Double Entry Bookkeeping Explained: a quick, clear guide

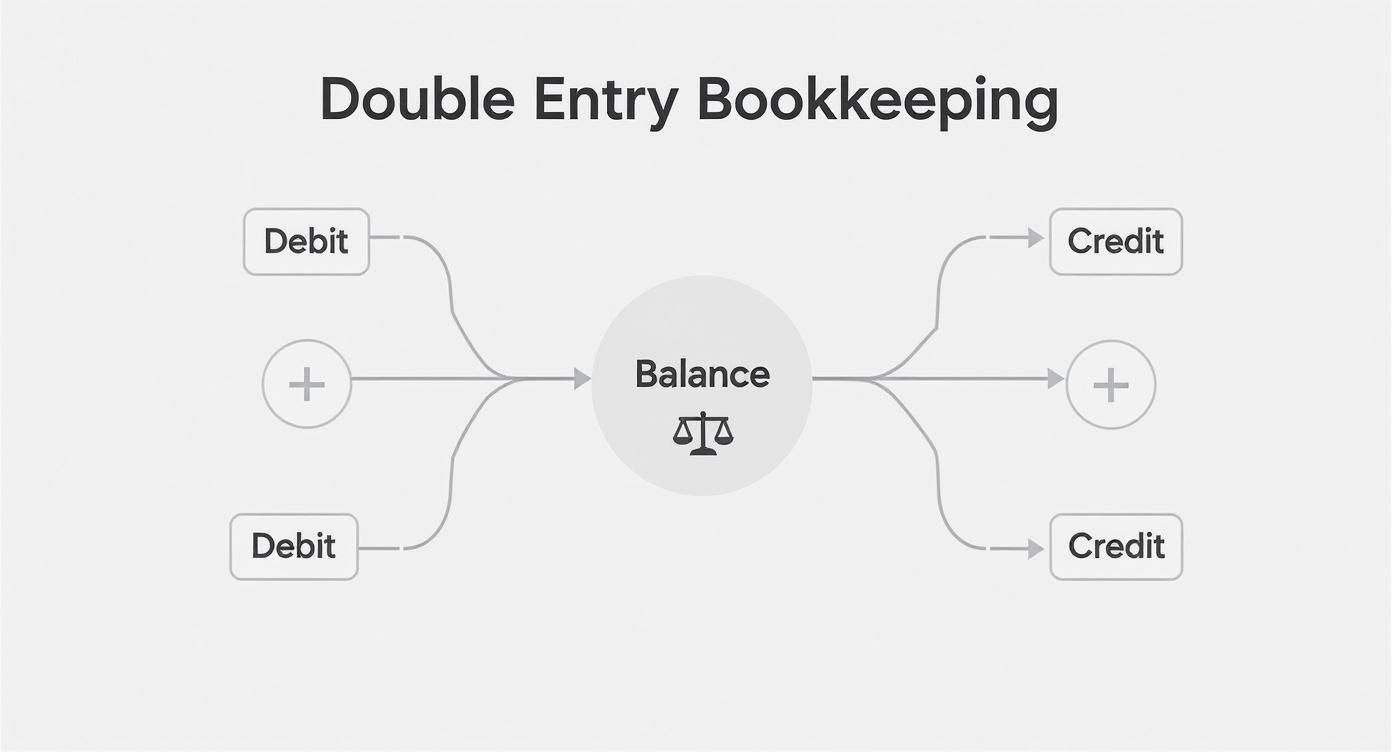

If you’ve ever felt like your business finances are a bit of a mystery, double-entry bookkeeping is the system that turns on the lights. At its heart, it’s a simple idea: every transaction has two sides, and you need to account for both. Think of it like a classic balancing scale. For every action, there’s an equal and opposite reaction that keeps your books perfectly level and honest.

This two-sided approach provides a complete, clear picture of your company’s financial health, leaving no room for guesswork.

How Does Double-Entry Bookkeeping Actually Work?

The whole system is designed to keep your finances in perfect balance. Every time money moves, something of value is exchanged. Double-entry bookkeeping just captures both sides of that exchange so nothing gets missed.

