Mastering the Accrual to Cash Adjustment for Service Firms

An accrual to cash adjustment is the process of converting your financial records from accrual-basis accounting over to a cash basis, or the other way around. It's a key reconciliation that ensures your financial reports show what you really need them to show—either your true profitability (accrual) or your actual cash position (cash).

Why Cash Flow Alone Can Mislead Your Business

The money sitting in your bank account doesn't tell the whole story of your company's financial health. Relying solely on cash flow is like driving while only looking in the rearview mirror—it shows you where you've been, but not where you're headed. This is where understanding the accrual to cash adjustment becomes a game-changer for service business owners.

Cash-basis accounting is simple: it records revenue when you get paid and expenses when you pay a bill. Accrual-basis accounting, on the other hand, gives you a much better dashboard for looking ahead. It recognizes revenue when you've earned it and expenses when you've incurred them, no matter when the cash actually moves.

A Real-World Scenario

Let's look at a marketing agency that signs a client for a three-month project. The team works hard for two full months, paying salaries and software costs along the way, but they don't send the invoice until the project wraps up at the end of the third month.

- On a cash basis: The agency's books would show a big loss for the first two months. Then, in month three when the check clears, they’d see a massive spike in profit.

- On an accrual basis: The revenue from that project would be spread out proportionally over the three months, properly matching the expenses incurred each month to earn it.

That cash-flow rollercoaster gives a wildly misleading picture of the agency's performance. It makes it nearly impossible to make smart decisions about hiring new staff, increasing marketing spend, or planning for growth. To get a better handle on this, you can explore the fundamental difference between cash basis and accrual basis accounting.

Accrual vs Cash Basis At a Glance

To quickly see the differences, this table breaks down the core concepts of each accounting method. Understanding this is the first step to knowing when an adjustment is needed.

| Aspect | Cash-Basis Accounting | Accrual-Basis Accounting |

|---|---|---|

| Revenue Recognition | Recorded when cash is received from customers. | Recorded when revenue is earned, regardless of payment. |

| Expense Recognition | Recorded when cash is paid for expenses. | Recorded when an expense is incurred, regardless of payment. |

| Complexity | Simpler and easier to maintain. | More complex; requires tracking receivables and payables. |

| Financial Picture | Shows the immediate cash position. | Provides a more accurate view of long-term profitability. |

| Best For | Very small businesses or sole proprietors with simple transactions. | Most businesses, especially those with inventory or credit transactions. |

This comparison highlights why many businesses run their day-to-day operations on an accrual basis but might need to adjust to a cash basis for specific reporting, like for certain tax situations.

The core purpose of an accrual to cash adjustment is to bridge the gap between economic reality and cash transactions. It translates your company's performance into the language that lenders, investors, and even tax authorities require.

Ultimately, performing this adjustment isn't just some tedious accounting task. It's a vital strategy for getting true clarity on your finances. To see how this works in practice, reviewing an accounting reconciliation example can be incredibly helpful. It empowers you to see your business’s true profitability, month by month, giving you the stability and foresight needed to steer your company with confidence.

When Does Your Service Business Need This Adjustment?

