What are the basic accounting equation: Guide to assets, liabilities, and equity

At its core, the basic accounting equation is Assets = Liabilities + Equity. This simple but powerful formula is the absolute foundation of all modern bookkeeping. It shows that everything a company owns (its assets) is financed by either what it owes to others (its liabilities) or what the owners themselves have invested (its equity).

The Accounting Equation Explained Simply

Think of it like a perfectly balanced seesaw. On one side, you have everything of value your business controls—its Assets. On the other side, you have all the claims against those assets. These claims come from two places: what you owe to lenders and suppliers (Liabilities) and the owner’s own stake (Equity).

No matter what happens, that seesaw must always stay level. Every single transaction, from buying a coffee to landing a huge client, will adjust the components, but the balance remains.

This isn’t some new concept. In fact, its roots stretch back over 500 years to its first official documentation in 1494 Italy. It has proven incredibly resilient through centuries of economic change and remains the unshakable backbone of modern finance.

A Quick Guide to the Basic Accounting Equation Components

To really get a feel for this, let’s break down each piece of the puzzle. This table lays out what each component means and gives you some real-world examples you’d see in a typical service business.

| Component | What It Is | Common Examples for Service Businesses |

|---|---|---|

| Assets | Resources your business owns that have future economic value. | Cash in the bank, accounts receivable (invoices), office equipment, computers, company vehicles. |

| Liabilities | What your business owes to outside parties (creditors). | Bank loans, credit card balances, accounts payable (bills from suppliers), deferred revenue. |

| Equity | The owner’s claim on the assets after all liabilities have been paid off. | Owner’s contributions (initial investment), retained earnings (accumulated profits). |

Understanding these three pillars is the first step to mastering your company’s financials and feeling confident in the numbers.

A Real-World Analogy

Let’s make this tangible. Imagine your consulting firm buys a small office building for $500,000. You put down $100,000 from your business savings and take out a $400,000 mortgage from the bank.

Here’s how the equation perfectly balances that transaction:

- Assets: Your company now has a $500,000 building.

- Liabilities: You have a new debt to the bank for $400,000.

- Equity: Your ownership stake in the building—the part you own outright—is $100,000.

When you plug this into the formula, you get:

$500,000 (Assets) = $400,000 (Liabilities) + $100,000 (Equity)

See? It balances perfectly. Every transaction you ever record will cause a similar shift, keeping the equation in constant equilibrium.

Key Takeaway: The accounting equation provides a clear, logical snapshot of your company’s financial position at any given moment. It’s the framework that organizes all your financial data into a coherent story, which is ultimately told through key reports like the balance sheet. To see exactly how this works in practice, check out our guide on how to read a balance sheet.

