Outsourced accounting for small business: Save time, cut costs, grow fast

When you hear “outsourced accounting,” what comes to mind? For many small business owners, it’s about hiring an external firm to handle some or all of their financial tasks. But it’s much more than just offloading work.

Think of it as instantly gaining a full-fledged finance department—from bookkeepers to strategic advisors—for less than the cost of a single full-time hire. This partnership lets you get back to focusing on growing your business instead of getting lost in spreadsheets.

What Is an Outsourced Financial Co-Pilot?

Let’s be honest: most business owners see accounting as a chore. It’s that mountain of receipts and endless data entry that pulls you away from what you’re truly passionate about. But what if you could flip that script and turn your accounting from a cost center into your secret weapon for growth? That’s exactly what modern outsourced accounting is all about.

It’s about bringing on a dedicated financial co-pilot for your business journey. Instead of shouldering the weight of financial management all by yourself, you team up with experts who provide the clarity and direction you need to navigate with confidence.

Moving Beyond Basic Bookkeeping

Outsourcing today isn’t just about getting tasks off your plate; it’s about getting access to a deep bench of specialists that would be nearly impossible for a small business to hire in-house. A single monthly fee can unlock a complete team of pros.

This integrated approach typically includes:

- Meticulous Bookkeepers: They’re the foundation, making sure every single transaction is recorded accurately. This gives you clean, reliable numbers to work with.

- Experienced Controllers: These professionals oversee your entire financial process. They manage cash flow, keep an eye on compliance, and make sure everything runs smoothly.

- CFO-Level Advisors: This is where the magic happens. They take your financial data and translate it into a strategic roadmap, helping you make smart, forward-thinking decisions.

This model directly tackles the biggest financial headaches that hold small businesses back. When you’re bogged down in administrative tasks, you lose precious time that should be spent on strategy, client relationships, and innovation. A good outsourced partner lifts that burden, freeing up your most valuable asset: your time.

For a business owner, this change is a game-changer. It allows them to focus on running the business—whether that means expanding into new markets, exploring new opportunities, or designing a new product. It all leads to better profitability.

Leveraging Technology for Efficiency

A huge part of modern outsourced accounting is using technology to handle the routine stuff. Top firms invest in the latest software and tools to create efficiencies that save you both time and money. They understand how AI in accounting can automate administrative tasks and integrate those tools seamlessly into your operations.

Ultimately, outsourcing your accounting means you stop reacting to what happened last month. Instead, you start proactively shaping your company’s future with accurate data, expert guidance, and the peace of mind that comes from knowing your finances are in expert hands. It’s a smart investment that pays dividends in clarity, confidence, and growth.

The Core Services That Fuel Business Growth

Bringing on an outsourced accounting partner isn’t just about checking tasks off a list; it’s about installing a powerful financial engine in your company. The services they provide are the interconnected parts that work together to give you clarity, improve cash flow, and lay the groundwork for smart growth.

Let’s unpack what these core functions actually are and how they shift from being simple chores to becoming strategic assets for your business.

Building Your Financial Blueprint With Bookkeeping

Think of professional bookkeeping as the architectural blueprint for your entire business. Every single transaction—a sale, an expense, a payment—is a building block. Without a clean, organized blueprint, the whole structure becomes unstable and you’re left guessing where you stand.

An expert bookkeeping service makes sure every transaction is meticulously recorded and categorized. This is so much more than data entry. It means reconciling your bank and credit card accounts to ensure your books are a perfect match with reality. This creates a rock-solid foundation for everything else, which is why so many owners first look to outsource bookkeeping for their small business.

Optimizing Cash Flow With AP and AR Management

For any small business, cash flow is the lifeblood. Managing the money coming in and going out is the difference between surviving and thriving. This is where Accounts Payable (AP) and Accounts Receivable (AR) management come in—these services directly impact how much cash you have in the bank.

- Accounts Payable (AP): This is all about managing and paying the bills you owe to vendors. An outsourced team makes sure your bills are paid on time, helping you avoid late fees, keep your suppliers happy, and even grab early payment discounts when they make sense.

- Accounts Receivable (AR): This involves managing the money your customers owe you. The team takes care of invoicing, tracking payments, and following up on overdue accounts so you get paid faster. This shortens your cash conversion cycle and makes your financial position much stronger.

By professionally managing both sides of the coin, your outsourced partner becomes a cash flow optimizer, making sure your financial engine runs smoothly. It’s a huge relief for busy owners who are stretched thin.