Here’s the core concept: every single transaction creates two entries. One is a debit in one account, and the other is an equal credit in another. This simple duality is the secret sauce. It builds a self-checking mechanism right into your bookkeeping, which drastically cuts down on errors. If your books don’t balance, you know immediately that something’s off and exactly where to start looking.

The Unbreakable Rule of Accounting

The entire world of accounting is built on one foundational principle: the accounting equation. This isn’t just a suggestion; it’s a rule that must always stay in balance.

Assets = Liabilities + Equity

Let’s quickly break that down into plain English:

- Assets: This is all the stuff your business owns. Think cash in the bank, your equipment, or invoices that clients owe you (accounts receivable).

- Liabilities: This is what your business owes to others. This includes things like bank loans, credit card balances, or bills you owe to suppliers.

- Equity: This is what’s left over for the owners after you subtract all your liabilities from your assets. It’s the net value of your business.

Every debit and credit you record is just an adjustment to one of these categories, all while keeping the equation perfectly balanced. Whether you’re buying new software, paying a contractor, or cashing a client’s check, the transaction always keeps this essential formula in check.

A System with a Storied Past

This isn’t some newfangled tech trend. In fact, the principles of double-entry bookkeeping have been the gold standard for centuries. The system was first formally documented way back in 1494 by an Italian mathematician named Luca Pacioli. His work took complex accounting ideas and laid them out in a way that merchants and bankers could easily use, setting the stage for modern finance as we know it. You can explore the rich history of accounting to see just how these foundational concepts took shape.

The fact that this system has endured for over 500 years says everything about its effectiveness. From Renaissance traders to today’s service-based businesses, the logic is as solid as ever. By recording the dual impact of every transaction, you get a trustworthy and complete financial story—not just a simple list of cash in, cash out.

Mastering Debits, Credits, and the Accounting Equation

To really get a feel for how double-entry bookkeeping works, you have to understand its engine: debits and credits. A lot of people get tripped up thinking “debit” means minus and “credit” means plus, but that’s not quite right. Their real job is much more elegant. Instead of being simple addition or subtraction, they’re balancing entries that tell the story of where value comes from and where it goes.

Think of it this way: a debit is an entry that records where value goes to in a transaction. A credit shows where the value came from. Every single transaction needs at least one of each, and they must always be equal. This is what keeps your books perfectly balanced.

This concept map really helps visualize the relationship between debits, credits, and the constant goal of balance in double-entry bookkeeping.

As you can see, every transaction keeps the scale level. A debit on one side gets an equal credit on the other, maintaining that critical equilibrium.

Debits and Credits in Action

Now, how a debit or credit affects an account depends entirely on what type of account it is. This is the part that can feel a bit confusing at first, but it follows a clear, consistent logic that ties directly back to the accounting equation.

Here’s a simple breakdown of the rules:

- For Asset and Expense Accounts: A debit will increase the balance, and a credit will decrease it.

- For Liability, Equity, and Revenue Accounts: A credit will increase the balance, and a debit will decrease it.

See the pattern? They’re exact opposites. This duality is the secret sauce that makes the whole system self-checking.

A T-account is a great way to picture this. Just imagine a large letter “T.” The account’s name sits at the top, debits go on the left, and credits go on the right. So, if you buy a new laptop (an asset), you would debit your Equipment account to show its value increased. If you get a loan (a liability), you would credit your Loans Payable account to show you owe more.

The Accounting Equation as Your North Star

The one fundamental rule that governs everything is the accounting equation we talked about earlier: Assets = Liabilities + Equity. This isn’t just some formula to memorize; it’s the bedrock of your entire financial system. Every single transaction, with its debits and credits, is designed to keep this equation in perfect balance.

The accounting equation is your constant. It’s the unchanging principle that proves every transaction is recorded correctly. If your equation is ever out of balance, that’s your first sign that something’s gone wrong in the books.

Let’s walk through a common scenario for a service business to see how it all connects.

Example: Receiving a Client Payment

Let’s say a client pays you $1,000 for a project you just completed. This one event actually triggers two separate entries in your books.

- Your cash goes up: Your Cash account, which is an Asset, increases by $1,000. To increase an asset, you debit it.

