Outsource Bookkeeping for Small Business to Save Time

That nagging feeling you get when you’re wrestling with spreadsheets instead of running your business? That’s a huge sign. Outsourcing your bookkeeping isn’t about giving up control; it’s about making a smart move to get your time back and finally achieve financial clarity. It’s how you gain a real competitive edge, all thanks to accurate, on-time financial data.

Knowing When to Outsource Your Bookkeeping

The decision to finally hand off your books usually boils down to a few key pain points. Are late nights spent trying to categorize expenses becoming your new normal? Do you get a pit in your stomach just thinking about tax compliance?

These aren’t small annoyances. They’re bright red flags telling you that your business has outgrown its current way of managing money. Making big decisions with fuzzy or old numbers is like driving with a foggy windshield—you’re moving, but you have no idea what’s coming.

Lots of entrepreneurs start by doing their own books to save cash, and that makes perfect sense at the beginning. But as you grow, that DIY approach starts causing major problems and risks. Let’s be honest: you didn’t start your company to become a part-time bookkeeper. Every hour you spend on admin is an hour you’re not spending on sales, marketing, or taking care of your clients.

Telltale Signs You’ve Hit a Growth Ceiling

Not sure if it’s the right time? See if any of these sound painfully familiar:

- You’re always playing catch-up. Your books are weeks, maybe even months, behind. This makes it impossible to know your real-time cash flow or see if you’re actually profitable.

- Tax season is a total nightmare. You’re in a mad dash to find receipts and make sense of your records at the last minute, likely missing out on deductions and risking expensive mistakes.

- Your financial reports are Greek to you. Sure, you have reports from QuickBooks, but you don’t really know what they’re telling you or how to use them to make smart business moves.

- Growth has made things complicated. You’ve hired people, added new services, or opened up new revenue streams, and your simple spreadsheet just can’t handle the volume anymore.

The real tipping point for many business owners is the realization that their time is far more valuable when it’s spent making money. Outsourcing isn’t admitting defeat; it’s a strategic investment in your own growth and efficiency.

And you’re not alone in thinking about this. Over 37% of small businesses in the U.S. already outsource tasks like bookkeeping or payroll. According to research from Velan, this helps them improve accuracy and compliance by tapping into expert knowledge, which ultimately makes them more efficient.

A Mindset Shift from Cost to Investment

It’s crucial to stop thinking of bookkeeping as just another expense. Instead, see it for what it is: an investment in your company’s financial health and your own sanity.

A good bookkeeper does more than just enter data. They deliver peace of mind and the kind of financial clarity you need to make decisions with confidence. If you’re new to this side of the business, getting a handle on the fundamentals can show you exactly what a pro can take off your plate.

A great place to start is our guide on the bookkeeping basics for small business. By handing over the financial reins, you free yourself up to focus on what you do best—steering your business toward its next big win.

Finding the Right Outsourcing Model

Once you’ve decided it’s time to outsource your bookkeeping, the next big question is: what kind of help do you actually need? Outsourcing isn’t one-size-fits-all. It’s a spectrum of options, and the right choice hinges on your business’s complexity, your budget, and how many transactions you handle each month.

Getting this right from the start will save you a world of headaches later. A new consultant with ten invoices a month has completely different needs than a growing service business juggling multiple contractors, client retainers, and software subscriptions.