Ensuring Team Stability With Payroll Services

Payroll is about so much more than just cutting checks. It’s a complex, high-stakes function that directly affects your team’s morale and your legal standing. One small mistake can lead to frustrated employees and hefty fines from tax agencies.

An outsourced payroll service handles it all—from calculating wages and deductions to processing direct deposits and sending payroll taxes to the right federal and state authorities. This guarantees your team is paid accurately and on time, every time. It also keeps you compliant with constantly changing tax laws, taking a major source of stress and risk off your plate.

Turning Data Into Decisions With Financial Reporting

This is where all the hard work comes together to deliver real strategic value. Clean bookkeeping, managed cash flow, and accurate payroll produce a ton of raw data. Financial reporting is the process of turning that data into something you can actually use to make decisions.

Your outsourced partner will prepare key financial statements like the Profit & Loss (P&L), Balance Sheet, and Cash Flow Statement. But their true value is in helping you understand what those numbers mean for your business’s future, turning historical data into a strategic roadmap.

It’s a model that’s catching on fast. In fact, a recent study found that 37% of small businesses now outsource accounting and IT, making them the most commonly outsourced functions. This shift shows that more owners are choosing to focus on what they do best while trusting experts to handle specialized work.

Ultimately, these integrated services give you a clear, complete, and up-to-date view of your company’s financial health. It’s what empowers you to make smarter, more confident decisions to fuel sustainable growth.