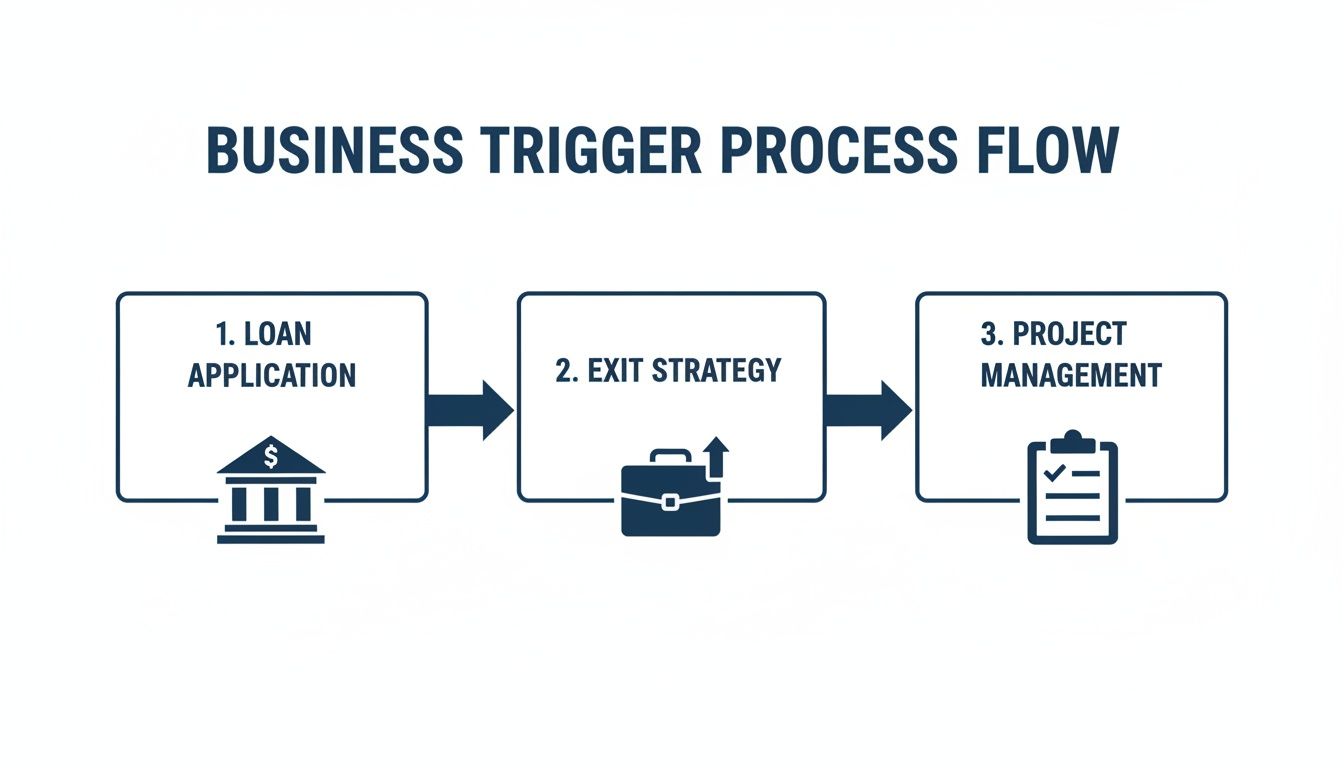

For many service businesses, the need for an accrual to cash adjustment isn't obvious until it’s staring you in the face. Most of the time, specific growth milestones or big strategic moves are what force the issue, turning this accounting task from a "maybe someday" into a "we need this now."

Think about it. When you're a one-person consultancy, tracking cash in and cash out is simple and effective. It works. But the moment you walk into a bank to apply for a serious loan or line of credit, the rules change completely.

Lenders want to see financial statements prepared under Generally Accepted Accounting Principles (GAAP), and that means accrual-basis accounting. They aren’t just looking at your current bank balance. They want to see a predictable, stable picture of your revenue and expenses to feel confident you can make payments down the line. A cash-basis report that shows big income spikes followed by droughts looks risky, even if your business is perfectly healthy.

Getting Ready for an Exit or Investment

Another huge trigger is planning for the future, whether you’re looking to bring on investors or sell the business. Buyers and investors are interested in your future earning potential, not just what you did last quarter. They need to see clear trends to forecast performance.

Accrual accounting gives them that clarity by showing:

- Steady Revenue Streams: It properly accounts for things like annual retainers, spreading the income over the time you’re actually doing the work.

- True Project Profitability: It lines up the expenses of a project with the revenue it generates in the same period, giving a real look at your margins.

- Overall Financial Health: It brings hidden liabilities (like deferred revenue) and assets (like accounts receivable) to light that cash-basis accounting completely ignores.