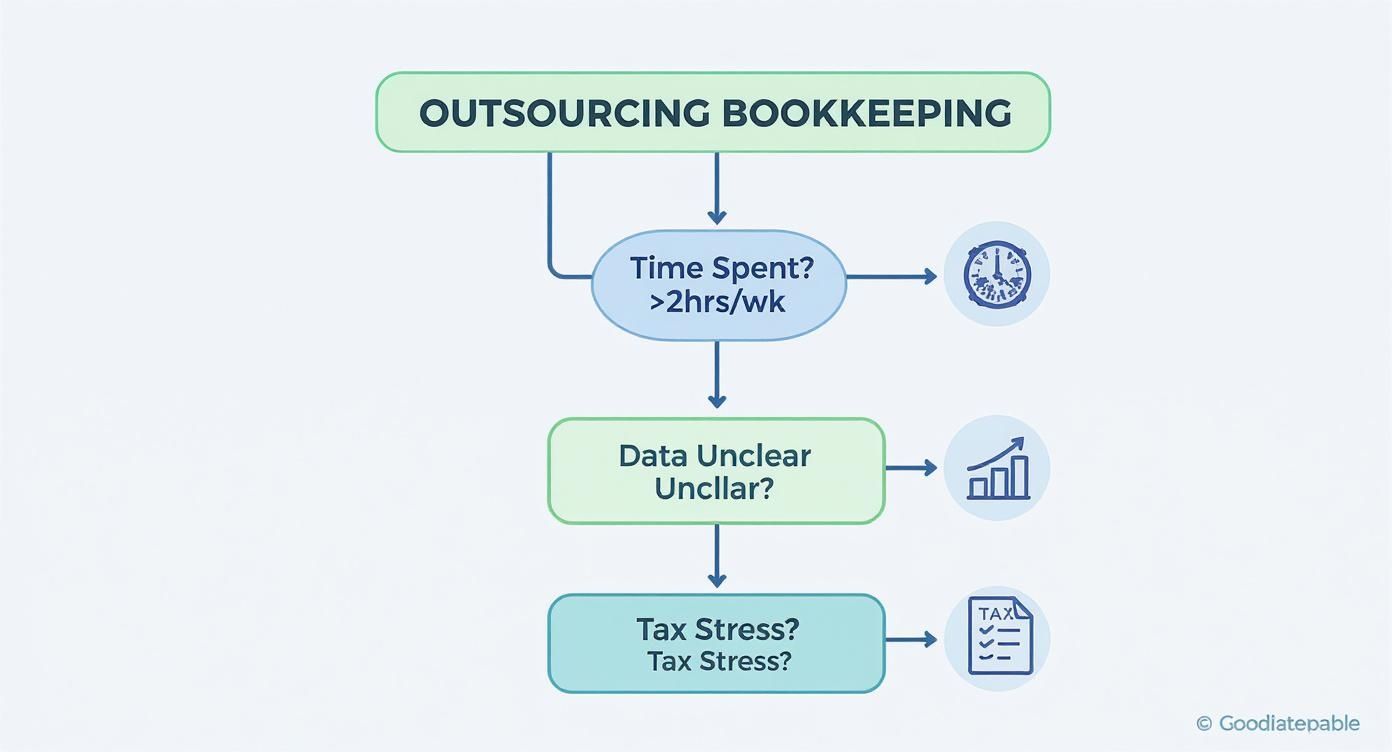

This flowchart can help you see which path might make the most sense based on your current pain points.

If you find yourself constantly struggling with time, unclear data, or that familiar wave of tax-season anxiety, those are all strong signals that it’s time to bring in a pro.

Independent Freelance Bookkeepers

Freelancers are a popular first step for many solopreneurs and brand-new businesses. You can find them on platforms like Upwork or, even better, through local referrals. They tend to offer the most flexibility and can be a very budget-friendly way to get the basics handled.

However, the responsibility for vetting them is entirely on you. Their availability can be a bit hit-or-miss, and if they get sick or take a vacation, you’re left without a backup.

Specialized Bookkeeping Firms

For many growing service businesses, this is the sweet spot. A specialized firm provides a dedicated team of professionals, offering more structure, reliability, and deeper expertise than a lone freelancer.

These firms are built to handle growing complexity. They already have proven processes for month-end closes, financial reporting, and integrating with tools you’re already using, like QuickBooks and Gusto. This means you get consistency and accuracy, even as your business scales.

When you partner with a firm, you’re not just hiring a person; you’re investing in a proven system. You get a team with diverse skills, established security practices, and the bandwidth to grow alongside you.