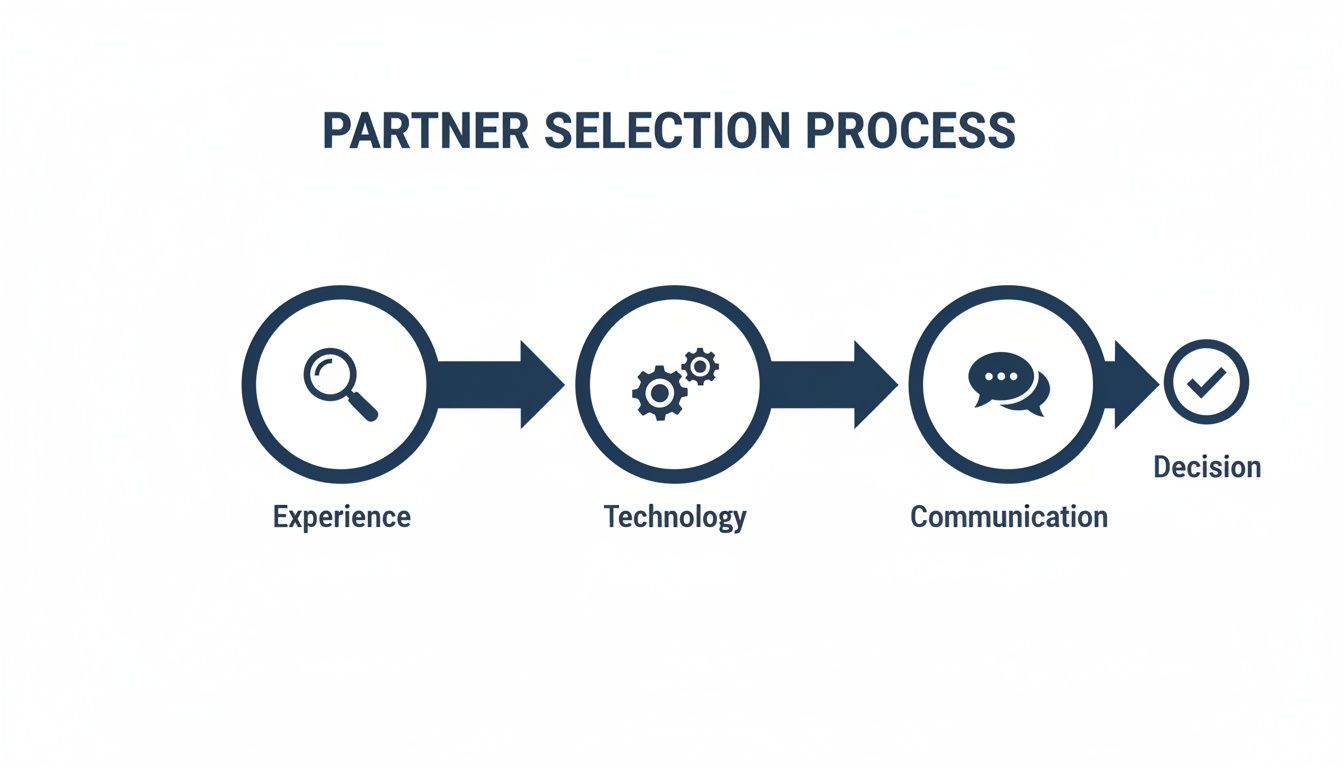

How to Choose the Right Financial Partner

Picking an outsourced accounting firm is a huge decision. It should feel like one. You’re not just hiring someone to crunch numbers; you’re trusting a partner with the financial pulse of your entire business. To get it right, you have to look past the slick website and ask the tough questions. You need to find a team that truly feels like an extension of your own.

This is all about finding a proactive partner who gives you strategic advice, not just a stack of reports at the end of the month. For service-based businesses, the right fit is a firm that just gets your world—from tracking project profitability to handling client retainers.

Evaluate Industry-Specific Expertise

Your first filter should always be industry experience. A firm that already works with other service-based businesses will speak your language from day one. They understand the quirks of your revenue, what your biggest expenses should be, and the metrics that actually matter for growth.

A generalist accountant can handle the basics, but an industry specialist offers a whole different level of insight. They can benchmark your numbers against similar companies and give you advice that’s specifically tailored to how your business operates.

When you’re talking to potential firms, be direct:

- “Can you give me some real-world examples of how you’ve helped service businesses like mine?”

- “What are the most common financial mistakes you see in my industry?”

- “How do you handle job costing for a service company?”

Their answers will tell you everything you need to know. A true expert will offer concrete examples, not vague promises. This is the difference between a reactive bookkeeper and a strategic partner who can help you see around corners.

Assess Their Technology and Systems

A modern accounting partner needs to have their tech figured out. This is non-negotiable. Their systems are about to become your systems, so you need to be sure they’re experts on the tools that will run your financial back office.

Ask them what platforms they use. Most top-tier firms build their workflows around cloud-based software like QuickBooks Online for accounting and Gusto for payroll. Their expertise with these tools means everything will integrate smoothly, giving you real-time access to your financial data. You should also see how they handle other systems. When checking out potential partners, ask about their experience with popular solutions, like Sage 100 accounting software, to make sure they can work with what you already have.

A great partner uses technology for transparency, not just efficiency. They should give you a secure client portal to share documents and provide clear, easy-to-read reports that offer 24/7 visibility into how your business is doing.

Key tech questions to ask:

- “What accounting and payroll software do you specialize in?”

- “Walk me through your process for our monthly financial review. What tools do you use?”

- “What security measures do you have in place to protect my company’s data?”

Prioritize Proactive Communication and Partnership

Finally, and this might be the most important part, get a feel for their communication style. The best outsourced firms act like true partners. They’re responsive, proactive, and genuinely invested in seeing you succeed. You shouldn’t ever feel like you’re chasing them down for answers; they should be the ones bringing insights—and potential problems—to you.

Before you sign anything, get a clear picture of what working with them will be like. Ask how they handle historical bookkeeping clean-ups if your books are a mess. A confident, detailed answer shows they have a solid process for messy situations.

Also, dig into how they manage payroll, which is a critical piece for any service business. Taking a moment to understand the benefits of outsourcing your payroll can show you just how much value a specialized firm adds in keeping you compliant and accurate.

Set clear expectations from the get-go.

- Define a Primary Point of Contact: Who is my go-to person on your team?

- Establish a Meeting Cadence: Will we connect weekly, bi-weekly, or monthly to go over the numbers?

- Clarify Response Times: What’s your policy for getting back to emails or phone calls?

The goal is to find a firm that clicks with your technical needs and your company culture. This alignment is what builds a valuable, long-term partnership that helps you grow with clarity and confidence.

Your Onboarding Journey With a New Partner

Taking the leap to an outsourced accounting partner might feel like a huge step. It’s natural to worry about the hand-off, learning a new process, or sharing sensitive financial data. But a great firm makes this transition feel surprisingly simple and collaborative, not scary.

A professional partner doesn’t just take the keys and drive off. They guide you through a clear, structured onboarding process. The whole point is to minimize disruption and get you set up for success right from day one, so you can start seeing the benefits without the headaches.

The Initial Discovery and Kick-Off

It all starts with a discovery call. This isn’t some high-pressure sales pitch; it’s a real conversation where the firm digs into the nuts and bolts of your business. They’ll want to know your goals, your biggest financial headaches, and how you operate day-to-day.