Without this adjusted view, your business could be seriously undervalued because its financial performance looks choppy and unpredictable.

Getting a Clear View of Your Monthly Operations

Even without a big loan or sale on the horizon, the need for accrual adjustments often comes from simple day-to-day management.

Imagine your software agency pays $12,000 for an annual software license in January. On a cash basis, your books make January look like a financial disaster. With an accrual adjustment, you properly recognize that cost at $1,000 per month. Suddenly, you have a much more accurate monthly profit and loss (P&L) statement.

This is critical for making smart business decisions. It helps you price your services correctly, understand the true cost of delivering a project, and manage your monthly budget without guesswork. The same logic applies when a client pays you for a six-month retainer upfront; the cash lands in one month, but you earn that revenue over the next six.

This adjustment moves you from just watching your bank account to truly understanding your business's profitability. It’s the difference between reacting to financial surprises and proactively managing your company.

The relationship between accruals and cash flow has also changed over the years. Decades ago, accruals were a great predictor of future cash flow. But that link has weakened. Research has shown that the power of accruals to smooth out cash fluctuations has dropped from around 70% in the 1960s to less than 10% today. For a modern B2B service business, this means a proper accrual adjustment requires more than just a formula; it requires a careful look at your data, especially in high-risk areas like revenue recognition. You can explore more about this financial evolution and how it impacts service firms.

A Practical Walkthrough of Key Journal Entries

This is where the rubber meets the road—turning accounting theory into real entries in your general ledger. The accrual-to-cash adjustment process comes alive through these specific journal entries.

But before you start adding new adjustments, there's a critical first step: dealing with last month's entries.

Every month-end close should begin with reversing the prior period's accruals. This isn't optional. Skipping this is one of the most common ways businesses accidentally double-count expenses or revenue, completely throwing off their financial reports. Reversing entries essentially hit the reset button, making sure that when cash finally changes hands, the transaction isn't counted a second time on top of the accrual you already recorded.

And remember, every entry we're about to make follows the rules of the double-entry bookkeeping system. For every debit, there's an equal and opposite credit. It's what keeps the whole system in balance.

Adjusting for Accrued Revenue

Accrued revenue is simply income you've earned but haven't invoiced for yet. This happens all the time in service businesses, especially when projects stretch across multiple weeks or months.

Let's say your consulting firm did $5,000 of work for a client during the last week of March, but you won't send the invoice until April 5th. If you do nothing, your March income statement will be short by $5,000, making the month look less profitable than it actually was.

To fix this, you’ll create an adjusting journal entry at the end of March:

| Account | Debit | Credit |

|---|---|---|

| Accounts Receivable | $5,000 | |

| Service Revenue | $5,000 |

To record revenue earned but not yet invoiced

This entry correctly boosts your March revenue and adds to your Accounts Receivable, showing that a cash payment is on its way.

Recording Accrued Expenses

Accrued expenses are the other side of the coin. These are costs your business has incurred, but you haven't received the bill or paid for them yet.

Imagine you hired a freelance designer who completed $1,500 of work in March. They finished on the 30th, but their invoice won't arrive until mid-April. Without an adjustment, your March expenses will be too low, making your profit look artificially high.

Here’s the adjusting entry you'd make at the end of March:

| Account | Debit | Credit |

|---|---|---|

| Design Expense | $1,500 | |

| Accrued Expenses (Liability) | $1,500 |

To record design services incurred but not yet paid

This ensures the expense is counted in March when the service actually happened, matching it against the revenue it helped you earn.

Handling Deferred Revenue

Deferred revenue (sometimes called unearned revenue) is when a client pays you before you've done the work. The cash is in the bank, but from an accounting perspective, you haven't earned it yet. It’s a liability, not revenue.

Let's say a client pays your marketing agency a $12,000 annual retainer on January 1st for a full year of service. You can't just book all $12,000 as revenue in January. You have to earn it, month by month.

