Unlocking the Benefits of Outsourcing Payroll

Handing off your payroll to an expert partner can bring some serious benefits, like dramatic cost savings, much lower compliance risk, and, maybe most importantly, more time for you to actually grow your business. It’s about turning a complicated, time-sucking administrative chore into a real strategic advantage.

Understanding the Real Cost of In-House Payroll

For a lot of business owners, keeping payroll in-house feels like staying in control. But that feeling of control often comes with a steep, and often hidden, price tag. The obvious costs—salaries for payroll staff, software subscriptions—are just the tip of the iceberg. The real financial drain is in all the costs you don’t see on a balance sheet.

Think about the sheer number of hours that go into manual data entry, processing payroll, and then double-checking every single calculation. Then there are the ongoing costs of training your team to keep up with tax codes and labor laws that seem to change every other week. Each one of these tasks pulls your team away from things that actually make money, like sales, marketing, and taking care of your customers.

The Hidden Financial Leaks

The true cost of doing payroll yourself is usually a slow leak, not a sudden flood. It’s the little things, adding up over time, that quietly drain your company’s efficiency and budget.

These hidden costs often include:

- Software and Technology Fees: The licensing, maintenance, and mandatory upgrades for payroll software can get expensive, fast.

- Staff Training and Development: Tax laws are always in flux, which means your team needs constant training just to stay compliant and avoid mistakes.

- Error Correction: A single mistake on a paycheck can take hours to track down and fix, creating headaches for your admin team and frustration for your employees.

- Opportunity Cost: Every hour your team spends wrestling with payroll is an hour they aren’t spending on the strategic work that pushes your business forward.

The Specialist vs The Generalist Analogy

To really get it, think of it like this: managing your own payroll is like asking your family doctor to perform a complex heart surgery. Your family doctor is great and knows a lot about general health, but a specialized cardiac surgeon has the exact tools, deep expertise, and focused experience to do the job with far more precision and a much higher chance of success.

An outsourced payroll provider is that specialist. They do one thing, and they do it all day, every day. That focused expertise doesn’t just guarantee accuracy; it brings a level of efficiency that a general internal team simply can’t match.

