A Simple Guide to Understanding Debit and Credit in Accounting

To understand debits and credits in accounting, you have to get one thing straight: it’s all about tracking where money comes from and where it goes. Every single transaction has two sides. Think of it like a perfectly balanced scale.

A credit is where the value originates, and a debit is where that value ends up. They must always, always be equal. This two-sided approach is what keeps your financial story complete and, more importantly, accurate.

The Foundation of Modern Accounting

Let’s be honest, the words ‘debit’ and ‘credit’ sound intimidating. Most business owners immediately picture complicated spreadsheets and a language they don’t speak. But what if they’re just simple labels for a balancing act? This whole system, called double-entry bookkeeping, is designed to give you a crystal-clear picture of your company’s financial health.

For every transaction—from paying the internet bill to cashing a client’s check—there are two equal and opposite effects. This is the magic that ensures the basic accounting equation (Assets = Liabilities + Equity) always stays in balance. It’s a built-in error-prevention system that creates a verifiable trail for every single dollar moving through your business.

A Timeless System for Financial Clarity

This isn’t some new-fangled idea; it’s a time-tested method that’s been the bedrock of finance for over 500 years. The double-entry system was first written down in 1494 by an Italian friar named Luca Pacioli. He literally wrote the book on how every transaction needs to hit two accounts to keep things balanced.

Pacioli famously said that a merchant shouldn’t go to sleep until his debits equaled his credits. That same principle is just as critical for accurate bookkeeping today.

The system forces a logical check on everything. If you just recorded that cash left your bank account but didn’t say why, the story would be incomplete. Did you buy a new computer? Pay an employee? Repay a loan? The double-entry method demands an answer by requiring a corresponding entry.

The core idea is simple: You can’t just make money appear or disappear. Every financial event has a source (credit) and a destination (debit), and double-entry bookkeeping is the language we use to tell that story accurately.

Why This Matters for Your Business

Getting a handle on this is way more than just an accounting exercise. A solid grasp of debits and credits is crucial for a few key reasons:

- Accurate Financial Reporting: It’s the only way to ensure your income statement, balance sheet, and cash flow statement are correct. Without it, you’re flying blind.

- Informed Decision-Making: When you know exactly where your money is coming from and going, you can make much smarter choices about your budget, spending, and where to invest in growth.

- Error Detection: The balancing act makes it incredibly easy to spot mistakes. If your books don’t balance, you know right away that something is off and needs a closer look.

So, forget the dry, textbook definitions. Start thinking of debits and credits as two sides of a scale. Once you do that, you’ll demystify the entire process and finally gain real control over your company’s financial story.

The Simple Rules That Govern Debits and Credits

Alright, now that we’ve covered the why behind the balancing act, let’s get into the simple rules that make it all work. The first step is to forget everything you think you know from your debit card or bank statement. In the world of accounting, debit simply means left, and credit simply means right. That’s it.

These aren’t “good” or “bad” terms. They’re just neutral directions, telling us which side of an account an entry goes on. Every single transaction you record will have at least one debit and at least one credit, and the total amounts have to be perfectly equal every time.

The real magic happens when you see how these left and right entries affect different kinds of accounts. Your entire business can be broken down into five basic account types: Assets, Liabilities, Equity, Revenue, and Expenses. How a debit or credit behaves depends entirely on which of these five buckets it lands in.

Introducing Normal Balances

Every account has what accountants call a Normal Balance. This is the side—debit (left) or credit (right)—that makes the account balance go up. Think of it like a light switch: flipping it one way increases the balance, and flipping it the other way decreases it.

Understanding the Normal Balance for each account type is the secret to getting debits and credits right without having to memorize a bunch of confusing rules.

Here’s how it breaks down:

- Asset Accounts: This is stuff your business owns, like cash, equipment, or invoices customers owe you (accounts receivable). Their Normal Balance is a Debit.

- Expense Accounts: This is the money you spend to run the business—things like rent, software subscriptions, and payroll. Their Normal Balance is also a Debit.

- Liability Accounts: This is money your business owes to others, like credit card debt, loans, or bills you haven’t paid yet (accounts payable). Their Normal Balance is a Credit.

