Small Business Bookkeeping A Guide for Service Businesses

Trying to run your business without proper small business bookkeeping is a bit like driving your car with a blanket thrown over the dashboard. You might be moving forward, but you have no clue how fast you’re going, if you’re about to run out of gas, or if the engine is on the verge of overheating. Bookkeeping isn’t just about staying compliant; it’s about having control and a clear view of the road ahead.

The Hidden Costs of Poor Financial Management

For most service business owners, bookkeeping gets shoved to the bottom of the to-do list, right after client work, sales calls, and everything else. But treating it as an afterthought comes with some serious, often hidden, costs. This reactive approach can quietly undermine a growing company long before the owner even knows what’s happening.

And this isn’t just a hunch; it’s a massive issue. A shocking 60% of small business owners admit they don’t feel knowledgeable about accounting. Another 21% specifically say they don’t know enough about bookkeeping itself. This knowledge gap isn’t just academic—it leads to real-world problems like missed tax write-offs, chaotic cash flow, and late tax filings. You can see for yourself how common these challenges are.

Common Pitfalls Service Businesses Face

When bookkeeping gets neglected, service-based businesses are especially vulnerable to a few key dangers. These aren’t small slip-ups; they’re genuine threats to your company’s stability and future.

- Crippling Cash Flow Gaps: If you don’t have a clear, up-to-date picture of your accounts receivable, you’re just guessing when client payments might come in. This makes it impossible to plan for your own expenses, pay your team on time, or invest in growth, leaving you stuck in a stressful feast-or-famine cycle.

- Missed Tax Deductions: Every expense you forget to categorize is a missed chance to lower your tax bill. All those software subscriptions, client lunches, and home office costs really add up. Poor bookkeeping means leaving that money on the table for the IRS.

- Inability to Secure Funding: Need a business loan or a line of credit to expand? Lenders and investors will ask for clean financial statements first thing. Messy books are an instant red flag that often leads to a quick “no.”

Bookkeeping is not a backward-looking administrative task. It is the forward-looking strategic instrument that tells you where your business has been, where it is now, and where it has the potential to go.

At the end of the day, good small business bookkeeping gives you the clarity you need to make decisions with confidence. It turns your financial data from a source of stress into a powerful dashboard that guides every move you make. Without it, you’re just driving blind.

The Four Pillars of Service Business Bookkeeping

Solid small business bookkeeping isn’t some huge, single task you have to tackle all at once. It’s actually a system built on four distinct, essential activities. Think of them as the legs of a table—if all four are strong, your business is stable and ready for growth. But if you neglect even one, the whole thing starts to wobble.

Let’s break down these four non-negotiable pillars into simple, practical terms.

Pillar 1: Transaction Categorization

At its core, transaction categorization is all about giving every single dollar a job. Every time money comes into or leaves your business bank account, you have to assign it to the right category. This isn’t just busywork; it’s the absolute foundation of all your financial reports.

Was that $200 expense for a client lunch (Meals & Entertainment), a new software subscription (Software & Subscriptions), or office supplies? Was that $5,000 deposit from Client A’s project payment (Service Income) or a loan from the bank (Loan Payable)?

Getting this right is the only way to generate an accurate Profit & Loss statement. For a service business, this directly impacts your ability to price your projects correctly. Without it, you’re just guessing which services are truly profitable and which ones are secretly draining your resources. This whole process hinges on a well-organized Chart of Accounts, which acts as the blueprint for all your financial categories. To nail this from the start, check out our detailed guide on how to create a Chart of Accounts.

Pillar 2: Bank and Credit Card Reconciliation

Think of reconciliation as fact-checking your finances. It’s the process of matching every transaction in your bookkeeping software (like QuickBooks) to what actually happened in your bank and credit card statements, line by line. The goal is simple: make sure the numbers in your books perfectly mirror the numbers at the bank.

This monthly ritual is your first line of defense against costly mistakes. It helps you catch:

- Bank errors that could be costing you money.

- Missed transactions that never got entered into your books.

- Duplicate entries that are inflating your expenses or income.

- Potentially fraudulent charges you didn’t even know were there.

A 99.5% accuracy rate just doesn’t cut it in bookkeeping. Reconciliation is what guarantees 100% accuracy, giving you total confidence that your financial reports reflect reality.