- Your revenue goes up: Your Service Revenue account, which rolls up into Equity, also increases by $1,000. To increase revenue, you credit it.

The journal entry would look like this:

- Debit: Cash $1,000

- Credit: Service Revenue $1,000

Now, let’s check it against our North Star, the accounting equation:

- Assets (your cash) increased by $1,000.

- Equity (through your revenue) also increased by $1,000.

The equation Assets = Liabilities + Equity is still perfectly balanced. Once you grasp this relationship, bookkeeping stops being about tedious data entry and starts becoming a logical process. You’re telling the financial story of your business, one balanced entry at a time.

Applying Double Entry Bookkeeping in Your Business

Theory is great, but seeing double-entry bookkeeping in action is where it all starts to make sense. Let’s walk through a few real-world scenarios that service businesses face every day. This is how the rules of debits and credits move from the textbook to your actual financial statements.

Seeing how the accounting equation stays perfectly balanced with every transaction will build your confidence and help you apply these principles directly to your own company’s finances.

Example 1: Invoicing a Client and Getting Paid

This is a classic two-step dance for any service business. First, you do the work and send an invoice. A little while later, your client pays you. Double-entry bookkeeping tracks both of these moments separately, which is crucial for accuracy.

Imagine you’ve just wrapped up a consulting project and you invoice your client for $2,500. At this exact moment, you’ve earned the revenue, but the cash isn’t in your bank account yet. That money owed to you is an asset called Accounts Receivable.

Here’s the first journal entry:

- Debit Accounts Receivable $2,500: You’re increasing this asset because someone now owes you money.

- Credit Service Revenue $2,500: You’re also increasing your revenue account to reflect the income you’ve earned.

Fast forward a few weeks, and the client pays the invoice. Now, you’re essentially swapping one asset (the promise of payment) for another (cold, hard cash).

This leads to the second journal entry:

- Debit Cash $2,500: Your cash account—another asset—goes up.

- Credit Accounts Receivable $2,500: This asset account goes down because the client’s debt to you is now settled.

Did you catch that? Revenue was only recorded once—the moment it was earned. The payment simply changed the form of your asset from an IOU into cash.

Example 2: Paying a Monthly Software Subscription

Now let’s flip the script and look at a common expense. Your business relies on a project management tool that costs $150 per month, and you pay for it with your business debit card. This transaction reduces one asset (Cash) while increasing an expense.

The journal entry is refreshingly simple:

- Debit Software Expenses $150: You increase your expense account to track the cost.

- Credit Cash $150: Your cash account decreases because money just left your bank.

This single entry tells the whole story. Your cash is down, but you’ve properly recorded a business cost that will be used to calculate your company’s profit. This clean logic applies to almost every routine expense you can think of, from rent and utilities to marketing spend.

A key takeaway is that every transaction tells a story with two parts. By capturing both where the money came from and where it went, you create a complete and verifiable financial record that is impossible to achieve with simpler methods.

Example 3: Securing a Small Business Loan

Finally, let’s look at a transaction that involves taking on a liability. Let’s say your business gets approved for a $10,000 small business loan to fuel some growth. The bank wires the full amount right into your business checking account.

This gives your assets a nice boost (more cash!) but also increases your liabilities (you now owe the bank).

Here’s how you record the influx of loan funds:

- Debit Cash $10,000: Your cash balance, a key asset, jumps up.

- Credit Loans Payable $10,000: You create or add to a liability account, showing your new debt.

The accounting equation remains in perfect harmony. Your assets went up by $10,000, and your liabilities increased by the exact same amount.

It’s amazing to think that while this system feels so logical today, it took centuries to become the standard. There’s evidence of it being used in Florence around 1299-1300, but it didn’t really take off globally until the industrial boom of the 19th century demanded better ways to track costs and capital. You can read more about the historical development of bookkeeping on journals.sagepub.com.

These examples show that whether you’re earning revenue, paying bills, or taking on debt, the double-entry system gives you a clear and balanced framework. Every financial event has a dual effect, and getting both sides right is the secret to accurate, trustworthy books.