At the end of each month, you'll make an adjusting entry to recognize one-twelfth of that retainer. The entry for January would be:

| Account | Debit | Credit |

|---|---|---|

| Unearned Revenue (Liability) | $1,000 | |

| Service Revenue | $1,000 |

To recognize one month of earned retainer revenue

This is the proper way to spread that income out over the service period. You can find more complex examples of adjusting entries for other scenarios to see how this works in different situations.

As you can see, these kinds of adjustments are absolutely critical when you're seeking a loan or planning to sell your business. Banks and buyers need to see a true picture of your financial performance.

Accounting for Prepaid Expenses

Prepaid expenses are the opposite of accrued expenses. This is when you pay for something up front that your business will use over time. Business insurance is a classic example.

Suppose you pay $6,000 on July 1st for a 12-month liability insurance policy. That payment doesn't just benefit you in July; it covers you for a full year. The initial payment creates an asset on your books called "Prepaid Insurance."

Each month, you have to "expense" a portion of that asset. Since the policy covers 12 months, the monthly cost is $500 ($6,000 / 12). At the end of July, you'd make this adjusting entry:

| Account | Debit | Credit |

|---|---|---|

| Insurance Expense | $500 | |

| Prepaid Insurance | $500 |

To recognize one month of insurance expense

This entry moves $500 from your asset account (Prepaid Insurance) to your expense account, reflecting that you've "used up" one month of the coverage you paid for.

Applying Your Adjustments in QuickBooks

Knowing the theory behind an accrual to cash adjustment is great, but what really counts is making it happen inside the accounting software you use every day. For the millions of businesses running on QuickBooks, the process is refreshingly straightforward once you know where to click. It all boils down to a simple journal entry.

Our goal here is to translate the debits and credits from our examples into a language QuickBooks understands. Getting this right ensures your financial reports are dead-on accurate, reflecting the true performance of your business. Let's walk through how it's done.

Creating Your First Adjusting Journal Entry

First things first, you'll need to head to the manual entries section in QuickBooks Online. This gives you complete control over how the transaction is recorded.

- Find and click the + New button, which is usually in the top-left corner of your dashboard.

- Look under the "Other" column and select Journal Entry. This brings up a fresh screen where you can build your adjustment.

- Set the date for the adjustment. If you're closing out a month, this will almost always be the last day of that month (like March 31, for example).

- Now, fill in the grid with the accounts, debits, and credits for whatever you're adjusting—accrued revenue, prepaid expenses, you name it.

- Don't skip the "Description" field. This is non-negotiable for clean bookkeeping. A note like "To accrue March 2024 design services revenue" gives crucial context for you or your accountant down the road.

- Once you're happy with it, click Save and close.

That's it. The entry immediately hits your general ledger and will be reflected in your Profit & Loss and Balance Sheet. A clean journal entry is a cornerstone of good financial hygiene and is a key part of how to properly reconcile your bank accounts.

Pro Tip: Your Chart of Accounts is the backbone of your financials. Before you start making entries, double-check that you have the right accounts set up. You’ll need specific accounts like "Prepaid Insurance" (Asset) and "Unearned Revenue" or "Accrued Expenses" (Liabilities) to categorize these adjustments correctly.

Streamlining Your Workflow with Recurring Entries

Many of these adjustments are predictable. Think about it: you pay the same insurance premium annually, recognize the same monthly retainer fee, or amortize an asset on a fixed schedule. Manually plugging in the same journal entry month after month is a classic time-waster.

This is exactly where QuickBooks’ recurring transaction feature becomes a lifesaver.

Instead of starting from scratch every time, just find an adjustment you already made. At the bottom of that Journal Entry screen, you'll see a button that says Make recurring. Clicking this lets you put the entire process on autopilot.

You can schedule the entry to repeat:

- Monthly on a set day.

- Automatically, so you don’t even have to click "approve."

- With a reminder, if you'd rather give it a quick once-over before it posts.

