What Is a General Ledger? General Ledger, Explained

At its heart, the general ledger is the master financial record for your entire business. Think of it as the central hub where every single financial transaction—from a client payment to a software subscription—is logged and organized. It’s the ultimate source of truth for your company’s financial health.

Your Business’s Financial Command Center

If your business’s finances were a massive library, the general ledger would be its complete catalog. Each “book” in this library represents a specific financial category, like “Cash,” “Revenue,” or “Office Expenses.” The ledger meticulously tracks every book and every page within it, creating a detailed story of your company’s financial journey.

Every time money moves, the ledger records the event, ensuring nothing falls through the cracks. This complete record is what makes all other financial reporting possible. It provides the raw data needed to build essential reports like your Profit & Loss statement and Balance Sheet. Without an accurate general ledger, you’re essentially flying blind.

The Foundation of Financial Clarity

This concept is anything but new; it’s been a cornerstone of business survival and growth for centuries. For instance, back in the 18th century, English potter Josiah Wedgwood used detailed ledger analysis to get a real handle on his production costs. By tracking labor and materials for each item, he could make precise, informed decisions—a move that ultimately saved his business from failure and is now fundamental to modern accounting.

This organized system is built on a structured list of all your financial accounts. To see how these accounts are organized, it’s helpful to understand how a chart of accounts works as the ledger’s blueprint. By maintaining this central record, you gain the clarity needed to make confident, strategic decisions for your business’s future.

How Financial Data Flows Into Your Ledger

To really get a handle on the general ledger, you first need to see how your financial data actually gets there. Think of it as the central filing cabinet for your business finances. Every single daily transaction—sending an invoice, paying a vendor, or running payroll—starts as its own separate piece of paper.

This “paper,” known as a journal entry, is the initial record of a transaction, pulled from source documents like receipts or bills. Getting good at how to organize business receipts is the first step to making sure these entries are right from the very beginning.

Once a journal entry is created, it’s not just thrown into a pile. It’s carefully sorted and posted to the correct “file folder” in your general ledger. Each folder is a specific account—like Cash, Accounts Payable, or Service Revenue—giving you a neat, complete history for every part of your finances.