How to Build a Powerful Chart of Accounts

If double-entry bookkeeping is the engine, your Chart of Accounts (COA) is the GPS. It’s a complete, organized list of every single account in your financial system, giving you a roadmap for every transaction. Think of it as the ultimate filing cabinet for your money—every dollar has a specific home, and you know exactly where to find it.

Without a well-built COA, even the most careful bookkeeping turns into a mess of confusing, unusable reports. A powerful COA, on the other hand, is the foundation for genuine business insight. It’s what transforms raw numbers into financial intelligence you can actually act on.

Too many business owners treat their COA as just another list. That’s a huge mistake. Its structure directly impacts the quality of your financial reporting and determines how easily you can track different income streams, keep an eye on spending, and understand your company’s overall health.

The Anatomy of a Great Chart of Accounts

Every COA is built around the fundamental accounting equation. It organizes all your accounts into five main categories, making sure every transaction has a logical place to land.

The five primary account types are:

- Assets: Everything your business owns (Cash in the bank, Accounts Receivable, computers, etc.).

- Liabilities: Everything your business owes (Credit Card Balances, Loans Payable, etc.).

- Equity: The net worth of the business (Owner’s Contributions, Retained Earnings, etc.).

- Revenue: All the ways your business makes money (Service Fees, Client Retainer Income, etc.).

- Expenses: What your business spends to operate (Software Subscriptions, Rent, Payroll, etc.).

Within these big buckets, you create specific sub-accounts that actually reflect how your business runs. For instance, under the main “Expenses” category, a service business would want distinct accounts like ‘Marketing & Advertising,’ ‘Professional Development,’ and ‘SaaS Subscriptions’ to see exactly where the money is going.

A well-designed Chart of Accounts strikes the perfect balance. It needs to be detailed enough to give you real insights but simple enough that you can use it consistently without getting confused.

An overly complicated chart is just as useless as one that’s too simple. The goal isn’t to create hundreds of accounts—it’s to create the right accounts that tell you what you need to know to make smarter business decisions.

A Sample Chart of Accounts for Service Businesses

Service-based businesses have different needs than a retailer or manufacturer. You’re not worried about inventory costs; you need to know about project profitability, which clients are most valuable, and what your operational overhead looks like.

Here’s a basic template you can adapt. It includes accounts that are particularly relevant for service firms to help you get started on the right track.

| Account Type | Account Name | Description |

|---|---|---|

| Revenue | Client Retainer Revenue | Tracks recurring income from ongoing client retainers. |

| Revenue | Project-Based Fees | Records one-time income from specific client projects. |

| Expenses | Software & SaaS | Tracks all monthly/annual software subscription costs. |

| Expenses | Contractor Payments | Records payments made to freelance or contract workers. |

| Expenses | Professional Development | Tracks costs for training, courses, and certifications. |

| Assets | Accounts Receivable | Shows money owed to you by clients for completed work. |

| Liabilities | Unearned Revenue | Tracks payments received for work not yet completed. |

This kind of structure helps you answer important questions at a glance. How much of your income is stable, retainer-based revenue versus one-off projects? Are your software costs creeping up month after month? This is how the concept of double entry bookkeeping explained becomes a practical management tool, not just an accounting theory.

Ultimately, your COA shouldn’t be set in stone. It should grow and change right along with your business. When you add a new service or start incurring a new type of expense, update your chart. A living, breathing COA ensures your financial reporting stays relevant, accurate, and incredibly powerful.

Using Modern Software for Double Entry Bookkeeping

The good news? You can forget the old-timey image of a bookkeeper hunched over a giant ledger. Modern accounting software has completely changed the game, handling the complex mechanics of double-entry bookkeeping automatically.

Platforms like QuickBooks and Xero are built on the very foundation of double-entry principles. Every time you record a transaction, they’re doing the heavy lifting in the background, creating the corresponding debits and credits without you having to lift a finger. This shifts your role from data entry clerk to a strategic overseer of your company’s financial story.

Your Job Is to Categorize, Not Calculate

When you connect your business bank and credit card accounts, your accounting software pulls in a live feed of every transaction. But the software isn’t magic—it doesn’t know that a charge from “Staples” was for office supplies or that a deposit from “Smith Consulting” was for services you provided.