Think about it: if you land a huge client that suddenly doubles your monthly invoicing, a firm has the staff to absorb that work without skipping a beat. A freelancer might get completely swamped.

Large Tech-Driven Services

You’ve likely seen the ads for big, tech-focused bookkeeping services. They promise a slick combination of software automation and human support, often for a predictable monthly price.

These platforms are great at processing high volumes of simple transactions automatically. The downside? The service can feel impersonal. When you have a specific question about your business, you might end up talking to a different person every time, which makes it hard to get tailored, strategic advice.

Comparing Bookkeeping Outsourcing Models

To make it even clearer, let’s look at these options side-by-side. Each has a place, but the “best” one truly depends on where your business is today and where you want it to be tomorrow.

| Model | Best For | Typical Cost | Pros | Cons |

|---|---|---|---|---|

| Freelancer | Solopreneurs and new businesses with simple needs. | Hourly rate, $25–$75+. | Very affordable and flexible for basic tasks. | Availability can be inconsistent; no backup. |

| Specialized Firm | Growing service businesses that need reliability and expertise. | Flat monthly fee. | Dedicated team, scalable processes, and strategic advice. | Higher investment than a freelancer. |

| Tech Service | Tech-savvy businesses with a high volume of simple transactions. | Tiered subscription. | Highly automated and predictable, fixed pricing. | Can be impersonal; lacks customized advice. |

Ultimately, you’re looking for a partner that not only solves your current bookkeeping problems but can also support your long-term goals. A freelancer might be perfect for right now, but a specialized firm is the partner that will help you navigate future growth.

How to Vet Your Next Bookkeeping Partner

Choosing a bookkeeping partner is a big deal—it’s about more than just finding the lowest monthly fee. You’re bringing someone into the financial core of your business, so things like trust, clear communication, and real technical skill are non-negotiable. This isn’t just another vendor relationship; it’s a partnership built on financial transparency.

Your job during the vetting process is to get past the sales pitch. You need to understand how they actually work day-to-day. How will they talk to you? And, critically, can they deliver the clean, on-time numbers you need to run your business?

Think of it like hiring a key employee. You have to check their skills, talk to their references, and make sure they’re a solid fit for how you operate.

Technology and Software Expertise

First things first: confirm they are fluent in your tech stack. If you run your entire business on QuickBooks Online and use Gusto for payroll, a potential partner who only knows Xero isn’t going to work. Trying to force a fit creates massive headaches and messy data migration problems later on.

Here’s what to look for:

- Platform Certification: Are they a QuickBooks ProAdvisor or certified in the software you use? This is the baseline for competency.

- Integration Experience: Ask how they’ve handled connecting bookkeeping software to other tools you rely on, like payment processors (Stripe, Square) or project management apps.

- Security Protocols: How are they going to protect your sensitive financial data? Ask about their policies on password managers, two-factor authentication, and how they share documents securely.

A bookkeeper’s ability to plug right into your existing systems is a huge sign of a smooth partnership. If they try to force you to switch to their preferred tools, that’s a red flag.

The global accounting outsourcing market is expected to hit $81.25 billion by 2030. This isn’t a fluke. It’s driven by business owners who are looking for more efficiency and better tech. In fact, about 65% of companies that outsource do it to free up their teams for more important work, while 48% are looking for access to better automation and tools. This just goes to show how critical a provider’s tech skills really are.

The Right Questions to Ask Potential Providers

A generic “So, tell me about your services” isn’t going to get you very far. You need to dig in with specific, operational questions to see how they really work. A confident, seasoned pro will welcome these kinds of detailed questions and give you straight answers.

If you get vague responses or they can’t clearly explain their own processes, you should probably be concerned. Here’s a checklist of questions that will tell you what you need to know:

- “Can you walk me through your month-end close process?” This pulls back the curtain on their system for getting things right. A good answer will mention bank reconciliations, reviewing payables and receivables, and delivering a standard set of financial statements.

