Accounting Chart of Accounts Definition for Service Firms

Ever wonder how your accountant turns a shoebox full of receipts into clean, professional financial reports? The magic isn’t in some complicated formula; it’s in a foundational tool called the Chart of Accounts (COA).

Simply put, a COA is a complete list of every account in your business’s general ledger, all neatly organized by type. Think of it as the financial filing system for your entire business, where every single dollar has a specific home.

What Is a Chart of Accounts

Imagine trying to run a library without the Dewey Decimal System. Books—your financial transactions—would just be piled up randomly. Finding anything specific would be a chaotic, time-consuming nightmare.

Your Chart of Accounts is that essential cataloging system. It’s more than just a list; it’s the architectural blueprint that organizes every transaction your business makes. Each time you send an invoice, pay a vendor, or buy software, that event gets categorized and placed into a specific account on your COA. This structure is what transforms a messy pile of bank statements into clear, actionable financial reports.

The 5 Core Pillars of a Chart of Accounts

At its heart, every COA is built on five fundamental account types. Getting a handle on these pillars is the first real step to understanding how your business finances actually work. Everything—from the cash in your bank to the cost of your morning coffee run for the team—fits into one of these buckets.

The table below breaks down these five core pillars with some simple examples.

The 5 Core Pillars of a Chart of Accounts

| Account Type | What It Represents | Example Accounts |

|---|---|---|

| Assets | What your company owns | Cash, Accounts Receivable, Equipment |

| Liabilities | What your company owes | Accounts Payable, Credit Cards, Loans |

| Equity | The owners’ stake in the business | Common Stock, Retained Earnings |

| Revenue | Income earned from sales | Service Fees, Product Sales |

| Expenses | Costs of operating the business | Salaries, Rent, Marketing, Software |

Understanding these five categories is crucial because they form the very foundation of your key financial statements.

A well-designed Chart of Accounts does more than just organize transactions; it tells the financial story of your business. It provides the structure needed to measure performance, ensure tax compliance, and make confident, data-driven decisions.

This organized approach is what allows accounting software like QuickBooks to generate critical reports like your Income Statement and Balance Sheet. Without a logical COA, these reports would be meaningless jumbles of numbers. By assigning every dollar to its proper “address,” you create a reliable map of your company’s financial health, paving the way for sustainable growth.

Why Your Chart of Accounts Is Mission-Critical

Think of your Chart of Accounts (COA) as more than just a list of categories your bookkeeper uses. It’s the engine running your entire financial back office. It’s a strategic tool that directly impacts everything from your tax return to your ability to make smart, data-driven decisions for your business.

Without a well-designed COA, you’re essentially flying blind.

A poorly structured COA is a recipe for messy books, inaccurate performance reports, and the frustrating inability to see which of your services are actually profitable. Simple questions like, “How much did we spend on software last quarter?” or “Is our marketing budget actually working?” turn into massive scavenger hunts. The result is often guesswork where strategy should be.

On the other hand, a thoughtfully designed COA gives you the real-time visibility you need to build a financial operation that can grow with you. It’s the foundation for confident growth.

A Tool Forged Over Centuries

This isn’t some new-fangled business concept; the idea has deep roots in the history of commerce. The accounting chart of accounts definition as we know it today goes all the way back to the double-entry bookkeeping system laid out by Venetian merchant Luca Pacioli in his 1494 book, ‘Summa de Arithmetica.’

This system became essential during the Industrial Revolution when businesses had to track huge capital investments in things like factories and railroads. Today, its principles are so fundamental that modern accounting standards like GAAP require structured COAs for public companies. If you’re interested, you can explore more about the fascinating history of accounting on Maryville University’s blog.

The history just proves a modern truth: organized financials have always been critical for success.

The Strategic Blueprint for Service Firms

For a service business, your COA can’t be a one-size-fits-all template. It needs to be customized to reflect how you operate, acting as a blueprint for measuring what really matters to your company. A generic setup just won’t cut it.