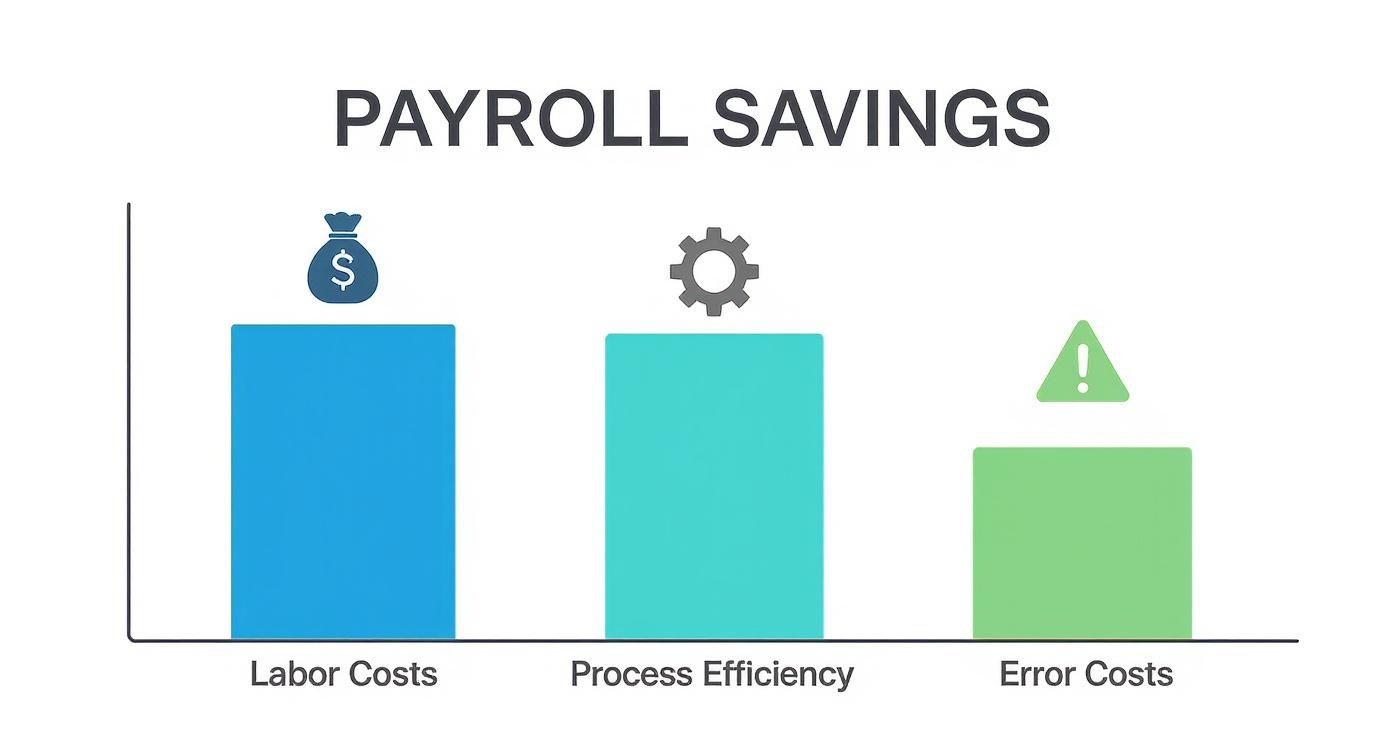

This chart breaks down exactly where businesses see the biggest financial wins when they make the switch.

As you can see, outsourcing has a direct and positive impact on labor costs, day-to-day efficiency, and the painful expense of fixing payroll errors. Let’s take a quick look at how the two approaches stack up side-by-side.

In-House vs Outsourced Payroll: A Cost and Efficiency Snapshot

| Aspect | In-House Payroll | Outsourced Payroll |

|---|---|---|

| Direct Costs | Salaries for payroll staff, benefits, software licenses, ongoing training. | Predictable monthly or per-employee fee. |

| Hidden Costs | Time spent on corrections, potential compliance penalties, opportunity cost of staff time. | Minimal. Provider handles compliance and corrections as part of the service. |

| Time Commitment | Significant hours spent on data entry, verification, tax filing, and issue resolution. | Minimal. A few minutes to approve hours and run payroll. |

| Compliance Risk | High. Burden of staying updated on all federal, state, and local tax laws rests on you. | Low. The provider assumes responsibility for tax compliance and filing accuracy. |

| Expertise | Limited to the knowledge of your internal staff. | Access to a team of dedicated payroll and tax specialists. |

| Scalability | Difficult. Adding employees or expanding to new states creates major administrative hurdles. | Easy. The service scales with your business growth effortlessly. |

The numbers don’t lie. Research from PwC shows that companies outsourcing their finance functions see an average 32% reduction in labor costs and a 25% improvement in process efficiency. On top of that, in-house payroll errors can cost a company up to 20% of its total payroll expenses each year. When you look at it that way, outsourcing isn’t just a convenience—it’s a smart financial move. You can dig into more outsourcing statistics to see the full picture.

By shifting payroll to a dedicated partner, you aren’t just offloading a task; you’re converting a cost center into a strategic asset. This frees up both capital and human potential to be reinvested into the parts of your business that matter most.

Navigating the Complex Maze of Payroll Compliance

For any business owner, staying on top of payroll regulations is a constant headache. It’s like trying to navigate a dense, ever-changing legal maze where the walls shift without any warning. A single wrong turn can easily lead to steep fines, legal headaches, and a reputation you’ve worked hard to build.

This challenge has only gotten bigger with the rise of remote and hybrid work. Suddenly, you’re not just dealing with federal laws. You’re juggling different state tax codes, local rules, and varying labor laws for employees scattered all over the country. Keeping up takes constant attention and a deep well of expertise.

This is where outsourcing your payroll really starts to shine. Handing this function over to a specialist is like hiring an expert guide who knows every twist and turn of that complicated maze. They don’t just know the current map; they anticipate how it’s going to change.