Reconciling your accounts isn’t about just checking boxes. It’s about building a foundation of trust in your own data, which is essential for making sound business decisions.

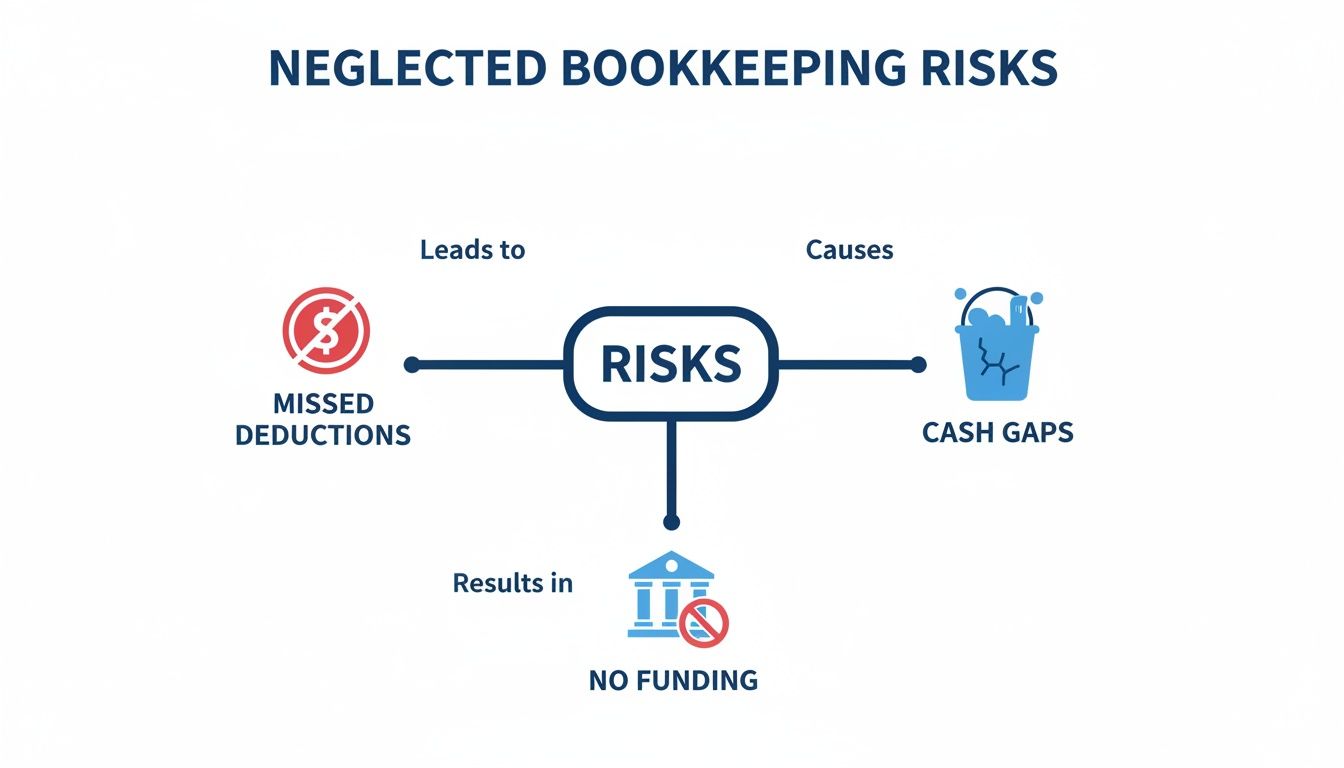

The image below shows what’s at stake when fundamental tasks like reconciliation get overlooked.

As you can see, poor bookkeeping is a direct path to missed tax deductions, surprise cash flow gaps, and trouble getting funding when you need it most.

Pillar 3: Managing Receivables and Payables

Your Accounts Receivable (A/R) and Accounts Payable (A/P) are your financial command center. Together, they give you a real-time snapshot of who owes you money and who you owe.

- Accounts Receivable (A/R): This is the money your clients owe you for services you’ve already completed. Managing A/R properly means sending invoices out fast, keeping track of who has paid, and following up on overdue payments. For a service business, even one or two slow-paying clients can create a serious cash flow problem.