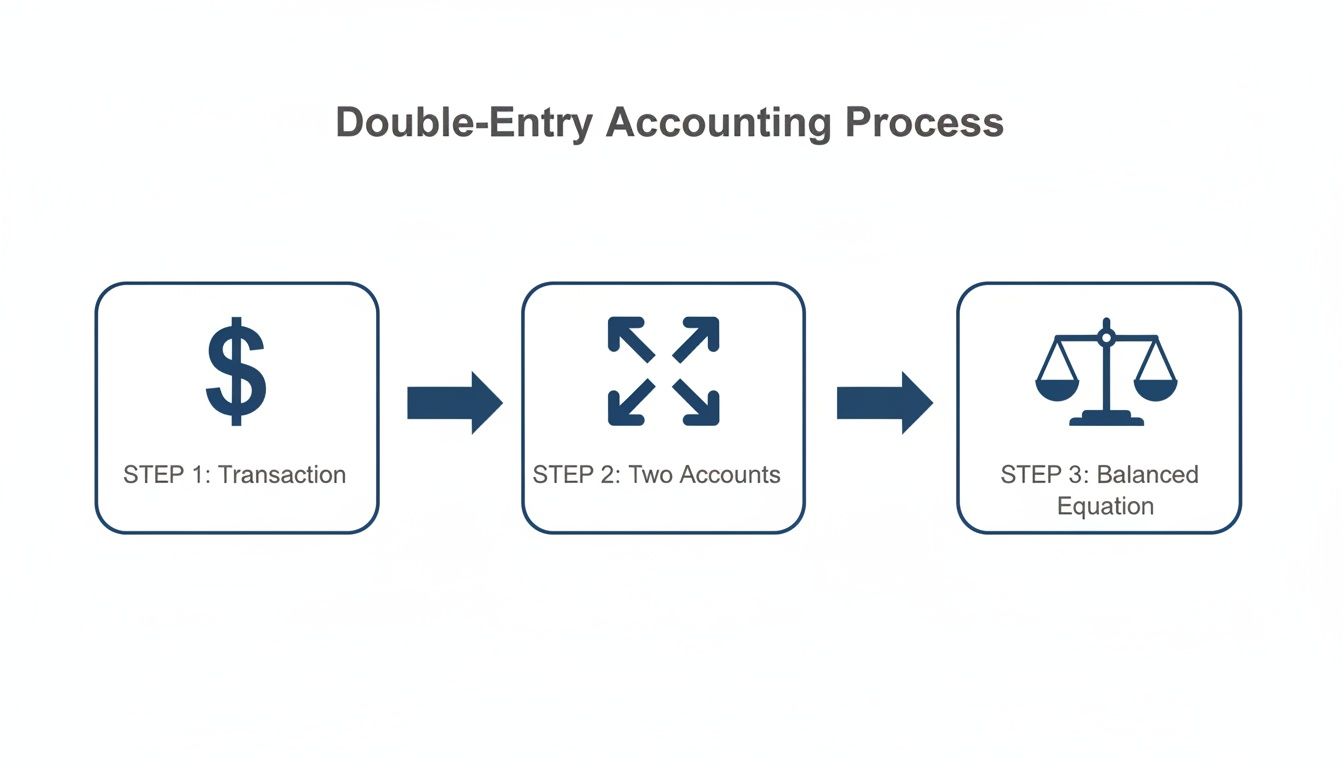

How The Equation Powers Double-Entry Bookkeeping

The accounting equation isn’t just a static formula you memorize; it’s the engine running the whole system of modern bookkeeping. This system is called double-entry bookkeeping, and it’s built on a simple idea: every business transaction has an equal and opposite reaction in your books. Think of it like a financial seesaw that must always stay perfectly level.

For every transaction, there are always two sides. When you take out a business loan, for instance, your cash (an Asset) goes up, but so does your loans payable account (a Liability). Both sides of the equation increase by the same amount, keeping everything in perfect balance. This dual-entry method is the secret sauce that guarantees accuracy and gives you a clear audit trail for every single dollar.

The Logic of Debits and Credits

So how do we actually record this two-sided effect? Through debits and credits. These terms can sound a bit intimidating at first, but they’re just labels for the two sides of a transaction. A debit increases an asset or expense account, while a credit increases a liability or equity account.

Every financial event triggers a balanced entry. Paying $1,000 for office rent decreases your cash (an asset) and simultaneously decreases your equity (by increasing an expense). The equation stays balanced because both sides decrease equally.

This constant balancing act is what makes your financial data reliable. It means no transaction ever gets recorded in a vacuum, which prevents a ton of common errors and shows you the complete picture of how one action affects your company’s financial position. For a deeper dive into the mechanics, check out our complete guide on double-entry bookkeeping explained.

A System of Checks and Balances

In day-to-day bookkeeping, this all comes down to one rule: every dollar that enters or leaves the business must hit at least two accounts and keep Assets = Liabilities + Equity in balance.

Let’s say a service company has $5,000,000 in total assets. If it financed 60% of that through liabilities, its equity must be 40% ($2,000,000) for the books to be correct. When bookkeepers perform bank reconciliations, they are really just confirming that every debit and credit posted still holds this fundamental relationship true.

Ultimately, this system turns what could be a chaotic mess of numbers into an orderly, logical, and trustworthy record. It lays the groundwork for creating accurate financial statements in tools like QuickBooks, giving you the confidence you need to make sound business decisions.