This first chat is crucial because it allows the team to understand what makes your business tick and start sketching out a plan that actually fits your needs. Think of it like a doctor’s visit—they need to understand the symptoms before they can offer a solution.

From there, you’ll have a formal kick-off meeting. This is where you’ll meet your main point of contact, go over the exact scope of work, and map out a timeline. You’ll know exactly who to call and what’s happening next.

Secure Data Migration and System Setup

One of the biggest questions we get is about transferring financial info securely. Any reputable firm will use encrypted portals to handle all your documents. This isn’t just email; we’re talking bank-level security to protect your sensitive data.

To get the ball rolling quickly, you’ll be asked to provide a few key documents. Having these ready makes everything go much faster:

- Financial History: Past business and personal tax returns, previous financial statements, and access to your current accounting file (like a QuickBooks backup).

- Bank and Credit Card Access: Secure, read-only access to your business bank and credit card accounts so the team can automatically sync transactions.

- Payroll Information: Details on your current payroll setup, employee info, and past payroll reports.

With this information in hand, your new partner will set up your accounts in their system. They’ll connect tools like QuickBooks Online and Gusto to build a seamless, efficient back office for your business.

The flowchart below gives you a good sense of what to look for in a partner who can guide you through this journey.

As you can see, the right fit combines industry expertise with modern tools and, most importantly, great communication.

The Foundational Books Clean-Up

It’s pretty common for a business’s books to have a few mistakes or messy spots, especially when you’ve been managing everything yourself. That’s why the next step is usually a “books clean-up” project. This isn’t a bad thing; it’s more like a financial health check-up.

A clean-up project is a one-time investment that establishes a reliable starting point. It’s about building a solid, accurate foundation so that all future financial reports are trustworthy and insightful.

During this phase, the accounting team dives into your past transactions, reconciles every account, and fixes any errors they find. They will also structure your chart of accounts to better match your business model. This is the foundational work that makes accurate, real-time reporting possible later on. Once it’s done, your onboarding is complete, and the real partnership begins.

Measuring the Real ROI of Your Investment

Handing over your finances can feel like a big step, but the decision to outsource your accounting should be based on real results, not just a gut feeling. How do you actually know if the investment is paying off? It’s about looking beyond the monthly fee to measure the true return on investment (ROI) across your entire business.

This means tracking hard financial numbers and recognizing the valuable operational wins that don’t always show up on a balance sheet. When you weigh the cost against the true value, the numbers often tell a very compelling story.

Key Financial Metrics to Track

The most direct way to measure success is by keeping an eye on the key performance indicators (KPIs) that show the health of your cash flow. A professional outsourced partner doesn’t just record transactions; they actively help you improve these numbers.

Key metrics to watch include:

- Days Sales Outstanding (DSO): This is the average number of days it takes for clients to pay you. A good accounts receivable process will lower your DSO, meaning cash gets into your bank account faster.

- Cash Flow Accuracy: How close are your financial projections to reality? Better bookkeeping leads to more accurate forecasts, which is critical for making smart decisions about spending and investing. Our guide on cash flow projection offers more detail on this.

- Time-to-Close: How quickly are your books closed at the end of the month? A faster close means you get essential financial reports sooner, allowing you to be more agile.

By monitoring these KPIs, you can see a direct link between your outsourced team’s work and your company’s financial stability.

Calculating the Hard Cost Savings

Next, let’s look at the direct costs you avoid. Hiring an in-house accountant isn’t just about their salary. The “fully-loaded” cost of an employee is often 1.25 to 1.4 times their base salary once you factor in benefits, payroll taxes, and other overhead.

Outsourcing gives you access to an entire team of experts—from bookkeepers to CFO-level advisors—for a predictable monthly fee. This is often less than the fully-loaded cost of a single senior in-house hire.

Here’s a simple comparison:

| Cost Factor | In-House Accountant | Outsourced Accounting Firm |

|---|---|---|

| Salary/Fee | $70,000+ per year | ~$24,000 per year ($2,000/month) |

| Benefits & Taxes | ~$21,000 per year | Included in fee |

| Software Costs | $1,000+ per year | Included in fee |

| Training & Overhead | $2,000+ per year | Included in fee |

| Total Annual Cost | ~$94,000+ | ~$24,000 |

This example shows a potential hard cost saving of $70,000 per year. The numbers make it clear that outsourcing can be a much more financially efficient model for gaining high-level expertise without the high overhead.