Your Shield Against Shifting Regulations

A professional payroll partner lives and breathes tax codes, labor laws, and reporting deadlines. Their entire business is built on staying ahead of legislative changes, from major federal updates down to obscure local rules. This proactive approach turns compliance from a source of anxiety into a background process you barely have to think about.

Instead of your team spending hours researching new withholding requirements or trying to decipher updated filing procedures, your outsourced partner just handles it. That protection is priceless.

Think about the most common compliance traps businesses fall into:

- Incorrect Tax Withholding: Miscalculating federal, state, or local taxes is a frequent and expensive mistake.

- Late or Inaccurate Filings: Missing a single deadline for a tax payment can trigger immediate penalties and interest.

- Employee Misclassification: Classifying an employee as an independent contractor by mistake can lead to severe legal and financial fallout.

- Overtime and Wage Law Violations: Failing to follow Fair Labor Standards Act (FLSA) rules is a huge source of lawsuits.

An outsourced provider is your first line of defense against these risks, making sure every paycheck and tax form is correct and on time. This is especially critical during tax season, and understanding how to prepare for tax season is much simpler when you have an expert managing your payroll compliance all year.

The Complexity of a Modern Workforce

Today’s workforce is increasingly spread out, which adds layers of complexity to payroll. As companies hire talent from different states, they become responsible for following each location’s unique set of rules.

This trend is a big reason why so many businesses are turning to outsourced solutions. According to the ADP Global Payroll Complexity Report, this is especially true for companies operating in multiple locations. While 55% of single-country businesses manage payroll in-house, that number plummets to just 19% for companies with operations in 6-10 locations.

With 81% of companies now being either remote or hybrid, the need for expert-driven payroll is greater than ever. Industry data even shows that companies using outsourced compliance platforms see a 24% drop in audit findings. You can read more about payroll outsourcing trends and their impact.

By outsourcing payroll, you are essentially purchasing peace of mind. You transfer the immense burden of compliance risk to a partner whose primary job is to protect your business from it.

Gaining Confidence to Lead

At the end of the day, outsourcing compliance isn’t just about dodging penalties. It’s about freeing yourself and your leadership team from that nagging, low-level worry that something might have been missed. When you’re confident your payroll is accurate and compliant, you can dedicate your full mental energy to what you do best.

This lets you focus on big-picture initiatives like developing new products, winning new customers, and building your team. You can lead with confidence, knowing that a critical—but non-revenue-generating—part of your business is in the hands of specialists. That strategic shift is one of the most powerful and lasting benefits of handing off your payroll.

Reclaiming Time to Focus on Business Growth

Payroll is a non-negotiable part of running a business, but let’s be honest—it’s an administrative function that doesn’t add a single dollar to your top line. Instead, it quietly eats away at your most valuable resource: time.

For most small and medium-sized businesses, the entire payroll process can easily chew up 10 to 20 hours every single month. That’s a huge chunk of time pulling your key people away from the work that actually matters.

This isn’t just about punching in numbers, either. It’s the hours spent chasing down timesheets, calculating deductions, fixing inevitable errors, and double-checking every detail before you can finally click “submit.” This administrative weight often lands on the shoulders of business owners, HR managers, or finance leaders—the very people who should be focused on strategy and growth.

When you outsource payroll, you aren’t just handing off a task. You’re making a conscious investment in your company’s future by buying back those lost hours and putting them toward activities that move the needle.

Turning Administrative Hours into Growth Opportunities

Take a second and imagine what you could do with an extra 10, 15, or even 20 hours a month. That time suddenly becomes a powerful asset you can reinvest directly into your company’s core mission.

Instead of just managing processes, you and your team can start driving real strategic initiatives. Here are a few ways we see our clients repurpose this newfound time:

- Client Acquisition and Retention: More hours in the day to nurture client relationships, follow up on leads, and build out sales strategies.

- Product and Service Development: Your team gets the breathing room to innovate, refine what you offer, and stay a step ahead of the competition.

- Strategic Planning: Leadership finally gets the mental space to work on the business, not just in it. This is where long-term growth and market positioning happens.

- Team Training and Development: You can invest in upskilling your employees, which is a triple-win for morale, performance, and retention.