That’s where you come in. Your main task is simply to review these transactions and assign them to the correct category from your Chart of Accounts.

- For Income: When a client payment hits your bank, you’ll match it to an invoice or categorize it directly as “Service Revenue.”

- For Expenses: When a purchase for new software shows up, you’ll categorize it as “Software & SaaS Subscriptions.”

The moment you categorize a transaction, the software instantly creates the correct double entry. For example, categorizing a $150 office supply purchase automatically debits your “Office Supplies” expense account and credits your “Cash” account. You don’t have to sweat the debits and credits; you just have to accurately describe what the transaction was for.

This screenshot shows a typical dashboard where a user is reviewing and categorizing transactions pulled from a linked bank account.

This simple act of classification is what powers the entire system. It’s the key to ensuring your financial reports are accurate and actually mean something.

Why Understanding the Principles Still Matters

So if the software does all the work, why bother learning the concepts? Because while technology automates the entries, a foundational understanding of double-entry is what allows you to use the software effectively. Knowing the “why” behind the software’s actions helps you spot problems, make smarter decisions, and trust the story your data is telling you.

Technology is a powerful tool, but it’s not a substitute for understanding. Knowing the logic of double-entry bookkeeping empowers you to verify the software’s work, catch errors, and have true confidence in your financial reports.

This system might feel modern, but its roots go deep. The earliest records of double-entry bookkeeping date back to Florence in the late 13th century. It’s a testament to the system’s logic that this 700-year-old innovation is still the global standard for financial accounting. You can learn more about the fascinating origins of double-entry bookkeeping on Wikipedia.

Ultimately, modern software and a solid grasp of the fundamentals are a powerful partnership. The software gives you speed, while your knowledge ensures accuracy and provides the insight you need to guide your business toward financial health.

Got Questions? Let’s Clear Things Up.

Even after seeing how it all works, a few questions might still be swirling around. That’s perfectly normal. Let’s tackle some of the most common things business owners ask when they’re getting started with this system.

We want to make sure you have complete confidence in what you’re doing, so you can see the real-world value this brings to your business, whether you’re a one-person shop or a growing firm.

Do I Really Need Double-Entry Bookkeeping for My Small Business?

Legally speaking, it’s not always mandated for the simplest business structures, like a sole proprietorship filing basic taxes. But in practice? It’s the universally accepted standard for credible financial reporting. When banks, investors, or even the IRS look at your business, they expect to see financial statements—like a balance sheet and income statement—that can only come from a proper double-entry system.

Think of it this way: using a single-entry system is like navigating with just a compass. It points you in a general direction. Double-entry is like having a full GPS that shows your exact location, your speed, and the entire landscape around you. You just get a much clearer picture.

What Happens If I Make a Mistake?

It happens to everyone. The great thing about the double-entry system is that it’s designed to help you catch those mistakes. If you accidentally type the wrong number or miscategorize an expense, your books will fall out of balance. That imbalance is an immediate red flag telling you something needs a closer look.

The golden rule here is to never just delete the wrong entry. Instead, you create a new “reversing entry” to cancel out the mistake. Then, you make the correct entry. This leaves a clean, clear audit trail showing exactly what happened and how you fixed it.

Isn’t This Unnecessary if I Use Accounting Software?

Nope, it’s absolutely essential. While software like QuickBooks does the heavy lifting of handling the debits and credits behind the scenes, it can’t read your mind. The software depends on you to tell it where each transaction belongs.

When you understand the logic behind double-entry, you’re empowered to:

- Set up your Chart of Accounts the right way, so your reports actually make sense.

- Spot errors in a heartbeat. You’ll develop a gut feeling for when something looks off in your reports.

- Talk confidently with your accountant or financial advisor, because you understand the language they’re speaking.

The software is your high-powered calculator, but you still need to know basic math to tell if the answers it gives you are reasonable. Understanding the “why” behind what the software does is the key to having financial records you can truly trust.

Feeling confident about your books is crucial for growth. Steingard Financial specializes in setting up, cleaning up, and managing meticulous double-entry bookkeeping systems for service businesses just like yours. Let us build a financial back office you can depend on. Learn more at steingardfinancial.com.