For something like a 12-month prepaid expense, you can literally set it to recur 11 more times and then stop on its own. This "set it and forget it" method massively cuts down on human error and frees you up to analyze the numbers, not just type them in.

Gaining Deeper Insights with Classes and Locations

Standard reports give you the 30,000-foot view, but what if you need to know if your "Web Design" services are more profitable than "SEO Consulting"? This is where Classes come into play.

QuickBooks Online lets you assign a "Class" to each line of a transaction, journal entries included. By creating Classes for different departments, service lines, or even business locations, you can run a Profit & Loss report by Class.

This is huge. When making an accrual adjustment, you can tag the revenue or expense to its specific class. For instance, when you accrue $5,000 in revenue, you can tag it to the "Web Design" class. Suddenly, you have a much clearer, more granular picture of your profitability, which helps you make smarter decisions about where to invest your time and money. It turns a simple bookkeeping chore into a powerful business intelligence tool.

Understanding Tax Rules and Reporting Standards

Making an accrual-to-cash adjustment isn’t just an internal cleanup task. It has real-world consequences for how you report your finances to the IRS and potential investors. Getting this wrong can lead to some painful tax penalties or even get your loan application tossed in the reject pile.

For years, the U.S. tax code has been pretty friendly to cash-basis accounting, especially for smaller businesses, because it's just simpler. But as your company grows, the IRS eventually puts its foot down and requires a switch to the accrual method. This isn't a friendly suggestion—it's a mandate tied directly to your revenue.

This isn't a new development. While recent proposals have tossed around a $10 million average gross receipts threshold, the standard used to be much lower. The Tax Reform Act of 1986 set a $5 million threshold that stayed put for decades without any adjustment for inflation. This forced a lot of growing service businesses into a messy and expensive accounting transition. You can discover more about the history of these tax policies to see how they've evolved.

The Mandatory Switch to Accrual for Tax Purposes

Once your business blows past the IRS gross receipts threshold (which is now thankfully much higher and adjusted for inflation), you’re on the hook to switch to accrual accounting for your tax returns. This is a formal change, and it means filing Form 3115, Application for Change in Accounting Method, with the IRS.

It’s more than just paperwork. The switch kicks off a one-time tax adjustment called the Section 481(a) adjustment. This calculation figures out the total difference between your lifetime taxable income under cash versus accrual, making sure no income or expenses get double-counted or missed in the shuffle. The tax hit can be substantial, but the IRS often lets you spread the adjustment over a few years to ease the financial pain.

This transition is a major turning point for any growing business. It’s a sign that you’re moving from simple cash-in, cash-out management to more disciplined financial reporting that stands up to federal tax law.

Aligning Your Books with Formal Reporting Standards

Taxes aside, your accounting method has a huge impact on your ability to get funding or attract buyers. Lenders, VCs, and potential acquirers all want to see financial statements prepared according to Generally Accepted Accounting Principles (GAAP). And for any U.S. company, GAAP means accrual-basis accounting.

So, why are they so insistent? Because accrual-basis reports paint a far more accurate and stable picture of a company’s financial reality.

- Balance Sheet Integrity: Adjustments for things like prepaid expenses and deferred revenue add assets and liabilities to your balance sheet that cash accounting completely ignores. This gives everyone a full picture of what you own and what you owe.

- Income Statement Accuracy: By matching revenues with the expenses it took to earn them, your income statement reflects true profitability month over month. You get rid of the wild swings caused by the timing of when cash actually hits your bank account.

This level of consistency is non-negotiable for anyone doing serious due diligence. They need to see predictable trends and a stable financial footing to properly assess risk and value your company. A clean set of accrual-based financials shows you're professional, you have solid controls in place, and you’re ready to close the deal.

Staying Out of Trouble: Common Mistakes and Smart Controls

Getting the accrual-to-cash adjustment cycle right takes a bit of discipline. I’ve seen it time and time again—small, seemingly harmless mistakes can snowball into some pretty significant reporting headaches down the line.