- Accounts Payable (A/P): This is the money you owe to vendors, contractors, and suppliers. Good A/P management ensures you pay your bills on time, which helps you avoid late fees and maintain strong relationships with the partners who help your business run.

Keeping a close eye on both A/R and A/P is the key to healthy cash flow. It lets you accurately forecast your cash position, so you know exactly when you can afford to invest in new tools, hire another team member, or take on that bigger project.

Pillar 4: Payroll Management and Integration

The final pillar is all about connecting your team to your bottom line. Payroll isn’t just about cutting checks; for most service businesses, it’s the single largest expense. Managing payroll, taxes, and benefits correctly is critical for compliance, but integrating it into your bookkeeping system is where the real strategic value comes in.

When your payroll system (like Gusto) syncs seamlessly with your accounting software, every dollar spent on wages, payroll taxes, and benefits gets categorized automatically. This gives you a precise understanding of your true labor costs on a per-project or per-client basis. That data is priceless for calculating your actual profitability and making sure your pricing covers all your overhead. Without that connection, your labor costs become a giant financial blind spot.

To put it all together, here’s a quick summary of these four essential tasks and why they’re so critical for any service-based business.

Essential Bookkeeping Tasks and Their Impact

| Core Task | What It Means in Simple Terms | Why It’s Critical for a Service Business |

|---|---|---|

| Transaction Categorization | Giving every dollar a specific “job” (e.g., income, software, travel). | Reveals which services are truly profitable and helps you price your work accurately. |

| Bank Reconciliation | “Fact-checking” your books against your bank statements to ensure 100% accuracy. | Catches costly errors, prevents fraud, and builds trust in your financial data. |

| A/R & A/P Management | Tracking who owes you money (A/R) and who you owe money to (A/P). | The key to managing healthy cash flow and avoiding surprise financial shortfalls. |

| Payroll Integration | Connecting your payroll system to your accounting software. | Provides a clear picture of your true labor costs, which is vital for profitability analysis. |

Mastering these four pillars isn’t just about “doing the books”—it’s about building a financially intelligent business that’s equipped to make smart decisions and grow sustainably.

Choosing Your Bookkeeping Technology Stack

Now that we’ve covered the core tasks of small business bookkeeping, it’s time to move from the “what” to the “how.” The right technology does more than just make these jobs easier; it turns your financial data from a pile of numbers into an engine for smart business decisions. This setup is basically the central nervous system for your company’s finances.

The best way to think about your tech stack is as a two-part system built for total efficiency. One part is your financial headquarters, where every bit of data lives. The other is your people operations hub. When they talk to each other, you get a seamless flow of information that cuts out mistakes and saves you a ton of time.

Your Financial Headquarters: QuickBooks Online

For nearly every service business out there, QuickBooks Online (QBO) is the clear winner for the financial headquarters. It’s the central spot where every transaction, invoice, and payment comes together. Because it’s cloud-based, you can access your financial data from anywhere, giving you a live look at your business’s health.

But just having QBO isn’t the whole story. The real magic is in setting it up correctly from day one. This starts with a smart Chart of Accounts designed specifically for your type of service business, which makes sure every dollar is categorized in a way that actually makes sense. A good setup transforms QBO from a simple digital checkbook into a powerful tool for analysis.

If you’re exploring your options, it can be a huge help to work with a dedicated QuickBooks Virtual Assistant who knows how to tweak the platform for your specific business needs.

Your People Operations Hub: Gusto

While QBO is busy managing the numbers, a platform like Gusto is the perfect hub for all things people-related. It handles everything connected to your team—payroll, benefits, onboarding, and compliance—and makes it look easy. For service businesses, where your team is both your biggest asset and usually your largest expense, getting this part right is absolutely critical.

Gusto takes complicated tasks like calculating payroll taxes, managing health benefits, and staying on top of labor laws off your plate. By using a specialized tool for these functions, you slash the risk of expensive payroll errors and get that time back to focus on your clients and team. This approach makes sure your people operations are just as buttoned-up as your financials.

A well-chosen tech stack isn’t about having the most features; it’s about creating a frictionless system where financial and payroll data communicate automatically, giving you a complete and accurate picture of your business without the manual effort.

When these two powerful systems are connected, that’s when the real magic happens.