- Equity Accounts: This represents the owner’s stake in the company, from initial investments to profits you’ve kept in the business. Its Normal Balance is a Credit.

- Revenue Accounts: This is the money you earn from selling your services or products. Its Normal Balance is a Credit.

The whole system is built to keep the main accounting equation (Assets = Liabilities + Equity) in perfect harmony. Every entry you make is carefully tracked in your company’s financial record book, and you can learn more about how this works by understanding what is a general ledger.

Easy Ways to Remember the Rules

Instead of staring at a dry chart, most accountants use a simple mnemonic to keep the rules straight. One of the most popular is DEAD CLIC. It’s a bit morbid, but it works.

DEAD stands for Debits increase Expenses, Assets, and Draws. These are all the accounts with a normal debit balance.

CLIC stands for Credits increase Liabilities, Income (or Revenue), and Capital (or Equity). These are the accounts with a normal credit balance.

Here’s a quick table that pulls it all together.

Normal Balances for Account Types

This table gives you a snapshot of how debits and credits work for each of the five major account types.

| Account Type | Normal Balance | To Increase | To Decrease |

|---|---|---|---|

| Assets | Debit | Debit the account | Credit the account |

| Expenses | Debit | Debit the account | Credit the account |

| Liabilities | Credit | Credit the account | Debit the account |

| Equity | Credit | Credit the account | Debit the account |

| Revenue | Credit | Credit the account | Debit the account |

So, what’s the big takeaway here?

To increase an account, you just hit it on its “Normal Balance” side. To decrease it, you do the opposite. Since an Asset account has a normal debit balance, you debit it to add more and credit it to take some away.

This simple framework is the engine that powers all of double-entry bookkeeping. Once you get a feel for it, you’ll start seeing the logic behind every transaction. You’ll understand that when a client pays an invoice, you’re just increasing one asset (Cash) while decreasing another (Accounts Receivable), keeping the scales perfectly balanced.

Putting It All Together with Real Business Examples

Theory is one thing, but seeing debits and credits work in the real world is where it all clicks. To really get a handle on this, we need to translate everyday business activities into the language of double-entry bookkeeping. Let’s walk through a few common transactions you’d see in any service business.

For each scenario, we’ll pinpoint the accounts involved, use our rules of normal balances to figure out the debit and credit, and then build the final, balanced journal entry. This is the exact logic happening behind the scenes every time you categorize a transaction in your accounting software.