The most common tripwire? Forgetting to reverse last month's accruals. It’s an easy mistake to make when you’re busy, but it leads directly to double-counting expenses or revenue, completely throwing off your numbers. Another classic is applying the matching principle inconsistently. Maybe you’re great at accruing for big contractor invoices but let the smaller, recurring software fees slide. These little oversights mess with your monthly profit figures and make it tough to see what’s really going on.

It usually isn't a lack of knowledge that causes these issues; it’s the absence of a simple, repeatable process.

The point of internal controls isn't to create more paperwork. It's to build a financial system you can trust—one that gives you reliable data without a ton of manual gymnastics every month. A simple checklist is often your best friend here.

Building a Bulletproof Financial System

Instead of constantly putting out fires, you can build a few simple habits into your financial routine. These practices protect the integrity of your data and make your business much easier to manage, not to mention ready for any audit that might come your way.

- Create a Month-End Close Checklist: Don't rely on memory. Make a simple, step-by-step list that covers every adjustment you need to make, from accruing unpaid vendor bills to recognizing prepaid expenses.

- Document Every Journal Entry: Insist on a clear, plain-English description for every single journal entry. A note like, "Accrue March revenue for Project X" is infinitely more helpful six months from now than a blank description field.

- Reconcile Your Balance Sheet Monthly: Make it a non-negotiable task to reconcile key accounts like Accounts Receivable and Accrued Liabilities every single month. This is how you catch errors and confirm your adjusting entries are doing their job.

Skipping these steps can be seriously misleading, especially when the market gets a little shaky. In some industries, the gap between cash and accrual income has inflated a company's financial health by as much as 20-30% during tough years. That's the kind of bad data that leads to poorly timed expansion plans. For any service business, this just goes to show that meticulous adjustments aren't just a tax-time chore; they're critical for making sound decisions all year long. You can read more on why accrual-adjusted information is so valuable if you want to dig deeper.

Common Questions About Accrual Adjustments

Even when you feel like you have a handle on the process, a few specific questions always seem to pop up. Let's tackle some of the most common ones I hear from clients.

How Often Should I Be Making These Adjustments?

For the most accurate picture of your finances, you really should be performing accrual adjustments every month. Think of it as a key part of your month-end close process. This discipline ensures your financial statements are a true reflection of how your business is actually doing, letting you make smart decisions based on real data, not guesswork.

While a very small, simple business might get by with quarterly adjustments, a monthly rhythm is the only way to go for any growing service business. If you need a reliable, up-to-date look at your profitability, monthly is a must.

Can I Keep My Books on Accrual but File Taxes on a Cash Basis?

Yes, you absolutely can. This is a very common and perfectly legitimate strategy for many businesses. You maintain your day-to-day books on an accrual basis for the clear performance insights it provides, and then convert everything to a cash basis when it's time to file your taxes (as long as you meet the IRS requirements, of course).

This hybrid approach gives you the best of both worlds: the operational clarity you get from accrual accounting and the potential tax simplicity of the cash method. It just requires careful, diligent record-keeping to track the differences between the two methods.

What’s the Real Difference Between an Accrual and a Deferral?

It's easy to get these two mixed up, but they're essentially opposites. Both are all about timing, which is the key to getting your accrual-to-cash adjustment right.

- An accrual is when you recognize revenue or an expense before any cash has actually moved. A perfect example is recording income for consulting work you finished this month but won't get paid for until next month.

- A deferral is the reverse—you recognize revenue or an expense after the cash has already been exchanged. For instance, a client pays you for a full year of service upfront, but you only recognize one month's worth of that revenue each month.

An accrual recognizes a transaction before the cash moves, while a deferral recognizes it after the cash has already moved. Both are essential timing adjustments.

At Steingard Financial, we transform complex bookkeeping into a clear, reliable system that powers your decisions. If you're tired of messy financials and ready for accurate, timely reporting, we can help. Schedule a consultation with Steingard Financial today to build a scalable back office you can depend on.