A strategic COA allows you to:

- Track Profitability by Service Line: Easily see if your “Consulting Retainers” are bringing in more profit than your “One-Time Projects.”

- Monitor Key Expenses: Isolate and analyze critical costs like “Subcontractor Fees” or “Client-Specific Software” so you can manage your expenses effectively.

- Simplify Tax Preparation: A clean COA makes tax time so much smoother, ensuring all your deductions are properly categorized and easy to pull together.

- Generate Insightful Reports: Produce clear, reliable financial statements that tell you the real story of your business’s health.

A well-structured Chart of Accounts transforms raw financial data into business intelligence. It’s the difference between merely recording transactions and truly understanding them.

Ultimately, the quality of your COA determines the quality of your financial data. If the foundation is shaky, every report you build on top of it will be unreliable. This can lead to poor decisions, missed opportunities, and a lot of unnecessary stress. To dig deeper into this, you can learn more about why your chart of accounts matters for your business.

Taking the time to build a solid COA is one of the best investments you can make in your company’s future. It empowers you to stop wrestling with messy data and start building a scalable back office that supports real, sustainable growth.

Building a COA That Works for Your Service Business

Generic templates are a decent starting point, but let’s be honest—they rarely capture the unique rhythm of a service business. To get real insight into your numbers, you have to move beyond the defaults. The goal is to design a Chart of Accounts (COA) that actually reflects how you make money and run your operations, answering your most important questions with total clarity.

The whole process kicks off with a logical numbering system. This isn’t just some fussy detail for accountants; it brings a consistent, predictable order to your financial data, which makes your reports much more intuitive and easier to read.

Establishing Your Numbering System

Think of these number ranges as designated neighborhoods for your financial data. Every single transaction gets an “address,” and that address instantly tells you what kind of financial activity it represents. This simple organization is the key to a clear and useful COA.

A standard, best-practice setup usually looks something like this:

- 1000s – Assets: Everything your company owns (think 1010 Checking Account, 1200 Accounts Receivable).

- 2000s – Liabilities: Everything your company owes (like 2010 Credit Card Payable, 2100 Loans Payable).

- 3000s – Equity: The owners’ stake in the business (e.g., 3000 Common Stock, 3200 Retained Earnings).

- 4000s – Revenue: All the income you bring in from your services (like 4010 Consulting Fees, 4020 Retainer Income).

- 5000s – Cost of Services: The direct costs tied to delivering your services (e.g., 5010 Subcontractor Payments, 5020 Project-Specific Software).

- 6000s & 7000s – Expenses: General operating costs that keep the lights on (like 6010 Salaries, 7020 Marketing & Advertising).

Pro tip: By numbering accounts in increments of 10 (like 1010, 1020, 1030), you give yourself breathing room. It makes it easy to slot in new accounts later without having to tear up your entire system. This kind of forward-thinking is what makes a COA truly scalable.

Tailoring Accounts for Service-Based Operations

For any service business, the real magic of a COA comes from how you structure your revenue and direct cost accounts. A generic account like “Sales” is practically useless. It tells you nothing. You need more detail to understand what’s actually driving your profitability.

For anyone just mapping out their new venture, building a solid COA is just as foundational as learning how to start a service business. It forces you to think critically about your income streams and cost structure right from the beginning.

Instead of one vague income account, consider breaking it down with more specific accounts:

- 4010 Project-Based Fees: For those one-off projects with a clear scope.

- 4020 Monthly Retainer Income: For clients on recurring service contracts.

- 4030 Hourly Consulting: For any income you bill by the hour.

This same granular logic applies to your direct costs, which you might see called Cost of Goods Sold (COGS) or, more accurately for us, Cost of Services.

A well-customized COA turns your financial reports from a simple scoreboard into a strategic playbook. It highlights which services are your star players and which ones might be dragging down your margins, letting you make smarter calls about where to focus your energy and resources.