This isn’t just a niche idea; it’s a strategic shift happening everywhere. A recent ADP report found that 70% of payroll leaders are looking at outsourcing parts of their payroll to better support their teams. This trend allows companies to refocus on high-impact areas like talent management and employee engagement. You can find more details in the latest payroll statistics and trends.

The Strategic Value of Redirecting Your Best People

Your most skilled employees are your biggest asset. When they’re bogged down with routine administrative tasks, you’re not just paying for their time—you’re wasting their potential. Outsourcing payroll frees your best people to stop managing tedious processes and start driving growth.

Think of it this way: every hour your head of operations spends fixing a payroll issue is an hour they aren’t improving your service delivery. Every moment your founder spends double-checking tax calculations is a moment they aren’t closing a major deal.

This is about more than just efficiency; it’s about optimizing the very structure of your organization. By delegating administrative functions, you align your internal team with your most critical business goals. It’s a core principle that works for payroll, and it works for other financial tasks, too. Many business owners discover that once they see the benefits here, the next logical step is to outsource bookkeeping for their small business to achieve the same gains.

At the end of the day, reclaiming your time is probably the single most powerful benefit of outsourcing payroll. It transforms a necessary chore into a strategic opportunity, letting you invest your energy, talent, and resources where they’ll deliver the greatest return and push your business forward.

Boosting Accuracy and the Employee Experience

Nothing torpedoes employee morale faster than a payroll mistake. A paycheck is more than just a number—it’s a direct measure of the trust and reliability between you and your team. The moment that number is wrong, that trust starts to crumble. In-house, manual payroll processes are just naturally prone to human error, which can lead to frustrating underpayments or costly overpayments.

The foundation of any solid employer-employee relationship is a consistent, reliable paycheck. When your team knows they’ll be paid correctly and on time, every single time, it builds a powerful sense of security and stability. Outsourcing your payroll is one of the most effective ways to guarantee this consistency, turning a potential point of friction into a source of confidence.

Achieving Flawless Precision

Dedicated payroll providers operate with a level of precision that’s almost impossible for a non-specialist to replicate internally. They use advanced automation and multiple layers of review to catch mistakes before they ever happen. Think of it as a safety net woven from technology and deep expertise.

Their systems are built from the ground up to automatically calculate complex deductions, overtime, and tax withholdings with near-perfect accuracy. This systematic approach takes the guesswork and human error out of the equation, something that constantly plagues manual data entry and spreadsheet-based payroll.

A study by Forrester found that fragmented, in-house payroll processes cost businesses an average of $480 more per employee every year. A huge chunk of that cost comes from the time and resources spent tracking down and fixing errors. Outsourcing wipes out these hidden costs by getting it right the first time.

This isn’t just about avoiding mistakes; it’s about building a system that reinforces trust. When payroll runs smoothly and silently in the background, it sends a clear message: you value your employees’ contributions and respect their financial well-being. That reliability is a quiet but incredibly powerful benefit.

Enhancing the Employee Experience

Beyond just getting the numbers right, modern outsourced payroll platforms completely change the day-to-day experience for your employees. Gone are the days of an employee having to hunt down someone in HR for a copy of a pay stub or a W-2 form.

Today’s best providers offer intuitive, secure self-service portals. These online dashboards give your team direct, 24/7 access to their own payroll information, putting them in the driver’s seat.

Through these portals, employees can handle all the common tasks on their own, including:

- Accessing Pay History: View and download current and past pay stubs whenever they need them.

- Retrieving Tax Documents: Instantly grab W-2s and other tax forms, making tax season a breeze.

- Updating Personal Information: Easily change an address or update direct deposit details without filling out a single piece of paper.

- Managing Withholdings: Adjust their tax withholdings directly through the portal as their life circumstances change.

This self-service model does more than just add convenience. It gives your employees a real sense of control and transparency over their financial information, which is a major boost to their overall experience. At the same time, it frees up your HR and admin staff from the constant flow of routine requests, letting them focus on more strategic, people-first initiatives.

By delivering both accuracy and empowerment, outsourcing turns payroll from a simple transaction into a tool for building a stronger, more trusting workplace.

