What Is Double Entry Accounting System A Simple Guide for Business

At its core, double-entry accounting is a simple but incredibly powerful idea: every single transaction a business makes touches at least two different accounts.

Think of it like a classic balance scale. For every action (like cash going out), there’s an equal and opposite reaction (like a new asset coming in). This fundamental principle is what keeps your financial records in perfect equilibrium, giving you a complete and trustworthy picture of your company’s health.

Why Every Transaction Has Two Sides

The double-entry system isn’t just a suggestion; it’s the gold standard for businesses of all sizes, and for good reason. It’s built on one foundational accounting equation that never changes: Assets = Liabilities + Equity. This isn’t just a guideline—it’s the unbreakable rule that governs your books and makes sure every dollar is accounted for.

Unlike the simpler single-entry method that just tracks cash in and cash out, this system tells a full story. It doesn’t just show that you have more cash; it explains exactly how you got it. Did you make a sale? Take out a loan? Or did an owner invest more money? Each of those sources tells a very different story about your business’s operations and financial stability.

Getting this level of detail is critical for a few key reasons:

- Accurate Financial Reporting: You simply can’t generate reliable reports like a balance sheet or an income statement without it.

- Catching Errors Fast: If your books don’t balance, the system instantly flags that something, somewhere, is wrong. It’s a built-in safety net.

- Making Smarter Decisions: When you understand the full context behind your numbers, you can make much better strategic plans for the future.

This robust framework is hardly a new invention. The double-entry system actually popped up in the bustling merchant cities of Italy way back in the late 13th century. It completely changed how businesses tracked their finances as global trade exploded. In fact, some of the earliest surviving records show Florentine merchants meticulously using this “Venetian method” as far back as 1299 to handle complex deals with an accuracy that was unheard of at the time. You can learn more about the early days of bookkeeping and its Italian roots over on Wikipedia.

By capturing both sides of every transaction, the double-entry system creates a self-checking mechanism that maintains the integrity of your financial data. It offers the peace of mind that your numbers are correct and dependable.