- “How do you handle a historical cleanup for a new client?” Let’s be honest, most businesses come to an outsourced bookkeeper with books that are… a little messy. Their answer reveals if they have a structured plan for organizing past transactions and how they price that crucial one-time project.

- “What’s your typical communication rhythm with clients?” This is all about setting expectations. Do they schedule regular calls? Are they quick to respond to emails? You need to make sure their style matches what you need.

- “Who will be my main point of contact?” With larger firms, you want to know if you’ll have one dedicated person or if you’ll be tossed into a general support queue. A consistent point of contact makes everything more efficient and builds a much stronger relationship.

Hiring a bookkeeper for the first time can feel overwhelming. If you need more guidance, check out our guide on what to consider when hiring your first bookkeeper for an even deeper dive.

Verifying Credentials and Checking References

Last but not least, do your homework. A true professional will be happy to connect you with current clients for references, especially if they’re in an industry similar to yours.

When you get on the phone with a reference, ask targeted questions that get to the heart of the matter:

- How responsive are they when you have a question or an urgent need?

- Have they ever helped you spot a way to save money or a new financial opportunity?

- What’s been the single biggest positive impact of working with them?

This final step is your social proof. It gives you the confidence that you’re not just hiring someone to do a task—you’re gaining a trusted financial partner who’s genuinely invested in seeing your business succeed.

Calculating the True Value of Outsourcing

Signing on for a monthly bookkeeping fee can feel like a big commitment. But it’s a decision that should be driven by the numbers, not just a gut feeling.

The real value of handing off your books goes way beyond the invoice you get each month. It’s about figuring out the total return on your investment—looking at both the hard costs and the powerful benefits that don’t show up on a spreadsheet.

To really get the full picture, you have to stack the cost of outsourcing against the true cost of doing it yourself. And trust me, it’s about a lot more than just the hours you put in.

The Tangible ROI of Outsourcing

Let’s start with the easy stuff—the financial wins you can actually measure. When you outsource your bookkeeping, you’re basically trading several big, often unpredictable expenses for one clear, fixed monthly fee.

Think about what it really costs to hire an in-house bookkeeper, even just a part-timer. The expenses pile up fast and go way beyond a simple salary.

- Salary and Benefits: You’re not just paying an hourly wage. You’re on the hook for payroll taxes, health insurance, retirement plans, and paid time off.

- Software and Tools: Professional accounting software like QuickBooks Online, receipt management apps, and secure file storage all have their own monthly subscription costs.

- Training and Development: The world of accounting and tax law never sits still. An employee needs ongoing training to keep up, and that costs both time and money.

- Overhead: Don’t forget the little things that add up, like the cost of a new computer, desk space, and other administrative costs that come with another body on the payroll.

When you tally it all up, the true cost of just one in-house employee can easily eclipse the monthly retainer for an entire outsourced team. You’re turning a high fixed cost into a much more manageable variable one.

The real financial comparison isn’t just your time versus their fee. It’s the total cost of an employee—salary, benefits, taxes, software, and training—versus the cost of a dedicated professional team.

The financial upside is pretty well-established. Some studies show that businesses that outsource their bookkeeping can slash overhead costs by as much as 60% compared to keeping a full accounting team in-house. It’s a smart financial move, especially for businesses that are growing and need support that can scale up without the friction of hiring. You can discover more insights about outsourcing statistics that really drive these advantages home.

The Powerful Intangible ROI

Now for the good stuff—the benefits that are tougher to put a number on but are arguably way more important. These are the returns that actually change your business and give you back your most precious resource: time.

1. The Value of Your Reclaimed Time

Let’s say you spend about eight hours a month wrestling with your books. What could you do with an extra full day of work? You could finally focus on the things that actually grow your business:

- Networking and landing new clients.

- Developing and launching a new service.

- Following up with existing customers to get referrals.

- Or just taking a much-needed break to recharge and avoid burnout.