Seeing The Equation In Action With Everyday Transactions

Understanding the accounting equation in theory is one thing, but seeing it work with real transactions is where it all starts to click. Every single thing your business does—from sending an invoice to paying a bill—creates a ripple effect that keeps your financial books in perfect balance. This isn’t just some abstract accounting exercise; it’s the real-time story of your company’s financial journey.

Let’s walk through five common scenarios for a new consulting business to see exactly how Assets, Liabilities, and Equity shift with each move. The whole point is to watch how every transaction gets captured by the double-entry system to keep that essential balance.

This process is the core logic of all bookkeeping: a financial event happens, it affects at least two accounts, and the fundamental equation always stays in equilibrium.

To really see this in action, the table below breaks down a few common business activities. Notice how, no matter what happens, the equation always balances out in the end.

Impact of Common Transactions on the Accounting Equation

| Transaction | Impact on Assets | Impact on Liabilities | Impact on Equity | Is The Equation Balanced? |

|---|---|---|---|---|

| Owner Invests Cash | Increases (Cash) | No Change | Increases (Owner’s Capital) | Yes |

| Buys Equipment with Cash | Increases (Equipment) & Decreases (Cash) | No Change | No Change | Yes |

| Provides Service on Credit | Increases (Accounts Receivable) | No Change | Increases (Revenue) | Yes |

| Pays Rent in Cash | Decreases (Cash) | No Change | Decreases (Expense) | Yes |

| Takes a Business Loan | Increases (Cash) | Increases (Loan Payable) | No Change | Yes |

As you can see, for every action, there is an equal and opposite (or corresponding) reaction that keeps the books straight. Let’s dig into the numbers with a step-by-step example.

Transaction 1: Starting The Business

The owner invests $20,000 of their personal savings to get the business off the ground. This is the initial owner’s capital contribution that gives the company its first resources.

- Cash (Asset) goes up by $20,000.

- Owner’s Equity goes up by $20,000.

Our equation is now: $20,000 (Assets) = $0 (Liabilities) + $20,000 (Equity). Perfectly balanced.

Transaction 2: Buying Equipment

Next, the business buys a new computer and software for $3,000, paying in cash. This move doesn’t actually change the total value of the company’s assets, it just changes what kind of assets it holds.

- Cash (Asset) goes down by $3,000.

- Equipment (Asset) goes up by $3,000.

One asset was simply swapped for another. The equation stays balanced at $20,000 = $0 + $20,000.

Transaction 3: Providing A Service On Credit

The business wraps up a project and bills a client $5,000. The client isn’t paying today, but they will soon. This creates an asset called Accounts Receivable—money you’ve earned but haven’t collected yet.

- Accounts Receivable (Asset) increases by $5,000.

- Equity increases by $5,000 (this is recorded as Revenue, which eventually boosts your Retained Earnings).

The equation now looks like this: $25,000 (Assets) = $0 (Liabilities) + $25,000 (Equity).

Transaction 4: Paying Monthly Rent

Time to pay the bills. The business pays its $1,500 monthly office rent in cash. This is a classic business expense, which reduces the company’s net worth (Equity).

- Cash (Asset) decreases by $1,500.

- Equity decreases by $1,500 (as an Expense, which lowers your Retained Earnings).

Both sides of the equation drop by the same amount, keeping everything in check: $23,500 = $0 + $23,500.

Transaction 5: Receiving A Client Payment

Finally, that client from Transaction 3 pays their $5,000 invoice. This is another one of those transactions that only impacts the asset side of the equation.

- Cash (Asset) increases by $5,000.

- Accounts Receivable (Asset) decreases by $5,000.

Key Insight: This transaction shows the company simply converted one type of asset (a client’s promise to pay) into another, more liquid asset (cash in the bank). The total value of the assets didn’t change, so the overall equation remains untouched.

After these five transactions, the company’s books are sitting at: $23,500 (Assets) = $0 (Liabilities) + $23,500 (Equity). Each step shows that dual-sided nature of accounting, which is the secret to keeping financial records accurate and trustworthy.

Connecting Profitability With The Expanded Equation

The basic accounting equation gives you a fantastic snapshot of your business at a single moment in time. But what about the story of how you got there? What happens when you start sending invoices, paying bills, and actually running the business?