The Power of Integration

Connecting QuickBooks Online and Gusto creates an automated financial ecosystem that practically runs itself. When you run payroll in Gusto, all the important details—wages, employer taxes, benefit deductions—flow straight into QBO and get categorized automatically. This link gets rid of the boring, error-prone task of entering data by hand.

Here’s what that seamless connection really gives you:

- Real-Time Accuracy: Your financial reports are always up-to-date. The second payroll is processed, your Profit & Loss statement shows your true labor costs, giving you an instant and accurate look at your profitability.

- Drastically Reduced Admin Work: This automation saves hours of manual work every single month. That’s time you can put back into things that actually make money, like client service or strategic planning.

- A Single Source of Truth: With connected systems, you have one reliable place for all your financial information. This ends the confusion and makes sure that everyone, from you to your accountant, is looking at the same correct numbers.

This integrated setup is the foundation of modern small business bookkeeping. It delivers the clarity and efficiency you need to make confident, data-driven decisions that will push your service business forward. With the right tools working together, you spend less time managing your data and more time using it to grow.

Creating Your Financial Reporting Rhythm

Good small business bookkeeping isn’t just about logging numbers after the fact. It’s about creating a consistent rhythm, a steady financial pulse that tells you exactly how your company is doing at any given moment.

Think of it like a fitness routine. Hitting the gym once in a blue moon won’t get you very far. But a steady, predictable schedule? That’s what builds real strength and endurance over time. The very same principle applies to your finances.

When you establish a consistent reporting rhythm, bookkeeping stops being a reactive chore and becomes one of your most powerful strategic tools. It helps you spot trends, catch problems before they blow up, and make decisions with confidence because they’re backed by real data. This rhythm is built on three simple cadences: weekly, monthly, and annually.

Your Weekly Financial Pulse Check

Think of your weekly tasks as a quick “financial pulse check.” These aren’t deep dives into complex spreadsheets; they’re fast, simple checks to make sure the business is on solid ground day-to-day. This little routine is all about staying connected to your cash flow—the absolute lifeblood of any service business.

There’s a startling statistic from U.S. Bank that every business owner should know: a massive 82% of small businesses that fail do so because of poor cash flow management. It’s rarely about a lack of sales. It’s about a lack of visibility into when money is actually coming in and going out, a problem that’s especially tough for service businesses with varying project timelines and unpredictable client payments.

Here’s what your weekly checklist should look like:

- Check bank and credit card balances. Know exactly what your cash position is right now.

- Categorize new transactions. A few minutes a week prevents a mountain of work later.

- Review Accounts Receivable. Who owes you money? Is it time for a friendly follow-up?

- Process upcoming bills. Stay on top of your Accounts Payable so nothing gets missed.

Your Monthly Strategic Business Review

If the weekly tasks are a pulse check, then your monthly reports are the “strategic business review.” This is your chance to step back from the daily grind, look at the bigger picture, and see how you’re tracking against your goals. This is where the real insights are hiding.

For a service business, three reports are absolutely essential:

- Profit & Loss (P&L) Statement: This tells you your total revenue, all your expenses, and your net profit for the month. It’s the ultimate report for answering the big question: “Are we actually making money?”

- Balance Sheet: This is a snapshot of your company’s overall financial health, showing your assets, liabilities, and equity at a specific moment in time.

- Statement of Cash Flows: This report breaks down how cash moved through your business—where it came from and where it went.

For instance, your monthly P&L might show that a high-ticket service, while bringing in big revenue, is actually less profitable than a smaller, simpler offering because of high labor and software costs. With that knowledge, you can adjust your pricing or marketing to focus on what truly grows your bottom line. Our team at Steingard Financial helps clients master this by implementing financial reporting best practices that turn raw data into smart business moves.

Your Annual Performance Scorecard

Finally, your annual reports act as your “performance scorecard and tax-prep toolkit.” This is where all your consistent weekly and monthly efforts pay off big time. When your books are clean and reconciled all year, tax season goes from a frantic scramble to a calm, organized process.

Your annual financial statements do more than just satisfy the IRS. They tell the complete story of your business’s performance over the past year, providing invaluable data for setting ambitious goals for the next one.

A critical piece of this puzzle is understanding the significance of payment references, which ensures every dollar that comes in gets matched to the right invoice. By establishing this clear weekly, monthly, and annual rhythm, you create a powerful feedback loop. This constant flow of information gives you the clarity you need to lead with confidence, turning your bookkeeping from a necessary evil into your most valuable strategic asset.