Getting Debits and Credits Right

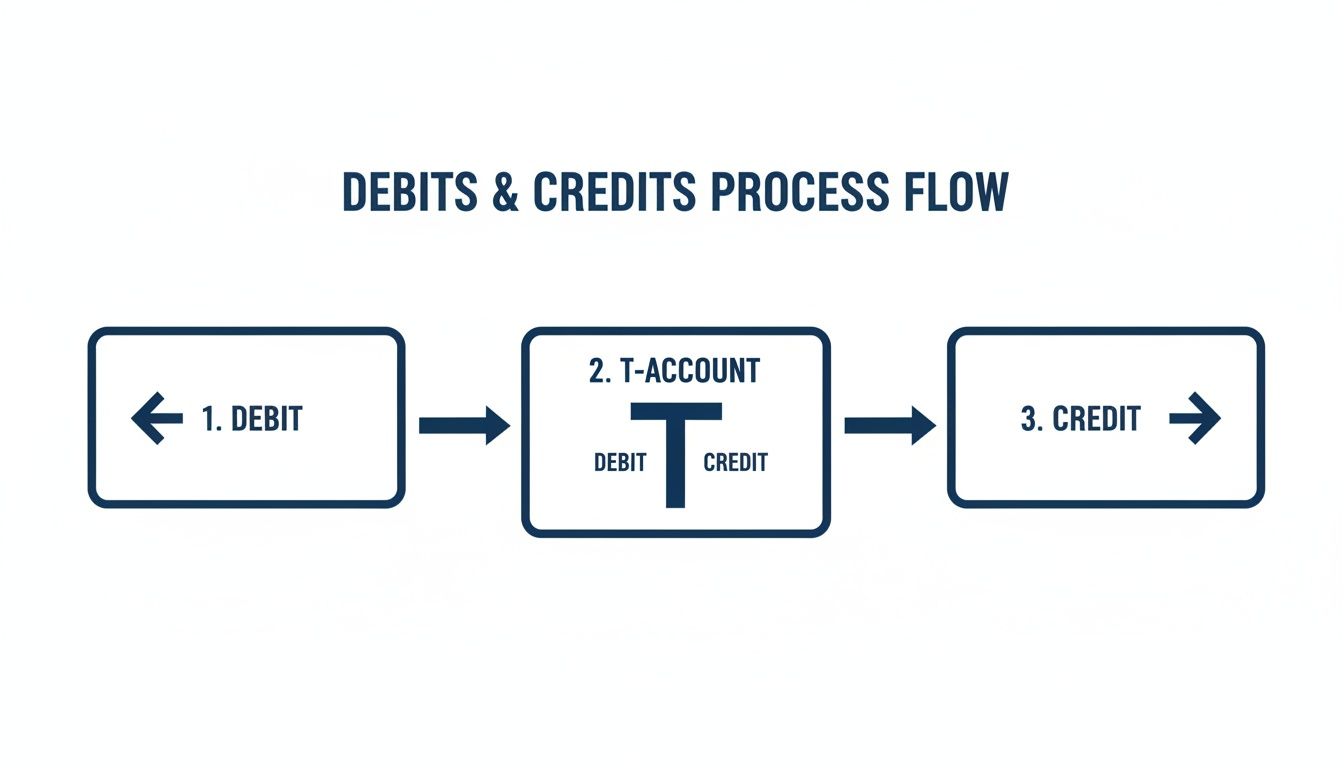

Let’s clear up the biggest source of confusion right away: debits and credits. If you’re new to this, your first instinct is probably to think of them as “good” or “bad.” A debit card takes money out, and a store credit adds money back, right? For accounting, you need to completely erase that idea.

Instead, let’s picture something simple: a T-account. It’s literally just a capital letter “T” that bookkeepers use to visualize where money is moving.

- A debit (or Dr. for short) is just an entry on the left side of that “T.”

- A credit (or Cr.) is an entry on the right side.

That’s it. That’s the whole definition. A debit isn’t inherently negative, and a credit isn’t inherently positive. Whether an entry increases or decreases an account balance depends entirely on the type of account we’re talking about. Getting this distinction down is the key to making everything else click.

The DEA LER Rule: Your Secret Weapon

To keep it all straight, bookkeepers and accountants have a handy little mnemonic device: DEA LER. This acronym neatly splits the main account types into two groups, and each group plays by its own set of rules.

First up is DEA. Accounts in this group go up with a debit (a left-side entry).

- Dividends (or Drawings for sole proprietors)

- Expenses

- Assets

When a transaction increases one of these accounts, you debit it. For example, when a client pays you and cash comes into your business, your Cash account (an asset) goes up. To show that, you’d debit the Cash account. It follows that a credit (a right-side entry) would decrease one of these accounts.

The other side of the coin is LER. These accounts are the opposite—they increase with a credit (a right-side entry).

- Liabilities

- Equity

- Revenue

So, when you make a sale and earn revenue, you credit your Sales Revenue account to show the increase. A debit (a left-side entry) would be used to decrease these accounts.

Remember: Debits are always on the left, and credits are always on the right. The non-negotiable rule of double-entry accounting is that for every single transaction, the total dollar amount of debits must perfectly equal the total dollar amount of credits. This is what keeps your books in balance.

Once you have this framework in your head, you can start to follow any transaction with confidence. You’ll see exactly how it fits into the bigger financial picture of your business. This foundation makes tracking real-world examples—like paying bills or receiving client payments—feel much more intuitive.

Seeing Double Entry Accounting in Action

Theory is one thing, but seeing double entry accounting work in the real world is what really makes it click. This is where the whole idea of debits and credits stops being an abstract rule and starts being a practical tool that tells the financial story of your business.

Let’s walk through a few common situations for a service business. You’ll see exactly how every action creates an equal and opposite reaction, keeping your books perfectly balanced every single time.

Example 1: Getting Paid in Cash

Imagine your business just finished a project and the client pays you $2,500 right into your bank account. Two accounts are immediately affected here: Cash (which is an asset) and Service Revenue (which is, you guessed it, revenue).

Since cash is an asset and you have more of it now, you debit the Cash account. At the same time, your revenue has gone up, and revenue accounts increase with a credit. So, you credit the Service Revenue account.