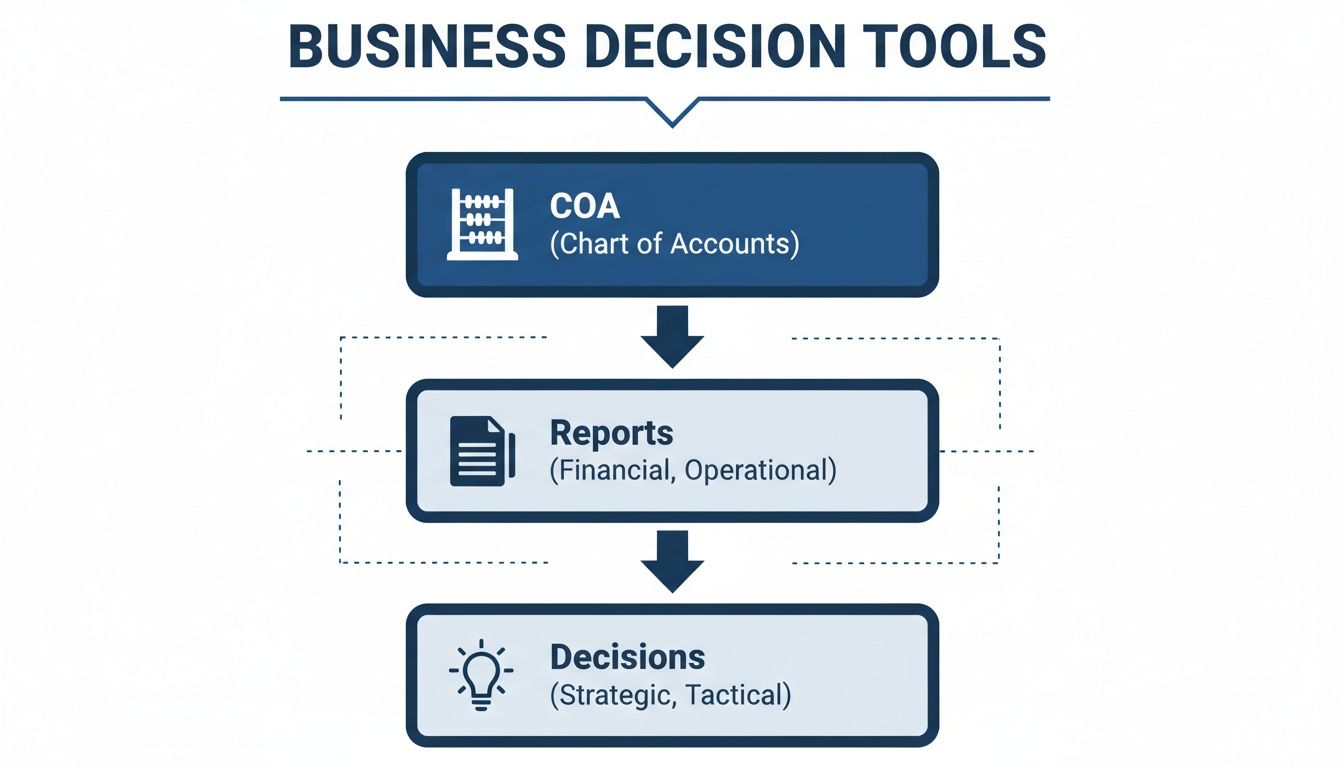

This is why a well-structured COA is the first, non-negotiable step toward generating clear reports that lead to informed decisions.

As the flowchart shows, your COA is the foundation. Everything else—your reports, your strategy, your big decisions—is built right on top of it.

Using Sub-Accounts to Add Detail Without Clutter

Sometimes you need to get even more specific, but creating dozens of top-level accounts will turn your reports into a cluttered mess. This is where sub-accounts are a lifesaver. They let you pack in all the detail you need while keeping your main financial statements clean and easy to scan.

For instance, instead of creating separate top-level expense accounts for every single software tool you pay for, you could group them under one parent account.