How to Choose the Right Payroll Partner

Once you see the benefits of outsourcing payroll, the next question is obvious: how do you actually pick someone? This isn’t just about buying a service; it’s about bringing a specialized extension onto your team.

Choosing the right partner is a major decision that will shape your operations, your team’s morale, and your financial health for years. The best partners do more than just cut checks—they become a strategic asset that helps you grow. They handle the complex world of compliance and technology so you can get back to what you do best.

But with so many options out there, how do you find the right fit?

Evaluate Their Technology and Integration Capabilities

First things first, look at their tech. A modern, easy-to-use platform isn’t just a “nice-to-have” anymore. You need a clean interface for your administrators and a self-service portal for your employees. Giving your team the power to check their own pay stubs and tax forms saves your HR staff a massive amount of time.

Just as crucial is how well their system plays with the tools you already rely on. It needs to seamlessly connect with your accounting software, like QuickBooks Online, to keep your financial records straight without painful, manual data entry.

At Steingard Financial, we get this. We work with our clients on their existing platforms like Gusto and QuickBooks Payroll, so our services plug right into their current setup. This means no disruptive software changes and a back-office system that simply works. It’s a core part of our approach to providing flexible payroll solutions for small businesses that are built around their needs.

Scrutinize Their Security and Compliance Expertise

You’re handing over incredibly sensitive employee information, so trust is paramount. You have to be rigorous when evaluating a partner’s security. Don’t hesitate to ask tough questions about how they protect your data.

A professional provider will be completely transparent about their security measures. Here are a few things to demand:

- Data Encryption: Make sure all your data is encrypted, both when it’s moving and when it’s stored.

- Secure Infrastructure: Ask about their server environments and what happens in a disaster.

- Compliance Certifications: Look for recognized standards like SOC 2, which proves they have strong controls over security and privacy.

A provider’s commitment to security is a direct reflection of their professionalism. Weak security isn’t just a red flag; it’s a deal-breaker that puts your business and your employees at risk.

Beyond keeping data safe, make sure they are experts in tax compliance. Do they have a team that lives and breathes the ever-changing world of federal, state, and local tax laws? A great partner doesn’t just run payroll; they actively shield you from costly fines and legal headaches.

Assess Their Customer Support and Scalability

When you have a payroll question, you need an answer—fast. Take a hard look at the provider’s support model. Will you get a dedicated person who actually knows your business, or will you be stuck in a generic call center queue? Look for a partner with a reputation for quick, expert support.

Check online reviews and ask for client references to see what their service is like in the real world. A fast response from someone who knows what they’re doing can be a lifesaver, especially during tax season.

Finally, think about your future. You’re going to hire more people, maybe expand to other states, or add new benefits. You need a partner who can grow right alongside you. The right provider will have a scalable solution that handles this growth easily, so you aren’t forced to switch platforms just as you’re hitting your stride.

Vendor Evaluation Checklist: Key Questions to Ask

To make this process easier, we’ve put together a checklist. Use these questions to systematically compare potential partners and make sure you’re covering all your bases. This isn’t just about features; it’s about finding a true partner who aligns with your business goals.

| Evaluation Category | Key Questions to Ask | Importance (High/Medium/Low) |

|---|---|---|

| Technology & Platform | Is the platform intuitive for both admins and employees? Does it offer a mobile-friendly employee self-service portal? | High |

| Integrations | Does it integrate seamlessly with our current accounting software (e.g., QuickBooks, Xero)? What about our HR or time-tracking tools? | High |

| Security & Compliance | What are your specific data encryption and storage protocols? Are you SOC 2 compliant? How do you stay updated on tax law changes? | High |

| Customer Support | Will we have a dedicated account manager? What are your guaranteed response times? Can we see client testimonials or references? | High |

| Pricing & Contracts | Is the pricing structure transparent? Are there extra fees for year-end processing (W-2s/1099s) or off-cycle payrolls? What are the contract terms? | Medium |

| Scalability & Services | Can your services scale as we add employees or expand to new states? Do you offer additional HR services or benefits administration? | Medium |

Taking the time to ask these questions upfront will save you from major headaches down the road. It ensures you’re not just picking a vendor, but a long-term partner invested in your success.