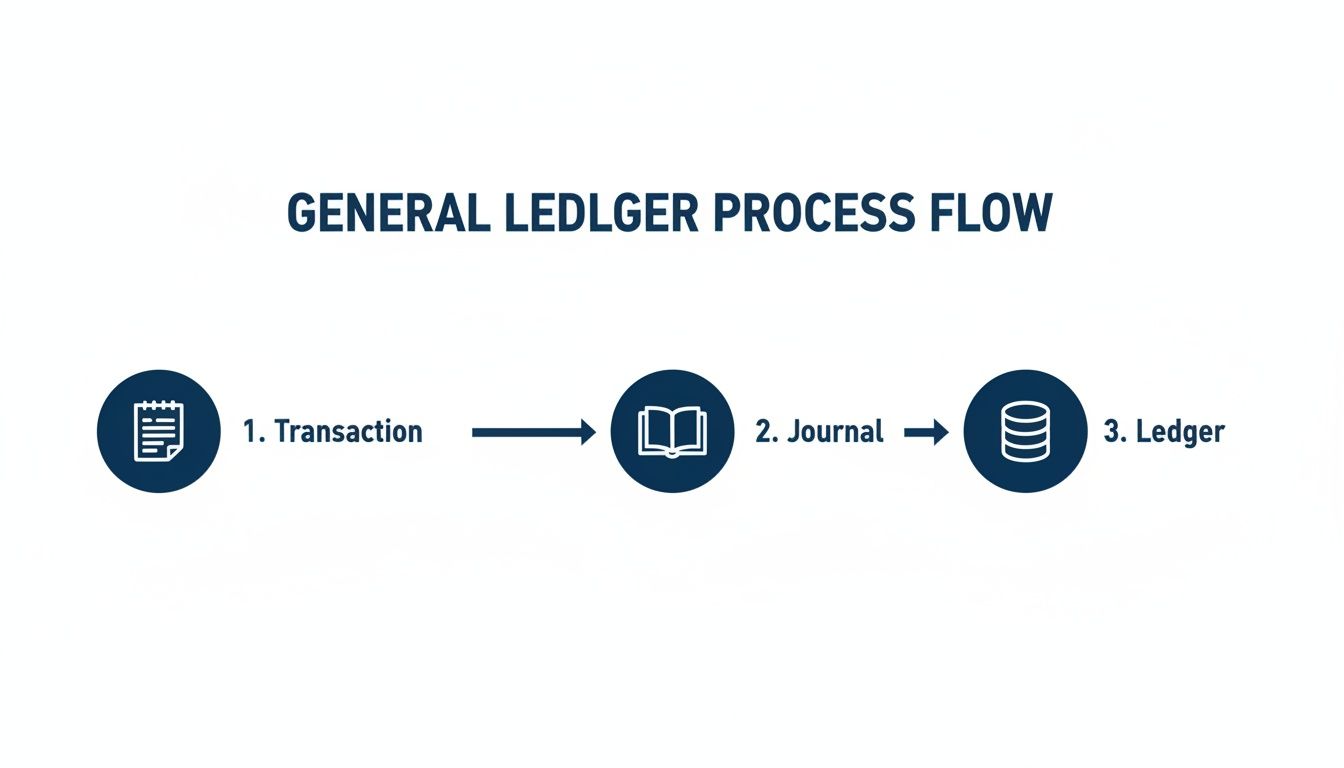

This flow turns the daily chaos of transactions into an organized, meaningful financial record. The path is always the same: a transaction happens, it’s recorded in a journal, and then it’s permanently filed away in the ledger.

This diagram shows that simple, essential journey. Each step brings more order to the data, creating a clear, traceable path for every dollar moving through your business.

The Double-Entry Foundation

This whole sorting process isn’t just random filing; it follows a very specific system called double-entry bookkeeping. The idea is that for every action, there’s an equal and opposite reaction. In accounting, this means every transaction affects at least two accounts. One account gets a debit, and another gets a credit.

The magic is that the total of the debits must always equal the total of the credits. This fundamental rule keeps your books balanced and accurate.

How do you check this balance? That’s where the trial balance comes in. It’s a report that lists the final balance of every single account in your ledger. Its entire job is to prove one thing: that all your debits equal all your credits. If they do, your books are mathematically correct.

Understanding this flow is crucial when you bring in outside data, like information from professional pay services. Every detail—from payroll expenses to tax withholdings—is captured in a journal entry and posted to the right accounts, ensuring every part of your business is reflected accurately in your financial master record.

Decoding the Language of Debits and Credits

The two words that cause the most confusion in bookkeeping are debit (often shortened to DR) and credit (CR). It’s easy to get tangled up here, so the best thing to do is forget any ideas you have about them meaning “good” or “bad.” In the accounting world, they are simply neutral terms for the two sides of every single transaction.

Think of your books like an old-fashioned balancing scale. Every time a financial event happens, you have to add equal weight to both sides to keep things perfectly level. This is the heart of the whole system, which you can read more about in our guide to double-entry bookkeeping explained.

The one unbreakable rule is this: every transaction has to touch at least two accounts. A debit in one account must be perfectly matched by an equal credit in another. No exceptions.

Debits and Credits in Action

To make this easier to picture, bookkeepers often use what’s called a “T-account.” Just imagine a big letter ‘T’ drawn on a piece of paper for each account you have. The account’s name sits on top, all debits are listed on the left side, and all credits go on the right. Simple as that.

Let’s walk through an example every service business owner sees: you receive a $1,000 payment from a client for an invoice they owed you. Here’s how that one event gets recorded:

- Cash Account: Your cash balance just went up. To show this increase, you debit the Cash account for $1,000.

- Accounts Receivable Account: The money your client owed you has gone down. To show this decrease, you credit the Accounts Receivable account for $1,000.

See how that works? The $1,000 debit to Cash is perfectly balanced by the $1,000 credit to Accounts Receivable. Your fundamental accounting equation (Assets = Liabilities + Equity) stays in complete harmony.

This constant balancing act is precisely what gives the general ledger its power. It creates a reliable, self-checking system that tracks every financial move your company makes. It catches errors and gives you a rock-solid foundation for all your financial reports. A transaction never happens in isolation—it’s always part of a balanced pair.

Putting the General Ledger into Practice

Theory is one thing, but seeing the general ledger in action is what really makes it click. Let’s walk through a few common scenarios for a service business to see how everyday activities get translated into the language of accounting.

Every single transaction, from sending an invoice to paying a bill, creates a journal entry. That entry is then “posted” to the specific accounts in your general ledger, meticulously tracking every dollar coming in and going out.

From Daily Business to Balanced Books

Let’s imagine you’re a consultant. You finish a project, send an invoice, and eventually, the client pays you. You also have your own bills to pay, like that monthly software subscription. Here’s how each of those steps hits your books.

Here’s a closer look at how these common business events are recorded, first as a journal entry and then how they affect the general ledger accounts.