Your day-to-day performance—your profitability—is what shapes the company’s financial health over the long haul. That’s where the expanded accounting equation steps in.

Think of it as the link between your Balance Sheet (what you own and owe) and your Income Statement (how you performed). It peels back the layers of the “Equity” part of the equation to show you exactly how your daily operations make it grow or shrink.

Unpacking The Expanded Formula

This more detailed version shows how four key activities directly impact your equity:

- Revenues: When you earn money by selling your services or products, your equity increases. This is the fuel that strengthens your company’s net worth.

- Expenses: Every time you pay for rent, software, or salaries, your equity decreases. These are simply the costs of keeping the lights on.

- Owner’s Contributions: If you invest more of your own money into the business, equity goes up.

- Owner’s Draws (or Dividends): When you take money out of the business for personal use, equity goes down.

This creates a powerful, direct link between what you do every day and your overall financial standing. Getting the most out of this requires knowing how to read the reports it generates. For a deeper dive, check out this guide on how to read financial reports for smart investing.

How Profit Flows Into Equity

The whole point of the expanded equation is to explicitly connect your balance sheet to your income statement, which is absolutely critical for accurate month-end and year-end reporting.

One of the most common versions looks like this: Assets = Liabilities + Beginning Equity + Revenues − Expenses − Draws.

This formula clearly shows how your profit (Revenues – Expenses) flows directly into your equity. To get a better handle on how revenue and expenses are tracked, you can explore our detailed guide on understanding profit and loss statements.

Let’s walk through a quick example. Imagine a consulting business starts the year with $100,000 in equity.

Throughout the year, the business brings in $40,000 in revenue and racks up $25,000 in expenses. The owner also takes a $5,000 draw for personal living costs.

The net income of $15,000 ($40,000 revenue – $25,000 expenses) makes the equity grow, but the $5,000 draw reduces it. The result is an ending equity of $110,000. It’s a simple, logical flow.

By understanding this expanded view, you gain a much deeper insight into how every sale and expense doesn’t just affect your bank balance today, but systematically builds or reduces your company’s net worth over the long term.

Common Mistakes And How To Keep Your Books Balanced

Knowing the theory behind the accounting equation is one thing. Actually keeping your books perfectly balanced in the real world? That’s where the rubber meets the road. Even tiny mistakes can snowball, leading to financial reports you can’t trust and major headaches come tax season.

Fortunately, most of these errors are pretty common, and once you know what to look for, they’re much easier to avoid.

One of the most frequent slip-ups is the single-sided entry. This happens all the time—a business owner remembers to record that they spent cash but forgets to log what they spent it on. That immediately throws the whole equation out of balance because it breaks the fundamental rule of double-entry bookkeeping.

Another classic pitfall is misclassifying transactions. Think about recording the purchase of a new company laptop (an asset) as an office supply expense. This simple mistake understates what your business owns and overstates what it spent, warping both your Balance Sheet and your Profit and Loss statement.

Identifying and Fixing Common Errors

Catching these issues early is absolutely critical. Trying to find a small data entry error from January when you’re closing out the year in December can feel like searching for a needle in a haystack. The best strategy is a consistent review process.

Here are a few of the usual suspects and how to fix them:

- Forgetting a Transaction’s “Other Half”: This happens when you record a cash withdrawal but don’t categorize what it paid for.

- The Fix: Always ask yourself, “What did this money do?” If cash went down, something else must have happened. Maybe an expense went up, you bought another asset, or you paid down a loan. Every transaction needs a source and a destination.

- Mixing Personal and Business Funds: Using the business credit card for a personal dinner might seem harmless, but it creates a messy paper trail and can land you in hot water with the IRS.

- The Fix: This should be recorded as an “Owner’s Draw.” It’s not a business expense—it’s a reduction in your Owner’s Equity. The absolute best practice here is to maintain completely separate bank accounts for business and personal use. No exceptions.

- Data Entry Typos: It’s so easy to do. Transposing numbers (like typing $54 instead of $45) is a simple human error that can throw off your totals for months.