If your billable rate is $150 per hour, those eight hours are worth $1,200 in lost revenue. For many business owners, that number alone makes the decision to outsource a no-brainer.

2. The Competitive Edge of Real-Time Data

Trying to make big decisions with old or messy financial data is like driving with a blindfold on. It’s a recipe for disaster.

With a pro bookkeeper, you get clean, up-to-date reports that give you the power to:

- Confidently manage your cash flow.

- Pinpoint which of your services are the most profitable.

- Catch rising expenses before they spiral out of control.

- Make smart calls on hiring, pricing, and expansion.

This kind of clarity gives you a huge leg up. While your competitors are busy guessing, you’re making strategic moves based on solid financial intelligence.

3. The Peace of Mind from Reduced Stress

Finally, you just can’t put a price on peace of mind. That nagging worry in the back of your head about tax deadlines, compliance rules, and whether your numbers are even right takes a massive mental toll.

Handing all that stress over to an expert who genuinely enjoys this stuff? That’s a huge weight off your shoulders. It frees up your mental energy so you can get back to what you do best: leading your business forward.

Your Onboarding and Financial Cleanup Plan

Making the move to an outsourced bookkeeper is a huge step forward for your business. For this new partnership to really work, you need a smooth and structured onboarding process. This is about more than just handing over your passwords; it’s about getting on the same page from day one.

A solid start will prevent a world of headaches down the road. When you know what to expect and have the right documents ready, your new bookkeeper can get to work delivering accurate, timely financials right away.

Preparing for a Smooth Handoff

Think of your new bookkeeper as a financial doctor—they need to see everything to make an accurate diagnosis. Pulling together the right documents beforehand will make the entire process faster and show your new partner you mean business.

Here’s a quick checklist of what they’ll likely need:

- Bank and Credit Card Access: Be ready to provide read-only access to your business bank and credit card accounts. At a minimum, have monthly statements ready to go.

- Accounting Software Login: They’ll need accountant-level access to your QuickBooks Online account or whatever software you’re currently using.

- Payroll History: Detailed reports from your payroll provider, whether it’s Gusto or another service, are crucial if you have a team.

- Past Tax Returns: Your most recent business tax returns offer a great snapshot of your financial history and how your business is structured.

- Loan and Lease Documents: Got a business loan, line of credit, or equipment lease? Your bookkeeper needs those agreements to track your liabilities correctly.

Tackling the Financial Cleanup Phase

It’s completely normal for business owners to come to us with books that are a bit of a mess. Maybe you have a few months of unreconciled transactions or a chart of accounts that doesn’t quite make sense. That’s okay! The first step is always a “cleanup” or “catch-up” project.

This isn’t just about making things look neat. It’s about building a solid foundation. If we start with bad data, every report we generate will be unreliable, making it impossible for you to make smart business decisions.

The historical cleanup is easily the most important part of the entire process. It ensures every P&L and Balance Sheet you see from that point on is accurate, trustworthy, and actually reflects what’s happening in your business.

This cleanup is typically treated as a one-time project before your regular monthly service kicks in. The cost usually depends on how many months need to be tackled and how complex the transactions are. You have to be ready for this initial investment—it’s the only way to get the financial clarity you’re after.

During this project, your bookkeeper will dive deep into your past transactions, categorize everything properly, and reconcile all your accounts. They’ll also fine-tune your Chart of Accounts, which is the skeleton of your entire financial reporting system. To get a better handle on this, you can learn more about why your Chart of Accounts is so important and how it shapes your business insights.

Establishing a Communication Rhythm

Once the cleanup is done and you’re rolling with a monthly service, communication becomes everything. A great bookkeeper doesn’t just crunch numbers in a silo; they become a proactive part of your financial team.

Right from the start, agree on a communication cadence. It could look something like this:

- Weekly Check-ins: A quick email to flag any uncategorized transactions or ask for missing documents.

- Monthly Report Meetings: A scheduled call to walk you through your financial statements, explain what the numbers mean, and track your progress.