Sample Transactions and Their General Ledger Impact

| Transaction | Journal Entry (Debit/Credit) | Impact on General Ledger Accounts |

|---|---|---|

| 1. Invoice Client for $5,000 | Debit Accounts Receivable $5,000 Credit Service Revenue $5,000 |

Accounts Receivable (Asset) goes up by $5,000. This is money you’re owed. Service Revenue (Equity) goes up by $5,000. You’ve officially earned this income. |

| 2. Receive Client’s Payment | Debit Cash $5,000 Credit Accounts Receivable $5,000 |

Cash (Asset) increases by $5,000 because the money is now in your bank. Accounts Receivable (Asset) decreases by $5,000 because the client no longer owes you. |

| 3. Pay Monthly Software Bill ($200) | Debit Software Expense $200 Credit Cash $200 |

Software Expense (Expense, which reduces Equity) increases by $200, showing a business cost. Cash (Asset) decreases by $200 because you paid the bill. |

Did you notice how in the second transaction, we didn’t touch the Revenue account again? That’s because you already recognized the income the moment you sent the invoice. The payment entry simply shows the movement of assets—from an IOU (Accounts Receivable) to actual cash in hand.

These simple, logical steps are what build the foundation of your financial story. The general ledger takes these individual transactions and organizes them into a detailed, balanced history that eventually becomes your financial statements.

Automating Your General Ledger with Modern Tools

Thankfully, the days of manually recording every single debit and credit are long gone. Modern accounting software, like QuickBooks Online, has completely changed the game. Think of it as a tireless bookkeeper working for you 24/7.

Every time you send an invoice, pay a bill, or log an expense, the software is working behind the scenes. It instantly creates the correct journal entry and posts it to the right accounts in your general ledger. This means your financial data is always up-to-the-minute, which is a massive relief compared to the old way of doing things.

Integrating Your Key Business Systems

This isn’t just about simple income and expenses, either. The real power comes from connecting all your business systems. For example, payroll platforms like Gusto can link directly to your accounting software, turning what used to be a complicated process into a set of clean, accurate ledger entries.

When you run payroll through an integrated system:

- Employee wages are automatically recorded as an expense.

- Payroll taxes are sent to the correct liability accounts.

- Any benefit contributions are documented properly.

This kind of integration ensures every moving part of your business is reflected accurately in your general ledger, all without you lifting a finger. The key is having a well-structured Chart of Accounts, which acts as the roadmap, telling every transaction exactly where it needs to go. This is how you build financial reports you can actually trust.

Ultimately, the goal is to build a financial system that’s efficient and resistant to human error. By exploring the right accounting automation solutions, you can bring a whole new level of accuracy and clarity to your business finances.

Turning Your Ledger From a Chore Into a Strategy

Knowing what a general ledger is and knowing what it can do for your business are two very different things. For many business owners, it’s just a necessary record-keeping task. For successful ones, it’s the financial command center for every major decision they make.

Think of it this way: your general ledger is the single source of truth that feeds your most important financial reports, like the Profit & Loss statement and the Balance Sheet. If the ledger is a mess, those reports are just wishful thinking. But when it’s accurate, you get the clarity you need to answer the tough questions with real confidence.

From Historical Data to Future Decisions

Can we actually afford to hire a new person? Is now the right time to buy that expensive piece of equipment? Should we add a new service line? The answers aren’t in your gut; they’re buried in the data of your general ledger.

A well-kept ledger transforms a pile of past transactions into a roadmap for the future. It gives you the financial intelligence to stop reacting to problems and start proactively building the business you want.

This is where professional bookkeeping really shows its value. It takes the tedious job of data entry and turns it into a powerful strategic asset. By making sure your ledger is always accurate and up-to-date, you create a solid foundation for growth. That frees you up to focus less on the books and more on running your company.

A Few Common Questions About the General Ledger

As you start to get a handle on the general ledger, a few questions almost always come up. Let’s walk through them to make sure you’re feeling confident about this core piece of your company’s financial records.

What Is the Difference Between a General Ledger and a Chart of Accounts?

This is a great question, and there’s a simple analogy that clears it up perfectly. Think of your Chart of Accounts as the table of contents for a book. It’s just a neat list of all the financial accounts your business uses—things like “Cash,” “Accounts Receivable,” or “Office Supplies.”

The General Ledger, on the other hand, is the book itself. It contains the full story, with all the detailed transaction history—every single debit and credit—for each of those accounts listed in your table of contents.

How Often Should I Review My General Ledger?

Even though modern accounting software updates your ledger in real-time with every transaction, a detailed, hands-on review should happen at least monthly.

This review is a critical part of your month-end close process. It’s your chance to reconcile accounts, hunt for any transactions that got put in the wrong category, and just generally make sure everything looks right. This regular check-up is what keeps your financial picture accurate and reliable.

What happens if you find a mistake? The proper accounting procedure is to make a correcting or adjusting journal entry. You should never just delete an incorrect entry, because that breaks the audit trail. A new, correcting entry clearly shows what was changed and why, keeping your records transparent.

A clean general ledger is the foundation for making smart business decisions. The team at Steingard Financial provides meticulous bookkeeping and reporting, ensuring your financial data is always accurate and reliable. Learn how we can help at https://www.steingardfinancial.com.