- Debit: Cash $2,500 (Increases an asset account)

- Credit: Service Revenue $2,500 (Increases a revenue account)

The journal entry shows that the total debits ($2,500) equal the total credits ($2,500). Just like that, the accounting equation stays in balance. Your assets went up, and your equity (through revenue) went up by the exact same amount.

Example 2: Paying the Monthly Office Rent

Now, let’s say it’s time to pay the $1,200 monthly office rent with your business debit card. The two accounts involved this time are Rent Expense (an expense) and Cash (an asset).

Your expenses have increased, and expense accounts always increase with a debit. At the same time, the cash in your bank account has gone down, and asset accounts decrease with a credit.

- Debit: Rent Expense $1,200 (Increases an expense account)

- Credit: Cash $1,200 (Decreases an asset account)

Once again, the debits and credits are a perfect match. Your expenses went up (which lowers your equity), and your assets went down by the same amount, keeping everything in harmony. This level of detail is exactly what you need to generate an accurate trial balance format.

This image gives you a simple visual of how debits on the left and credits on the right work within the classic T-account structure.

This process is the foundational strength of the whole system, making sure every transaction is captured with those equal and opposite entries.

Example 3: Buying a New Computer on Credit

For our last example, let’s say you buy a new office computer for $1,800 using the business credit card. This transaction involves Office Equipment (an asset) and Credit Card Payable (a liability).

You’ve gained a new asset, so you debit the Office Equipment account to show that increase. But you didn’t pay with cash—you created a debt. That means your liabilities have also increased, and liability accounts increase with a credit.

- Debit: Office Equipment $1,800 (Increases an asset account)

- Credit: Credit Card Payable $1,800 (Increases a liability account)

In this case, your assets went up, and your liabilities went up by the same $1,800. The equation balances perfectly. It’s this beautiful, logical system that keeps your financial picture clear and accurate.

The Real World Benefits for Your Business

Knowing the mechanics is one thing, but the real question is, why should you care? Adopting double-entry accounting isn’t just about following the rules; it’s a strategic move that gives your business a serious competitive edge. It turns bookkeeping from a tedious chore into a powerful tool for growth and stability.

The most immediate benefit is accuracy you can count on. The system’s self-balancing nature—where every debit must have an equal and opposite credit—acts as a built-in error checker. If a number is keyed in wrong or a transaction is missed, the books simply won’t balance. This structure makes it incredibly hard for mistakes to slip through the cracks, giving you confidence that your financial data is solid.

Gaining a Complete Financial Picture

A double-entry system gives you so much more than just a peek at your cash flow. It provides a full, 360-degree view of your company’s financial health by carefully tracking your assets, liabilities, and owner’s equity. This level of clarity is absolutely essential for making smart, strategic decisions.

Instead of just knowing how much cash is in the bank, you’ll also understand:

- What you own (Assets): Everything from your work computer to the cash in your business account.

- What you owe (Liabilities): Things like credit card balances, vendor bills, and business loans.

- The net worth of your business (Equity): The true value you’ve built over time.

This complete picture is the bedrock of real financial intelligence. While this system was famously documented in 14th-century Italy, its core ideas are even older. Some historians believe an early form was developed around 800 AD by the mathematician al-Khwarizmi to solve complex inheritance laws, which required a system of equal debits and credits long before it reached European merchants.

Streamlining Reporting and Building Trust

Finally, this system is built to make financial reporting almost effortless. It organizes your data perfectly so you can generate crucial reports—like the Income Statement and Balance Sheet—with just a few clicks in modern accounting software. When your books are set up right, learning how to read a balance sheet becomes a simple, empowering task.

This streamlined reporting is a game-changer. When it’s time for tax season, loan applications, or meetings with potential investors, you’ll have accurate, professional-grade statements ready to go.

This reliability builds trust not just with outsiders like banks and investors, but also gives you—the business owner—profound peace of mind. To get the most out of a double-entry system and ensure your records are always spot-on, many businesses turn to professional support, like virtual assistant bookkeeping services.

Ultimately, having dependable financial data means you can stop worrying about the numbers and focus on what you do best: leading your business forward with confidence.

Using Modern Tools to Automate Double Entry

The good news is you don’t need a dusty ledger and quill pen to manage your books. Modern accounting software has completely changed the game, automating the core mechanics of the double-entry accounting system and making it accessible to everyone.