- On-Demand Support: A clear understanding of how to get in touch when you have an urgent question.

This regular back-and-forth keeps you in the loop and in control. When you outsource bookkeeping for your small business, you’re not giving up control—you’re gaining a strategic partner who’s focused on your financial health.

Common Questions About Outsourcing Bookkeeping

Taking the leap to outsource bookkeeping for your small business is a big move, and it’s natural to have questions. Concerns about cost, control, and security are not just valid; they’re smart things to be thinking about. Getting straight answers is the only way to feel confident you’re making the right call for your company’s future.

A lot of owners I talk to worry that bringing in an outsider means losing touch with their own numbers. In reality, it’s usually the exact opposite. A professional service arms you with modern, cloud-based tools that often give you more clarity and easier access than you ever had trying to manage it all yourself.

How Much Should I Expect to Pay?

This is always the first question, and the honest answer is: it really depends. The price for outsourced bookkeeping can vary quite a bit based on your company’s needs, how many transactions you have each month, and the general complexity of your finances.

A few things that will move the needle on cost include:

- Transaction Volume: A business with 50 transactions a month has much simpler needs than one juggling 500.

- Service Complexity: Are you just looking for basic bank reconciliations? Or do you need someone to manage your bills (accounts payable), chase down invoices (accounts receivable), and handle payroll?

- Cleanup Needs: If your books are messy or months (even years) behind, there’s usually a one-time project fee to get everything cleaned up and organized before the regular monthly service kicks in.

As a general rule, freelancers often charge by the hour, somewhere in the range of $25 to over $75. Specialized firms tend to prefer flat-rate monthly packages. These can start around $300 for a very small business and go up to $1,500 or more for a company with more moving parts. The key is to find a partner who gives you a custom quote after really digging into how your business operates.

Is It Secure to Share My Financial Data?

Handing over the keys to your financial kingdom can feel unnerving, I get it. But professional bookkeeping firms live and die by their reputation for security. Reputable providers use robust systems and have strict internal rules to protect your information.

A professional bookkeeper’s entire business is built on trust and confidentiality. They use enterprise-grade security practices that are often far more advanced than what a small business can manage in-house.

When you’re vetting potential partners, don’t be shy about asking about their security measures. You want to hear them talk about things like data encryption, using a secure client portal for sharing documents, and having strict controls over who can access what. A trustworthy firm will be happy to show you exactly how they keep your data locked down.

What Is the Difference Between a Bookkeeper and an Accountant?

This is a really common question, and it’s easy to get them mixed up. The roles are different but work together perfectly.

I like to think of it like building a house. The bookkeeper is the master carpenter on site every day. They’re meticulously measuring, cutting, and placing every single board to build a solid, accurate structure.

- A bookkeeper handles the daily financial data entry. They’re in the weeds recording transactions, categorizing expenses, reconciling bank accounts, and managing invoices. Their job is to make sure the data is accurate and organized.

- An accountant is the architect. They take the solid structure the bookkeeper built and use it for big-picture analysis. They prepare the official financial statements, map out tax strategies, and help you use the financial data to make smart, long-term decisions.

Many firms, like ours, offer both services, so you get the complete financial team you need all in one place.

Will I Lose Access to My Financial Information?

Nope, not at all. You’ll actually gain more control and a clearer view. Modern bookkeeping services run on cloud-based platforms like QuickBooks Online. This gives you 24/7 access to your financial dashboard from your computer, tablet, or phone.

Your bookkeeper is working inside your account. You can log in anytime you want to pull a report, check your cash flow, and see exactly where things stand. You aren’t giving up the keys; you’re hiring an expert chauffeur who knows the best route, with you sitting right there watching the map.

At Steingard Financial, we provide the financial clarity and expert support service businesses need to thrive. Our team handles everything from historical cleanups to ongoing bookkeeping and payroll, so you can get back to focusing on growth. Learn how we can build a scalable back office for your business.