The Invaluable Soft Benefits

The ROI of outsourced accounting goes far beyond saved dollars. The “soft” benefits—like getting your time back and gaining peace of mind—are often the most impactful for a business owner.

Think about how many hours a week you spend on bookkeeping, chasing invoices, or running payroll. If you get back just 10 hours per week, that’s over 500 hours a year you can put back into activities that actually grow your business, like serving clients, making sales, and planning your next move.

This strategic shift is a major reason why the global accounting outsourcing market is projected to hit $54.79 billion in 2025. Small businesses are increasingly seeking smarter, more cost-effective ways to manage their finances.

Ultimately, the real ROI is measured in your ability to lead with confidence. When you have accurate numbers, expert guidance, and more time to focus on your vision, you aren’t just saving money—you’re making a smart investment in your company’s future.

Common Questions About Outsourced Accounting

Even after seeing all the benefits, it’s completely normal to have a few questions before you hand over your company’s finances. Making the switch to an outsourced accounting partner is a big decision for any small business. To help you feel confident moving forward, we’ve put together answers to some of the most common questions we hear from owners just like you.

How Much Does Outsourced Accounting Typically Cost?

This is usually the first thing on every owner’s mind, and the simple answer is: it depends on what your business needs. Most modern firms use a flexible monthly subscription model. For a small business that just needs the essentials, a basic package covering bookkeeping and monthly reconciliations could start at just a few hundred dollars per month.

For a more complete plan that includes services like payroll, managing payables and receivables, and strategic financial reporting, you can expect to see prices ranging from $1,000 to $2,500+ per month. It’s easy to compare that number to an employee’s salary, but don’t forget the fully-loaded cost of a new hire—benefits, payroll taxes, software, training, and office space all add up. In almost every scenario, outsourcing gives you an entire team of experts for less than the cost of one senior in-house accountant.

Is My Financial Data Safe With an Outside Firm?

Absolutely. For any reputable firm, data security isn’t just a feature; it’s the foundation their entire business is built on. Professional firms use bank-level security measures to protect your sensitive information 24/7.

This typically includes things like:

- Data Encryption: Protecting your information both when it’s stored (at rest) and when it’s being sent (in transit).

- Secure Cloud Platforms: Using established, highly secure infrastructure from trusted providers to house all financial data.

- Strict Internal Controls: Limiting access to your information to only the specific team members who need it to do their job.

When you’re vetting a potential partner, always ask them to walk you through their security protocols, confidentiality agreements, and liability insurance. In many ways, a professional firm’s dedicated security is far stronger than what you can manage on a local office computer, which significantly reduces your risk of a breach.

Do I Lose Control by Outsourcing My Finances?

This is a common fear, but the reality is the complete opposite. Outsourcing your accounting actually gives you more control, not less. By handing off the time-consuming, day-to-day financial tasks, you pull yourself out of the weeds and gain the high-level clarity you need to make smarter, more strategic decisions for the business.

You always keep full ownership of your financial data and have the final say on all payments. Your outsourced partner is like your financial co-pilot—they provide the accurate maps, expert guidance, and real-time data, but you’re always the captain, confidently steering the ship.

Think of it this way: a pilot doesn’t lose control by trusting air traffic control. They gain the critical information needed to fly safely and efficiently. Your outsourced accounting partner plays that exact same role for your business’s financial health.

Can You Still Help If My Current Books Are a Mess?

Yes, and you’d be surprised how often this is the starting point. Many business owners come to us after trying to manage the books themselves, and over time, things have naturally gotten a bit disorganized. Most experienced firms specialize in what we call “catch-up” or “clean-up” bookkeeping projects.

The process is pretty straightforward:

- Diagnostic Review: First, we do a thorough review of your existing books to see what’s going on and figure out the scope of the work.

- Strategic Plan: Based on that review, we create a clear plan to reconcile your accounts, fix any past errors, and get everything organized.

- Execution: Our team gets to work, bringing your historical records into perfect order.

While this initial clean-up involves a one-time fee, it’s a crucial investment. It creates the clean, reliable foundation you need for accurate, stress-free financial management from here on out, setting you up for long-term success.

Ready to gain clarity and control over your finances? At Steingard Financial, we specialize in building scalable back-office solutions for service businesses, turning messy books into a powerful tool for growth. Let’s talk about how we can help your business thrive.