Tools like QuickBooks handle the complex debit and credit entries for you behind the scenes. When you categorize a payment from a client or record a business expense, the software automatically creates the corresponding journal entry, making sure your books always stay in balance. You don’t have to manually think about T-accounts at all.

This automation is incredibly powerful, but it comes with one major condition: it’s only as good as the initial setup. The software needs a clear set of instructions to work correctly, and that’s where your Chart of Accounts comes in.

Why Your Chart of Accounts Is Crucial

Think of the Chart of Accounts as the blueprint for your company’s entire financial structure. It’s a complete list of every single account in your general ledger, neatly organized by type: assets, liabilities, equity, revenue, and expenses. A well-structured Chart of Accounts essentially acts as a GPS for your money.

When it’s set up correctly, the software knows exactly where to route every transaction. For instance, it understands that a payment for your website hosting is a “Software & Subscriptions” expense, not an “Office Supplies” expense. This precision is what transforms raw data into reliable financial intelligence.

A poorly configured Chart of Accounts is one of the most common—and costly—mistakes business owners make. It leads to miscategorized transactions, inaccurate reports, and a messy cleanup project down the road.

This foundational setup is the key to unlocking the true power of automation. For businesses looking to significantly reduce manual effort, understanding how to automate invoice processing is another crucial step. It helps ensure that revenue data flows into your system accurately right from the start.

Ultimately, automation doesn’t replace the principles of the double-entry accounting system; it just executes them for you flawlessly and instantly. With a professional setup, you gain confidence that every report you pull is accurate. This accuracy is also vital for routine financial health checks; our guide on how to reconcile bank accounts shows how this process builds on a well-organized system.

Common Questions About Double Entry Accounting

As a business owner, you have a lot on your plate, and figuring out the best way to manage your finances is a big one. The double-entry system is the gold standard in accounting, but it definitely brings up some questions. Let’s walk through the most common ones so you can feel confident about the right path for your company.

Think of this as a quick-start guide to clear up any confusion about your company’s financial future and long-term stability.

Do I Really Need This for My Small Business?

Honestly, it depends on your goals. If you have a simple side hustle with just a handful of cash sales, a single-entry ledger might get you by for a little while. But the second your business gets more complex—we’re talking loans, multiple clients, inventory, or employees—double-entry becomes non-negotiable.

It’s the only way to generate the official financial statements, like a Balance Sheet and an Income Statement, that lenders, investors, and even the IRS are going to ask for. If you have any plans to grow, you need to start with double-entry. It builds the solid financial foundation required to scale your operations and secure funding down the road.

Can I Do Double Entry Bookkeeping Myself?

You absolutely can. Modern accounting software like QuickBooks has made the day-to-day process much more accessible. You don’t need to be a CPA just to categorize your transactions.

That said, there’s a real learning curve, and the biggest risk for DIY bookkeeping is getting the initial setup wrong. Miscategorizing expenses is one thing, but a poorly structured Chart of Accounts can cause serious problems.

A common mistake we see is an improperly set up Chart of Accounts. This leads to financial reports that are basically useless and often requires a costly cleanup project to fix everything. Getting a professional to handle the setup ensures you start on solid ground and avoid those headaches.

A little expert help at the beginning can save you a massive amount of time and money later on. It’s all about making sure your system is built on a reliable framework from day one.

How Does This System Help with Getting a Loan?

When you go to a bank for a business loan, they need to see a complete and credible picture of your company’s financial health. They aren’t just looking at your bank balance; they’re trying to assess your stability and your ability to actually repay the debt.

To do that, they will always ask for a few key reports:

- Balance Sheet: This shows them what you own (assets) and what you owe (liabilities).

- Income Statement: This details how profitable your business has been over a certain period.

These reports can only be reliably generated from a properly maintained double-entry accounting system. It’s the ticket to entry for securing business financing and proving your company is a solid investment.

Ready to build a financial foundation you can trust? The team of CPAs and experienced bookkeepers at Steingard Financial specializes in setting up and managing double-entry bookkeeping for service businesses. We ensure your data is accurate, your reporting is timely, and you have the clarity to make confident decisions. Learn more about our bookkeeping and payroll services.