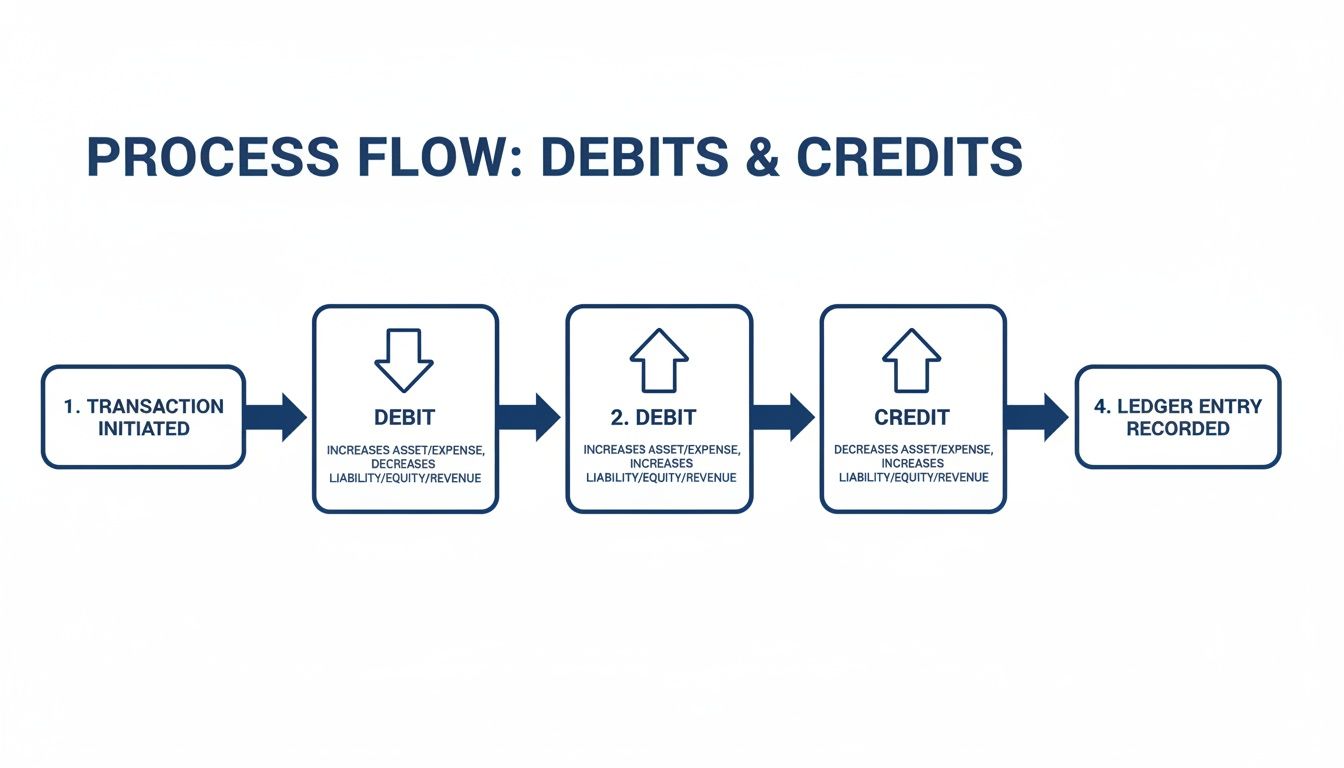

This flow chart helps visualize how every transaction is a two-sided story—a debit shows where the value is going, and a credit shows where it came from.

This just reinforces the core rule: for any transaction, your total debits must equal your total credits. It’s what keeps your financial records in perfect balance.

Example 1: Receiving a Client Payment

Let’s start with everyone’s favorite transaction: getting paid. Imagine you sent an invoice for $2,500 last month for a completed project. Today, that client pays you in full, and the money hits your business checking account.

Two accounts are in play here:

- Cash: An asset account (your bank balance).

- Accounts Receivable: Also an asset account, representing the money clients owe you.

Your cash went up because the client paid you. To increase an asset, you debit it. At the same time, the amount of money owed to you decreased. To decrease an asset, you credit it.

Here’s what the journal entry looks like:

| Account | Debit | Credit |

|---|---|---|

| Cash | $2,500 | |

| Accounts Receivable | $2,500 | |

| To record receipt of client payment |

See what happened? One asset (Cash) went up, while another (Accounts Receivable) went down. The total value of your assets didn’t change, and your books are perfectly balanced.

Example 2: Paying a Vendor Bill

Now for the flip side—money going out. Let’s say you get a $350 bill from your marketing consultant, and you pay it right away with your business debit card.

The two accounts involved are:

- Marketing Expense: An expense account.

- Cash: An asset account.

Your marketing costs have increased. To increase an expense account, you debit it. Since you paid with your debit card, your bank account balance decreased. To decrease an asset, you credit it.

The journal entry is straightforward:

| Account | Debit | Credit |

|---|---|---|

| Marketing Expense | $350 | |

| Cash | $350 | |

| To record payment for marketing services |

This entry correctly shows that you spent cash to run your business—a fundamental piece of the financial puzzle.

Example 3: Purchasing Equipment on Credit

Business is picking up, so you buy a new high-end printer for $1,200. You put it on the business credit card, which means you’ll pay the bill later.

This transaction affects two accounts:

- Equipment: An asset account for long-term items you own.

- Accounts Payable: A liability account for money you owe to others.

You’ve gained a new asset—the printer—so your Equipment account needs to increase. To increase an asset, you debit it. You’ve also taken on a new debt by using a credit card. To increase a liability, you credit it.

Key Takeaway: Don’t get tripped up by the language. An accounting “credit” is not the same as using a “credit card.” A credit card purchase actually increases your liabilities, which is recorded with an accounting credit.