- The Fix: Regular bank reconciliation is your best friend. At the end of every month, sit down and compare your bookkeeping records to your bank and credit card statements line by line. This process is designed to make discrepancies like typos jump right off the page.

Key Insight: The accounting equation is your financial integrity check. If your books don’t balance, it’s a bright red flag that a transaction was misrecorded, an asset was misstated, or a number was entered incorrectly.

Proactive Steps for Balanced Books

Instead of just getting good at fixing mistakes, you can build habits that prevent them from happening in the first place. Taking the time to set up a proper chart of accounts in your software (like QuickBooks) gives you clear, predefined categories for every transaction, dramatically reducing the odds of a classification error.

Most importantly, you need to perform a bank reconciliation every single month. Make it a non-negotiable part of your routine. It is the single most effective way to guarantee your records match reality and that the accounting equation stays in perfect balance, giving you trustworthy numbers to run your business.

Why This Equation Is Your Financial North Star

Let’s be clear: the basic accounting equation is so much more than a formula you memorize for a test. Think of it as the financial compass for your entire business, the one true north that guides all your strategic planning. It’s the unshakeable foundation that your Balance Sheet is built on, giving you a clean, reliable snapshot of what your company is actually worth at any given moment.

When you really get how Assets, Liabilities, and Equity dance with each other, you stop just tracking numbers. You start reading your financial statements with confidence. You can look at your books and instantly gauge your company’s ability to handle debt, and you can make much smarter calls about growth and where to invest next.

From Bookkeeping Rule to Business Strategy

Mastering this one concept puts you in the driver’s seat of your financial story. It turns bookkeeping from a tedious chore into a powerful strategic tool, letting you see exactly how every single operational choice—big or small—affects your company’s value. That kind of clarity is what sustainable growth is built on.

The accounting equation is the financial equivalent of a structural integrity check for your entire business. It ensures that every decision, from taking on debt to investing in new assets, is reflected in your company’s foundational health.

As you apply this equation, don’t forget that your company’s legal framework plays a role, too. For instance, understanding the different legal structures like incorporation versus a sole proprietorship is a big deal, as it can change how liabilities and equity show up on your balance sheet.

Getting this down allows you to:

- Evaluate Financial Health: Quickly see if your assets are growing faster than your debts (a very good sign!).

- Secure Financing: Walk into a bank or investor meeting with a clear, balanced financial picture that inspires confidence.

- Plan for the Future: Make decisions about expansion, hiring, and big purchases based on solid data, not just a gut feeling.

Grasping the accounting equation isn’t just about being better at bookkeeping—it’s about becoming a more capable and confident business owner.

Frequently Asked Questions

Even after you get the hang of the basic formula, questions always pop up about how the accounting equation plays out in the real world. Let’s tackle a few of the most common ones we hear from business owners.

Can A Business Have Negative Equity?

Yes, a business can absolutely have negative equity. This happens when your total liabilities (what you owe) creep up and surpass your total assets (what you own).

Think of it as being “upside down” on a loan. It’s often a red flag for serious financial trouble and can make it nearly impossible to get new funding from banks or investors. Keeping your books clean and up-to-date is the best defense; it lets you watch your equity trend over time so you can step in before things get out of hand.

How Does The Equation Apply To A Service Business?

The accounting equation is just as critical for service-based businesses, even if you don’t have a warehouse full of products. You might not have inventory, but your assets still include the lifeblood of your business: cash in the bank, accounts receivable (the money clients owe you), and your computers, software, and office furniture.

For a service business, the equation is the clearest way to see how your day-to-day work—every project you complete and every bill you pay—connects directly to your owner’s equity. It shows you exactly how your hard work is building (or not building) your company’s net worth.

The equation must always balance because every single transaction has two sides. This is a core bookkeeping principle called the dual-aspect concept. If your business buys a new computer (an asset), the money had to come from somewhere—either you took on debt (a liability) or you used your own funds (equity). There are no other possibilities. This simple, built-in check is what keeps your financial records complete and accurate.

At Steingard Financial, we turn your bookkeeping from a chore into a tool for growth. Our team makes sure your books are always balanced and accurate, giving you the clear financial picture you need to make smart decisions. Schedule a consultation today and see what a difference it makes.