Knowing When to Outsource Your Bookkeeping

For a lot of service business owners, doing your own small business bookkeeping feels like a rite of passage. It’s a sign of being scrappy and a smart way to keep costs down when you’re just starting out.

But there’s a tipping point. Sooner or later, DIY bookkeeping stops being a smart move and quietly starts holding your business back. You might not even realize it’s happening.

Deciding to outsource isn’t just about getting rid of tasks you don’t like. It’s a strategic decision to get your time back, lower your financial risk, and clear a path for real growth. The first step is learning to spot the signs that you’ve hit that critical point.

Red Flags That DIY Bookkeeping Is Hurting You

If you’re wondering whether it’s time, your own day-to-day frustrations are usually the best guide. These aren’t just small annoyances; they’re symptoms of a system your business has outgrown. When you see these red flags pop up, it’s a clear signal that your energy is better spent on other things.

Here are the most common signs it’s time to call in a professional:

- You spend more than five hours a month on bookkeeping. Your time is your most valuable resource. If you’re losing a full workday (or more) every single month trying to categorize transactions or fight with software, that’s time you aren’t spending with clients, making sales, or thinking about the big picture.

- You constantly feel behind or disorganized. Are you always playing catch-up with your books? Do you have that nagging feeling that the numbers aren’t quite right? That kind of uncertainty makes it impossible to make decisions with confidence.

- You dread tax season. Tax time should be a simple process of filing your returns. It shouldn’t be a frantic, last-minute scramble to dig up documents and make sense of a year’s worth of messy records. If you feel a sense of dread, your system is broken.

- You lack confidence in your financial data. When you pull up your Profit & Loss statement, do you actually trust what it says? If you pause on making a big purchase or hiring someone new because you’re not sure about your real cash position, your books are failing you.

Outsourcing bookkeeping isn’t an expense; it’s an investment in accuracy, efficiency, and peace of mind. It transforms your financial data from a source of stress into a reliable tool for strategic growth.

Calculating the True Return on Investment

It’s easy to get stuck on the cost of hiring a professional, but the real conversation should be about the return on that investment. A professional bookkeeping firm like Steingard Financial does more than just manage your books; we create value that far outweighs the monthly fee. This value shows up in tangible savings and priceless strategic advantages.

The ROI of outsourcing your small business bookkeeping comes from several key areas:

- Preventing Costly Errors: A pro bookkeeper catches mistakes—like paying an invoice twice or forgetting to follow up on a client payment—that can quietly eat away at your cash flow.

- Optimizing Tax Strategies: Clean, accurate books are the foundation for smart tax planning. This ensures you claim every single deduction you’re entitled to without worrying about an audit.

- Freeing Up Your Time: Figure out what an hour of your time is worth when you’re focused on activities that actually generate revenue. The hours you get back by outsourcing often pay for the service itself.

There’s a reason the demand for professional financial management is growing. In the U.S. alone, the Payroll & Bookkeeping Services industry is a $76.5 billion market serving over 324,000 businesses. This growth shows just how many owners are realizing that professional oversight is a key ingredient for success. You can discover more insights about this industry trend on ibisworld.com.

Ultimately, making the switch empowers you to focus on what you do best—serving your clients and growing your business. If you’re ready to explore what this transition looks like, check out our guide on how to outsource bookkeeping for your small business.

Your Action Plan for Financial Clarity

Knowing the theory behind small business bookkeeping is a great start, but real change only happens when you take action. It’s easy to feel a little stuck when trying to turn all this information into a practical system, so I’ve put together a simple, five-step plan to get you moving. Think of this as your road map to building a rock-solid financial foundation, one step at a time.

This isn’t about becoming a CPA overnight. It’s about building smart habits and putting a system in place that gives you the control and clarity you deserve as a business owner.

Your Five-Step Checklist

Ready to make it happen? Just follow this checklist. Each step builds on the one before it, helping you create a strong, sustainable financial system for your service business.

- Select Your Core Software: Your first move is to set up a financial home base. Choose a reliable, cloud-based platform like QuickBooks Online. This is where all your financial data will live, making every other step possible.