Here’s how we structure that entry:

| Account | Debit | Credit |

|---|---|---|

| Equipment | $1,200 | |

| Accounts Payable | $1,200 | |

| To record purchase of office printer on credit |

Your assets went up by $1,200, but so did your liabilities. Everything stays in balance.

Example 4: Processing Employee Payroll

Paying your team is a bit more complex, but the same rules apply. Let’s say your one employee earned $1,500 in gross wages. We’ll keep it simple and ignore payroll taxes for this example. You run payroll, and the money gets sent to their bank account.

The main accounts we’re looking at are:

- Wages Expense: An expense account.

- Cash: An asset account.

The cost of labor increases your business expenses. To increase an expense, you debit Wages Expense. The payment lowers your bank balance, so you need to decrease your Cash account. To decrease an asset, you credit it.

The simple journal entry for this payroll run is:

| Account | Debit | Credit |

|---|---|---|

| Wages Expense | $1,500 | |

| Cash | $1,500 | |

| To record payroll for the period |

When you use a platform like Gusto or QuickBooks Payroll, this entry (plus more complicated ones for taxes) is created automatically. Now you know exactly what’s happening in the background.

Example 5: Taking an Owner’s Draw

Finally, it’s time to pay yourself! As the owner of an LLC or sole proprietorship, you take an owner’s draw. You transfer $3,000 from your business checking account to your personal one.

The two accounts involved here are:

- Owner’s Draw: An equity account that tracks your withdrawals.

- Cash: An asset account.

An owner’s draw reduces your total equity in the business. To decrease equity, you debit the Owner’s Draw account. The transfer also drains cash from the business. To decrease an asset, you credit the Cash account.

Here is the final journal entry:

| Account | Debit | Credit |

|---|---|---|

| Owner’s Draw | $3,000 | |

| Cash | $3,000 | |

| To record owner’s withdrawal of funds |

By working through these examples, you can start to see how the simple rules of debits and credits create a complete and logical financial story for every single thing that happens in your business.

Common Debit and Credit Mistakes to Avoid

Look, nobody gets debits and credits perfect right out of the gate. Every business owner I’ve ever worked with has hit a few bookkeeping bumps in the road, especially at the beginning. The secret isn’t about never making mistakes; it’s about knowing how to spot and fix them before they snowball.

Think of it this way: learning to troubleshoot your own books gives you a massive advantage. You gain confidence and a much deeper understanding of what’s really happening with your money. Let’s walk through some of the most common errors I see and how you can catch them.

Reversing Debits and Credits

This is, hands down, the most frequent slip-up. It’s as simple as putting the debit where the credit should be and vice-versa. For instance, when a client pays an invoice, you should debit your Cash account (because your cash, an asset, is increasing) and credit Accounts Receivable (because the amount owed to you, another asset, is decreasing).

If you accidentally credit Cash and debit Accounts Receivable, your books will tell a very wrong story. It will look like you just paid out cash and that the client now owes you even more money. These little reversals can quietly mess up your entire financial picture, making it seem like you have less cash and more unpaid invoices than you really do.

Transposition and Typographical Errors

You’d be surprised how often a simple typo can throw everything off. A transposition error is when you accidentally flip two numbers—typing $86 instead of $68. Another classic is a “slide error,” where the decimal point lands in the wrong spot (like entering $50.00 as $500.00).

These might feel like minor fat-finger mistakes, but they create imbalances that can take forever to hunt down. If your debits and credits just aren’t adding up, check for this first. A transaction that’s exactly half the amount of the discrepancy is a huge red flag—it’s the classic sign of a debit posted as a credit, which doubles the error.

Here’s a powerful troubleshooting trick: If your trial balance is off by an amount that’s perfectly divisible by 9, you almost certainly have a transposition error. This little mathematical quirk can save you hours of searching.

Using the Trial Balance as Your Detective

So, how do you actually find these errors? Your best friend here is the trial balance report. This is a standard report you can pull in any real accounting software like QuickBooks that simply lists the final debit or credit balance for every single one of your accounts.

