to upgrade to newer technology. | You’re stuck with the asset until you sell it. |

| Cash Flow Impact | Predictable, smaller monthly payments. | A large, immediate negative hit to CFI. |

For a business trying to conserve cash, leasing often makes more sense in the short term. It transforms a major capital expense into a predictable, manageable operating expense.

When it comes to financing, a business line of credit can be a lifesaver, but only if you’re disciplined. It’s meant for bridging short-term cash gaps—like making payroll while you wait for a big client payment to clear—not for funding a business that isn’t profitable. Used correctly, debt helps manage timing, not mask fundamental problems.

The ultimate goal is to create a business that is self-funding through its operations. Strong bookkeeping is the foundation that gives you the clarity to make these strategic moves with confidence and precision.

Improving your net cash flows is a continuous process. By putting these tactics into action, you can take real control over your company’s financial stability. For a deeper dive, resources like 10 Ways to Increase Cash Flow offer more detailed guidance for finance operators.

Common Questions About Net Cash Flows

As you get more comfortable with your Statement of Cash Flows, you’ll naturally start asking deeper questions. That’s a good sign—it means you’re moving past just seeing the numbers and are on your way to truly understanding what they mean. Here are some of the most common questions and points of confusion business owners have about net cash flows.

My goal here is to give you clear, direct answers to help solidify your knowledge. Think of it as a quick reference guide to managing your business’s financial health with total confidence.

Is Net Cash Flow the Same as Net Income?

No, and this is probably one of the most critical distinctions in all of business finance. While they sound alike, they measure two very different—though equally important—things. Net income, or profit, is what’s left on your Income Statement after you subtract all your expenses from revenue.

The key difference is that net income includes non-cash expenses, like depreciation. You might have a $5,000 depreciation expense for a company vehicle. This reduces your taxable profit on paper, but no actual cash left your bank account.

Net cash flow is the pure, unfiltered story of the cash that actually moved in and out of your business. It’s entirely possible to be highly profitable on paper but have negative net cash flow if clients are slow to pay their invoices. You absolutely need both metrics for a complete financial picture.

Can a Business Have Negative Net Cash Flow and Still Be Healthy?

Absolutely. A negative net cash flow isn’t automatically a red flag; context is everything. A rapidly growing service business, for instance, often has negative net cash flow precisely because it’s investing heavily in its own future.

Here are a couple of scenarios where negative cash flow is perfectly normal, or even a good sign:

- Heavy Investment: Spending cash on new laptops, critical software, or a down payment on office space will create a negative cash flow from investing. This is simply the cost of growth.

- Debt Repayment: Making a large principal payment on a business loan will result in a negative cash flow from financing. This shows financial discipline and strengthens your balance sheet over the long term.

The real red flag is a consistently negative cash flow from your core operations. If your day-to-day business can’t bring in more cash than it spends, it suggests a fundamental problem with the business model that can’t be sustained without outside funding.

How Often Should I Review My Net Cash Flows?

For most service-based businesses, reviewing your Statement of Cash Flows on a monthly basis is a solid best practice. This rhythm is frequent enough to spot developing trends and tackle potential problems before they spiral out of control. It gives you a regular, structured look at your financial performance.

However, for managing short-term liquidity, a weekly cash flow forecast is invaluable. This is a more forward-looking tool that helps you plan for upcoming bills like payroll and vendor payments, making sure you always have enough cash on hand to meet your obligations.

What Is the Biggest Cash Flow Mistake Business Owners Make?

The single most common—and dangerous—mistake is focusing only on profit while ignoring cash. Countless businesses have failed not because they weren’t profitable, but because they simply ran out of cash to pay their team, their rent, and their suppliers.

This “cash crunch” often comes from a lack of attention to accounts receivable, like letting client invoices age for 60 or 90 days. It can also happen from a simple lack of awareness of the business’s cash cycle. Proactive cash flow management isn’t just a good habit; for a service business, it’s essential for survival.

At Steingard Financial, we help service businesses move beyond just looking at reports to truly understanding their financial story. We provide the accurate bookkeeping and clear reporting you need to manage your net cash flows with confidence. Get in touch with us today to build a more resilient financial future.