Common Questions About Outsourcing Payroll

Even with all the benefits laid out, it’s natural to have a few nagging questions. Handing over a critical function like payroll is a big step, and you absolutely need to feel confident before making a move.

We get it. That’s why we’ve put together some straight, honest answers to the most common concerns we hear from business owners. We’ll cover everything from data security to what it really looks like to get started.

Is Outsourcing My Payroll Secure?

This is usually the first question people ask, and for good reason. The short answer is: yes, absolutely. Reputable payroll providers invest a huge amount of resources into security—far more than a typical small or medium-sized business could ever justify.

Think of it like this: you can keep cash in a safe at your office, or you can put it in a bank vault. Your safe is fine, but the bank’s vault is built with layers of security designed specifically to protect high-value assets. Payroll companies operate the same way.

They use tools and protocols like:

- End-to-End Encryption: This keeps your data locked down tight, both when it’s being sent and when it’s sitting on their servers.

- Secure Data Centers: Their servers are housed in fortresses with physical security, backup power, and disaster recovery plans ready to go.

- Compliance Certifications: They follow strict industry standards like SOC 2, which involves rigorous third-party audits of their security and privacy controls.

When you’re vetting a partner, ask them to show you their security protocols. A good provider will be more than happy to walk you through exactly how they keep your company’s—and your employees’—information safe.

Will I Lose Control Over My Payroll Process?

This is probably the biggest myth out there. The truth is, you don’t lose control at all. What you do is gain a partner who handles all the tedious, repetitive work, freeing you up to focus on what actually matters.

You’re still in the driver’s seat for all the key decisions. You approve hours, set salaries, decide on bonuses, and determine the pay schedule. Your provider just takes that information and handles the complicated mechanics of calculating taxes, making direct deposits, and filing the right paperwork.

Outsourcing isn’t about giving up control; it’s about delegating the administrative burden. You remain the decision-maker, while your partner manages the high-stakes execution of tax filings, calculations, and direct deposits.

In fact, modern payroll platforms often give you more visibility than clunky in-house systems. With clear dashboards and reports available anytime, you get a much better real-time picture of your labor costs without drowning in the details.

What Is the Implementation Process Like?

Getting started isn’t the technical nightmare you might be imagining. Any good provider will assign a dedicated specialist to walk you through the entire process, making sure the transition is totally seamless for you and your team.

It usually breaks down into a few simple stages:

- Data Collection: They’ll help you gather the essentials: your company info, employee details (like W-4s and direct deposit info), and any past payroll records.

- System Configuration: They set up their system to match your business, including your pay schedule, benefit deductions, and any other unique needs you have.

- Parallel Run (Optional but Recommended): To be extra safe, many providers will run your first payroll alongside your old system. This lets you compare the numbers side-by-side to ensure everything is 100% accurate before going live.

The timeline depends on your company’s size, but most small businesses are up and running in just a few weeks. The goal is always to time the switch perfectly between pay periods so your employees don’t notice a thing—except that their pay stubs are clearer and easier to access.

Can an Outsourced Service Scale With My Business?

Yes, and this is where outsourcing really shines. Scalability is baked right into the service. It doesn’t matter if you’re hiring your fifth employee or your five-hundredth—a professional service can handle that growth without skipping a beat.

Just think about the headaches of growing your payroll in-house. Hire someone in a new state? Now you have to become an expert on a whole new set of tax laws and labor regulations. With an outsourced partner, that’s their job, not yours.

They make it easy to:

- Add new employees to the system in minutes.

- Manage payroll for people in multiple states, each with different tax rules.

- Handle increasing complexity without you needing to buy new software or hire more admin staff.

This kind of flexibility means your back-office can finally keep up with your growth instead of holding it back.

At Steingard Financial, we know that payroll is about more than just numbers—it’s about trust, accuracy, and giving you the freedom to lead. We build scalable back-office solutions on the platforms you already use, like Gusto and QuickBooks, ensuring a seamless partnership from day one. If you’re ready to reclaim your time and gain a dependable partner invested in your financial health, let’s talk.

Get Your Free Consultation at https://www.steingardfinancial.com