The whole point of the trial balance is to prove one thing: your total debits equal your total credits.

- If the totals match, your books are “in balance.” This doesn’t mean every transaction is in the right account, but it does confirm your fundamental debit/credit equation is solid.

- If the totals don’t match, you know for a fact there’s a mistake somewhere. This report is your starting point for the investigation.

Get into the habit of running a trial balance regularly. It’s like a quick health check for your financials. By glancing at it often, you’ll catch imbalances right away and can focus your search on the most recent transactions to find the culprit.

Strategies for Finding and Fixing Mistakes

When your trial balance is off, don’t panic. Just work through it methodically.

Here are a few practical steps to take:

- Check for the Imbalance Amount: First, figure out the exact difference between your total debits and credits. Scan your recent transactions for that exact number. It’s possible it was only entered on one side of a journal entry.

- Look for Half the Imbalance: Divide the difference by two. Now, look for a transaction of that amount. This is the classic sign that a debit was mistakenly entered as a credit (or vice versa).

- Scan for Transpositions: If the difference is divisible by 9, you’re likely hunting for a transposition error. Go back through your recent entries and look for numbers with swapped digits.

- Review the Audit Log: Modern accounting software is a lifesaver here. Tools like QuickBooks have an audit log or transaction history that shows every single change made to your books. This lets you pinpoint exactly when and where an error popped up.

Your absolute best defense against errors is regularly reconciling your bank and credit card accounts. This process forces you to match your books against what the bank says, making it incredibly easy to spot missing transactions, duplicates, or wrong amounts before they get buried.

How Technology Transformed Bookkeeping

The core principles of double-entry bookkeeping haven’t changed in centuries, but how we use them has been completely flipped on its head by technology. For hundreds of years, bookkeeping meant hunching over dusty ledgers, doing painstaking calculations, and a whole lot of erasing. Every debit and credit was a physical entry, demanding incredible precision and even more patience.

This manual process was painfully slow and a magnet for human error. A single misplaced number could trigger hours—or even days—of manually combing through every single entry to find where things went wrong. The focus was almost entirely on the mechanics of getting the numbers down, not on what those numbers were actually telling you about the business.

From Punch Cards to The Cloud

The shift started slowly, then picked up serious speed as computers became more common. A huge milestone came in 1955 when General Electric bought the first-ever computer just for business accounting tasks like payroll. Later, the arrival of spreadsheet software like VisiCalc in 1978 gave accountants a revolutionary new way to manage debits and credits digitally, finally breaking free from paper ledgers.

This evolution paved the way for the cloud accounting platforms we rely on today. Tools like QuickBooks and Gusto now automate almost every part of the double-entry process behind the scenes.

Modern accounting software doesn’t eliminate the need for understanding debits and credits; it makes that knowledge more powerful. The software handles the tedious “how,” freeing you up to focus on the strategic “why.”

How Automation Simplifies Debits and Credits

Instead of sitting down to manually craft a journal entry for every single transaction, today’s software does the heavy lifting for you.

- Bank Feeds: When you connect your business bank and credit card accounts, the software pulls in all your transactions automatically. Your only job is to categorize them—the system creates the correct debit and credit entries in the background.

- Invoicing and Payments: When you create an invoice in QuickBooks, it automatically debits Accounts Receivable and credits Sales Revenue. Once the client pays, the system debits Cash and credits Accounts Receivable. All you have to do is click a few buttons.

- Payroll Processing: Platforms like Gusto handle all the complex calculations for wages, taxes, and deductions. They then generate the multi-line journal entries that would be an absolute nightmare to create by hand.

This level of automation drastically cuts down the risk of common mistakes like transposing numbers or reversing entries. For tasks like managing vendor payments, this has been a total game-changer. Looking into solutions for https://steingardfinancial.com/what-is-ap-automation/ shows just how much time you can get back. And to see how tech can transform other processes, you can check out resources on specialized time tracking software for accountants.

Ultimately, this all means you spend less time acting like a data entry clerk and more time being a strategic business owner. The technology ensures the books are balanced, giving you confidence in your data so you can use your financial reports to make smarter decisions for your company’s future.