- Open a Dedicated Business Bank Account: This one is non-negotiable. Mixing personal and business spending is the fastest way to create a bookkeeping nightmare and miss out on valuable tax deductions. A separate account draws a clear, clean line between the company’s money and your own.

- Structure Your Chart of Accounts: Before you touch a single transaction, get your Chart of Accounts set up properly. This is the custom blueprint for your bookkeeping, and it ensures every dollar has a logical place to go. A clean setup here is the key to getting accurate and useful reports later on.

- Establish a Weekly Routine: Consistency is everything in bookkeeping. Block out 30 minutes on your calendar every single week—maybe Friday afternoon—to categorize new transactions and check your cash balance. This simple habit saves you from a monster cleanup at the end of the month and keeps you plugged into the financial pulse of your business.

- Schedule a Monthly Financial Review: Finally, put a recurring meeting on your calendar each month to review your main financial reports, like the Profit & Loss statement. This is your dedicated time to zoom out, see how you’re really doing, and make strategic decisions based on hard data, not just a gut feeling.

Following these steps bridges the gap between understanding bookkeeping and actually doing it. This plan is your launchpad for transforming financial data from a source of stress into your most powerful tool for growth.

Frequently Asked Questions About Small Business Bookkeeping

Even with a clear roadmap, it’s completely normal to have questions pop up about bookkeeping. Getting straight answers can clear up any confusion and give you the confidence to push forward. Here are a few of the most common questions we hear from service business owners.

We’ve designed each answer to be practical, building on the core ideas we’ve already covered and helping you figure out your next best step.

What Is the Real Difference Between a Bookkeeper and an Accountant?

It helps to think of it this way: a bookkeeper is focused on the day-to-day financial health of your business, while an accountant looks at that same information to give you strategic advice for the future.

A bookkeeper’s role is to keep a meticulous record of your daily financial transactions. They’re in the trenches, handling things like bank reconciliations, managing who owes you and who you owe, and just making sure your data is clean and current. They build the solid financial foundation everything else relies on.

An accountant’s role is more about analysis and planning. They take the clean data your bookkeeper organized and use it for bigger-picture tasks like tax strategy, financial forecasting, and advising on major business decisions. One builds the foundation; the other designs the building that goes on top of it.

How Much Should a Service Business Budget for Outsourced Bookkeeping?

The cost for an outsourced bookkeeper can vary quite a bit, but for most service-based businesses, you can expect to budget somewhere between $500 and $2,500 per month.

What drives that price? A few key things:

- Transaction Volume: A business with hundreds of transactions a month is simply going to require more time than one with just a handful.

- Complexity: Do you have employees on payroll? Are you juggling multiple bank accounts or credit cards? Do you have complex client invoicing? Each of these adds another layer to the work.

- Scope of Services: Are you just looking for the basics—categorization and reconciliation—or do you need someone to manage your bills and send detailed monthly reports?

The trick is to see this as an investment, not just another bill. A good bookkeeping firm will save you more than their fee by catching costly errors, finding tax efficiencies, and—most importantly—giving you back your time.

Can a Professional Bookkeeper Fix My Messy Books?

Yes, absolutely. In fact, that’s one of the main reasons business owners come to us. A professional bookkeeper is an expert in what we call a “cleanup” or “catch-up” project.

They will go back through your records—whether it’s a few months or a few years—and systematically untangle everything. They’ll sort out mixed personal and business expenses, categorize all those transactions sitting in limbo, and reconcile old accounts to make sure it all adds up. The process turns a chaotic financial past into a clean, accurate, and tax-ready set of books. It’s the best way to get a fresh start from a solid position.

What Is the First Step to Get My Finances Organized?

The single most important first step you can take is to open a dedicated business bank account. Mixing personal and business finances is the number one cause of bookkeeping headaches. It completely blurs the picture of how your business is actually doing, turns tax time into a nightmare, and can even put your personal assets at risk.

By simply creating that separation, you make categorizing your transactions a hundred times easier and get a much clearer view of your real cash flow. It’s a foundational step that makes everything else fall into place.

Ready to stop guessing and start getting the financial clarity your business deserves? The team at Steingard Financial provides expert bookkeeping and payroll services tailored for service businesses, turning your financial data into a reliable tool for growth. Schedule a consultation with us today to see how we can help.