Parent Account:

- 6500 Software Subscriptions

Sub-Accounts:

- 6501 CRM Software

- 6502 Project Management Tool

- 6503 Accounting Software

With this structure, you can see your total software spending at a glance on your main Income Statement. But with a single click, you can drill down into the sub-accounts for a detailed breakdown. If you want a more detailed walkthrough, our guide on how to create a chart of accounts breaks down the process step-by-step. This approach gives you the best of both worlds—simplicity on the surface, with powerful detail just underneath.

Common COA Mistakes and How to Avoid Them

A well-designed Chart of Accounts (COA) is your financial command center. But when it’s built poorly, it creates total chaos, leading to reports you can’t trust and hours of wasted time. Getting your COA right from the start is one of those things where a little effort upfront saves you from a world of hurt later on.

Unfortunately, many business owners stumble into the same predictable traps. These common mistakes can turn a tool meant for clarity into a constant source of frustration. Let’s walk through the most frequent missteps and, more importantly, how you can sidestep them completely.

Mistake 1: Using the Generic QuickBooks Template

One of the biggest blunders is just hitting “accept” on the default COA that QuickBooks provides. While it’s a decent starting point, it’s not made for your business. A generic template is often bloated with accounts you’ll never touch and missing the specific revenue and cost accounts a service business needs to get real insights.

This mistake leads straight to miscategorized transactions and vague, unhelpful reports. You end up trying to make decisions with a financial picture that’s blurry at best.

The Fix: Treat the default COA like a rough draft, not the final version. Take the time to customize it from day one. Get rid of irrelevant accounts and add new ones that actually reflect how you make money and where you spend it.

Mistake 2: Inconsistent Naming and Numbering

Another common pitfall is creating accounts with random names or ditching a logical numbering system. You might have “Software” in one place, “SaaS Subscriptions” in another, and “Monthly Software Fees” floating around somewhere else. This kind of chaos makes it impossible to track your spending accurately over time.

Likewise, a haphazard numbering scheme destroys the intuitive structure that makes your reports easy to read. Without that order, your financial statements become a confusing puzzle. You can get a better handle on the fundamentals by reading our guide to understanding debit and credit in accounting.

A clean, consistent COA is non-negotiable for generating data that means something. This level of organization has been vital not just for businesses, but for entire economies. Since 1958, the United Nations has compiled national accounts statistics for over 200 countries, a massive task made possible by standardized frameworks similar in principle to a COA. This consistency allows for clear, apples-to-apples comparisons—a benefit that applies directly to your own financial analysis.

Mistake 3: Creating an Overly Complex or Simple COA

Finding the Goldilocks zone of detail—not too much, not too little—is crucial. Some business owners make their COA far too simple, lumping everything into giant buckets like “Marketing” or “Sales.” This approach hides the important details, making it impossible to see which specific strategies are actually working.

On the other end of the spectrum is the overly complex COA, packed with hundreds of accounts for every tiny expense. This just creates a cluttered, overwhelming system where transactions get miscategorized simply because there are too many options to choose from. This is a real problem; some reports show that 65% of small businesses waste over 20 hours each month fixing miscategorized entries caused by a messy COA.

How to Find the Right Balance:

- Start with Core Categories: Begin with the essential, high-level accounts for your main operations, like Payroll, Marketing, and Software.

- Use Sub-Accounts for Detail: Instead of a new top-level account for every marketing channel, create a parent account called “Marketing & Advertising.” Then, nest sub-accounts like “Paid Search,” “Social Media Ads,” and “Content Marketing” underneath it.

- Follow the “Is It Significant?” Rule: Before you add any new account, ask yourself if the expense is significant and recurring enough to deserve its own line item. If not, it can probably be grouped with other similar costs.

By steering clear of these common mistakes, you’re building a financial system that provides clarity, not confusion. Your COA becomes a powerful strategic tool that helps you make confident decisions and grow your business sustainably from the very beginning.