Why Expert Guidance Still Matters in an Automated World

Accounting software is a fantastic tool, there’s no doubt about it. But it’s important to remember that it’s just that—a tool. It can automate the mechanics of double-entry bookkeeping, but it can’t craft a financial strategy.

While the software diligently records your debits and credits, it doesn’t know your business goals, your industry’s specific needs, or how to interpret what the numbers are really telling you about your company’s health. This is where human expertise becomes your most valuable asset.

Beyond Automation to True Financial Clarity

A skilled bookkeeper or CPA does so much more than data entry. They set up a customized chart of accounts that gives you meaningful insights, not just a jumble of generic categories. They ensure your financial foundation is rock-solid from day one.

Think of an expert as the interpreter for the language your business speaks through its finances. They translate raw data into actionable intelligence.

Here’s what that looks like in practice:

- Strategic Interpretation: An expert digs into your financial statements to identify trends, spot opportunities for cost savings, and flag potential cash flow issues before they become a full-blown crisis.

- Compliance and Confidence: They make sure you’re compliant with all the necessary regulations. This is absolutely critical for securing loans, getting through tax season without a headache, and making confident decisions about growth.

- Proactive Advice: A true professional partner helps you look forward, not just backward. They provide the strategic advice you need to scale your operations, manage payroll effectively, and build a more resilient company.

The real value isn’t just in having balanced books; it’s in understanding the story those balanced books tell about your business’s past, present, and future.

The need for this kind of professional guidance isn’t new. In fact, it has deep historical roots. The demand for certified public accountants (CPAs) skyrocketed in the early 1900s when the U.S. government first introduced the federal income tax. Suddenly, businesses needed expert help to navigate incredibly complex tax laws while keeping their debit and credit records perfect.

This historical shift shows why relying on qualified professionals is a standard business practice, not a luxury. You can find more insights about the history of professional accounting on Wikipedia.

Ultimately, the smartest move is to combine powerful technology with dedicated human expertise. This is how you achieve genuine peace of mind and a significant competitive advantage. Automation handles the tedious work, freeing up your financial partner to focus on what really matters—helping you build a more profitable and successful business.

Common Questions About Debits and Credits

Even after you start to get the hang of the rules, a few tricky questions always seem to pop up. It’s totally normal. Here are a few of the most common ones we hear from business owners who are just getting started.

Is a Debit Card a Debit in Accounting?

Nope, and this is probably the single biggest point of confusion for anyone new to bookkeeping. When you use your debit card, it reduces the cash in your bank account. Since cash is an asset, a decrease is always an accounting credit.

It helps to think about it from the bank’s perspective. When you swipe your card, the bank debits its liability to you (the money it owes you). But on your company’s books, you’re crediting your cash account to show that money has gone out the door.

Why Do My Debits and Credits Have to Balance?

The whole system of double-entry bookkeeping hangs on one simple, powerful idea: the accounting equation (Assets = Liabilities + Equity). For that equation to stay true, every single transaction has to have two equal, opposite effects.

If your debits and credits didn’t balance, it would be like trying to build a house on a crooked foundation. Your financial statements would be completely unreliable, giving you a distorted picture of your company’s health. It’s the ultimate self-checking system that makes sure every dollar is accounted for.

What if I Still Make a Mistake?

Don’t sweat it—mistakes are just part of the learning curve. The good news is that modern accounting software like QuickBooks Online has built-in safety nets that often won’t even let you save an entry that’s out of balance.

Pro Tip: The absolute best way to catch errors is to get in the habit of reconciling your bank and credit card accounts every month. This forces you to match your books against what the bank says, making it super easy to spot things like duplicate entries, missing transactions, or other simple slip-ups.

By reviewing your books consistently, you can fix these little issues before they snowball into big headaches.

Once you’ve moved past the basics of understanding debits and credits in accounting, you need a partner who can make sure your books are not just balanced, but actually giving you strategic insights. Steingard Financial offers expert bookkeeping and payroll services to give you total peace of mind and the financial clarity you need to grow. Learn how we can help your business thrive.