How a Strategic COA Drives Business Growth

So, how does a well-organized financial system actually help you hit your business goals? This is where the real power of a strategic Chart of Accounts (COA) comes into play. It’s about more than just having clean books; it’s about building a business that can scale and making decisions with confidence. Think of a proper COA as the engine that turns raw financial data into information you can actually use.

The whole point is to move past generic templates and build a structure that truly reflects how your business operates. It’s the difference between just recording transactions and genuinely understanding what they mean. When you have a clear view of your financial performance, you can accurately measure profitability, manage cash flow, and spot growth opportunities before anyone else.

From Messy Data to a Scalable Back Office

Getting this kind of clarity is a straightforward process. It starts with a deep dive into how your service business works. From there, we either design a custom COA or clean up the one you already have in your accounting software, like QuickBooks. This single step provides immediate and lasting benefits.

You’ll gain advantages that go far beyond simple organization:

- Real-Time Visibility: Instantly see which services are the most profitable and where your money is actually going. This lets you double down on what works.

- Eliminate Administrative Headaches: A logical structure makes bookkeeping much simpler, cuts down on errors, and makes tax season significantly less painful.

- A Foundation for Growth: As your business changes, a scalable COA adapts right along with you, ensuring your financial reports stay consistent and reliable.

Stop wrestling with messy spreadsheets and reports you can’t trust. A strategic COA gives you the solid ground you need to build a dependable financial back office that supports you today and fuels your growth tomorrow.

Ultimately, this isn’t just an accounting task; it’s a strategic investment in your company’s future. By working with an expert to put these principles into practice, you get more than just accurate numbers. You get a reliable partner for your financial journey, freeing you up to focus on what you do best—growing your business.

Chart of Accounts FAQs

Even after you get the hang of what a chart of accounts is, a few practical questions always seem to pop up. Here are some quick, straightforward answers to the questions we hear most often from service business owners.

How Often Should I Review My Chart of Accounts?

Think of your chart of accounts (COA) as a living document, not something you set up once and forget about. Your business is always changing, and your COA needs to keep up if you want it to stay useful and accurate.

We recommend giving it a thorough review at least once per year. But you should also plan on a review anytime you have a major business event.

Key moments that should trigger a COA review include:

- Adding a major new service line that needs its own revenue and cost tracking.

- Expanding into a new city or opening another office.

- Making a significant purchase, like expensive equipment or a building.

- Taking out a new loan or opening a line of credit.

An annual check-up makes sure your financial structure is still lined up with your real-world operations and future goals.

Can I Customize the Default QuickBooks Chart of Accounts?

Yes, you absolutely can—and you absolutely should. Sticking with the generic COA that comes with accounting software like QuickBooks is one of the most common mistakes we see business owners make. Customizing isn’t just a nice option; it’s what turns your accounting software into a powerful tool for your specific business.

Customizing your COA is how you transform a generic template into a strategic tool. It lets you add, rename, or organize accounts so the final list perfectly mirrors how your service business actually makes money and spends money.

If you skip this step, your financial data will stay vague, and your reports won’t give you the specific insights you need to make smart decisions.

What Is the Difference Between Cost of Services and Expenses?

Understanding this difference is crucial for knowing how profitable you really are. While both are costs, they tell very different stories about your business’s health.

Cost of Services, which you might also see called Cost of Goods Sold (COGS), covers all the direct costs of delivering your service to a client. Think of it as the cost of doing the actual work. This includes things like payments to subcontractors, software licenses for a specific project, or any materials you use directly for a client.

Expenses, or Operating Expenses (OpEx), are the overhead costs you have just to keep the lights on, whether you have client work or not. This category includes rent, marketing, administrative salaries, and general office supplies. Keeping these two separate helps you calculate your gross profit and truly understand how efficient your core operations are.

Ready to build a financial back office that empowers confident growth? The team of CPAs and bookkeepers at Steingard Financial specializes in creating strategic Chart of Accounts for service businesses, ensuring you have the clarity and accuracy needed to scale. https://www.steingardfinancial.com